bitcoin is trading in the green again, and the bullish forecasts are rolling in. Thomas Lee, Fundstrat’s co-founder and head of research, predicts that the crypto rally will continue and the bitcoin price could trade as high as $25,000 by year-end, according to an.

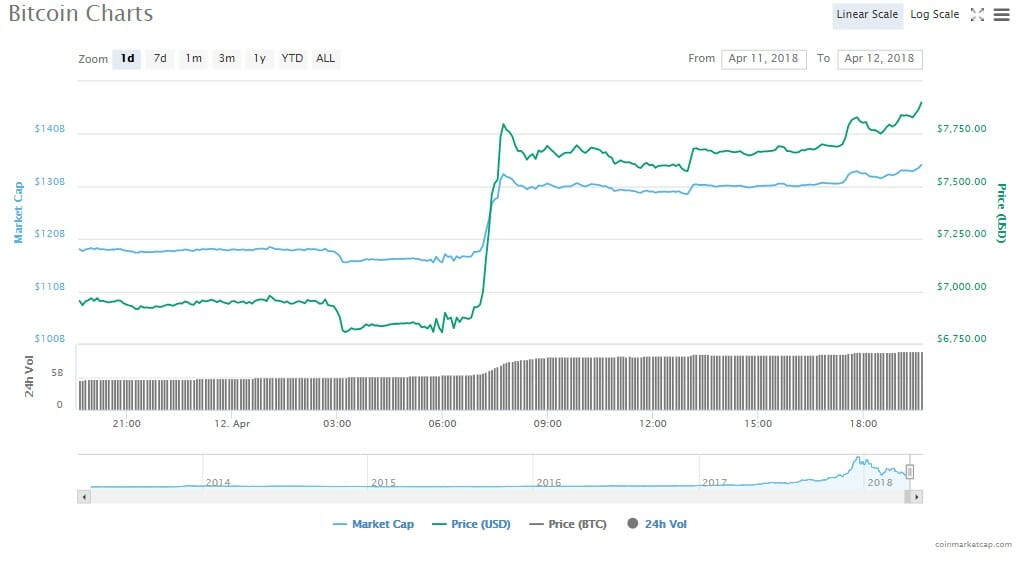

With the bitcoin price hovering at about $7,839 at press time, that means the No. 1 cryptocurrency could more than triple its value in the coming months, turning one of the most closely watched market downturns into a victory lap. Volume in the past 24-hour period has surpassed USD 8.8 million, which based on hasn’t happened since early March.

“We still feel pretty confident bitcoin is a great risk/reward, and we think it can reach $25,000 by the end of the year,” Lee told CNBC.

Fundstrat’s Lee is a known bull on bitcoin, having been able to see the forest for the trees throughout the first quarter bear market. So he’s not surprised to see the rally, saying that it’s actually “overdue” and that bitcoin has been “incredibly oversold.”

Indeed, Lee, a market strategist, has blamed the downturn in the cryptocurrency markets on tax selling, as investors looked to take profits to offset their capital gains tax. He said tax selling has “accelerated in the past couple of weeks because tax day is coming up.”

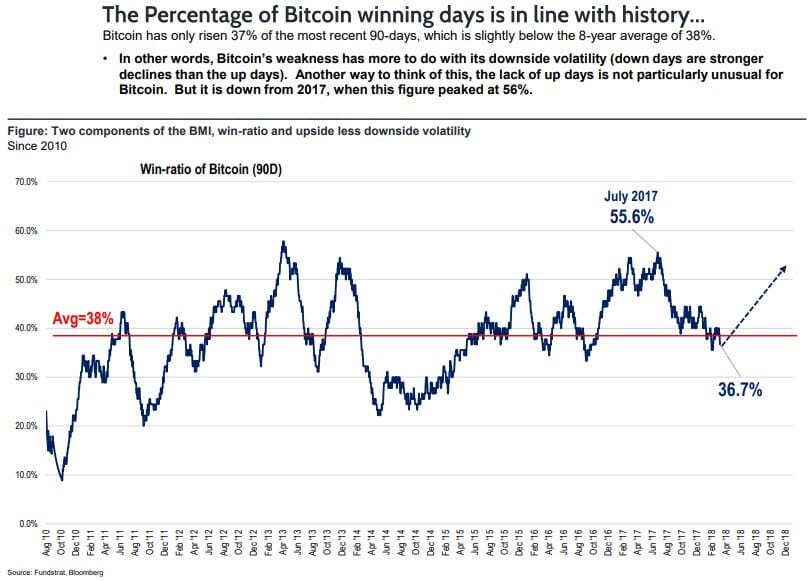

Lee also pointed to Fundstrat’s bitcoin Misery Index (BMI), which is comprised of a “win-ratio and upside less downside volatility.” He said it’s reminiscent of where the index stood at the end of the 2014 bear market in bitcoin (that bear market resulted from the demise of Japan’s Mt. Gox exchange.) A recent Fundstrat report said: “With the BMI at 18 (lowest since 2011), future returns for BTC are quite strong.”

Lee said back on March 28 that investors should be “patient buyers of bitcoin here.” He pointed out then that it wasn’t a good idea to try and time the markets, noting that “annual gains are driven by an average of nine days each year.”

Having said that, Lee was right on target with his prediction that the selling pressure would ease right about the time of tax day, which is April 17 this year. Naysayers have questioned the theory because of the global trading that occurs in the bitcoin market; it’s not just a US-phenomenon. But the theory appears to have been substantiated.

Fast and Furious

The bullish calls on bitcoin are coming , which only intensifies the expectation that cryptocurrencies have in fact turned a corner in the second quarter and that the bulls are out in full force.

Featured image from YouTube/.

Follow us on .

Advertisement

Published at Fri, 13 Apr 2018 11:44:41 +0000

bitcoin Price News