Today financial services sector’s electronic trading environment do not offer possibilities to trade with claims, invoices and factoring agreements (assignments, receivables). Receivables market is mostly human trading. Electronic trading platforms for receivables, like stock exchanges, do not exist. There are some entrepreneurs and startups. the trading platforms are eBay-like online invoices trading and human backed excel based system. There are no direct connections to investors.

PlanetZiggurat goal is to bring assignments on Ecex.Exchange trading platforms. We will fill the gap by creating a market environment, system for active trading platforms of assignments agreements. This means changing of owners of a multitude of agreements and documents, such as clains, invoices and factoring agreements etc.

The market system will be similiar to the stock market — very transparent and fast and it will allow trading claims, invoices from the moment thay are being issued until the payment date. Claims, invoices will be tarded until the obligations are either met or erased due to bankruptcy or natural end of the issuer. The owner of the invoices or claim can delist his right any moment (and exercise his right to realize their own requirements).

As all traders know, all market function through leading brokerage firms and online brokerage firms. All traders want to be close to possibilities that allow them to make fast decisions and make actions directly, using market data nad trading terminals. PlaneZiggurat will spread all relevant trading data on leading brokerage firms and online brokerage firms. We will make arrangements that will get existing investor community connected to the new assignments market.

PlaneZiggurat will start on the Estonian market due to the small size of the country as a test market and relatively high level of IT development in the country. This will allow to get a functional system up an running fast, have the system compatible with EU regulations and use a small market as a test site for further development in order to be able upscale in full range and functionally at bigger markets at the right time.

The stock exchange in Estonia is very small. There are 50 000 traders per year, the depository and market system are deisgned for a small volumes and are relatively cheap. PlanetZiggurat has an arrangement with an advisory company who will help to harmonize the system with legislation.

Funding Overview

We plan to start in Estonia because of the price. Keeping our cost low, we can also create a more attractive price list. Our budget for phase 1–2 is roughly 3.57 M EUR. Phase 3–4 budget will be clear by the end of phase 2. An example for us is IEX Group. IEX raised first, second and third round 1.5, 9.4 and 15 M USD respectively during two years.

Token Distribution Structure

The PlanetZiggurat OU Ecex.Exchange Ziggurat Token distribution and the corresponding token creation process will be organized around smart contract running on Ethereum.

Token name : ZIG

Total Token Supply: 531,000,000 ZIG. Token that are not sold during the Token Distribution will be destroyed.

Goals : Maximum : $53 million.

Our distribution campaign does not have minimal capital goal because of project continuity. Any sale Ziggurat Token that remain unsold after the conclusion of the crowdsale will be added to the PlanetZigguart Inventory. Initial rate : Ziggurat Token Price is locked to 0.0004561163 ETH per 1 ZIG, 1 ETH = 2400 ZIG.

If initial quantity allocated for public market sale will be sold before the end of planned ICO then it can be raised by reducing the share not planned for intial distribution.

Token distribution

Foundation : 10%

Partners : 7%

Founders : 7%

Advisors : 6%

Bounty : 4%

Token buyers : 66%

MORE INFORMATION

| | | |

========================================

Created by : 15persenlucky

Profile link :

ETH address : 0x1997B312D6e9cB863f939f9a7cEa3A36Ec185E69

Tale of Two Tokens: Security VS Utility

Author: El Crypto Chapo ()

US congress is painfully struggling through an attempt to determine how existing legislature applies to tokens. Should cryptocurrency tokens be considered a security and be subject to all existing SEC regulation as common stock is today? In case you’ve been living under a rock, there is a great deal of disagreement with respect to how this new asset class should be regulated, and for good reason. One of the fundamental challenges with structuring pragmatic regulation for digital assets is the fact that these tokens can serve widely varying purposes. Tokens are difficult to define as some can be redeemed for services, others represent ownership of physical assets, and still others may be used as company stock or strictly as a payment method/currency. Regulation that may make sense for one type of digital asset may be highly impractical and unnecessary for another. If the primary goal is to have practical legislature that protects investors and does not stunt innovation growth, the first step must be defining what type of token is being regulated.

SECURITY TOKENS

A security can be defined as any tradeable asset. Traditional securities include stocks, bonds & options. Securities are currently defined by performing the Howey Test, which was created in 1946, allowing regulators to determine what will be subject to regulation by the SEC (Securities and Exchange Commission). According to the Howey Test, a transaction is defined as a security if:

There is money (or other asset) investedThere is an expectation of profit from the investmentMoney is invested in a common enterpriseThe efforts of a promoter or third party is the source of profit (investment is passive)

A crypto token that derives its value from an external source that can be defined as a security under the Howey Test is considered a security token. In summary, if the token is being sold as an investment (expectation to profit) and it relies on the project team (third party) to recognize profit, it could be argued that it meets the definition of a security. Boiled down, if the primary use case for a digital asset is a share in future profits from revenue, dividends or simple price appreciation — it is a security token.

UTILITY TOKENS

Utility tokens are akin to digital coupons that can be exchanged for goods or services. They are not designed as investments and there is (theoretically) no owner expectation of profit or increase in value. For this reason, they are exempt from the federal laws which govern securities. An example of a functional token is Siacoin ($SC), a project which aims to decentralize cloud storage by taking advantage of all the world’s unused hard drive space. An owner of Siacoin tokens can be redeem these for future cloud storage space one the network is live & the service is fully operable. This type of digital assets does not represent a company’s share or equity ownership. With that said, utility tokens can see sizeable appreciation in value based on the demand for the underlying product or service. With fixed or limited supply, the simple supply/demand curve will result in increased token value if usage matures and network traffic accelerates. Given that these tokens are traded in an open market, there is also a substantial amount of speculative investment money wrapped up in “utility” tokens which currently are not redeemable for any tangible product or working service.

WHY IT MATTERS

Security tokens are subject to regulation by the SEC, are limited to accredited investors and can only be found on certain exchanges. Utility tokens, also known as app coins or user tokens, are exempt from the federal laws which govern securities. If a digital asset is defined as a security token, it will need registered with the SEC and will be subject to the paperwork, due diligence and increased scrutiny that comes with all registered investment products. For this reason, startups typically make a strong attempt to represent their tokens as having a well-defined use case & avoid any appearance of engaging in any type of activity which looks or smells like a security offering. In fact, many are referring to their ICO (Initial Coin Offering) instead as a TGE (Token Generation Event) solely due to the fact that the term “ICO” was derived from IPO (Initial Public Offering).

The bulk of ICO’s (TGE’s) exclude investors from the USA as they have not yet defined if their platform will be defined as a security or utility token. The risk of issuing an unregistered security is too great to take as the repercussions could completely derail a project. Ironically, today’s lack of regulatory clarity in America may be limiting innovation investment more than the ultimate legislature will.

The challenge of creating effective legislation in this new space could be dramatically simplified if it was easy to differentiate between these two types of tokens. Unfortunately, there is no objective means of making this determination today. The Howie Test is the most applicable, widely accepted, objective set of rules which can help to determine what is and what is not a security. However, it was written in a way that was intentionally vague and broad. In order for US Congress to make meaningful progress in defining rational laws for this new asset class, we first need a better way to differentiate between the types of tokens that exist. There needs to be a framework that clearly and objectively outlines what characteristics will classify a token as a security and what will fall into the scope of the respectively laws in place. The US needs a new Howey Test, one that is written specifically for this new class of digital assets. Creating structure and clarity in an arena that is chaotic and unique will be a tall task, but if congress wants to get it right, this is where it must start.

References:

1.

Hello guys, this time I will give you the hottest information from one of the world’s best platforms and this platform also has many advantages and benefits. This platform is called ThinkCoin and let’s together read the information guys.

About ThinkCoin?

ThinkCoin is one of the digital commerce token that supports the TradeConnect network. By bringing all trade to blockchain, ThinkCoin lets you trade forex, commodities, stocks, and other financial products in a simple, safe, and easy-to-use way. You can obtain TCO through our pre-ICO and ICO release stages, once ICO is completed, by redeeming fiat currency and other cryptocurrencies through selected exchanges.

Therefore, investors from all over the world who join ThinkCoin will benefit from all the benefits of Thinkcoin.

Bounty Campaign Overview

ANN THREAD :

Terms and Conditions

1% of all TCO tokens issued ThinkCoin before and to our sale sale campaign.

During ThinkCoin Pre-ICO and ICO events held from March 26 till April 27, there will be 500,000,000 TCO tokens issued. Therefore, we will distribute 5,000,000 TCO tokens as a bounty rewards program.

To earn and receive TCO tokens You should perform as many bounty tasks as you want by following the requirements below and submitting a bounty reward request form for each task you performed.

By completing bounty tasks, you will receive bounty tokens, which is divided into the following categories: Facebook, Instagram, Twitter, Reddit, BitcoinTalk Signatures Campaigns, Translations & BitcoinTalk Threads Moderation, writing articles, blog posts and making videos popular media. At the end of the token sale, we will distribute 5,000,000 TCO tokens proportionally to the bounty stakes of each supporter in each category.

Each bounty task will be validated before the token is distributed. Only tasks that followed the program bounty terms will be eligible to receive the rewards.

Rewards Distribution

Project OverView

ThinkCoin is the digital trading token that will power TradeConnect, our forthcoming blockchain-based multi-asset trading network.

TradeConnect will deliver:

The ability to trade any financial asset in the world — exchange and non-exchange.Flexible trading in a truly global marketplace.Blockchain-based smart contracts that automatically execute trades based on impartially-sources external information.Advanced AI trade matching and Digital Personas, our unique profiling technology.Trades settled in seconds, not days.

ROADMAP

May 2018 : TCO listed on crypto exchangesAugust 2018 : TradeConnect network enabled for trading in cryptocurrenciesOctober 2018 : Trading begins in FX and CFD products on TradeConnect NetworkJanuary 2019 : TradeConnect offers trading in equities commodities, Future and Other exchange productJuly 2019 : TradeConnect IPO

Our Team :

Nauman Anees, Chief Executive Officer & Co-Founder

A serial fintech entrepreneur with over 10 years of experience in the fintech sector, Nauman is the CEO and Co-Founder of ThinkMarkets, a global brokerage headquartered in the UK and Australia that is established as an industry leader in identifying and developing innovative trading technologies. With a strong background in computer science, he has extensive knowledge in designing and building complex trading systems and applications. He is highly strategic and drives the global teams across all the office to execute the company’s goals.

Faizan Anees, Director & Co-Founder

Faizan co-founded ThinkMarkets in New Zealand in 2010, and since then business has gone from strength to strength, winning multiple awards and with offices across the US, the UK, Australia, China and Dubai. He is a serial entrepreneur involved online startups in the finance sector and has over 12 years of experience in sales and business development. Over the last ten years he has been involved in several acquisitions and exits in his investment portfolio.

Rodolfo Festa Bianchet, CEO & Co-Founder of TradeInterceptor

Rodolfo has worked in financial services for almost thirty years. He has founded several companies based around analysis, research and financial information technology. He is the founder and managing director of TradeInterceptor, a mobile trading app that became the undisputed market leader.

Michael Herron, Strategic Advisor

A corporate and financial services lawyer of more than a decade’s standing, Michael brings a deep understanding of financial services, the technology that drives innovation in the space, and the regulatory framework. Michael has worked as General Counsel and Head of Compliance for several international financial services companies and has acted as advisor to several technology start ups.

Adil Siddigui, Director of Operations

Adil brings more than 15 years of experience in trading solutions, risk management and FX, gained both in the City of London and Wall Street. He specializes in quantitative trading solutions, risk management and treasury products as well as financial journalism, and provides bespoke consultancy in matters relating to regulations with FSA, CYSEC & ASIC.

Caroline Olsen, Marketing & Social Media Manager — ThinkCoin / TradeConnect

Caroline is a social media expert with years of experience in driving digital engagement and creating broad brand awareness with exciting and fresh content strategies.

Naeem Aslam, Chief Market Analyst — ThinkMarkets

A former hedge fund trader at Bank Of New York and portfolio manager at ITC with more than a decade ‘s trading experience, and CNN and other major outlets, and maintains a column for Forbes. He has lectured at the LSE, Warwick University and the University of Leeds, and regularly delivers keynote addresses at events and conferences around the world alongside senior financial and political officials. He is a member of the Global Blockchain Alliance, an organization dedicated to encouraging blockchain uptake.

Andrew Lowry, PR & Content Manager

With more than a decade’s experience as a journalist, copywriter and editorial strategist, Andrew has delivered compelling content for a range of blue-chip clients. His writing career has taken him from North Korea to the Texas panhandle to Trump Tower in New York.

Keith Goldson, Marketing Advisor

Keith has supporting a range of companies with business development, digital and commercial strategies, commodities, forex and cryptocurrency sectors. Prior to this, Keith was a Chief Operating Officer for six years in the comparison sites industry, and gained experience in the advertising industry with M & C Saatchi.

Ryan Case, Head of Sales Trading & Partnerships Europe — ThinkMarkets

Prior to joining ThinkMarkets Ryan was based in Hong Kong as Global Head of Institutional Sales for ABX. He also has a broad market experience from his hedge fund background at a boutique Australian hedge fund. He holds a Bachelor of Laws and a Bachelor of Business (Finance Major) from Queensland University of Technology.

Alla Polyanskaya, Audit & Compliance Manager

With a background in oil and gas and finance, Alla brings a combination of technical engineering and strategic business development skills to the company. Having been with the company since its inception, Alla also brings years of experience in relationship management, financial engineering, regulatory compliance, and world-wide industry knowledge. While managing the Australian Financial Services License, she also oversees compliance matters for Asia Pacific, and managed the securing of ThinkMarket’s license from the UK’s Financial Conduct Authority.

Jai Bifulco, Marketing Director — ThinkMarkets

Across 12 years experience in marketing, sales and business development in the fintech, investment and technology space, Jai has worked in all corners of the globe with startups and established corporations alike. He prides himself on a fresh, creative approach backed by solid management and a skills developed across a diverse range of companies and sectors.

Imane Benhima, Digital Marketing Manager

An expert in performance marketing, Imane has worked across finance, education and advertising. She combines a forensic eye for detail with a breadth of knowledge on paid digital acquisition channels. Fluent in English, Arabic, French and Spanish, she has designed, executed and optimized large-budget campaigns across the globe.

Mark Gosha, Senior Project Manager

Mark brings over ten years of experience in financial operations with a mix of technical, business analysis, and project management skills. As an early member of ThinkMarkets, Mark has been involved in the establishment, global expansion, and continued success of the company.

FOLLOW US :

Author: dhanax

bitcointalk url :

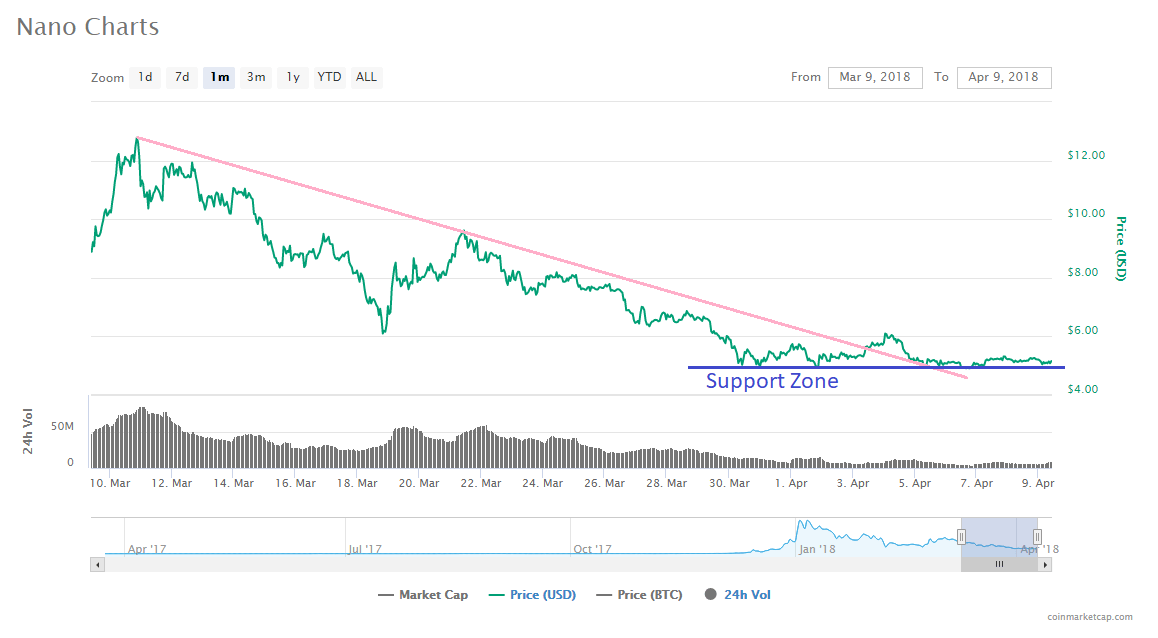

Nano price is stable above the $5.00 support against the US dollar. NANO/USD must break the $6.00 resistance to move towards $7.00.

Key Talking Points

Nano price is forming a decent support base above the $5.00 level against the US dollar.

There was a break above a key bearish trend line with resistance at $5.20 on the 1-month chart of the NANO/USD pair.

The pair is facing a major resistance near the $5.80-6.00 area, which is also a pivot zone.

Nano Price Forecast

There in Nano price from well above $7.00 against the US dollar. The NANO/USD pair declined and traded below the $7.00 and $6.00 support levels to move into a bearish zone.

However, the downside move was later protected by the $5.00 support. The mentioned $5.00 support is significant barrier for sellers and it won’t be easy for them to break it. It seems like a decent support base is forming above the $5.00 level.

Recently, the price traded higher and moved above the $5.15 resistance. There was also a break above a key bearish trend line with resistance at $5.20 on the 1-month chart of the NANO/USD pair.

However, the pair was not able to move past the $5.80 and $6.00 resistance levels. Moreover, there was no close above the 23.6% Fib retracement level of the last decline from the $7.50 high to $5.00 swing low.

There was a slight downside reaction, but the price was able to hold the $5.00 support. It seems like the price is currently trading in a range above the $5.00 level. Once the current consolidation is over, there could be a move towards $5.50 and $5.80.

A break above the $5.80 and $6.00 resistance levels is required for the price to gain upside momentum in the near term. Once there is a close above the $6.00 resistance, there could be an upside break above towards the $7.00 level.

On the downside, the $5.00 support may continue to act as a barrier for sellers and a buy zone for buyers.

Trade safe traders and do not overtrade!

The post appeared first on .