Since the creation and subsequent takedown of the darknet marketplace the Silk Road, the hidden market ecosystem has exploded with inventive solutions that promote private voluntary exchanges. According to recently published darknet market (DNM) research, the cat and mouse game continues with vendors inventing new ways to bolster online black market activities. In the last two years, the DNM ecosystem has popularized methods like ‘dropgangs’ and ‘dead drops’ to evade the clutches of the world’s law enforcement agencies.

Also read:

The Rise of Dropgangs

When the Dread Pirate Roberts (DPR), leader of the now defunct Silk Road marketplace, created his darknet web portal, a new economy of online trade was born. Even after the Silk Road’s head was cut off by U.S. three-letter agencies, the DNM idea continued to spread like a hydra. A number of reinvented Silk Road clones dispersed throughout the deep web and global law enforcement has been trying to take each one down ever since.

After the which saw the takedown of extremely large DNM the Alpha Bay and Hansa marketplace, vendors and patrons had to think of new ideas in order to continue to keep the economy thriving. Even though people still use DNMs such as Dream Market, online black market participants are reinventing the wheel when it comes to these types of illicit exchanges. Jonathan “smuggler” Logan’s , written on Dec. 28, gives a comprehensive look at how some DNM community members are participating in ‘dropgangs’ and utilizing ‘dead drops.’

Although some of the ideas are still primitive, DNM merchants have started to create new types of private communications and operational back-ends, explains Logan’s research. Dropgangs use communication systems like to conduct business and Logan details that chat channels can then be broken down into unique counterparties. The channels are so sophisticated that lots of them use automated bots, which removes human interactions from the equation. “Automated bots allow customers to inquire about offers and initiate the purchase, often even allowing a fully bot-driven experience without human intervention on the merchant’s side,” Logan’s report noted.

The researcher’s report also emphasizes that these messaging platforms make things more comfortable for customers as they can discuss things in real-time and protect themselves with a virtual private network (VPN). Dropgangs still use to transact, but Logan says these days are using privacy-centric digital assets to conduct trades. This is due to the rise of and cryptocurrency transaction tracing and the report details that this vector of attack is currently exploited by law enforcement.

Dead Drops

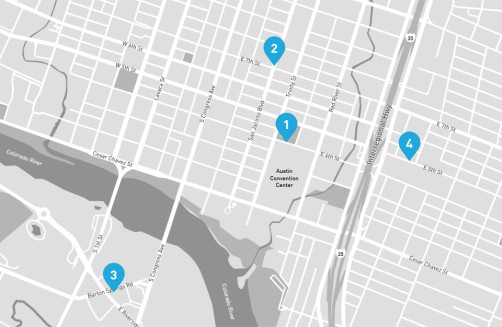

Another method of trade DNM users have been experimenting with is dead drops. Basically, a dead drop is a random geographical location that a dealer uses to drop off packages instead of using the global mail systems. Dead drops have to be an easy location to find, the report explains, but they have to be obscure enough so that they cannot be identified and surveilled by law enforcement. Logan’s study notes the use of dead drops makes things asynchronous for the merchant and makes it so the customer doesn’t have to reveal their address or an address tethered to their identity.

“The use of dead drops also significantly reduces the risk of the merchant to be discovered by tracking within the postal system — He does not have to visit any easily to surveil post office or letterbox, instead the whole public space becomes his hiding territory,” the report details.

Hierarchies and Anonymous Layers

The new DNM systems are not perfected yet and are nascent compared to centralized DNMs like Dream, but are gaining traction. Logan says cryptocurrencies are still the main choice of settlement, but escrow systems are nonexistent in this model. Sometimes multi-party transactions between customer and merchant are established, but Logan explains that it is rare. This has led to the regeneration of hierarchical structures, though the system can still be layered. Often times one layer of the structure doesn’t know the identity of the higher layers like product suppliers, messengers, and dead drop delivery employees. “All interaction is digital – messaging systems and cryptocurrencies again, product moves only through dead drops,” Logan’s research highlights.

What do you think about the use of dead drops and the advent of dropgangs? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, and Pixabay.

Show the world how cutting-edge you are with a Shipping all over the world, quality merchandise and, of course, a payment system that makes people say “wow”!

Published at Tue, 15 Jan 2019 02:50:26 +0000