- ETH price started a steady rise above the $158 and $160 resistance levels against the US Dollar.

- The price traded above the $165 level and recently corrected lower below $165.

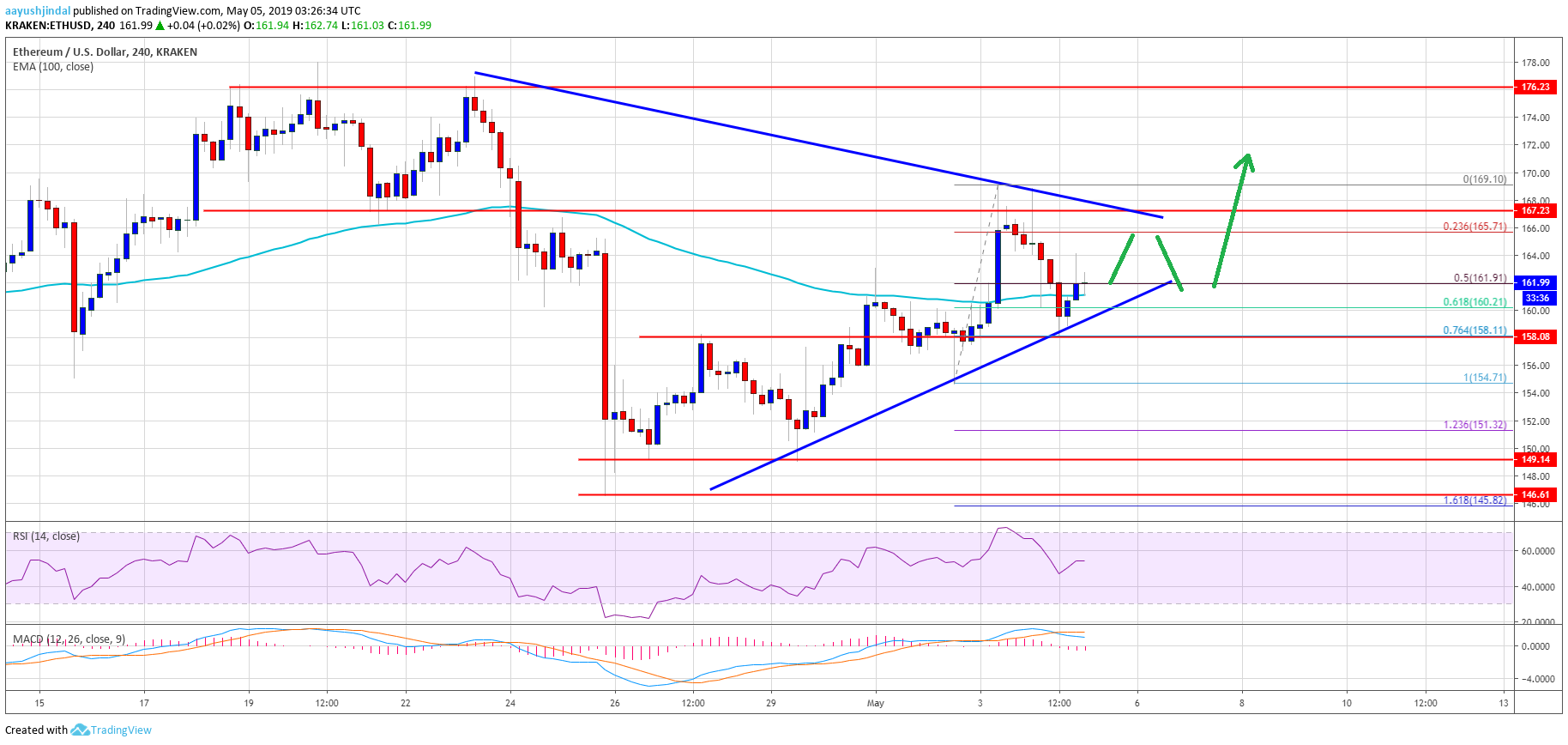

- There is a major contracting triangle in place with resistance near $167 on the 4-hours chart of ETH/USD (data feed via Kraken).

- The pair is likely to climb higher in the near term towards the $170 or even $180 level.

Ethereum price remains in a decent uptrend versus the US Dollar, but in downtrend against . ETH is struggling to follow BTC’s rise, but it may soon climb higher.

Ethereum Price Weekly Analysis

This past week, Ethereum price formed a decent support base above the $150 level against the US Dollar. The ETH/USD pair started an upward move after price started a strong rise above $5,500. There was a strong wave above the $155 and $156 resistance levels. The price even broke the $160 level and settled above the 100 simple moving average (4-hours). The bulls pushed the price towards the $170 level, where sellers emerged.

As a result, there was a downside correction below the $166 and $165 levels. The 50% Fib retracement level of the last wave from the $154 swing low to $169 swing high was breached. Ether price tested the $158-160 support area, where the . It seems like the 76.4% Fib retracement level of the last wave from the $154 swing low to $169 swing high acted as a support. More importantly, the price is still above $160 and the 100 simple moving average (4-hours).

There is also a major contracting triangle in place with resistance near $167 on the 4-hours chart of ETH/USD. If there is an upside break above the $165 and $166 levels, the price is likely to grind higher towards the $169 and $170 levels. Above the $170 swing high, the price is likely to rally towards the $180 level. On the other hand, if there is a downside break below the $158 support, the price could start another drop to $150.

The above indicates that Ethereum is trading above a few important supports near $158. Besides, as long as the price is above the 100 SMA, there are high chances of an upside break above $170 and $172. The main target for the bulls could be $180, where sellers are likely to defend a run towards the $200 level.

Technical Indicators

4 hours MACD – The MACD for ETH/USD is currently slowly moving in the bearish zone.

4 hours RSI – The RSI for ETH/USD recently moved back above the 50 level, with a positive angle.

Major Support Level – $158

Major Resistance Level – $166

Published at Sun, 05 May 2019 04:08:12 +0000

![Query the bitcoin [btc] cash blockchain with bitcoin [btc]. Com’s dedicated bitdb node Query the bitcoin [btc] cash blockchain with bitcoin [btc]. Com’s dedicated bitdb node](https://ohiobitcoin.com/storage/2019/01/3X8jsL.jpg)