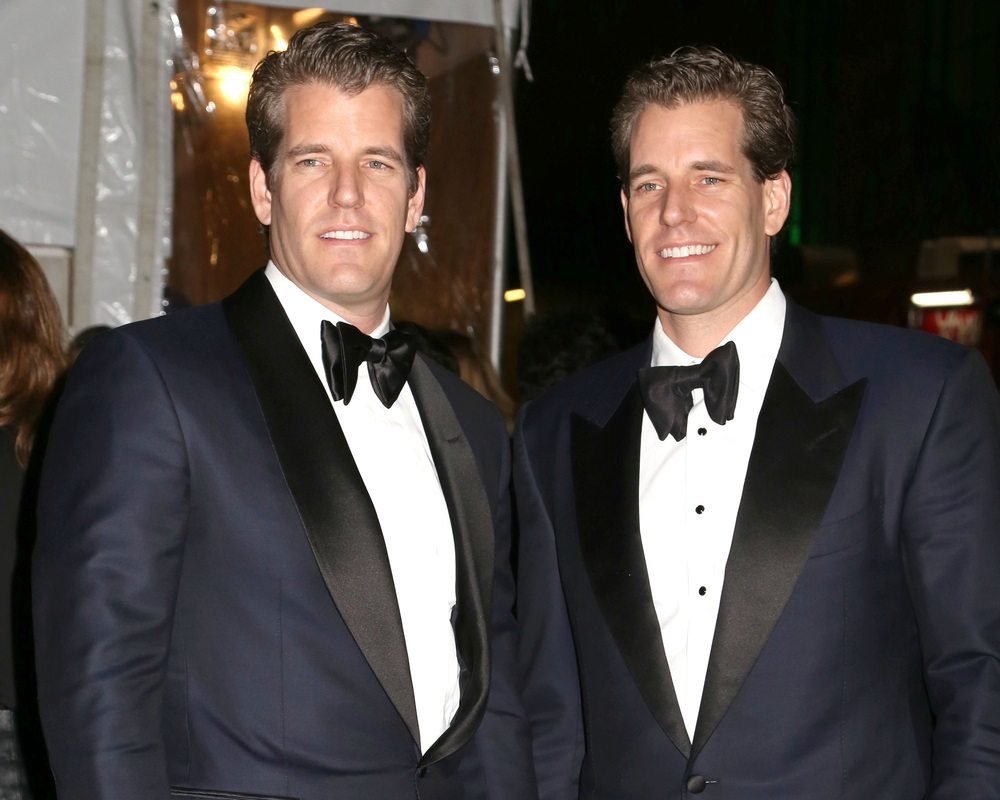

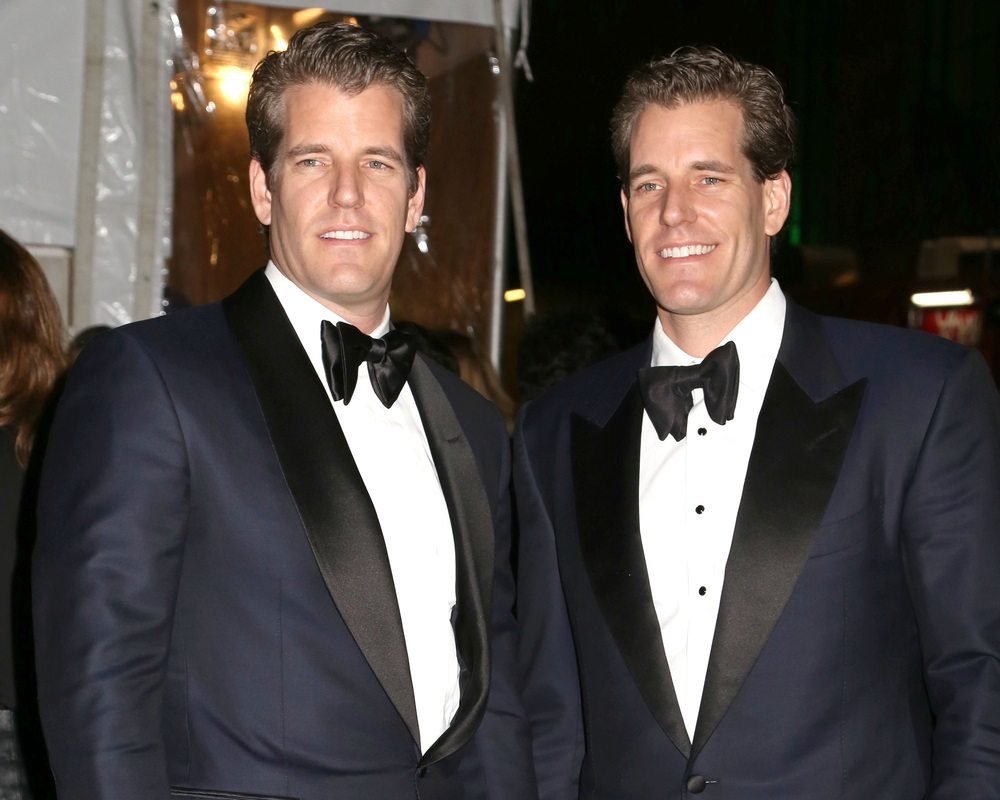

Gemini, a crypto exchange founded by brothers Cameron and Tyler Winklevoss, concluded a SOC 2 Type 1 security compliance evaluation, according to a blog last January 29.

A group that goes through a Service Organizational Control (SOC) 2 audit seeks to guarantee that it has fulfilled the service criteria established by the American Institute of Certified Public Accountants (AICPA). These criteria point to standards of confidentiality, security, privacy, processing integrity and availability.

The announcement indicated that Gemini is the first in the industry to go through such an audit. The audit was done by “Big Four” auditing company Deloitte, which took a look at Gemini’s exchange application, infrastructure, underlying customer database, and its storage systems that keep the keys of Gemini’s online and offline wallets.

Gemini also stressed that, aside from the SOC 2 Type 1 test, it would go through an SOC Type 2 review later this year, in order to further ensure compliance and a high security standard. It said that, “This additional level of assurance will further validate the effectiveness of our internal controls.”

Late last year, Gemini got insurance coverage for custodied digital assets from lending services firm Aon. The digital insurance coverage supplemented the Federal Deposit Insurance Corporation-insured U.S. dollar deposits on the exchange.

Early in this year, Gemini began a new ad campaign that pushed for better of the crypto space. Placards on taxis and in the New York City subway held slogans like “crypto needs rules” while others claimed that “money has a future” and touted Gemini as “crypto without chaos.”

The head of marketing at Gemini, Chris Roan, remarked to the Wall Street Journal:

“We believe that investors coming into deserve the exact same protections as investors in more traditional markets, adhering to the same standards, practices, regulations and compliance protocols.”

Published at Wed, 30 Jan 2019 03:14:37 +0000