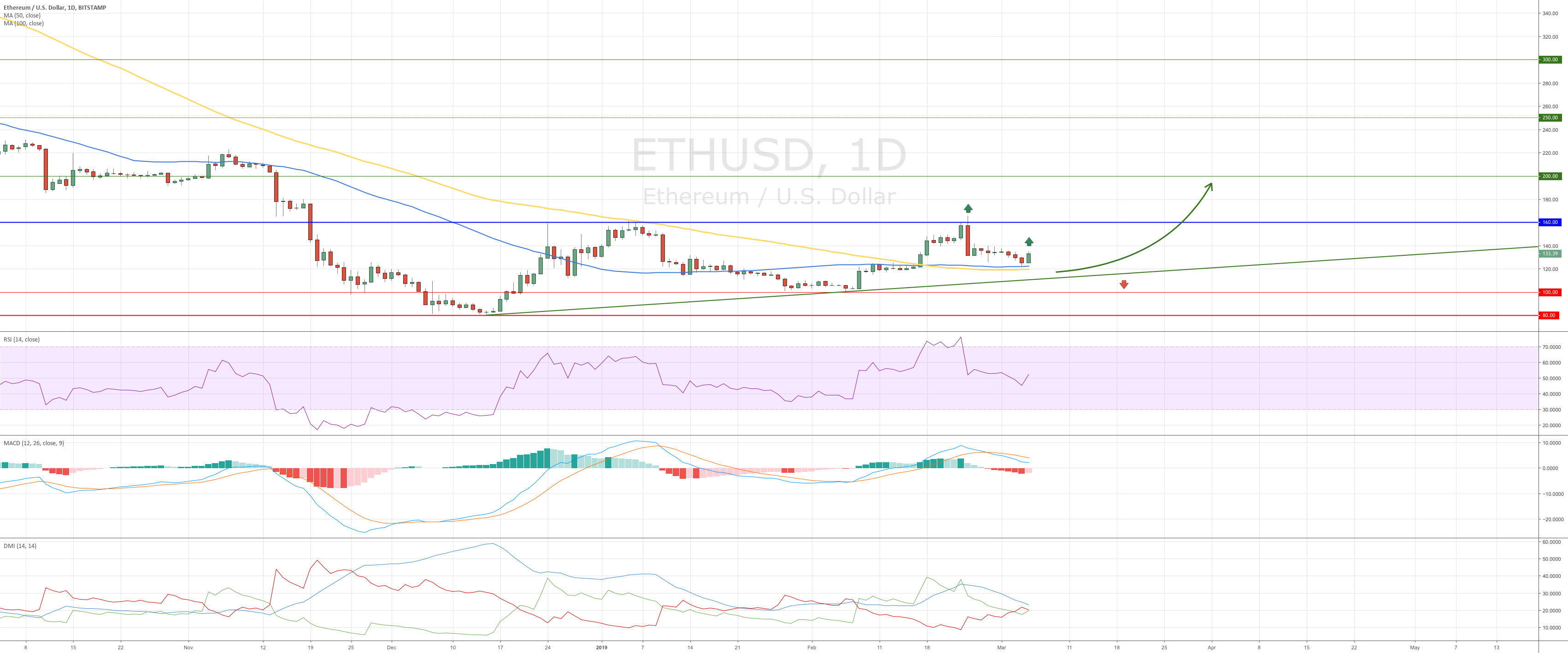

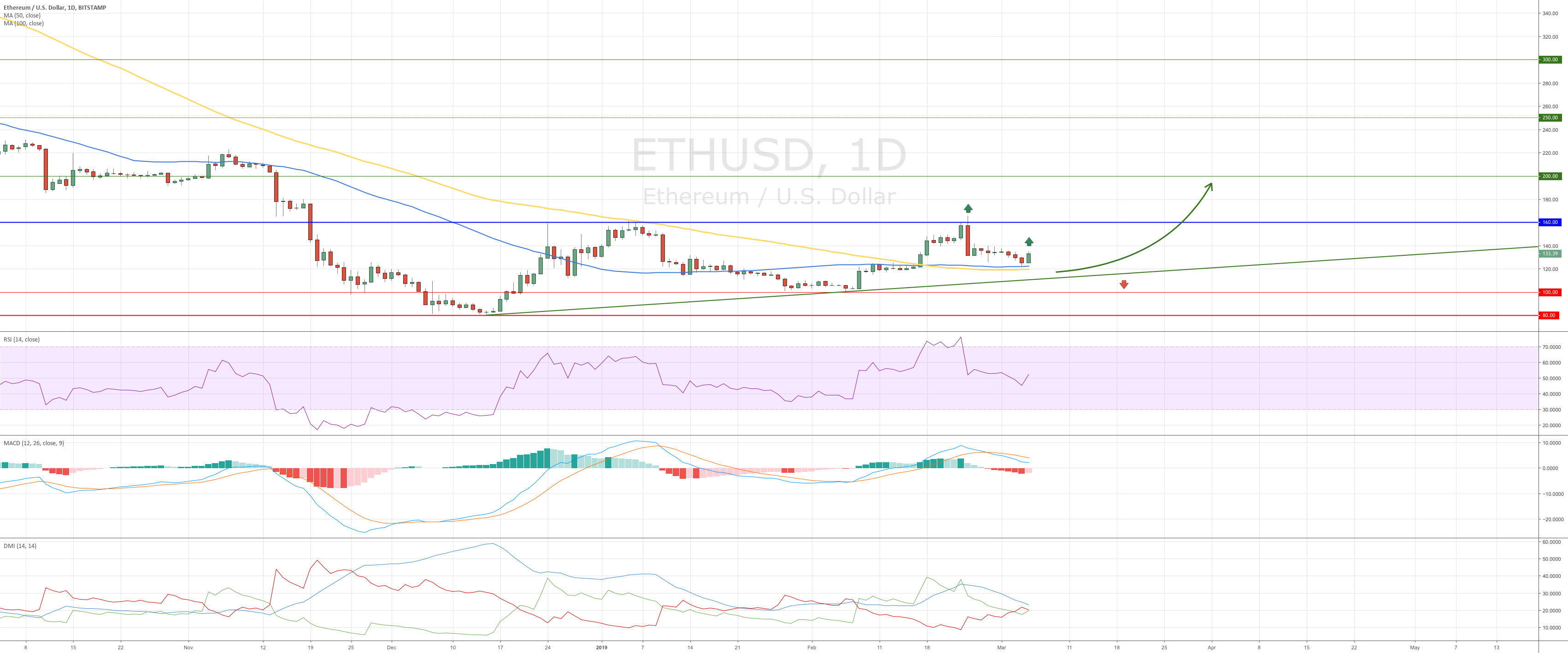

The market follows step by step. After the falling from 160.00 , the price reached the formed by SMA50 and SMA100. Now we can see the reversal from this zone, even the uptrend line for such reversals could be the better place.

We have the market which is bouncing from MAs, and the candle with are confirming it. histogram also is supporting the possible upward movement.

Please, pay attention that now we have these signals based on the current prices. If the close price of the daily candle is lower than it is now, probably some signals from indicators will be changed, and we will have another picture.

But now, we have the market which is bouncing and gives a new buy opportunity with entry based on the market price, stop orders below the downtrend line and the 1st profit target at 160.00 resistance and higher resistance levels. As a variant, it’s possible to wait for the close price and put pending orders for buy above the high of the daily candle. These buy trades can be run for short, medium and long run. Additional trade can be added based on the breakout above 160.00 resistance.

As the cryptomarkets are manipulated time by time, and any movement can be reversed very quickly, you must be careful and use proper risk and money management.

If you like this post, please support my work by your LIKEs. If you have any ideas about further price movements, please, leave them in comments!

Published at Tue, 05 Mar 2019 14:29:23 +0000