On March 13, 2018, European Bank Officials discussed the potential of a Central Bank-backed cryptocurrency and how it would challenge the current banking system. Although they believe that existing digital currencies like are not the future, they see do seem the financial advancement as ‘an early sign of change.’

Changing Transaction Mediums, but Probably not bitcoin

Benoit Coeure, Member of the Executive Board of the European Central Bank () and Jacqueline Loh, Chair of the Bank for International Settlements () Market Committee commented that while “cash will not be king forever,” the future of money will not revolve around existing cryptocurrencies since they are “poor imitations of money.”

“Almost nobody prices goods in bitcoin, few use them for payments, and, as a store of value, they are no better than gambling in a casino. Policymakers are rightly worried about consumer and investor abuses, as well as illicit use.”

Despite ECB’s pessimistic stance, Coeure and Loh believe today’s cryptocurrencies could pave the way for the future, just like “Palm Pilots paved the way for today’s smartphones.”

As such, the duo went on to explore the idea of Central Bank Digital Currencies (CBDC) and how this could potentially work under the current financial system.

ECB published the opinion piece a month after Italy’s economy Minister Pier Carlo Padoan that Central Banks were considering issuing their cryptocurrencies. Although the ECB did not openly embrace cryptocurrencies, they readily acknowledged that existing cryptocurrencies highlighted severe flaws in the existing financial system.

Central Banks Are Still Uncertain

Under the existing financial system, “only financial institutions have direct access to digital Central Bank money via accounts at their national Central Bank.” A consumer-focused CBDC could, however, theoretically extend that access to everyone, removing the need for intermediary financial institutions.

A such an institution would have significant ramifications concerning the role and movement of money in the economy. It would also challenge and disrupt the existing banking business models.

Further, the ECB raised the necessity of implementing a CBDC as existing payment arrangements are moving towards digital, convenient, instant, and round-the-clock availability alternatives.

While the ECB recognizes that non-cash payments play a significant role in the future of finance, society is, however, not yet ready to embrace a cashless system. Demand for still banknotes remains high in many of countries.

If a CBDC were to exist, the currency would need to retain the convenience, ease, and availability that currently exists. On the technical backend, it also needs to be safe from any hack attempts, something that has plagued the crypto community since its inception.

bitcoin is the most secure financial network on the planet. But its centralized peripheral companies are among the most insecure.

— Nick Szabo⚡️ (@NickSzabo4)

The recent , one of the largest heists in cryptocurrency history, saw over $500 million of NEM coins lost. Despite many bag holders being refunded, it comes as no surprise that security and safety are one of the top concerns regarding a CBDC.

The ECB also stated that a CBDC “should not grant the same anonymity of cash to users,” and that “there is no one-size-fits-all solution.”

Acknowledging Traditional Problems

Despite the existing with cryptocurrencies like bitcoin, the ECB openly acknowledged the problems with the existing financial system, especially regarding cross-border retail payments.

“Such payments not only permit shoppers to easily buy goods online from overseas, but also allow foreign workers to send money, supporting financial inclusion and development. However, there payment channels are generally much slower, less transparent and way more expensive than domestic ones.”

The ECB ends their report stating that “improvements here are the best way of rising to the bitcoin challenge.”

While it is unclear whether they see cryptocurrencies as a direct threat to the banking system like the , the ECB will address and improve on existing international payment channels.

The post appeared first on .

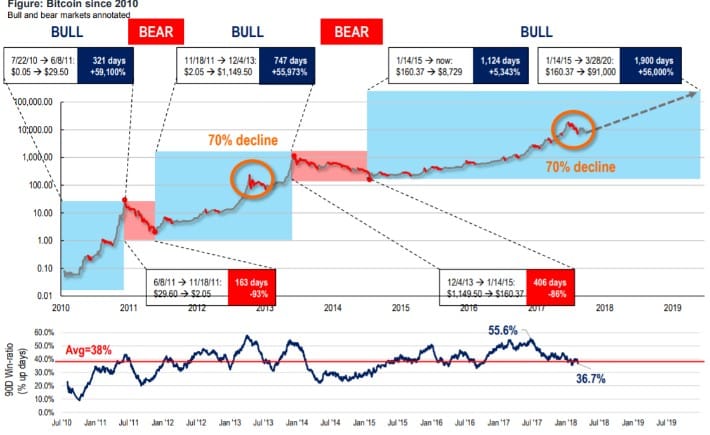

As bitcoin’s falling prices makes for a negatively fueled mainstream media headline, the market’s top fund managers are not fazed. Instead, they believe the market is still in an uptrend and is poised to keep increasing.

Tom Lee of Fundstrat Global Advisors, a Wall Street fund which has been historically bullish on bitcoin, strongly believes that the digital currency is . In a note to clients, Lee was bullish on even after a 70 percent fall from its all-time high in December 2017.

Lee compared the 70 percent decline to that of mid-2013, a retreat that was followed by a 700-plus day rally of more than 55,000 percent.

According to this chart, the is pegged at $91,000 by 2020.

Using Metcalfe’s Law to Chart bitcoin’s Price Movements

The framework Lee uses for purposes of valuing is based on three factors;

Growth of total money supply in the market,

The ratio of alternative currencies such as gold to that money supply,

Calculating bitcoin’s total market share among those alternatives.

“Based on a theorem based by George Gilder, which is the value of a network is the square of the number of users. And so if you build a very simple model valuing bitcoin as the square function number of users times the average transaction value. 94 percent of the bitcoin moved over the past four years is explained by that equation.” – .

In short, this explains the network effect. For example, the first fax machine was worthless because no one else used it and hence it held no utility. But once all of a person’s friends have fax machines, it becomes very valuable.

So has this been effective in valuing things, in the past, that have a strong network but weren’t producing any money.

also explains the growth of the market value of companies like Facebook, Alibaba, and Google. And these are all examples where the number of users – like if you double the number of users, you’re more than doubling the utility value. Hence, the market value of these company’s shares increases.

Institutional Investor Interest Increasing

The strategist also expects increased interest from institutional investors, and user account growth and usage to spur bitcoin’s gains. In July 2017, the former chief equity strategist became the first widely followed Wall Street market strategist to issue a report focused on predicting bitcoin’s price. Although the overall outlook for the firm is positive, it has observed some short-term technical red flags.

“We have seen a lot of technical damage since March 6,” said Robert Sluymer, technical strategist at Fundstrat. Sluymer added that the failure to take out the important $11,750 level has worsened the short-term technical view. However, they see the February low of $5,922 as a major low, meaning it will be tough to breach.

A slew of negative news has seen the price of digital assets come under immense pressure over the past two weeks. bitcoin fell ten percent on Wednesday, March 14 marking its eighth consecutive losing day out of the last ten. “March is typically the worst month for bitcoin, rising one of last seven years,” they wrote in sharing the following chart.

However stunning the figures on these crypto predictions may be, their percentage gains pale in comparison with 2017’s massive returns. bitcoin gained 2,000 percent in the 12 months leading up to its December peak above $19,800 on Coinbase. leaped roughly 9,600 percent to above $770, according to . And , or XRP, blew both away by soaring well over 35,500 percent to $2.30 at the end of 2017.

The post appeared first on .

In der zurückliegenden Woche ist rund um dem Globus mal wieder viel in Sachen Regulierung geschehen. In der Reihe “Regulierung in der Wochenrückschau” blicken wir zum Wochenausklang noch einmal zurück und fassen zusammen, was wann wo und von wem gesagt, gedacht oder beschlossen wurde. China: Kommen nationale Blockchain-Standards? Die chinesische Regierung arbeitet offenbar daran, einheitliche…

In der zurückliegenden Woche ist rund um dem Globus mal wieder viel in Sachen Regulierung geschehen. In der Reihe “Regulierung in der Wochenrückschau” blicken wir zum Wochenausklang noch einmal zurück und fassen zusammen, was wann wo und von wem gesagt, gedacht oder beschlossen wurde. China: Kommen nationale Blockchain-Standards? Die chinesische Regierung arbeitet offenbar daran, einheitliche…Der Beitrag erschien zuerst auf .