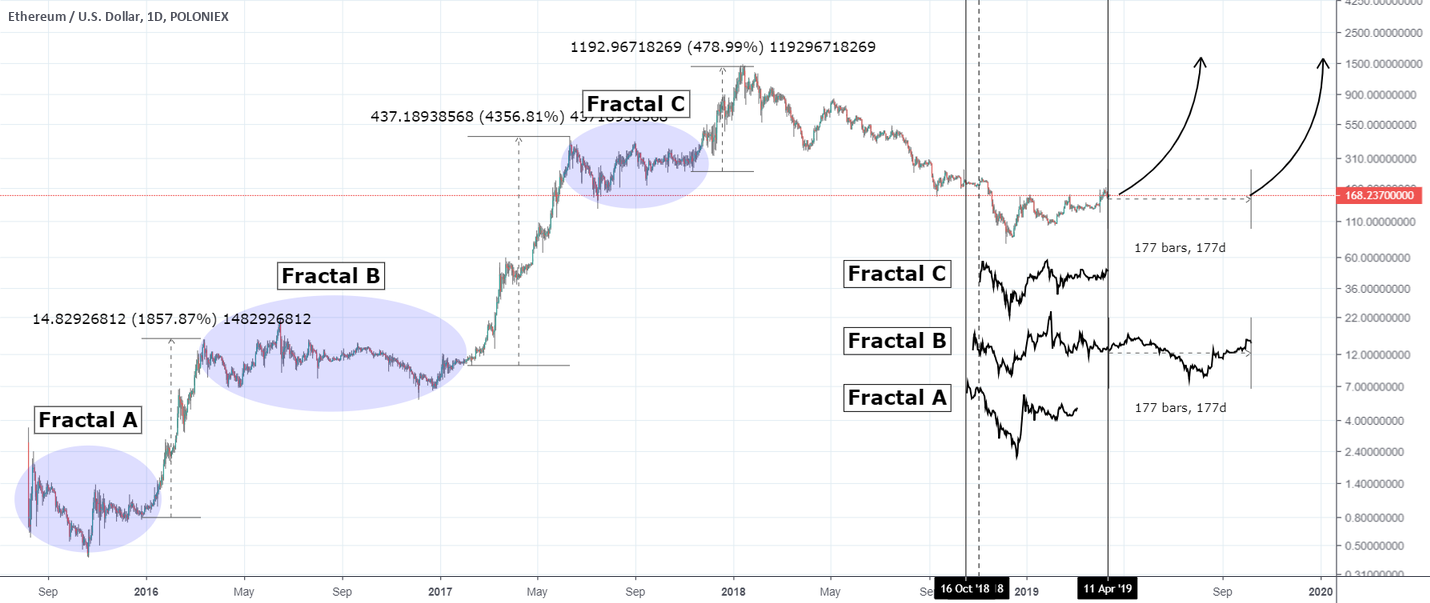

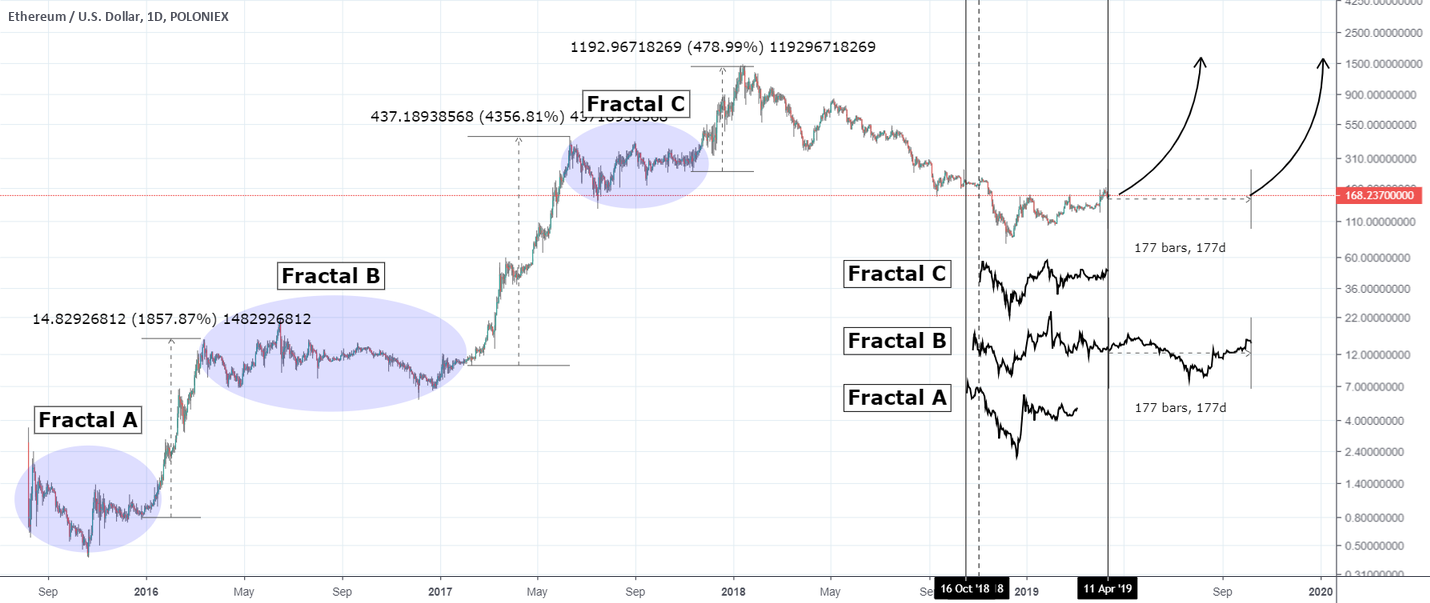

Cryptos have a habit of repeating some patterns over and over again. is no different.

I took a closer look to Ethereum’s bull market and in particularly 3 fractals which all appear to share a similar candle action to ETH’s price from October 2018 to date.

Initial price , high (consolidation) with an obvious Resistance and then aggressive rise. The exception is B which consolidated longer (almost twice as long) making a re-test of the initial drop/ low (even slightly breaking) it, before it broke out. It did however increase much more than then other two (around +4,300% as opposed to A +1,800% and C +480%.

Assuming that hit the bear cycle’s bottom in December, we can expect it to start rising more aggressively on the short term. If I had to make a pick one of the three to fulfill this scenario that would be B as in duration it is much more similar to bitcoin’s expected consolidation phase. In that case we have roughly another 175 days of trading between the cycle’s bottom ~80 and current Resistance ~ 185.

Do you think ETH bulls need to worry? Hit me with your estimate in the comments section!!

Published at Mon, 15 Apr 2019 10:14:37 +0000