By: Turns out 88-year-old isn’t warming up to crypto after all. Speaking at what’s been dubbed the “Woodstock of Capitalism”, the billionaire investor told shareholders in Berkshire Hathaway how he really feels about . His company’s annual shareholder event is being held in Omaha today, and he just couldn’t resist lamenting the digital currency that he just doesn’t understand. :

“It’s a gambling device… there’s been a lot of frauds connected with it. There’s been disappearances, so there’s a lot lost on it. hasn’t produced anything.”

At least didn’t call it “rat poison squared” like he did last year. His partner in , , reportedly once compared crypto to “dementia.” ’s shareholders probably come to Omaha just to hear what he’ll say next about the crypto revolution taking the economy by storm.

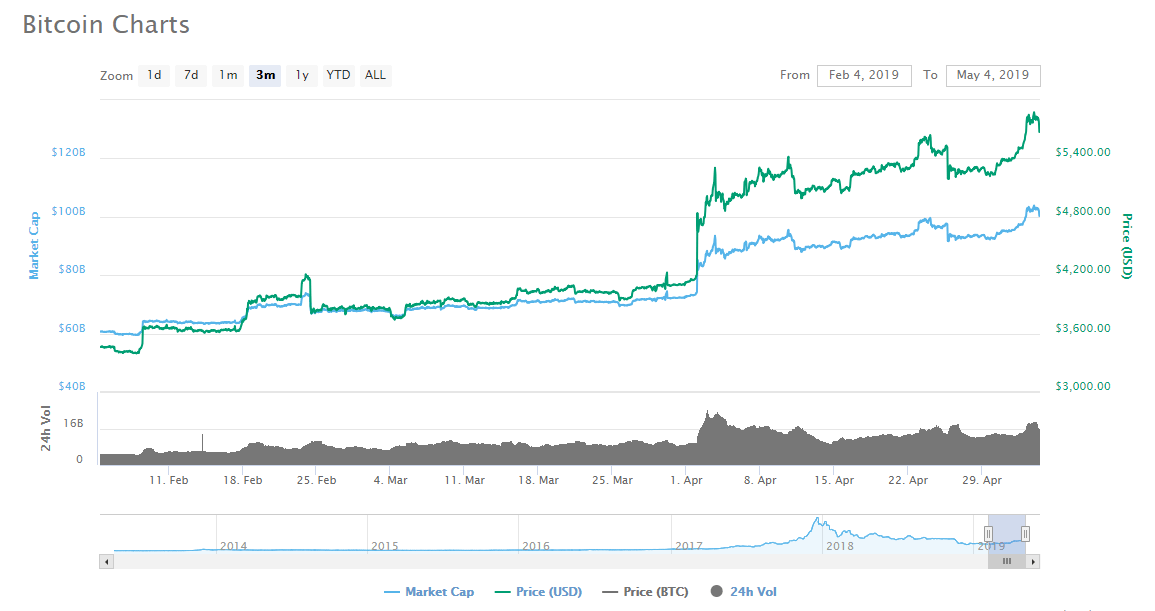

The price is barreling for $5,700. | Source: CoinMarketCap

bitcoin ‘Isn’t an Investment’

didn’t stop there. He went on to insult investors who not only have benefitted from the peer-to-peer nature of but he also suggested that it’s not an investment at all. Tell that to the 100-million strong crypto community, many of whom have seen their portfolios balloon since the price hit a new 2019 high this week. is digging his own grave, so to speak, saying:

“It doesn’t do anything. It just sits there. It’s like a seashell or something, and that is not an investment to me.”

’s market cap is now $101 billion; it’s increased from $89 billion in the past two weeks or so. If that’s a seashell, then take us to the beach so we can start collecting them.

’s market cap is $100 billion.

— Pomp 🌪 (@APompliano)

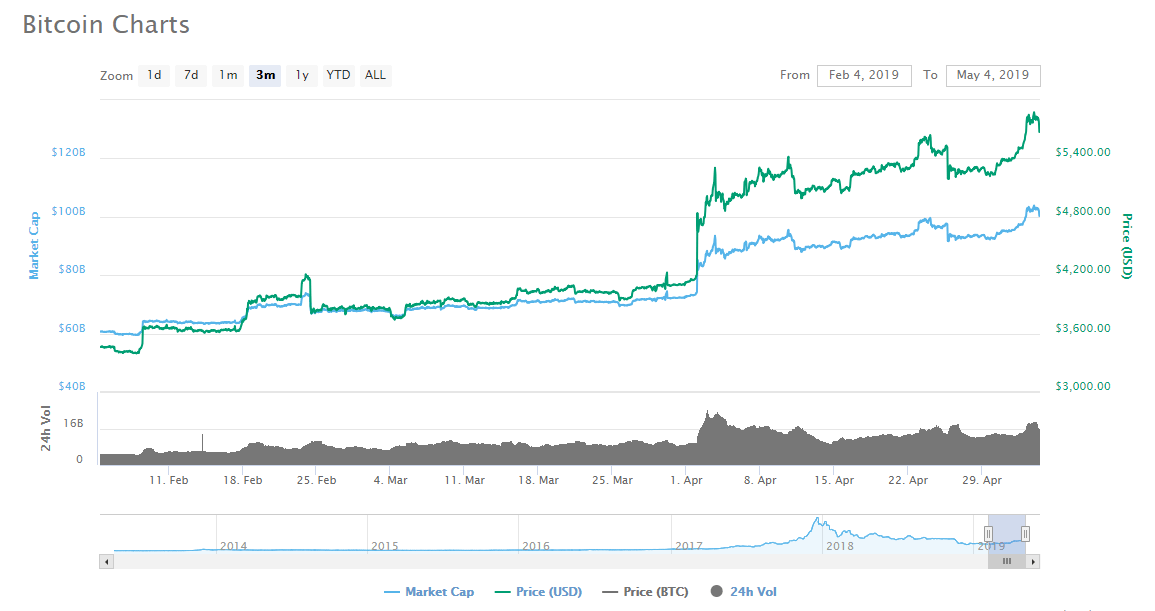

The thing to keep in mind about his remarks is that his own company’s stock, Berkshire Hathaway, is underperforming the broader stock market year-to-date. It has 8% gains vs. a double-digit percentage for the . And stocks are in the middle of an historic bull run. So probably he just can’t see the value in the because he doesn’t want to.

Berkshire Hathaway shares are underperforming the S&P 500 year-to-date. | Source: Yahoo Finance

Warren Buffett’s Button ICO

He went on to seemingly poke fun at ICOs next because he couldn’t possibly mean when he says:

“I’ll tear off a button here. What I’ll have here is a little …I’ll offer it to you for $1000, and I’ll see if I can get the price up to $2000 by the end of the day… But the button has one use and it’s a very limited use.”

Hmm, let’s see. is a of value that rivals gold. It is a peer-to-peer digital currency that gives migrants a way to send money to their families faster and cheaper than any money-transfer service without the can do. And it’s decentralized, so it’s not subject to the whims of any central bank or government that turns on the printing press and causes inflation.

IMF to crypto: “please be gentle with our house of cards”

— Spencer Bogart (@CremeDeLaCrypto)

Whether he realizes it or not, is spreading FUD about and the , saying:

“…is very big, but it didn’t need . J.P. Morgan, of course, came out with their own .”

pioneer that people who fail to recognize the value of but believe in tech demonstrate an “ignorance for how the system works.” We’ll leave Warren with Wences’ words of wisdom:

“ doesn’t exist without …If you were to remove the , miners would disappear and so would the .”

Published at Sat, 04 May 2019 16:16:55 +0000