Between and , Liqui.io delisted 25 token pairs. A shrill believes that signs point to an exit scam in progress.

Liqui.io has been delisting alot of their coins lately. Including some of their top 10 volume coins like BAT. Meanwhile they give customers just 15 days to withdraw after delisting (approx a month after announcement) to withdraw the coins. People that are on vacation / hodling / sick are likely to miss their announcements. It seems like this short announcement time has a reason: Liqui already started to liquidate 300k USD++ assets!

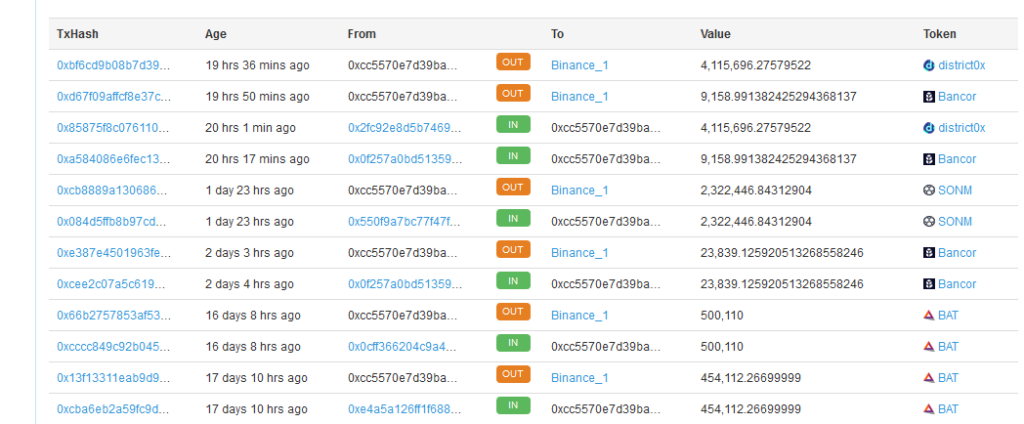

BAT was in the first batch of 13 tokens delisted. The post gives an address of _ and alleges that this address belongs to Liqui and that they are therefore laundering pilfered balances from clients who did not withdraw or liquidate their positions.

If this address is actually associated with Liqui, then it would seem that at least the assertion that they are liquidating the tokens would is correct. The move to eliminate Basic Attention Token came just weeks before news that Coinbase was listing the token and trading picked up, driving the price. At the time of the announcement, the BAT price was around 16 cents, whereas by the time Liqui saw fit to move over 1.4 million of the tokens, the price had risen all the way to more than 24 cents.

As noted by the Reddit post, Liqui’s 290,000+ users were only given 29 days total to withdraw their funds. If 1.4 million of the tokens remained on the exchange, it would seem prudent to extend that time. A possibility is that the exchange itself was participating in trading of BAT and the resulting balance is a result of their trading.

Liqui never mentions that they are trading against clients anywhere in their literature, so this would seem to be amoral at best. If they had been denominated in the tokens being traded, rather than the markets being used, then it would be also possible that these were leftover exchange fees. CCN has reached out to Liqui for comment regarding this matter and we hope to gain some insight.

Liqui’s of the BAT delisting tells users that it will be “unable” to process withdrawals. The trouble is, we see clearly on the blockchain that they in fact had many tens of thousands of BAT sitting around.

Once the withdrawal deadline has been reached (October 13, 2018 at 12: 00 UCT), withdrawals will be disabled and the asset will be fully decommissioned. From this point forward, we will be unable to process withdrawals of impacted assets. It is imperative that customers withdraw delisted tokens by the withdrawal deadline. Please note that this deadline also applies to previously delisted assets, such as VET, EOS.

A similar situation occurs with SONM, which was put on the chopping block on October 20th and fully eliminated on November 11th. Again, we see a strong market upward pressure in SNM, meaning that Liqui was able to sell the tokens left on its exchange for more than they were worth at the time of the delisting announcement.

In the case of SNM, over 2.3 million tokens were sent to Binance. The Ethereum blockchain notes that as a result of these deposits, Liqui subsequently brought back a total of more than 34,000 Bancor Network Tokens, worth over $1 each. Also acquired were around 4.1 million DNT tokens worth $0.024 each, for a sum asset acquisition of around $120,000 between the two tokens. Other delisted tokens were treated in a similar way, probably accounting for the Reddit user’s math adding up to over “300k USD.”

Featured image from Shutterstock.

Follow us on or subscribe to our newsletter .

Published at Tue, 13 Nov 2018 19:40:14 +0000