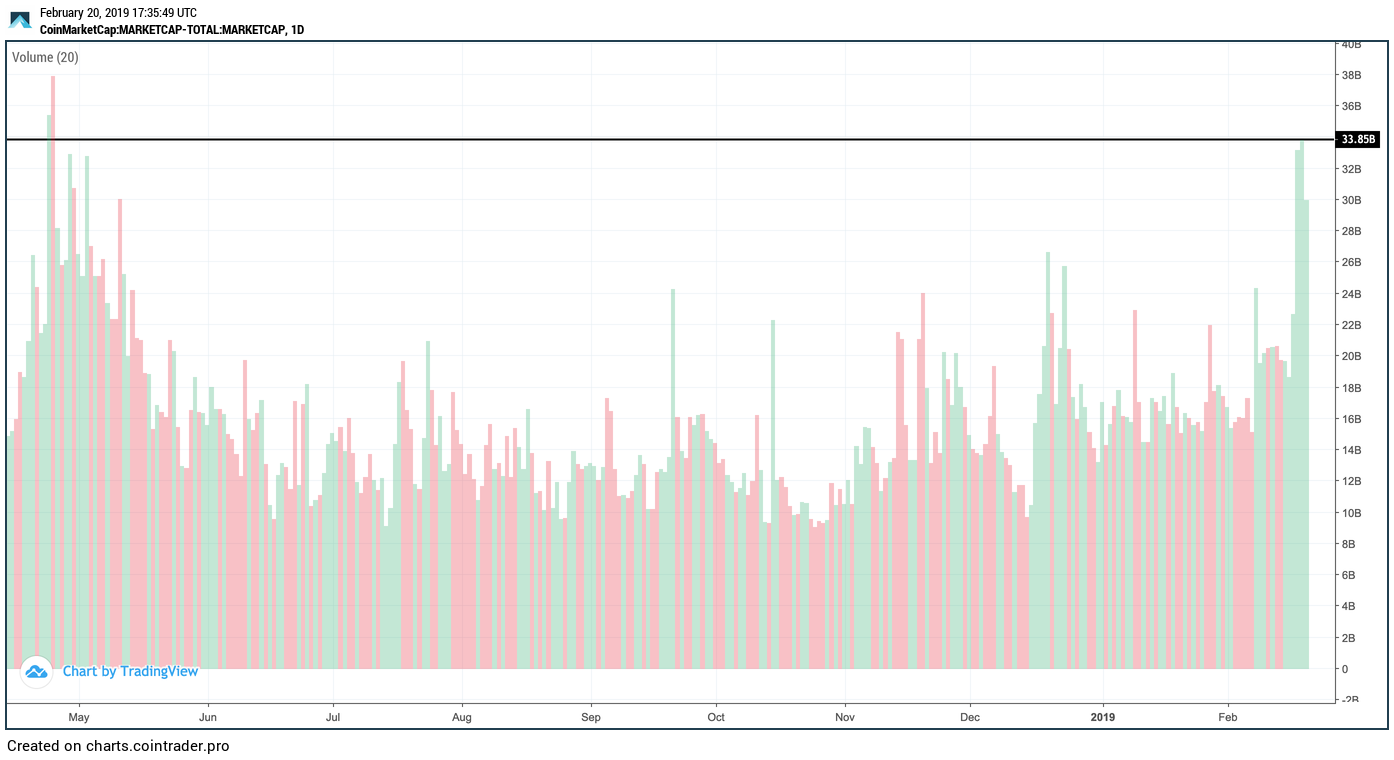

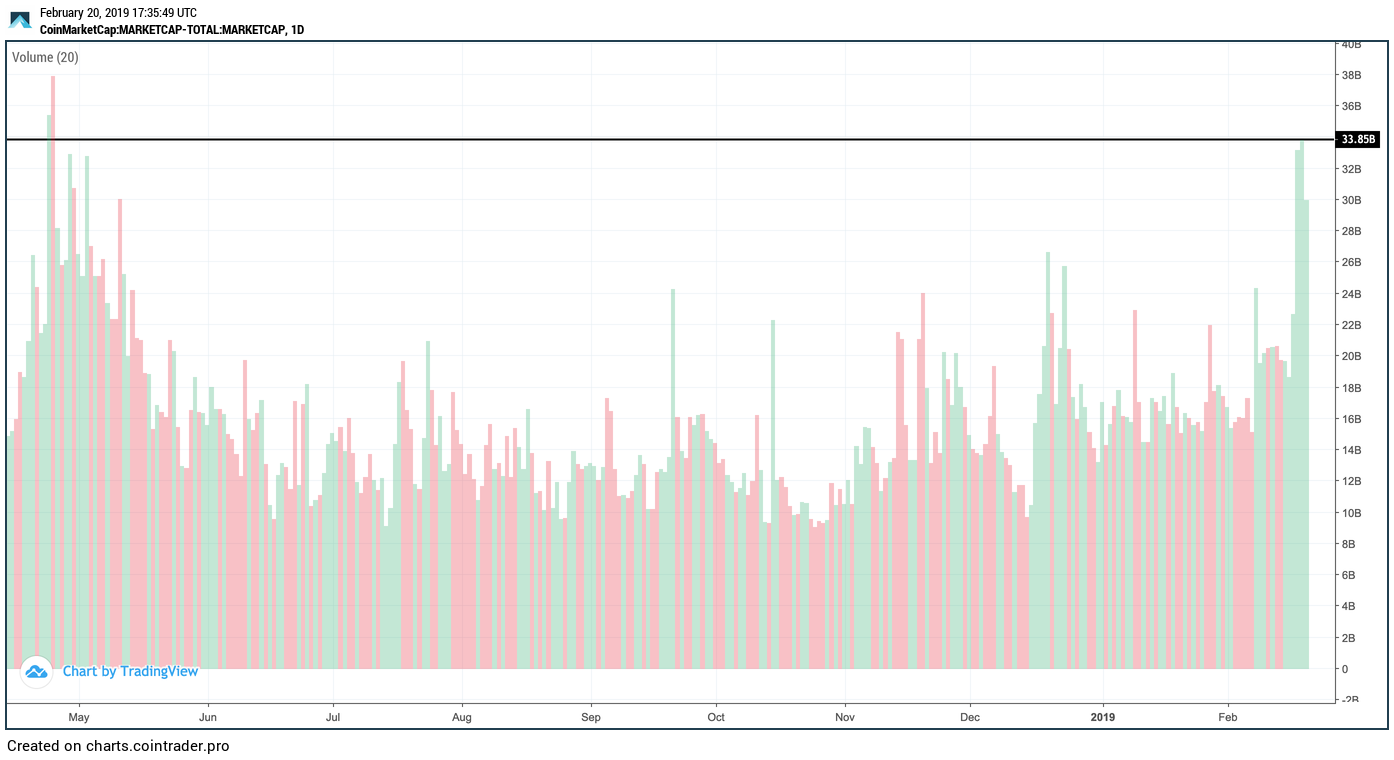

The total volume of all cryptocurrency trading as tracked by market metrics leader hit a 300-day high Tuesday, reaching $33.85 billion, the most observed in 10 months.

As such, the data point is the latest to suggest that trading activity in the cryptocurrency markets is increasing – Coinmarketcap tracks the aggregate trading volume of 2,074 cryptocurrencies, including data about how they are being bought and sold across exchanges worldwide.

Daily cryptocurrency trading volume

But, the data hints that there may be more nuance at work than simply a market-wide surge; a large majority of yesterday’s trading volume came from the 10 largest cryptocurrencies by market cap.

The aggregate trade volume from the top 10 alone was roughly $30 billion, or 88 percent of all trading volume seen Tuesday. bitcoin (BTC) and tether (USDT) recorded 24-hour trade volumes above $9 billion, each accounting for roughly 27 percent of the 24-hour total.

Still, the uptick in trading volume shows a renewed investor interest in the market, which perhaps should not come as a surprise seeing as the value of the broader cryptocurrency market has increased roughly 12 percent in the last seven days.

That said, trading volumes are still a fraction of what was seen toward the end of the most recent bull market in 2017. The most trading volume ever recorded in a single day occurred on Jan. 4, 2018, when just over $68 billion in cryptocurrency changed hands, an amount that’s more than double yesterday’s total.

Trading volumes are off to another strong start today, recording $29.8 billion at press time. Since the beginning of the week, $96.9 billion in total has been traded, which is already 68 percent of the volume recorded in the prior week, which at the time was a near nine-month high.

Disclosure: The author holds BTC, LTC, ETH, ZEC, AST, REQ, OMG, FUEL, ZIL, 1st and AMP at the time of writing.

Trading image via Shutterstock; charts from charts.cointrader.pro by TradingView

Published at Wed, 20 Feb 2019 18:20:16 +0000