NEWS

Several large Ethereum-based projects have come together to create the Ethereum Community Fund (EFC), a vehicle to connect and fund the growth of (ETH) infrastructure, according to the .

The founding members of the EFC are , , , , , and .

Ethereum co-founder , Ethereum Foundation executive director Ayako Miyaguchi, and OmiseGo managing director Vansa Chatikavanij will join the project as advisors, according to Jun Hasegawa’s, the founder of OmiseGO, .

The beginning basis of the EFC is the Infrastructure Grant program, which the website describes as a

“Permanent financial endowment to support and aid projects in building crucial open-source infrastructure, tooling, and applications.”

Jun Hasegawa tweeted at the participating members of the fund yesterday in celebration:

Happy to working with you guys !! 😉 Exciting moment has been started with (Ethereum Community Fund) . Happy to having as advisors too 😉

More details following. Inquiry UNICEF Asks PC Gamers To Mine Ethereum And Donate To Syrian Children

NEWS

UNICEF (United Nations International Children’s Emergency Fund) has started a new kind of charity drive for Syrian children, asking PC gamers to use their computers to mine and donate their earnings.

The two-month long charity campaign that began Feb. 2, dubbed , is aimed at gamers that use high level graphics cards capable of cryptocurrency mining, turning the cards into “humanitarian tool[s]:”

“Today, humanitarian collections often solicit the same people with the same methods, but cryptocurrencies and their revolutionary approach are an opportunity to raise funds differently. Have you heard of bitcoin? The Ethereum is the same, except that you can more easily ‘mine’ the Ethereum coins via your computer and that money will go directly into the UNICEF wallet.”

Donations work in the following way: when participating gamers take a break from their computers or go to sleep, they can turn on UNICEF’s Ethereum mining program, thus donating without giving away anything but access to their computer’s processing power.

The website reads:

“Through the use of mining we create an opportunity for those who can not give or have never had the opportunity to do so.”

Game Chaingers’s statistics currently shows a total of 360 contributors, 44 of which are currently active at press time, that have mined almost 900 euros in donations for humanitarian aid for Syrian children.

According to the website’s project info, 8.3 mln children in Syria and bordering countries are in need of vital emergency help. UNICEF will use the donated Ethereum to give these children access to water, education, and health and hygiene services.

This isn’t the first time that UNICEF has thought to mix cryptocurrencies and humanitarian aid.

In January 2017, UNICEF at London Blockchain Week, a -based program aimed at creating transparency in global aid by digitizing donations.

More recently, in August 2017, UNICEF Ventures, a branch of the main organization, began also to improve the transparency of asset transfers.

, a -only charity founded by an anonymous donor, has also made to a number of philanthropic organizations in the past few months. According to their website, the Fund plans to give out a total of $86 mln to charity.

Hottest bitcoin News Daily

For updates and exclusive offers, enter your e-mail below.

Why Would South Korea Plan to Legalize ICOs Again?

FOLLOW UP

Last week, The Korea Times, a mainstream media founded by the country’s largest newspaper Hankook Ilbo, that sources within the government revealed the plans of local financial authorities to legalize initial coin offerings (ICOs) in the future.

“The financial authorities have been talking to the country’s tax agency, justice ministry and other relevant government offices about a plan to allow ICOs in Korea when certain conditions are met,” who asked to remain anonymous due to the sensitivity of the subject.

Concerns regarding investor protection

Most recently, Choi Jong-ku Financial Services Commission (FSC) chairman expressed his concerns towards domestic ICOs, citing high risks involved for investors within the cryptocurrency market.

In a conference held at the Seoul Government Office, FSC chairman Choi stated that the agency still remains skeptical towards the investor protection policies in place. Choi’s statement :

“There is a possibility that during the creation and issuance of a new digital currency through an ICO, various Ponzi schemes and scam operations may emerge. The agency will remain its negative stance towards the investor protection policies currently imposed on the local cryptocurrency market.”

Still, despite the concerns over investor protection by the FSC, several sources within the government told The Korea Times that local financial authorities are attempting to authorize domestic ICOs by enabling strict Know Your Customer (KYC) and Anti-Money Laundering (AML) systems, as well as a taxation policy for investors.

US SEC and South Korea on the same page

In essence, the South Korean government is willing to allow companies to conduct ICOs as long as the token sales are registered with the government, which is similar to the .

In December 2017, the US SEC stated that while private ICOs can be conducted within the US targeting local investors, they must be registered with the SEC. As of December, the SEC stated that there were no ICOs registered with the agency and that no ICOs are allowed to accommodate US-based investors.

“A number of concerns have been raised regarding the cryptocurrency and ICO markets, including that, as they are currently operating, there is substantially less investor protection than in our traditional securities markets, with correspondingly greater opportunities for fraud and manipulation. Investors should understand that to date no initial coin offerings have been registered with the SEC. The SEC also has not to date approved for listing and trading any exchange-traded products (such as ETFs) holding cryptocurrencies or other assets related to cryptocurrencies,” .

However, the SEC has not completely ruled out ICOs. Its chairman Jay Clayton stated in a cryptocurrency hearing that every ICO is a security because the value of tokens is directly affected by the performance of the businesses distributing them, .

Currently, the South Korean government is on a similar page with the US SEC, in that it is willing to allow ICOs that are registered with local financial authorities and are conducted transparently. Another unnamed source within the government told The Korea Times:

“Various scenarios such as the imposition of a value-added tax, a capital gains tax, or both on trade; and the collection of corporate tax from local cryptocurrency exchanges, as well as the initiation of authorized exchanges with licenses are being discussed.”

FSC cryptocurrency trading policies director Kang Young-soo confirmed that there are speculations about the potential legalization of ICOs, as he said:

“There are many speculating about the possibility of allowing ICOs. The FSC has acknowledged a third-party view regarding the issue, but there’s nothing that we can say officially at the moment.”Reasons behind ICO legalization

On March 5, several mainstream media outlets in South Korea including and revealed that Kakao, the country’s largest Internet conglomerate which oversees KakaoTalk, KakaoPay, KakaoStory and KakaoTaxi, applications that have over 90 percent market penetration in their respective markets including fintech, taxi service, messaging, and social media, is focusing on integrating cryptocurrencies for its 12,000 merchants and over 100 mln users.

Kakao is reportedly planning to integrate cryptocurrencies on all of its applications, which would allow users to utilize KakaoPay to send and receive cryptocurrencies while paying for services on platforms like KakaoTaxi. Kakao also revealed its plans to conduct an ICO and to release its own token.

But, Asia Business reported that due to the current regulations on domestic ICOs, Kakao is planning to conduct its ICO outside of South Korea, to circumvent local policies.

If Kakao decides to conduct its ICO elsewhere and moves its Blockchain business outside of the country, it may lead to a substantial loss for the South Korean economy, especially in the Blockchain sector. It could lead to a domino effect, convincing other businesses and startups targeting the Blockchain sector to move outside of South Korea.

Almost immediately after , FSC chairman Choi that the ICO of Kakao may violate existing regulations established by the local government.

“Even if there is no prohibition on cryptocurrency or digital asset trading, there is a possibility that it [Kakao ICO] may be regarded as fraud or multi-level sales according to the issuance method. Since the risk is very high in terms of investor protection, the government has a negative stance on the ICO.”

It is entirely likely that the South Korean government is moving towards legalizing ICOs to prevent the country’s leading conglomerates from leaving South Korea to conduct ICOs, which may damage the local Blockchain sector and cryptocurrency industry.

Stellar’s McCaleb: Blockchain Could Power ‘Universal Payments Network’ By 2028

NEWS

CTO and co-founder, as well as creator, Jed McCaleb March 21 about his vision for a singular global payments system — one that will crucially involve technology.

Stellar, which like is a Blockchain-powered international remittance setup with its own , is currently attempting to create such a network.

“In the future, I think it’s pretty clear to me there will be a universal payments network that will operate,” McCaleb said.

While the solution he sees might not necessarily have or at its heart, it would involve a “public ledger that people can see and can’t change arbitrarily.”

A halfway house situation may evolve, facilitating continued use of fiat currencies via Blockchain, letting people “use things they’re used to, like dollars and euros,” he adds.

McCaleb’s comments come as more and more legacy financial institutions reveal they are considering both Stellar and Ripple as a major shake-up of their remittance models. Ripple is currently due to be implemented on a commercial basis by South Korean later this year.

In future, it may not just be payments, but traditional assets such as stocks that go digital using Blockchain tech, McCaleb meanwhile said, the change potentially occurring before 2028:

“In the next 10 years I wouldn’t be surprised if all equity isn’t tokenized on some blockchain somewhere.”

Today, March 21, Twitter and Square CEO Jack Dorsey than McCaleb in terms of specificity, making his own prediction for the future of Blockchain and crypto. Dorsey said he sees bitcoin in particular becoming the world’s “singular” currency within the same timeframe.

South Korea Financial Regulator Says Fintech Will ‘Solve The Youth Job Problem’

NEWS

’s Financial Services Commission (FSC) has announced that they will use technologies for future innovation by focusing on supporting new technologies as opposed to regulating them, local news outlet reports today, March 21.

Choi Jong-ku, the chairman of the FSC, said in relation to the impetus for the FSC announcement that “the players in the financial service market are becoming more diverse, with new companies entering, and the competition in the financial market is becoming fiercer. As a result, existing financial companies are also making attempts with fintech to raise their services.”

Jong-ku added that he sees the advantages for young people in a more contemporary fintech market:

“Fintech is an area that requires new technologies, and it will solve the youth job problem by increasing job positions for young people.”

The FSC hopes that the reported “regulatory rollbacks” will allow businesses to create more jobs and lower service charges, giving examples of fintech business improvements like offering customers the opportunity to buy investments over video chat and using crowdfunding for small businesses.

According to Korea JoongAng Daily, the FSC will also approve an app-to-app payment system which allows customers to buy products without using credit card companies or networks, although banks will still add charges for the transactions. Korea JoongAng Daily lists fintech company Toss and online banks K Bank and as already having begun testing app-to-app payment technologies.

South Korea, believed to be one of the world’s largest crypto markets, has began . In January 2018, the government on crypto exchanges. The government in mid-February, underlining that there is no planned crypto ban in the country but that regulations are in place to prevent “any illegal acts or uncertainties.”

ethereum

eth

etherium

etherum

eth promotion

ethereum promotion

promotions

eth promotions

ethereum promotions

eth gift

ethereum gift

etherum gift

airdrop

binance airdrop

eth airdrop

etherum airdrop

etherium airdrop

ethereum airdrop

binance bonus

eth bonus

ethereum bonus

etherium bonus

etherum bonus

eth donate

binance donate

ethereum donate

etherium donate

etherum donate

eth donate

xDAC PLATFORM FEATURES

xDAC PLATFORM FEATURES

The focus of an xDAC Platform is based on company creation and token distribution. It also establishes standards for decentralized businesses. Whether it’s taking full advantage of decentralized ledger technology, automated dispute resolution or security of stored information, the platform lets anyone create and manage any kind of company without the limitations of geography.

An xDAC ecosystem can be viewed as several distinct technological layers strategically connected together.

Among the decentralized smart contract platforms, EOS is the most advanced feeless Blockchain platform.

The public’s smart contract layer provides an open-sourced implementation of key components creating the governance for decentralized applications (DApps) and Autonomous Agents to be built upon.

TOKEN DISTRIBUTION & USE OF FUNDS

A token sale will distribute 40% of tokens within investors and 20% of tokens will be used to incentivize early adopters of the platform. The remaining 40% will be retained with the project team. Proceeds from a token sale will primarily be used for R&D, operational expenses and marketing.

TOKEN SALE

xDAC token is the platform currency used for dispute resolutions, payrolls, merchant payment processing, profit distribution and development incentives.

Name

Blockchain

Token Issue Volume

Token Sale Volume

Soft Cap

Hard Cap

Token Price

1 ETH

Min Purchase

XDAC

Ethereum-based (ERC20) token

100,000,000

40,000,000

1,500 ETH

35,500 ETH

0.001 ETH

1,000 XDAC

0.1 ETH/100 XDAC

Early Investors

Pre-Sale

ICO Round 1

ICO Round 2

ICO Round 3

ICO Round 4

45% Bonus

20% Bonus

15% Bonus

10% Bonus

0% Bonus

the cooking revolution from Croatia

· The first cooking-specific ICO (Initial Coin Offering) is organized in Croatia, enabling anyone who loves to cook to offer their services on the market

· Transactions within CookUp will be made using CHEF tokens

· The ICO starts May 5th and is preceded by Proof of Care

· You can join Proof of Care by registering at https:// and sharing the project on social media, which can earn you up to 400,000 CHEF Tokens

Today, a lot of us spend more time on viewing, reading, searching and tagging food on social networks than on cooking. We look for fast and flexible meals but don’t always pay attention to quality. On the other hand, there are numerous enthusiasts who always find the time to indulge in cooking, no matter how busy their lives get — bloggers, housewives, professional and amateur chefs, all passionate about their relationship with home cooked meals.

To connect these two sides, we – Mint Media, a digital agency from Dubrovnik, Croatia, developed CookUp — a cooking revolution which uses the power of blockchain.

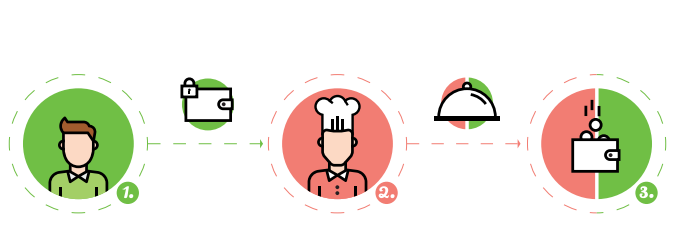

CookUp is a food ordering and knowledge sharing platform that connects anyone who cooks with those in need of quality home-made meals while helping to fight the world’s hunger problem. Users all over the world will be able to use it as a mobile or web application.

CookUp allows users to enjoy a quality and healthy meal without needing to spend time on food preparation while allowing cooking enthusiasts to offer food, organize dining events or share knowledge and make additional income, without the need for big investments.

CookUp plans to position itself within the global food delivery market valued at 83 billion EUR.

Our platform enables the freedom of doing what you love, offering your services on the market and making additional income.

CookUp Key Features

Cook

Become a CookUp Chef — Prepare food, organize dining events or share knowledge and make additional income

Eat

Enjoy home-made food — Order food from CookUp chefs, wine&dine at their place or hire a chef for special occasions

Share

Make a social impact — Help people affected by hunger simply by using the app. CookUp will donate 3% of every transaction to a charity fighting the world’s hunger problem.

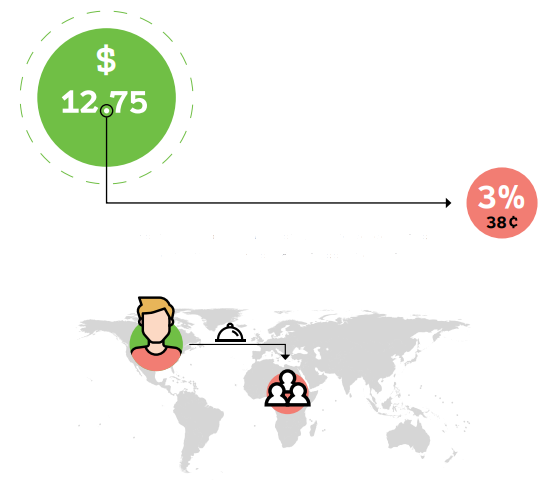

For 3% (38c) of every average meal price (12.75$) people eating out in the US, 3 meals could be provided for people in countries struck by the hunger problem.

CHEF Tokens

CookUp app will use CHEF tokens for transactions within its platform. They will be available for purchase within the application by credit cards, Ether (ETH) or other cryptocurrencies.

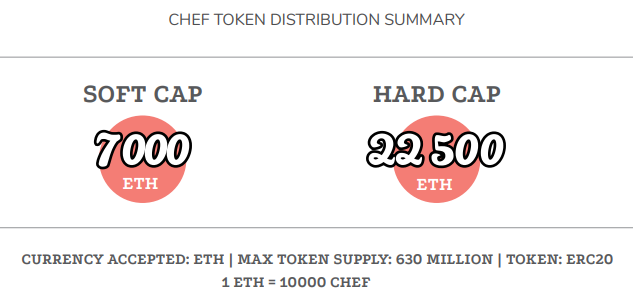

The CHEF token will be based on the ERC20 standard (Ethereum token) and will be generated during the Token Generation Event (TGE) in the limited quantity of 630 million tokens.

The CHEF token will be a utility token, listed on the most relevant cryptocurrency exchanges, and tradable through purchase and sale, so its value will be determined by the market.

ICO and blockchain

The CookUp team is made up of experts in the blockchain, marketing, IT, public relations, law, education, culinary advisors, and supported by the Croatian Association for Blockchain, and Cryptocurrencies — UBIK.

It has a number of advantages exclusively thanks to the blockchain technology — but the biggest are trust, transparency, and availability. Transactions are transparent, secure, automated, and implemented through a “smart contract”. User reviews are trustworthy and unchangeable while blockchain allows fully automated transactions towards a charity organization without involving third parties or paying bank fees. In addition, two billion people currently without a bank account would be able to use the platform.

The plan is for the Cook Up project to collect the funds needed for its development through the ICO and following the “go-to-market” strategy create opportunities for new jobs and healthy eating habits and help in fighting the world hunger.

A minimum amount of 7000 ETHs is required for soft cap, while the amount of 22,500 ETCs (hard cap) provides the possibility of faster development, community building, and opening towards new markets. The ICO starts on May 5th, but people can join the Cook Up now! In the Proof of Care phase, they can share the project information on social networks and earn a bonus of up to 400,000 CHEF Tokens.

See more and register at https://cookup.io