Just two days after Cboe that it was going to delist futures, the ’s spot market turned near-term bullish.

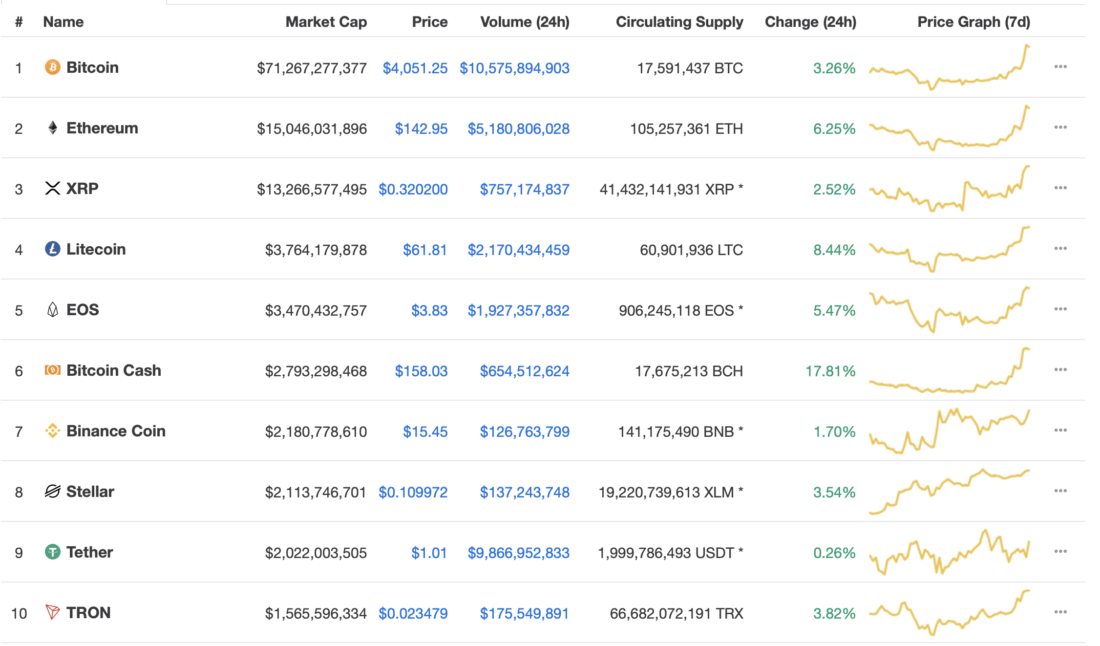

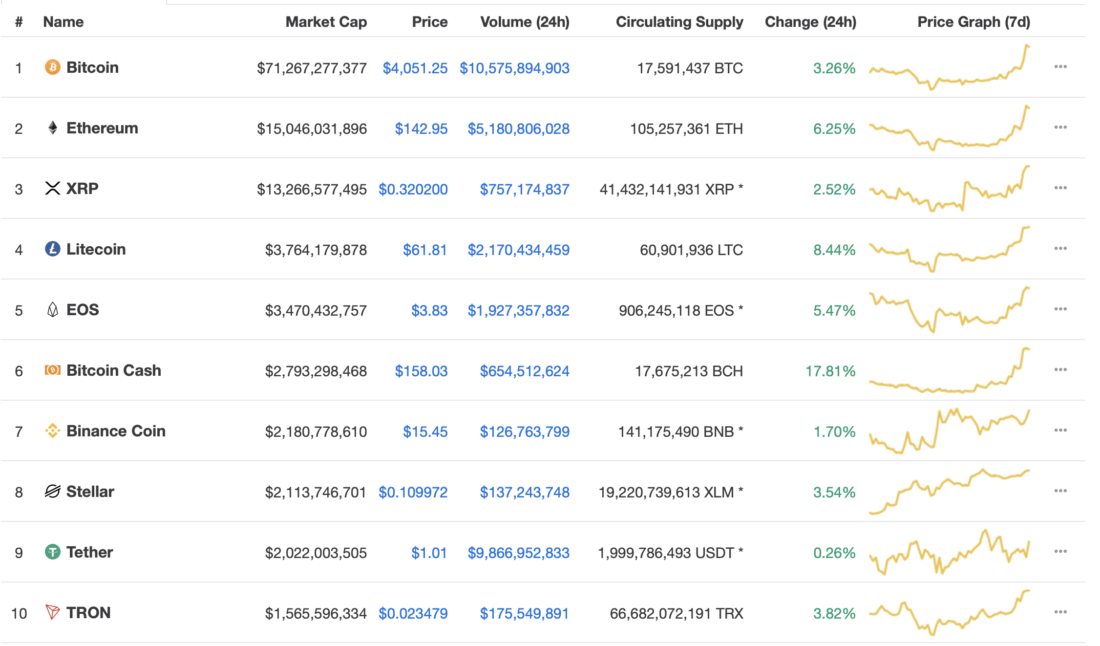

The /USD exchange rate surged 3.30-percent in the past 24 hours to establish a session high towards 4069. Simultaneously, the rest of the market also went green, with leading the bull pack with 17.81% gains, followed by , , and that rose 8.44-, 5.47-, and 6.25-percent, respectively. On the whole, the market capitalization added up to $6 billion worth of investments in a day.

All Top Trended in Green This Saturday | Source: CMC

Not the First Time

The rally follows an overstretched stable action since February 25. The ’s significant levels remain unchanged as it traded inside a $200-range for almost two weeks. Before that, failed when it came to piercing through key resistance areas. At the same time, the received equally stronger support from bulls on every downside correction. Have a look at this chart to understand further.

/USD Analysis | Source: Bitfinex.com

One can notice that is trending inside a symmetrical triangle defined by red trendlines. It is providing traders a clear understanding of the ongoing price action. As close as the price gets to the triangle’s apex, the lesser the volume becomes. At the same time, every upside attempt is failed by a stronger red resistance trendline – barring a few instances of false breakouts. From mid-December to now, the /USD market has seen six of such breakout attempts. The market is now in its seventh one.

Low bitcoin Volume

Luke Martin, a hugely followed trader, and analyst, expects the weekend to bring new volume spikes. He tweeted Friday:

major levels for me remain unchanged as it’s traded in the same $200 price range for 2 weeks.

Don’t get lost in the noise/low timeframe spikes.

I am expecting some action tomorrow or this weekend as this has been the trend for a month straight. Friday-Sun higher vol…

— Luke Martin (@VentureCoinist)

The market is somewhat mirroring Martin’s prediction. While there has been a modest volume spike on a daily chart, it is still not enough to kickstart a breakout run. Let’s have a closer look:

/USD Analysis | Source: Bitfinex.com

The orange bar reflects the highest 4H volumes in the past two weeks. These are not comparable to the mad spikes the market saw between February 20 and 25 hours. Atop that, the /USD market is below the orange bar and, at the same time, its Relative Strength Index, the momentum indicator, is already overbought.

Therefore, there is a considerable possibility of a bearish correction. There is not enough volume to support a breakout action.

I want to be bullish. I really do. But I have to ask myself, what if we’re wrong?

Please, tell me I’m just in disbelief.

— Jonny Moe (@JonnyMoeTrades)

Not a Rally, Until

Twitterati Room drew an interesting graph reflecting key resistance areas must break to establish a rally. As explained in the chart above, we are also expecting a confirmed bullish breakout once the price breaks above $4,408. However, according to the Room, one should watch out for the moving averages. Excerpts from their statement:

“ 50 MA has crossed over 100 MA in Daily Chart for 1st time since Aug. Ideal Conditions for a Move towards 200/350 MA. Need big impulse move to confirm a breakout.”

loves Ping Pong against Moving Averages

My favorite MAs

7 EMA

20 MA

50 MA

100 MA

200 MA

350 MA

500 MA 50 MA has crossed over 100 MA in Daily Chart for 1st time since Aug. Ideal Conditions for a Move towards 200/350 MA. Need big impulse move to confirm breakout— Room (@tradingroomapp)

Until that happens, every upside move would end up becoming a bull trap.

Published at Sat, 16 Mar 2019 12:17:11 +0000