New York Firm Launches Crypto Offering

2018 may have seen bitcoin (BTC) fall by over 70%, but institutions and powerhouses in traditional industries are still actively seeking to get their foot into the crypto door. CoinDesk that blockchain-friendly IBM, one of the largest forward-thinking technology companies across the globe, has quietly entered into the cryptocurrency custody space with a little-known partner.

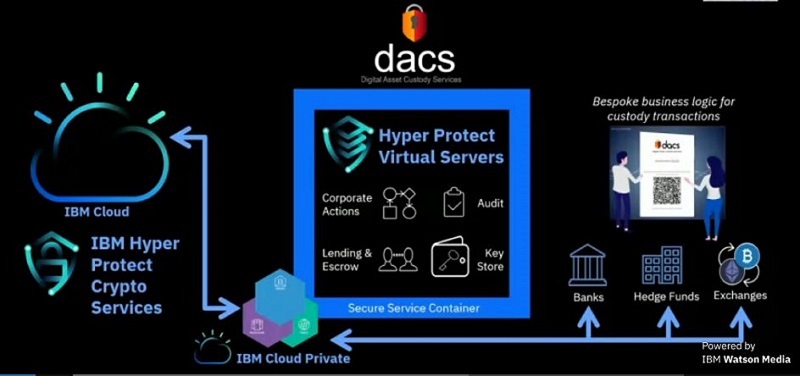

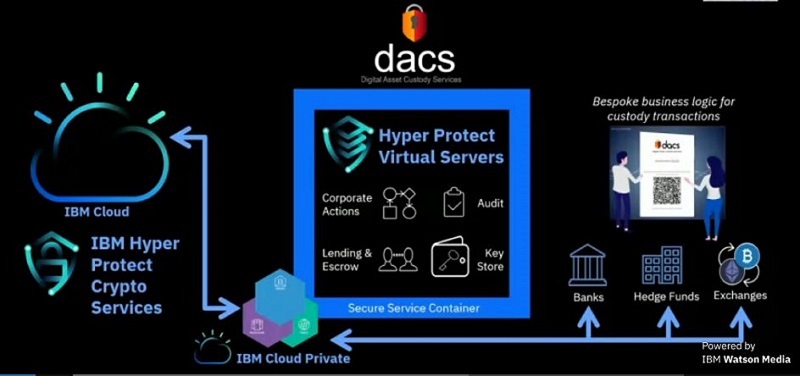

The outlet’s Ian Allison writes that Shuttle Holdings, a New York-headquartered investment group, will be launching custodial services for this newfangled asset class sometime in late-March. Shuttle has purportedly built the offering on private cloud service, backed by the Corporate America darling’s encryption technology. It is important to note that Shuttle is offering the tools for cryptocurrency custody, rather than handling the nitty-gritty itself.

Much like other institutional plays in this budding space, Shuttle has started small, offering its solution to a hand-picked list of clients that it believes can handle the cryptocurrency . Eventually, however, the company intends to see banks, brokers, custodians, family offices, along with other institutional subsets dabble in the storage of cryptocurrency.

Shuttle and IBM’s venture is not exactly what traditionalists would call cold storage. As hinted at earlier, private keys will be stored not on a device in a vault, but in the cloud (private that is) and secured by a number of layers of industrial-grade encryption. In a presentation at an IBM event, Shuttle’s Brad Chun explained that it sought to harness this method of custody as firms need their often at a moment’s notice, with a digital system being much more efficient in that regard. He even states that by some measures, Shuttle’s tools will be “just as secure, if not more secure” than , some of which were proven to have massive security vulnerabilities over recent months. Explaining more about the project, Chun told CoinDesk:

“There are always trade-offs between security and efficiency, but we do not utilize a traditional cold storage system. Instead, we keep keys at rest encrypted in multiple layers as data blobs so that an organization can these backups using their pre-existing disaster recovery and backup processes and media.”

Interestingly, Chun mentioned that he attempts to push Shuttle’s custody service to eventually service real world asset-backed , like those for (land titles), shares of both private and public standing, among others. As Anthony Pompliano, , among others are pushing for a tokenized world, this may only make sense.

This offering comes after IBM’s head, Jesse Lund, reporters that he expects to end the year at $5,000 before skyrocketing to $1 million as time elapses.

Custody: A Growing Trend

This, of course, only underscores the industry trend of custody of digital assets. Per reports, it has been officially confirmed that Fidelity Digital Asset Services (FDAS), the first fully-fledged crypto platform backed by Wall Street, has gone live. In a number of interviews with outlets this week, Tom Jessop, a former Goldman Sachs executive turned head of FDAS, explained that his brainchild’s offerings are live for a select list of “eligible clients.” Jessop adds that at the moment, the platform only supports , and will be staving off its verdict on due to impending upgrades.

Photo by on

Published at Wed, 13 Mar 2019 00:07:03 +0000