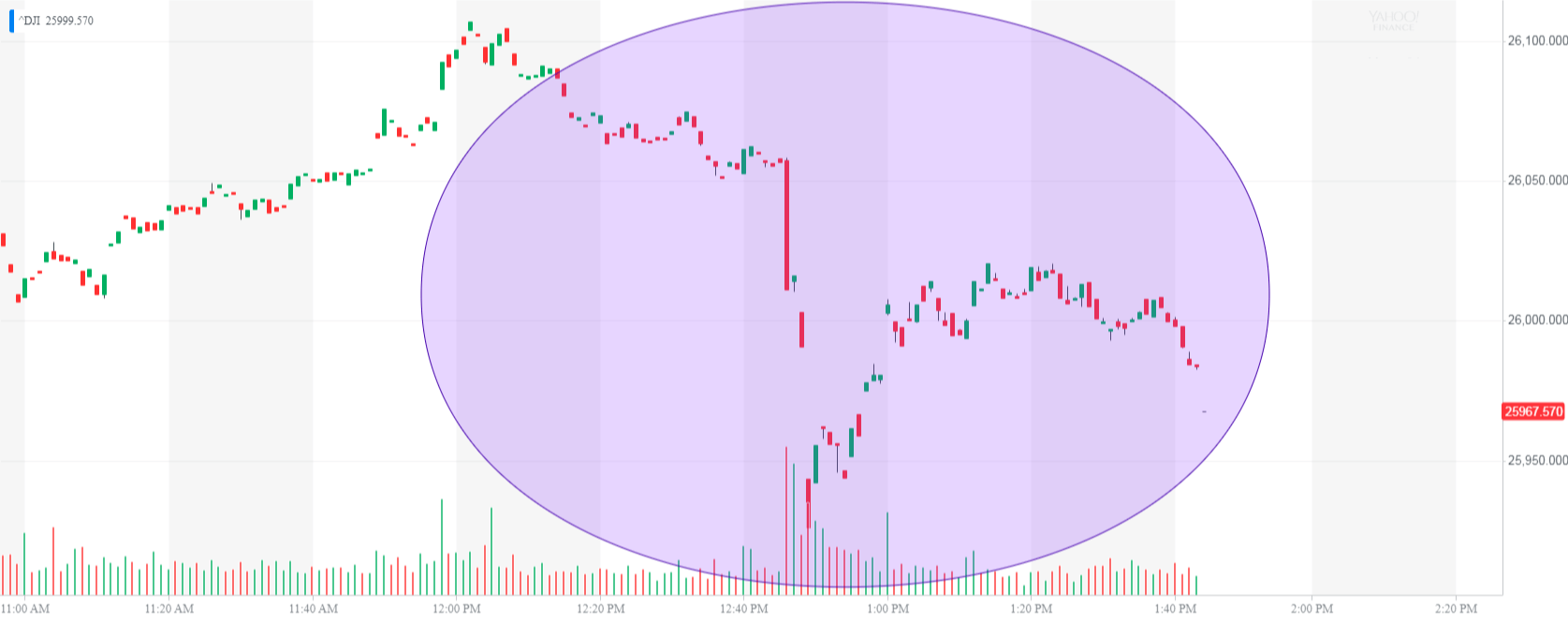

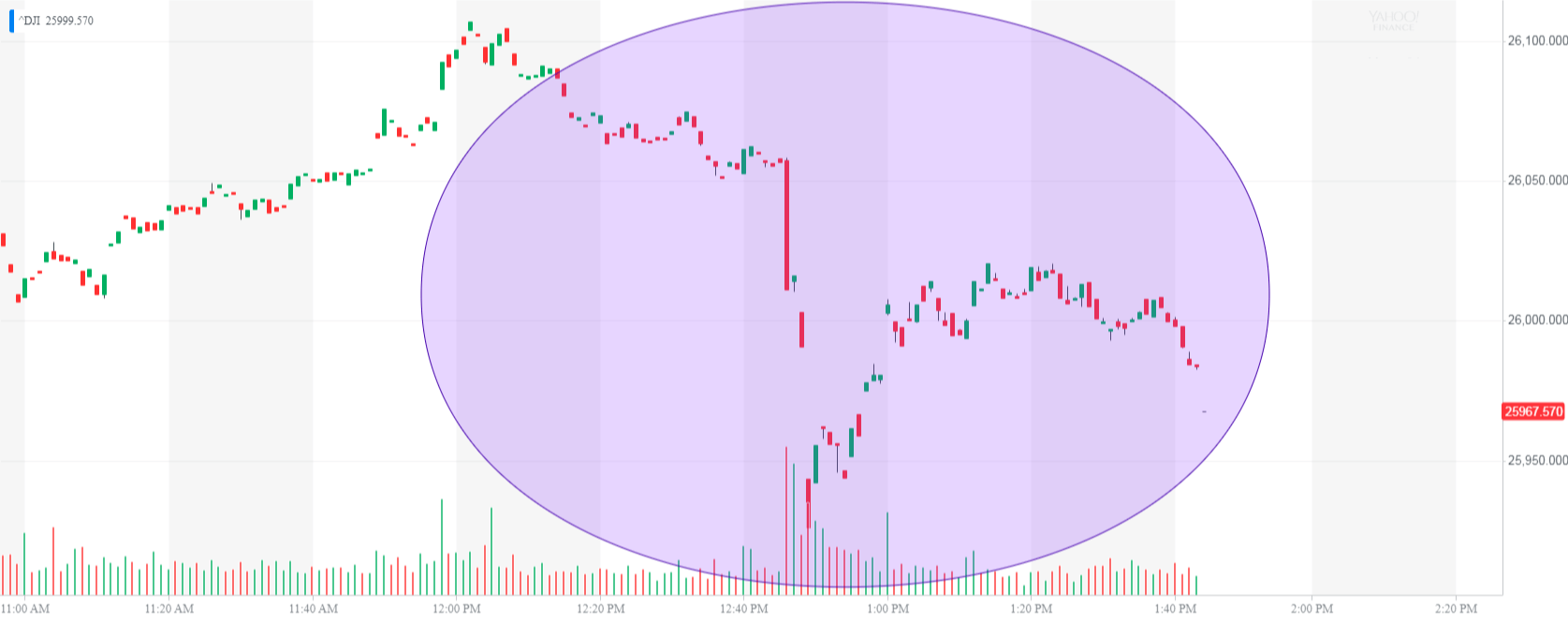

major concessions that it had made amid ongoing trade war negotiations and could also cancel pending orders for Boeing orders. Unsurprisingly, the Dow did not take the well, cratering more than 100 points after Bloomberg dropped the report.

Dow Plunges as China Yanks Trade Concessions

Dow Jones dropped sharply after allegedly walks back concessions. | Source: Yahoo Finance

The S&P 500 was also struck but retraced in ensuing minutes, as did the Dow. At last check, the DJIA was up 26 points or 0.1%.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click .

The move was clearly -centric, as the Australian dollar was also hit, and Caterpillar stock is wobbling intra-day. The retracement is being aided by further information that some US officials believed these were routine developments in trade talks. Softness did start leaking back into markets, as the WSJ reported that , suggesting that maybe there was a serious issue here.

Dow Jones Cushioned by Anticipated Fed Dovishness

The shrugging off bad is not a new trend, particularly given the recent recovery.

The market is currently bracing for the Federal Reserve’s rate meeting tomorrow, and this should limit the fallout as investor focus remains on what is likely to be another example of the Fed “pause.” , and this is deadening market fears to the trade worries. Tuesday’s price action indicates how much positive trade is being baked into the stock market.

Xi must tread carefully as concerns Donald . | Source: Fred DUFOUR / AFP

US stock sensitivity to the trade war dialogue is perhaps contrary to the claims made by Donald that they are . The real question in all of this is: what incentive does have to make a deal?

knows that doing positive things for likely increases his reelection hopes. If gets a second term, he will be entirely off the moderate leash. Xi Jinping will have a much bigger a problem on his hands should that happen. Xi has made it clear political pressure is a tool has available with its assault on

Trump Must Worry About Reelection; Xi Does Not

Xi Jinping is essentially in , as the nation’s ruling party has opted for stability over democracy in a period of heightened economic risk. The world’s second-largest economy is shifting from manufacturing to a service-based economy, but Xi is going nowhere.

This is where he has very different concerns than . The US president uses the Dow Jones and other indices as the , and knows this. Give the US president a blockbuster deal to take on the campaign trail, and the Dow could explode higher. In turn, his probability of reelection also soars. They also have no reason to trust that wouldn’t take any concessions and come back for more.

No Smoke Without Fire as Mnuchin and Lighthizer Plan Beijing Trip

Mnuchin and Lighthizer flying to is clear evidence that the US is also concerned about ’s trustworthiness.

In a classic case right out of Sun Tzu, Xi appears to be leveraging the to retract some of the concessions it made.

The US stock market is taking a glass half full approach, expecting a resolution of some kind. Dow traders could be thinking that this latest setback in Beijing will boost the Federal Reserve’s dovishness.

Xi, meanwhile, must walk a tightrope, balancing a favorable deal for with having to deal with the protectionist US for the next five years.

Published at Tue, 19 Mar 2019 19:13:05 +0000