Japan’s GMO Internet has postponed the shipments of its two lines of 7nm bitcoin mining rigs. A representative of the company has clarified the situation to news.bitcoin.com, noting that some refunds have already been issued. In addition, the company is planning to relocate its mining operations.

Also read:

Shipments Postponed

A representative of GMO revealed to news.bitcoin.com on Tuesday that the shipments of both lines have been postponed, elaborating:

It is because the parts we need for our mining machines are actually very difficult to acquire right now … It is difficult to acquire some of the electronic components, such as resistors, due to the tight global supply-demand balance.

He added that the company has not decided whether to ship any miners this year.

GMO Internet the B2 line in June and the line in July. In August, the company upgraded the B3 case shape design in order to improve its cooling performance and operational stability. Both B2 and B3 are priced at $1,999 and are sold out.

The representative emphasized that refunds will be issued to any customers who ask for them, noting:

We asked our customers whether they wish us to refund at the time of delay announcement. So far, we have already completed issuing refunds to customers who demanded them.

Relocating Mining Operations

Through its Swiss subsidiary, GMO engages in three mining business areas: in-house mining; developing, manufacturing and selling mining machines; and cloud mining.

On Nov. 5, the company released the monthly report of its mining business which shows that 595 BTC and 875 BCH were mined in October. GMO’s total hashrate increased to 674 PH/s during the month from 479 PH/s in the previous month.

The internet giant further detailed that its mining business recorded a loss during the third quarter even though the expansion of mining facilities progressed as planned. The company attributed the loss to a small net sales increase of only 1.249 billion yen ($11 million) year-on-year “because of a decline in profitability due to the deteriorated macro environment including stagnant bitcoin price and an increase in hash rate,” reiterating:

Cryptocurrency mining business experienced a decline in profitability due to a downturn in the macro environment.

At Monday’s press conference, GMO Internet’s founder and CEO, Masatoshi Kumagai, unveiled his company’s plan to relocate its mining operations in an effort to boost profitability by lowering electricity and production costs.

The GMO representative confirmed the plan to news.bitcoin.com. However, he noted that the details of location and timeframe are “under consideration at this moment,” emphasizing that “we have not decided it yet.”

What do you think of GMO postponing the shipments of its 7nm bitcoin mining equipment? Let us know in the comments section below.

Images courtesy of Shutterstock and GMO Internet.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

bitcoin Group SE has bought 100 percent shares of investment bank Tremmel for an undisclosed amount. This is the German digital currency exchange operator’s second acquisition in 2018. bitcoin Group, which holds current assets of $40 million, said Tremmel allows it to issue its own cryptocurrency-related products, conduct proprietary trading and operate bitcoin ATMs.

Also Read:

Acquisition to Expand bitcoin Group Services Portfolio

The Frankfurt Stock Exchange-listed company operates bitcoin.de, Germany’s only regulated digital currency exchange, trading BTC, BCH and ETH. It hopes to use Tremmel’s banking license to expand the range of its service portfolio. For example, bitcoin Group said it is now possible for the trading platform to maintain an order book and even quote prices, while simultaneously ensuring more liquid trading.

“We are very pleased that in Wertpapierhandelsbank Gmbh…we have been able to gain an excellently positioned partner with in-depth knowledge of the market,” Marco Bodewein, managing director of bitcoin Group, said in an on Nov. 12. “This will enable us to take the corporate development of bitcoin Group SE to a new level,” he added.

The deal is expected to be completed in the first half of 2019, subject to approval by relevant regulatory authorities. bitcoin Group did not disclose the actual purchase price, but said “it is in the lower seven-digit euro range.”

Rainer Bergmann, the previous sole shareholder and managing director of Tremmel, is to continue working at the investment bank in the same capacity. The bank, which trades shares, bonds and other stock exchange products on behalf of local and foreign banks, insurance companies and asset managers, will be expanded into a deposit-taking institution, bitcoin Group said.

Restructuring

Digital currency exchanges are looking for growth in new areas or to consolidate existing positions to help boost revenue and minimize risk from an uncertain regulatory environment in their home economies.

In January, bitcoin Group, which has 753,000 investors actively using its exchange to buy and sell digital assets, bought a 50 percent stake in financial investment broker Sineus Financial Services Gmbh, to diversify risk. “In the future, this will enable the group to offer additional financial services in the cryptocurrency sector,” the company said at the time.

For the first six months of this year, bitcoin Group net profit increase of 306 percent to $3.85 million from $0.95 million a year earlier. Revenues tripled to $6.57 million from $2.1 million in the comparable period a year ago. Operating profit climbed 368 percent to $5.64 million. The exchange said about $707.6 million worth of BTC was traded on the platform at the end of last year, when the price of the cryptocurrency peaked at $20,000.

After close Tuesday, shares of bitcoin Group were down 0.36 percent at $31.41 in Frankfurt trading. Over the past 52 weeks, the stock has reached a low of $28.02 and a high of $97.18.

What do you think about bitcoin Group’s latest acquisition? Let us know in the comments section below.

Images courtesy of Shutterstock.

The bitcoin universe is vast. So is bitcoin.com. Check our, where you can learn everything you were afraid to ask. Or read our coverage to stay up to date on the latest. Or delve into statistics on our helpful page

The post appeared first on .

In recent regulatory news, we report on an authorized mining company in China that has had its operations temporarily halted for tax inspection and implementation of real-name registration processes. We also look at the Michigan Secretary of State’s ban on crypto-based political donations, as well as the recent certification of X8’s stablecoin for Shariah compliance. In addition, we focus on the operator of a fraudulent cryptocurrency scheme who has been punished for misappropriating $601,000 in BTC and LTC from his employer.

Also Read:

Chinese Mining Farms Suspended

“According to the needs of the public security department’s network information security work, in the future, our company will implement higher standards for the company’s business real-name system according to the work needs of the public security department,” the anonymous company said. “For customers with the latest standard real-name systems, the data center will have to suspend reloading, restarting, moving in and out, etc.”

Michigan Secretary of State Says ‘No’ to Crypto

Baker, who lost his bid in the state’s Nov. 6 election, had previously sought clarification on how the value of donations in the form of cryptocurrencies should be recorded. He also asked whether virtual currency exchanges would qualify as valid secondary depositories for the storage of crypto assets.

Baker asserted that “it is self-evident that digital currency is a valid way to receive political contributions.” However, the state secretary’s office responded by stating that “the law does not authorize such a vehicle, and the department has never determined that digital currencies are a valid way to receive political contributions.”

The letter also highlighted concerns pertaining to the price volatility of cryptocurrencies. “As with stocks and commodities, bitcoin’s worth fluctuates daily,” the office said. “There is no way to ascertain the precise monetary value of one bitcoin on any particular day.”

The Michigan Secretary of State raised additional objections to the use of cryptocurrencies as donations. In the letter, the office added that state legislation also “requires that committees deposit funds in an account in a financial institution, which is not an option for cryptocurrency.”

X8 Stablecoin Certified as Shariah Compliant

Francesca Greco, director and co-founder of X8, announced that the company will soon establish a regional office in the Middle East. Greco also indicated that X8 plans to launch a Shariah-compliant virtual currency exchange, adding that the company has already met with representatives of exchanges based in Abu Dhabi, Dubai and Bahrain.

“The Gulf region is a really good place for financial technology companies, because they all want to become hubs for fintech,” Greco said.

CFTC Fines Crypto Scheme Operator Over $1.14M

Kim was found to have misappropriated $601,000 worth of BTC and LTC from his employer — described as “a Chicago-based proprietary trading firm” — before attempting to fabricate security-related issues to obfuscate the misappropriation of funds. Despite this, the company fired Kim in November 2017 after the theft of the cryptocurrency was discovered.

Between December 2017 and March 2018, Kim then sought to repay his former employer through profits that he had generated through the operation of a cryptocurrency trading scheme. According to the CFTC, he “falsely told customers that he would invest their funds in a low-risk virtual currency arbitrage strategy, when, in fact, Kim made high-risk, directional bets on the movement of virtual currencies that resulted in Kim losing all $545,000 of his customers’ funds.”

Do you think Chinese miners will report the temporary suspension of their operations for tax inspection and real-name registration? Share your thoughts in the comments section below!

Images courtesy of Shutterstock

At bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post appeared first on .

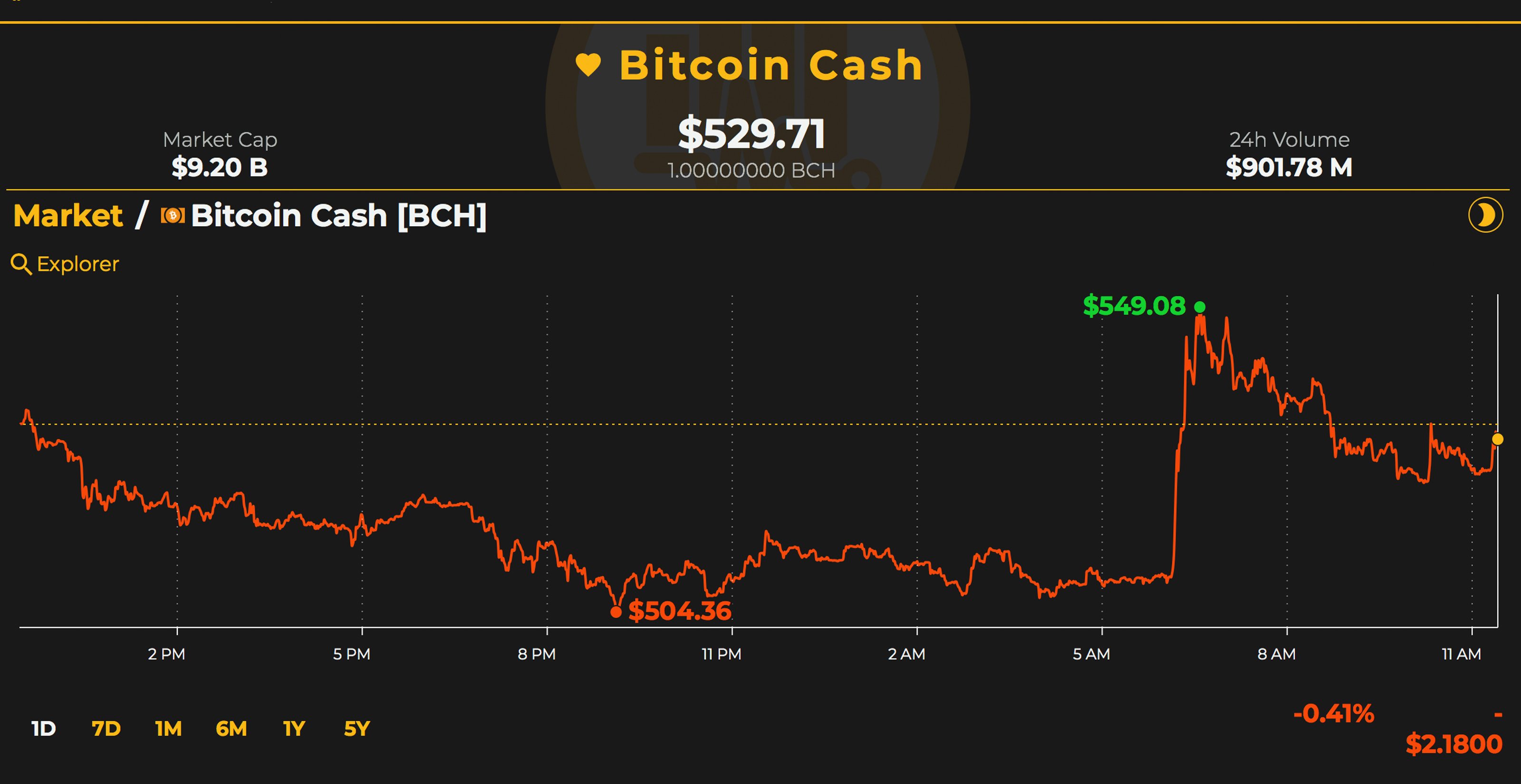

There are less than two days left until the bitcoin Cash (BCH) network faces a contentious hard fork and BCH markets are showing some unusual activity. They are being driven by heavy trading volumes that have doubled in the last two days, while BCH/USD short positions on Bitfinex have touched an all-time high. At the moment, bitcoin cash is trading for $529 per coin with more than $900 million worth of global swaps in the last 24 hours.

Also read:

Cryptocurrency Rally Stalls

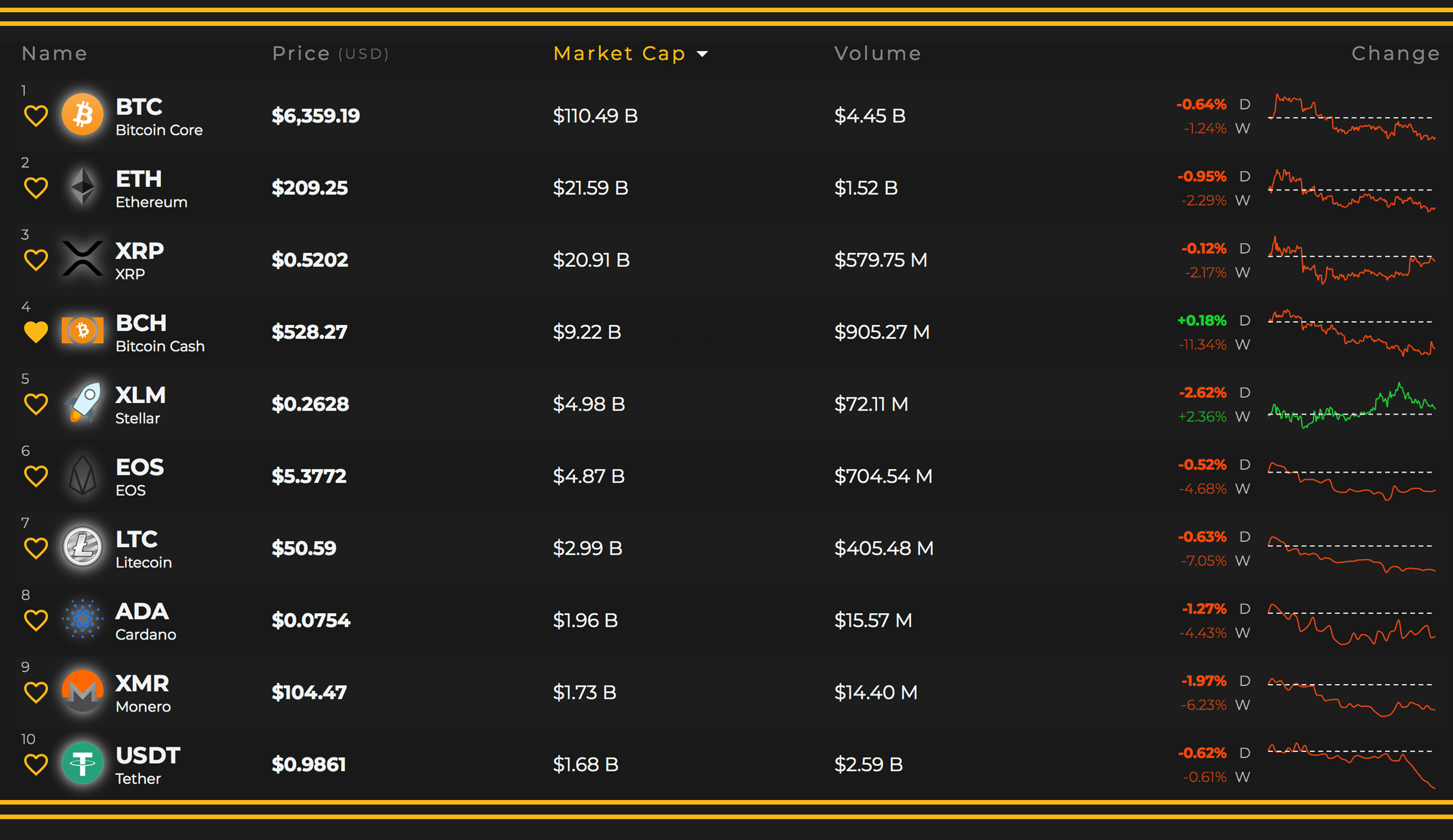

As news.bitcoin.com stated during our last markets update, all eyes are on cash prices before the pending fork and this is still the case. On Tuesday, Nov. 13, the overall is valued around $214 billion with over $13.3 billion in global trade volume over the last day. Currently, core (BTC) prices are hovering around $6,359 with a market valuation of about $110.4 billion. BTC prices are down 0.64% over the last 24 hours and down 0.95% for the last seven days. The second highest valued market held by is valued at $21.5 billion today and one ETH is swapping for $209. has dipped in value as well and the token is down 0.12% over the last 24 hours. Spot markets show one XRP is trading for $0.52 and ripple trade volume is around $579 million. Lastly, markets are down quite a bit as markets have lost over 3% today and one XLM is trading for $0.26.

bitcoin Cash (BCH) Market Action

Even though it looks as though some of last week’s spurred digital asset rally has stalled, a lot is going on behind the scenes. One BCH is trading for $527 per coin and the total market valuation is around $9.9 billion this Tuesday. According to statistics, bitcoin cash has the fourth largest trade volume just below tether (USDT) and ETH. This is because BCH trade volume has spiked considerably over the last day as the 24-hour volume is steadily approaching $1 billion. The trading platforms swapping the most BCH today include Lbank, Okex, Binance, Hitbtc, and Bitfinex. BTC is the largest pair trading with BCH and captures 39.5% of the market. This is followed by USDT (30.9%), USD (12.4%), ETH (7.1%), and QC (3.8%).

BCH/USD Technical Indicators

Looking at the 4-hour chart and the daily on Bitfinex and Bitstamp shows BCH bears have managed to push the bitcoin cash price down and suppress the value over the last few hours. Similar to our last markets update, the short term 100 Simple Moving Average (SMA) is still well above the long-term 200 SMA trendline. This confirms the path toward the least resistance is still the upside at the time of writing. On the 4-hour chart, the Relative Strength Index oscillator is meandering in the middle (44-56) and not giving much indication toward the next move.

Order books show bulls need to surpass the current suppression and prices above the $560 range to gain some more leeway. On the backside, order books show some solid foundations between the current vantage point and $485. Again, there is a massive buy wall at $445 which could hold for a decent period of time. However, the moving averages and current MACd show things may not be so dismal in the short term and the massive trade volume injected in the BCH ecosystem in the last 24 hours suggests a quick and unexpected trend change could definitely be in the cards.

Chain Split Token Markets and Short Positions

As mentioned above, the clock is ticking towards the pending bitcoin Cash network fork slated for Thursday, Nov. 15. Additionally, BCH/USD short positions on Bitfinex are still riding at the moment with people betting the currency’s value will plummet. Yet some traders believe the massive BCH daily trade volume coupled with short positions at an all-time high is a recipe for danger for margin traders without equity and many short positions could get “rekt.”

Many traders have also been watching the BCH futures markets on Poloniex with and being swapped against USDC and BTC pairs. At the moment, BCH-ABC is trading for $385, USDC and BCH-SV is around $139 per token. Moreover, Bitfinex has introducing new “chain split tokens” (CSTs) on Nov. 13 allowing traders to swap futures with the CSTs that have the dedicated ABC and SV symbols “BAB” (ABC implementation) and “BSV” (SV implementation). It’s safe to say that lots of eyes will continue to remain focused on the BCH market activity and possible reaction before the fork.

Where do you see the price of bitcoin cash and other coins headed from here? Let us know in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither .com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and .

Want to create your own secure cold storage paper wallet? Check our section.

The post appeared first on .