Eggciting opportunities are coming soon

Eggciting opportunities are coming soon

When we began to work on WINGS 2 years ago we anticipated that there would be 100s of new coins coming out each month, and we certainly would not have time to review every white paper. Thus, was born the idea WINGS to leverage the global community of those interested in funding causes and projects to vet, rate and help the most worth projects stand out.

After those 2 years of work we finally launched and announced the WINGS Beta quietly over the weekend of CoinAgenda Caribbean. The WINGS Beta allows for a seamless experience for evaluators, creators and funders to collaborate globally in a reputation based system held together by algorithmic incentives via the power of smart contracts on the Ethereum network.

WINGS allows for project creators to use a visually based system for configuring a token minting and sales contract, or connect an existing contract that has implemented specified methods; consequently, any token sales platform, crowdfunding portal or digital investment bank can leverage WINGS programmatically.

Creators: Why Submit Your Project to WINGS

WINGS is a community of several 1000s of individuals and companies many of whom also run crypto-funds or are well known in the community, like Jihan Wu of Bitmain, David Drake of LDJ Capital, and TransformPR headed by Michael Terpin. Thus, your project is not just vetted by some anonymous crowd but by well-known crypto whales, VCs, and influencers.

Our data analysis partner, DEEP, has helped us correlate the funding impact of people who submit forecasts and and funding. The correlated group trypically ranges from about 5–25% of the total funds; note that for projects that don’t get very good feedback this can be lower.

The WINGS pre-beta dapp reached about 40,000 unique viewers in January of 2018; that was accomplished with 2+ minute load times for the Dapp.

The cost structure of WINGS make it accessible to most projects and definitely for any platform to integrate.

First, there is a 5000 WINGS anti-spam/scam deposit, if the community does not reject the project it is accepted to be valued and potentially promoted by individual evaluators; the 5000 WINGS are returned to you. Second, each project is recommended to reward the community for this valuation work; in the pre-beta projects offered between 0.5% — 3% of tokens, however this is up to your discretion and what you believe is appropriate to your project. Keep in mind that this is a free market and the community may refuse to spend their time evaluating projects.

Mega-projects: Community Leadership for the Common Good

For projects with well known teams who clearly do not need any help from the WINGS community we still urge you to be good stewards of this developing ecosystem and opt-in to make use of WINGS in order to set an example for smaller projects to follow. The costs are nominal. Yet the gains to the common good are far unmatched if WINGS evaluators can understand what makes up a high-quality project and if project funders are given a nod that the project is open to scrutiny.

Get Rewarded for Qualified Projects

While the WINGS pre-beta saw many projects get 500+ forecasts, and perhaps several thousands of onlookers reviewing the community forecasts, we want to ensure that the system becomes self-sustaining and that there are WINGS experts around the world reaching out to project teams explaining to them the advantages of using WINGS.

To that end we will be awarding WINGS to those who bring successful projects to use WINGS Beta.

Qualifying projects must meet the following conditions:

must raise at least $2Mmust award at least $100k in token value to the WINGS community via the WINGS forecasting rewards algorithm contractmust not be rejected by the WINGS communitymust not be deemed by any G6 gov’t regulator to be an unregistered security or illegal (within 30 days of the closing of the funding)

Reward schedule:

Up to 100 projects (we are currently at 44): 5000 WINGS (up to 280,000 WINGS)from 101 to 200: 2500 WINGS (up to 250,000 WINGS)from 201 to 300: 1250 WINGS (up to 125,000 WINGS)from 301 to 500: 500 WINGS (up to 100,000 WINGS)

Note these numbers are based on all projects which are not rejected; some projects may not meet the qualification conditions yet will count toward the count.

Some Resources

Most projects which raise $2M or more for now will most likely write their own smart contract. Hence, anyone engaging founder teams should familiarize yourself with the following document:

Additionally, the team at WINGS Foundation is available to help with this integration and testing. The easiest way to engage the team is to create a joint chat room in Telegram; go to and ask to speak to some of the foundation staff.

How to Register a Project and Get Rewarded

The WINGS system has 1000s of forecasters and we know that some of you may contact the same projects. Think about partnering with others and split the reward. The following are the registration requirements:

Project must have committed verbally to using WINGSThere must be a joint chat room created with the person registering the project and at least one project founder.Check that no one else has registered the project successfully here: Fill out this form: After the project makes the forecasting reward to the community go to the WINGS reward portal (— coming this week) and make a claim for your reward.

Note that you will be asked to provide an invoice to WINGS Foundation from your person or a corporate entity.

Eggs are Back

Many of you will remember the launch of the original Eggs program which many 1000s of you hatched into WINGS. Now that we are in the beta phase we need the help and support of the community more than ever to make WINGS a de facto standard for decentralized crowd evaluation of things being sold on the Ethereum network.

Later this week the Eggs rewards portal will re-launch at https://rewards.wings.ai and we will post a blog about an allocation of WINGS that the WINGS Foundation will make available to those who collect Eggs.

Happy egg hunting!

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

Ronald Coase (credit )

Ronald Coase (credit )

In 1937 Nobel Laureate Ronald Coase wrote a paper called “The Nature of the Firm.” Economists like the break things down to their simplest form, and Coase pondered on the existence of companies at all. That may sound crazy, but wouldn’t you like like to be your own boss, and work wherever whenever you want? So why don’t we do that?

The Nobel winning idea that says, in part, that transaction costs are the reason why capital is aggregated, and people form corporations. Because transaction costs are high, people work together in business to lower that transaction cost collectively. Coase cites property rights, minimizing overhead costs, search and information costs.

In his second most famous paper “The Problem of Social Cost,” in 1960 Coase argued that property rights “should be distributed in such a way so as to encourage the owner of the property to take economically efficient actions.” So what does that mean? One of the major tenants of economics is that people respond to incentives. Property rights refer the right of ownership of one’s work and the guarantee of assets they produce.

Take music for example. A person makes a song, records it, and tries to bring it to market. To do so, they need to set up contracts that agree to pay the creator when the product is used. To guarantee that, contracts are made with record companies who solicit the work to radio stations and sell the record to stores. Lots of transaction costs involved in that process, in which not all the value created from the song are realized by the creator.

Digital ownership is a new form of property rights. Previously property rights were something that was protected by laws and governments i.e., you can’t steal, and the government can’t possess your property. However much of the wealth we own today is not measured in property or material things, it is measured in currency that’s is inherently not physical as well as intellectual property (like a song).

Currently, copyrights protect intellectual property, but we all know don’t do a good job as artists don’t get compensated fairly; and the Federal Reserve protects the integrity of the dollar. They are both centralized. This system has continued to place more value on owning capital (being the record company, not the artist) which has hurt wealth distribution. Transaction costs made corporations and owning capital extremely valuable.

Blockchain technology can prove ownership of currency and intellectual property through its network encryption protocols in a decentralized manner. The internet has drastically reduced transaction costs which has given technology firms a huge advantage in creating super-profitable businesses. Decentralized networks can essentially recruit any worker that has access to the internet and have them perform a task.

Ripple, a cryptoasset is the greatest example of how a blockchain structured over an incentive-based network can greatly reduce transaction costs. Currently, the market for currency exchanges racks up extensive fees and is split between multiple financial intermediates. Coase would argue that because transaction costs are high, the industry would continue to consolidate to lower transaction costs. Ripple’s network which pays independent validators of transactions in a token called XRP is a singular efficient entity. The network processes, validates and rewards securely using blockchain technology. What Ripple can do is skip the financial intermediary (large corporation or aggregated capital) and essentially perfects Coase Theorem.

This may seem complex, but let’s go back to the song example. If someone were to download the song from your computer, they would have it and potentially put it up for download for the rest of the world to have. One way to maintain ownership is through a distributed network, (a blockchain) in which computers all over the world come to a consensus on who a particular digital asset (like a song) belongs too. The network could then identify when the song is played/downloaded and reward you each time that occurs.

Ethereum is an example of a distributed network in which these validations occur. As a result of these computers validating ownership (proof of stake) the “miners” who power these validations are incentivized with the reward of the Ether token (ETH).

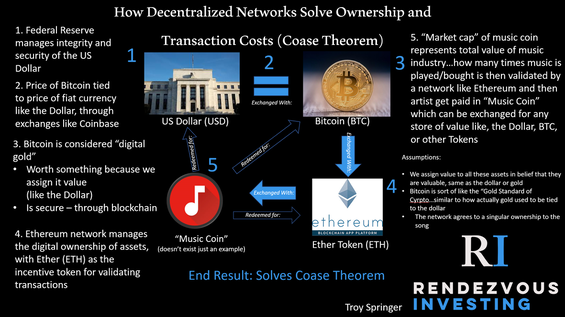

Let’s take a look at how a decentralized network can solve the ownership problems and high transactions costs associated with the music industry by making up my own Token “Music Coin”

In summary:

– Coase Theorem states that we have firms because transaction costs are high i.e ownership costs

-More value flows to those who own capital as a result of transaction costs

-People respond to incentives and Blockchain technology offers secure, decentralized incentive networks

-Ripple and my imaginary “music coin” can help solve the problems associated with ownership and transaction costs… solving Coase’s dilemma

For more of my work, visit my site:

Photo by on

Photo by on

As someone who is making a living in the space. I am constantly looking to network and try to keep up with what new platforms are coming to market. There is no question that the community is growing in the US. Recent polls show that more people are admitting to being involved in cryptos; as such new companies are trying to capture that growing potential user base.

These new platforms are targeting various sectors of the business world, from financing to identity control. The one commonality I have noticed in these new platforms is to enhance the end user experience by shortcutting what the GPP (General Purpose Person) has to worry about remembering to log into the platform or use a device.

Platforms like Stacks are taking the CoinBase model (controlling private keys) and combining it with the Acorns model (traditional stock exposure platform using spear change of end user to invest) to help GPPs invest in ICO platforms. They have streamlined the process to where the end user doesn’t have to know anything about private keys, cryptos, ICOs, or the blockchain. All they do is connect their bank card or credit card.

This new technology is a double-edged sword, in my opinion. On one hand, I think platforms like this are a great thing in helping people on-ramp into the crypto space. But on the other hand, there is a trade-off that most newcomers won’t understand. Being able to choose a streamlined on-ramping process inherently creates a new type of user in the community.

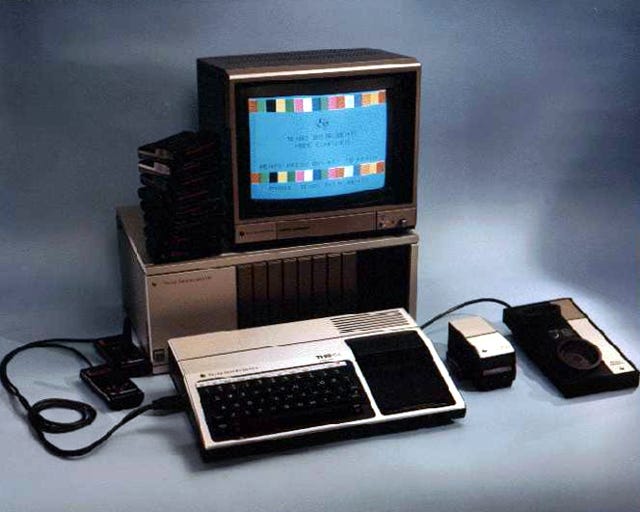

This is just my projection of how I see this playing out. But I am basing it on how things went when the internet started to achieve mainstream adoption. In the beginning, the email was more used by the “nerdy, techie types”.

All they had available at the time were clunky dial-ups and you had to know how to use command line interface and no fancy GUI. Slowly but surely the barrier to entry was lowered. Then came the day of AOL and then Yahoo. Yes, I know I skipped some stuff, but you understand where I’m going at this point, I hope. Those platforms gave the masses the option of convenience.

Some people look to do the least amount of work, especially when it comes to technical things. This is one of the reasons why Google is the predominant search engine it is today; fulfilling the need for convenience.

Now, come to the newly expanding landscape of cryptocurrencies and blockchain technology. Take the new user base of GPPs who are interested in the new “techie thing” because of something they heard in the mainstream news. They don’t care about how it works or the most secure ways to use it. All they care about is “getting rich” and the convenience of doing it without having to know any of the fundamentals like the seasoned folks (my peers) in the space had to. I think as a whole there is a mentality of instant gratification in the west. It is becoming very apparent in the crypto space as newer investors come in influencing the perception of the ground average end user.

But I digress. The point is that there is a shift happening in the business model of ICOs being presented to the growing masses. They are working to make the user interface experience to have the utmost convenience. So the technology for future GPPs thanks to the shrinking number who understand how it works will develop to where multi-sig wallets will be the standard and private keys will be made as a “back in the day” reference like using DOS.

But why the alarm, you ask? Because this type of user given enough time will grow in generations to where economic sovereignty as an original tenant for developing cryptocurrencies is a lost/foreign concept.

This is what the legacy systems want people to forget.

This technology allows the individual to control their spending, saving, pooling, and independence of a centralized authority telling/controlling how they choose to do those things (i.e. you put your money in the bank and want to pull some out to buy some cryptos; but the bank cancels the transaction and gives you an “official” reason). This was actually done to a friend of mine by MECU (Municipal Employee Credit Union), a Maryland based credit union. The big shocker to me was that it is a credit union. I would expect it from larger institutions such as a Bank of America or Wells Fargo.

In time, the same financial shenanigans will go on between the government and corporations leading to the economic ruin, again. That is a sentiment shared by many seasoned crypto users. Is this the absolute facts of what the future holds? No, but it is a relevant question/concern because of how the user base is changing based on the barrier to entry being lowered by technology providing greater levels of convenience.

In truth, I believe that a good number of people will opt for convenience and argue in favor of having the same control in the crypto space as in the fiat legacy systems; but I know that there will be those who look for the deeper understanding and mature pass being a GPP in the crypto space. I hope throughout my trek I can help individuals grow in the community this way.

![Bitcoin [btc]: binance research hints at ‘disruption with trading pairs’ as btc pairs lose 38. 9% market share Bitcoin [btc]: binance research hints at ‘disruption with trading pairs’ as btc pairs lose 38. 9% market share](https://ohiobitcoin.com/storage/2019/05/binance-1.png)