There’s no shortage of surprise in the world of crypto: Massive price swings, big corporate sponsorships, , and, of course, . Since ’s inception, the space has been plagued by technical bugs, user inexperience, as well as malicious agents hoping to leverage a still burgeoning technology in their favor.

To get a better idea of who’s working against these individuals, BTCManager spoke with architect Oleksii Matiiasevych from about ethical hacking, his history in patching vulnerabilities, and the case for decentralized exchanges.

Vulnerabilities in 8 Top-rated Cryptocurrency Exchanges

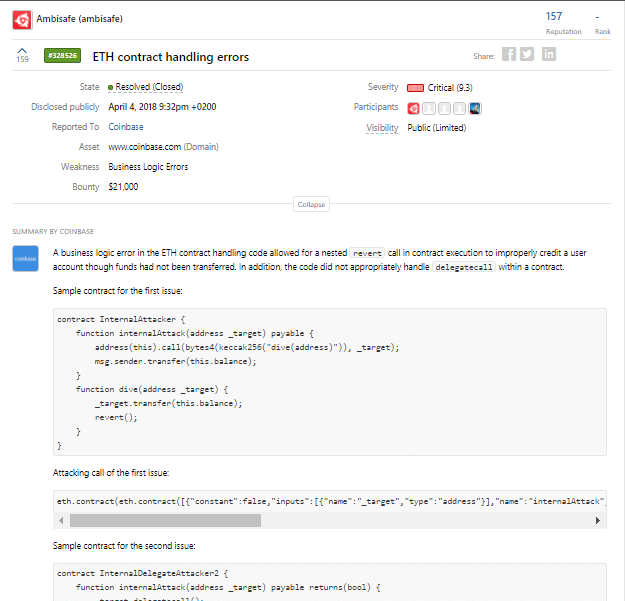

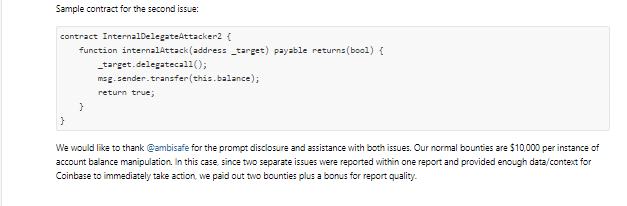

On March 22, 2018, a massive vulnerability was unveiled on the top 50 cryptocurrency exchanges. As it involved the Ethereum blockchain, and the Ambisafe team were a few of the first to react.

It began as a simple procedure to determine whether exchanges had adequately integrated the blockchain’s specifications. In this particular case, users interested in withdrawing would be pulling from a centralized exchange’s wallet. As such, the withdrawal wouldn’t necessarily be pulled from the first deposit, simply from the available stockpile.

Very little concern was placed on FIFO procedures, and from this lead, Matiiasevych determined that interested parties could fraudulently increase their account balances before proceeding to withdraw hefty sums of ill-gotten ether. With a background in software testing, Matiiasevych ran a handful of simulations to test his hypothesis.

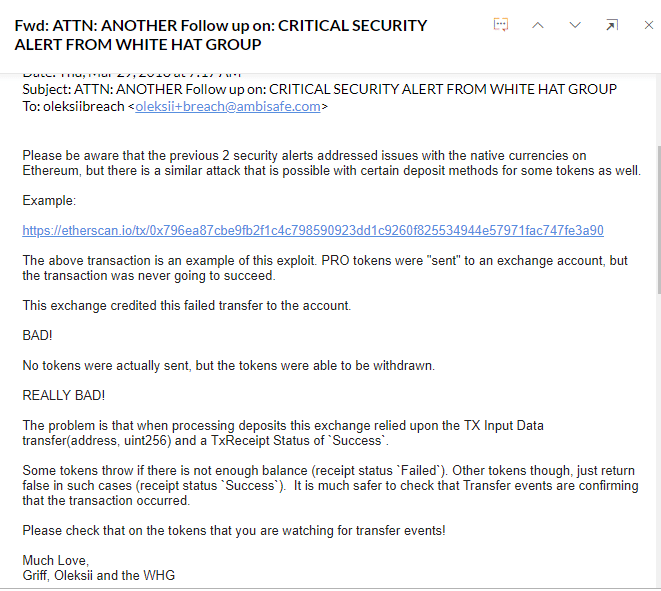

“At first, I detected one possible way for accounts to be compromised. We notified all the exchanges where this vulnerability was found and, just in case, sent a report to around 200 other exchanges that might have potentially been affected by the same bug,” recounts Matiiasevych.

The responses from various exchanges were mixed. Matiiasevych explained to BTCManager that “A few exchanges reacted quickly and made the changes. Some didn’t believe us or said they just discovered the same bug on their own and others simply didn’t respond.”

Immediately, made public their vulnerability on , a security platform that connects associations with individuals like Matiiasevych to resolve system weaknesses.

The White Hat Group’s Charitable History

All members of the White Hat Group (WHG) were also notified of which included Griff Green, founder of , a platform that is bringing the platform to charitable causes.

This swift action wasn’t the first that the group performed either; in July 2017 the group was also responsible for alerting, correcting, and ultimately helping to patch the . While malicious agents subsequently walked off with $32 million in spoils, the damage could’ve been much worse minus Matiiasevych and Green’s quick response.

The event generated such heat that claims for another hard fork paraded the Ethereum community leading Vitalik Buterin to comment on the matter.

Does anyone else notice how literally the only people calling for a hard fork or chain rollback right now are concern trolls?

— Vitalik "Not giving away ETH" Buterin (@VitalikButerin)

I demand my ETH back. chain rollback is imminent. We must hard fork now!

— Joshua Unseth (@junseth)

Decentralized Exchanges and Smashing the Honeypot

The Parity vulnerability was, of course, nothing more than a hiccup in the timeline of an emerging technology. Centralized exchanges, however, provide a much different solution: Instead of sitting on their fingers, investors, day traders, and amateur speculators have decentralized exchanges at their disposal. While this advent has only recently gained traction, it’s for good reason. Refer quickly to the , , and, most recently, the hack.

Each of these historic moments in the rise of cryptocurrencies could have been reduced to a blip on a security report if users were leveraging the same peer-to-peer technology underpinning the very asset itself.

Although Matiiasevych and Co. managed to deflect this most recent hack attempt, he agrees that this attack vector “was only possible via centralized exchanges” and that exchange operators “just want to get a coin listed rather than worry about how the technology works.” This latter point refers to the poor integration of Ethereum’s blockchain by the exchanges mentioned above.

Understanding decentralized exchanges like Ambisafe’s , , , , , , and means understanding Nick Szabo’s , “Trusted third parties are securities holes.”

The post appeared first on .

Despite warnings from the government, Brazilians have latched onto the crypto . With over 1.4 million bitcoiners and crypto investors, the vast South American nation undoubtedly has a vibrant virtual currency ecosystem. Now, bitcoin exchanges and cryptocurrency related businesses are creating rival associations instead of uniting themselves under one umbrella in the ‘spirit of the blockchain.’

A Divided House

According to , reputable blockchain-powered digital currency exchanges in Brazil recently came together and formed an association that would ‘defend the rights’ of the vast array of cryptocurrency enthusiasts, investors, and evangelists in the region.

Three significant exchanges – Bitcointrade, Mercado bitcoin, and Foxbit, as well as other smaller exchanges, created an organization called Associacao Brasileira de Criptoeconomia (ABCripto). However, other firms in the industry who felt the ABCripto ‘house’ wasn’t big enough to contain the entire Brazilian crypto population, also started their association.

Led by Atlas Project, a firm offering Fintech services in the region, these companies erected a different association dubbed Associacao Brasileira de Criptomoedas e Blockchain (ABCB).

While both organizations have different views concerning how the nation’s digital currency ecosystem should be regulated, they are both bent on making sure Brazil’s cryptocurrency industry remains vibrant and conducive enough for businesses.

ABCripto is determined to make its association one who takes care of a large number of crypto-related businesses. The association is looking to fight for the regulation of cryptocurrencies as assets. Vice President of ABCripto, Natalia Garcia hinted that the body is waiting to be given the relevant directives by the regulatory authorities.

ABCB President Commits to ‘Defend the Cryptocurrency Markets in Brazil’

Garcia told Portal do bitcoin she only got to know about the other association recently. Garcia also reiterated that in the coming weeks, ABCripto would launch into action in collaboration with some bitcoin exchanges. In her words (roughly translated):

“I’m concerned an association does not have any relevant exchanges. Everybody on the market knew we were building an association and getting ready to talk to other players in the market.”

Notably, ABCB is open to any form of the regulatory framework provided it won’t stifle the growth of the virtual currency ecosystem. President of ABCB, Fernando Furlan reiterated that the body would “defend the cryptocurrency markets in Brazil, defend privacy, and regulations that won’t end innovation. There is legal uncertainty. Depending on the purpose, it may be considered a means of payment or a financial asset.”

Additionally, Furlan stated that ABCB’s primary objective is to make it easy for its member firms in the ecosystem to scale regulatory hurdles, by acting as an intermediary between authorities and crypto-related businesses.

A Reasonable Compromise

Contrary to the opinions of many, ABCB has reportedly been in the works since October 2017, shortly before ABCripto was formed. However, both organizations have decided they will forget about all frivolities and concentrate more on the task ahead, for “the good of the nation.”

At a time when Brazilians are turning to blockchain technology in a bid to reduce the rate of and illegal practices by government officials, regulating the virtual currency system in a manner that encourages innovation will do the country a whole lot of good.

The post appeared first on .