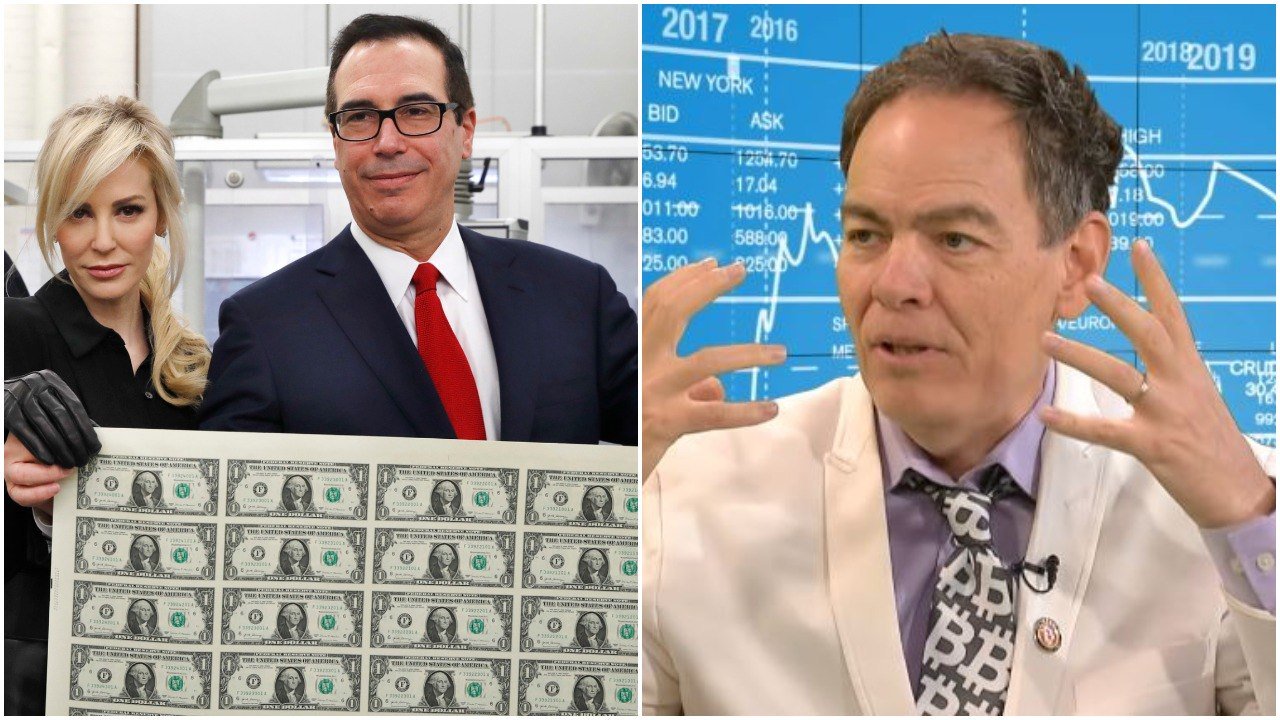

By : U.S. financial and opinion broadcaster Max Keiser is a textbook hodler. For the host of the Keiser Report on RT to dispose of the he has been accumulating since 2011, his price target of $100,000 will have to be achieved first.

The Fed Triggered This bitcoin Rally

Speaking to , Keiser said that since acquiring his first eight years ago, he had not sold any of it. According to the broadcaster, this is “because my price target is $100,000 and beyond.”

This is not the first time Keiser has stated that will reach $100,000. In his view, this price target will be realized as transitions from being a “-of-value commodity thing to a medium of exchange to a unit of account.”

Regarding ’s recent rally, Keiser explained that it was triggered by the signaling more quantitative easing.

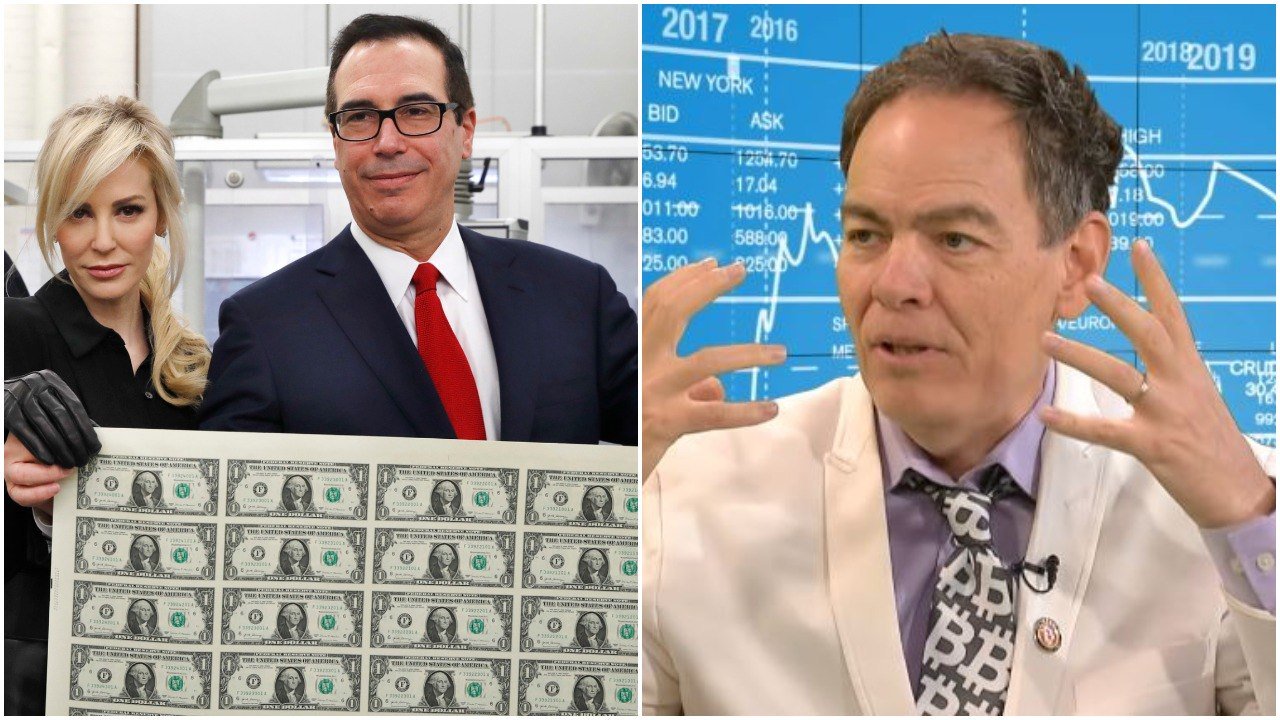

This, according to Keiser, was a message that the Fed had not learned from its past mistakes. It would, therefore, would print more dollars without any “accountability,” further debasing the reserve fiat currency.

As a result of the Fed’s intent, wealthy investors sought refuge in , igniting the crypto market’s meteoric ascent.

The financial and opinion broadcaster also suggested that the recent by Grayscale Investments may have contributed to ’s recent price rally. Gold now faces competition, according to Keiser.

Gold is no longer the standard of wealth.

— Grayscale (@GrayscaleInvest)

Despite his anti-gold stance, Keiser disclosed that “I own a lot of gold.” He also owns silver which he estimates to be in the range of around 35,000 ounces.

Keiser, incidentally, downplayed the role of the Chinese in driving the up. Recently, some analysts hypothesized that as a result of the U.S.- trade war, Chinese citizens have been turning to to get their money out of .

Keiser’s a bitcoin Maximalist Through and Through

Asked whether he was invested in other , Keiser revealed he was a . According to Keiser, don’t possess any unique feature that is not found in :

“There is nothing those coins can do that can’t do now or will be able to do soon.”

In the future, Keiser predicted that would continue to reign supreme. Already, according to the broadcaster, the flagship is “cannibalizing those coins, it’s eating their lunch.”

The broadcaster’s interest in the started after a guest on his show, Jon Matonis, told him about it. That was back in (video below; interview starts at 13:00). In the 1990s Keiser had also experimented with a virtual currency known as .

It’s Wall Street’s Turn to Succumb to FOMO

Among the factors that Keiser believes will drive the price of higher is .

“ is making the institutional play now, and there is going to be a mass fear of missing out… or FOMO is going to jump to the institutional level and they have got the big bucks, and now we are going to see some big moves.”

While stating that was making cross-border transactions cheaper and more efficient, Keiser also indicated that this was a threat to nation-states as they are currently constituted. He predicted that politicians would not be able to stop this, as it is impossible to regulate .

Regarding the call by U.S. Rep. Brad Sherman to “shut down because it is interfering with the dollar being the hegemonic force in the world,” Keiser had four words for the Californian: “huge advertisement for .”

Published at Thu, 16 May 2019 16:14:20 +0000