Dow futures are pointing north ahead of Tuesday’s opening bell as the US stock market gears up to claw back the sharp losses it endured during the week’s initial trading session. Similarly, the bitcoin price has begun to recover from an early week sell-off as it seeks to regain the $4,000 level.

Dow Futures Regroup from Monday Rout

As of 8:32 am ET, Dow Jones Industrial Average futures had gained 24 points or 0.09 percent, implying an opening bell increase of 21.35 points. S&P 500 futures rose 0.11 percent, and Nasdaq futures climbed 0.07 percent to round out a relatively-muted pre-market session.

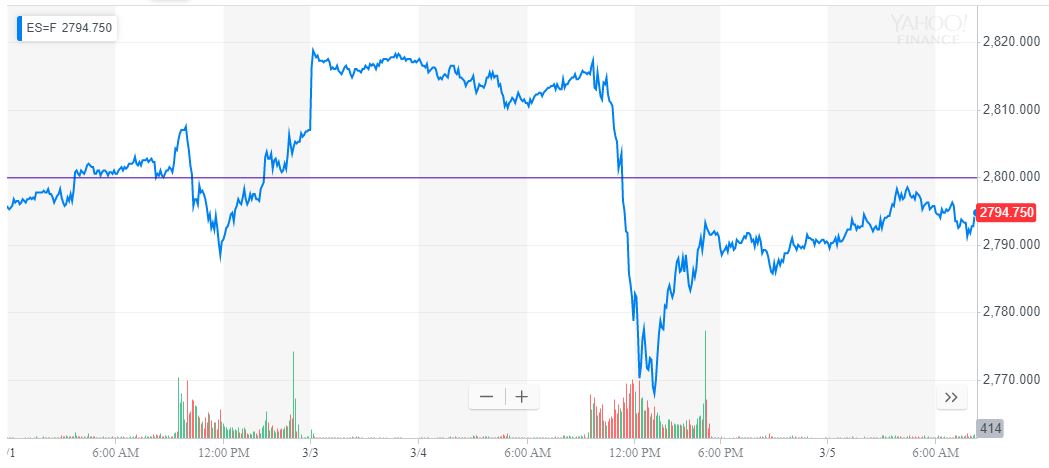

On Monday, futures climbed by triple digits ahead of the open on yet another report of incremental US-China trade deal progress, and we whether the stock market had already priced in a swift conclusion to the trade war. It seems that Wall Street became beset by similar doubts because the stock market shortly after the opening bell.

At one point, the had plunged by 510 points from its opening bell price, though it ultimately rallied in the late afternoon to close at 25,819.65 for a loss of 206.67 points or 0.79 percent.

The fell by 0.23 percent, which was best among the three major stock market indices.

The lost 0.39 percent, which was all the more concerning because it forced the index below the technically-significant 2,800 level, a mark that it had closed above last Friday for the first time since early November. The 2,800 mark is once again providing strong resistance to S&P 500 futures, perhaps capping the stock market’s latest recovery attempt.

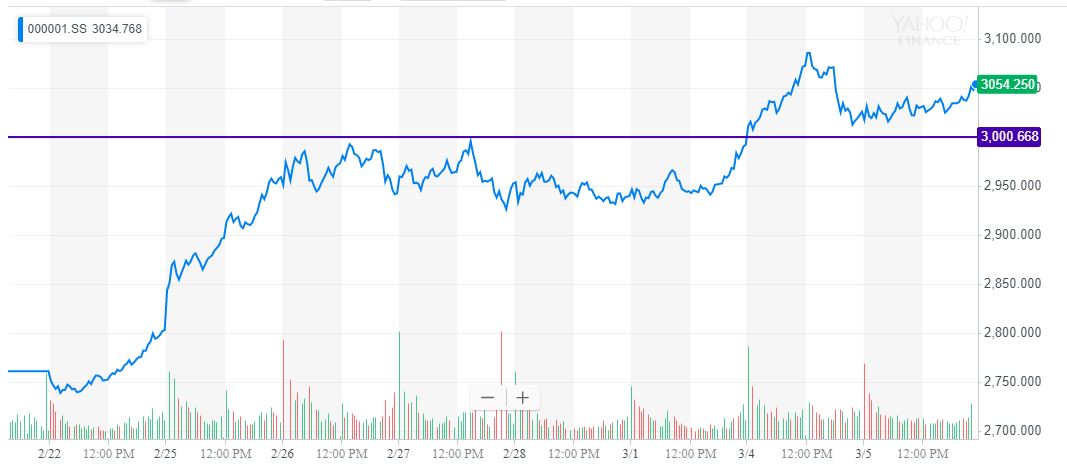

On the other hand, the Shanghai Composite Index (SSE) surged even further above the 3,000 mark, which some analysts have said is a for the US market.

The SSE Composite continues to put the 3,000 level in its rearview mirror, which some analysts say is a bullish indicator for the Dow. | Source: Yahoo Finance

Confirming the bull thesis, JPMorgan global equity strategist Mislav Matejka in a Monday report that the current stock market recovery is “far from done” and that the Dow and its peers could hit “new highs” before the next recession arrives.

“Our key theme remains that the current market backdrop has similarities to ’15-’16 mid cycle correction episode, and not to the end of the cycle,” he said. “Similarly, we believe the current bounce is far from done and we believe equities could potentially make new highs for the cycle before the next recession starts.”

On the other hand, some analysts that the breathtaking pace of the Dow’s recovery from its mid-December lows is an indication that investors have been fooled by a bear market rally and that Monday’s sell-off could be a canary in the coal mine.

bitcoin Price Climbs, But Binance Coin Soars

On the cryptocurrency front, investors are also debating whether bitcoin’s February recovery is the start of the next bull run, or – as may be the case on Wall Street – just another heartbreaking bear market rally.

This morning, the cryptocurrency market posted a moderate increase ahead of the US trading session, with every large-cap asset achieving gains against the dollar.

The rose 0.93 percent to $3,733 on Bitstamp but needs to climb another $500 before it begins to test stiff resistance at $4,200. added 2.25 percent, while (XRP) lagged the index with a 1.11 percent increase.

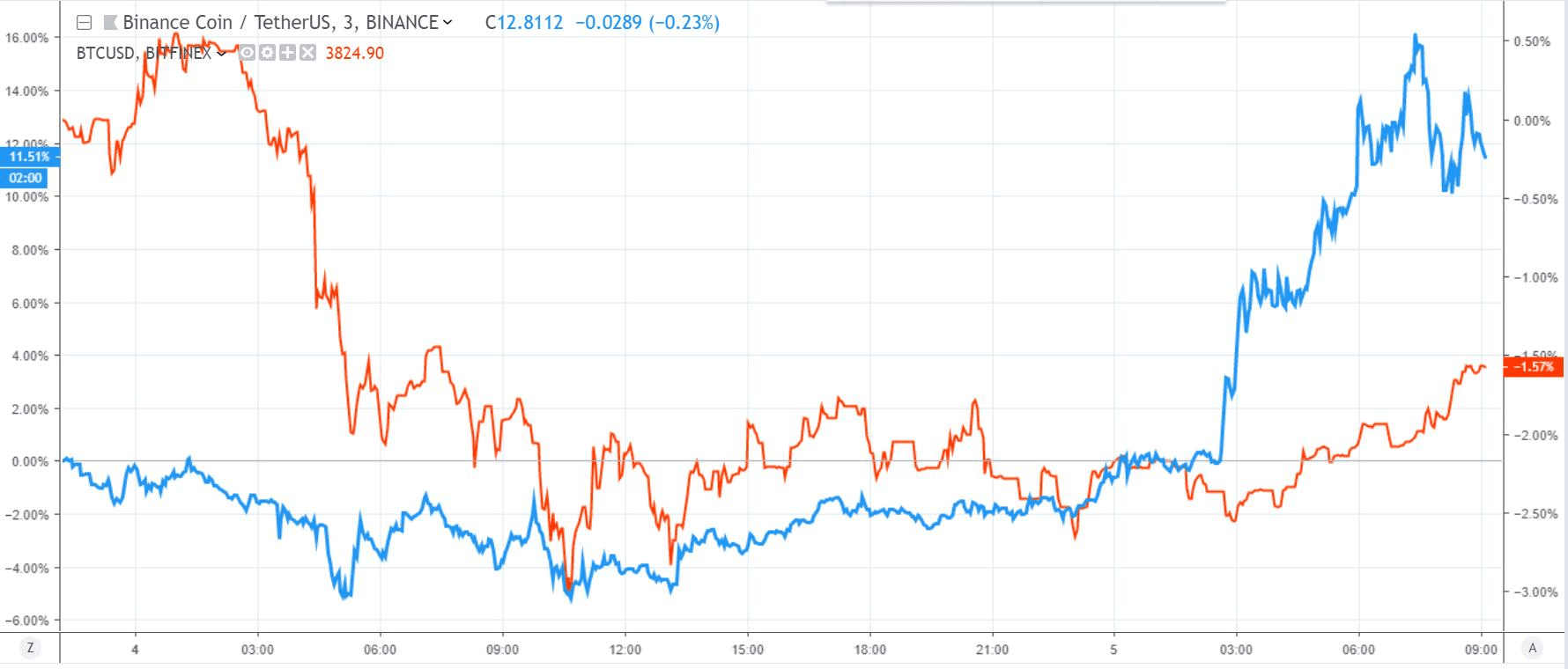

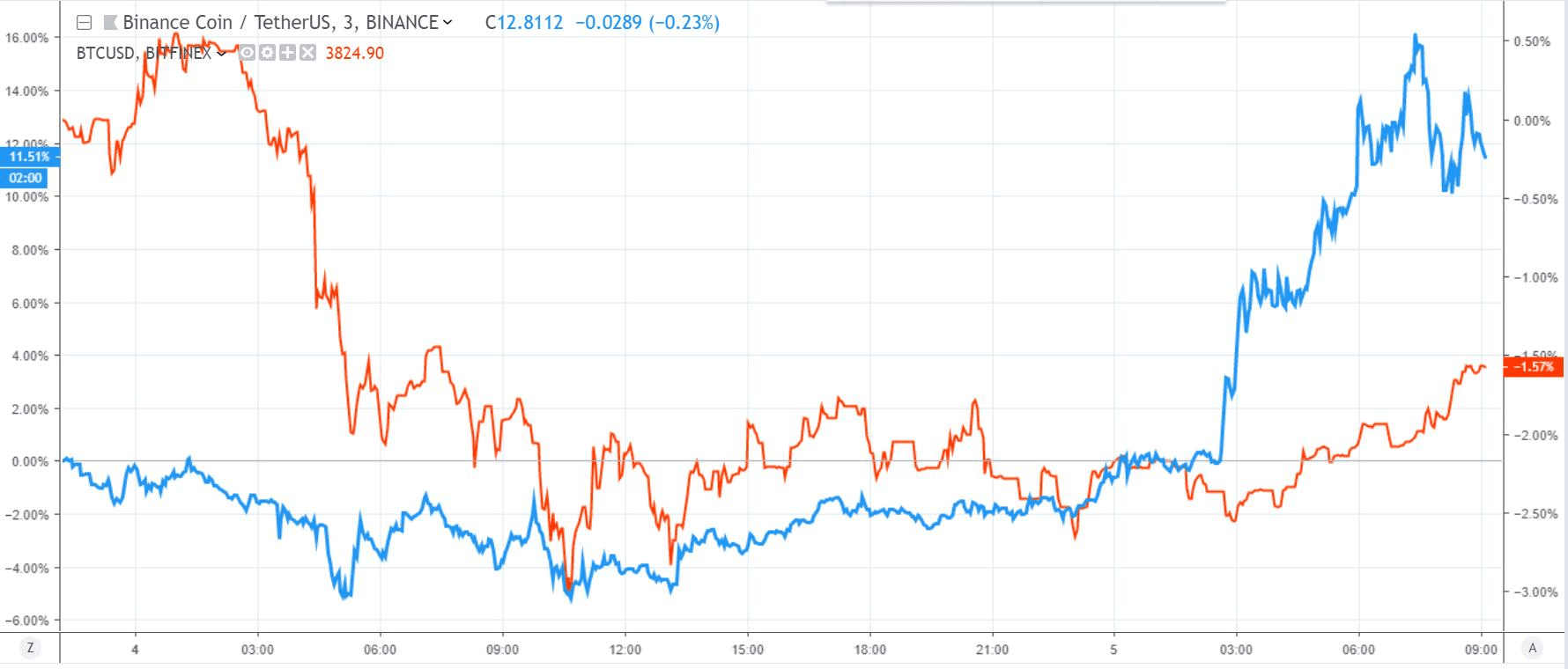

Binance coin’s phenomenal rally might have contributed to bitcoin’s moderate bump. | Source: Mati Greenspan/TradingView

Binance coin, now the eighth-largest cryptocurrency, was far and away the market’s top performer, by an astonishing 20.48 percent within the past day.

According to new research from , Binance – already the world’s largest cryptocurrency exchange – has been growing its market share further in recent months, which should help fuel demand – both real and speculative – for the so-called utility token.

Binance coin’s rally was so pronounced that eToro Senior Market Analyst Mati Greenspan suggested that BNB may have even helped lift the bitcoin price, and by extension the overall crypto market.

Published at Tue, 05 Mar 2019 13:47:02 +0000