By : The Dow shot higher on Friday after President stunned Wall Street with his prediction that the trade war would be resolved unbelievably quickly.

However, as an increasingly-nationalist Beijing continues to strike an isolationist pose, is the White House fattening the stock market on a of false hopes ahead of a painful economic cold war?

Dow Bounces Into Recovery Mode

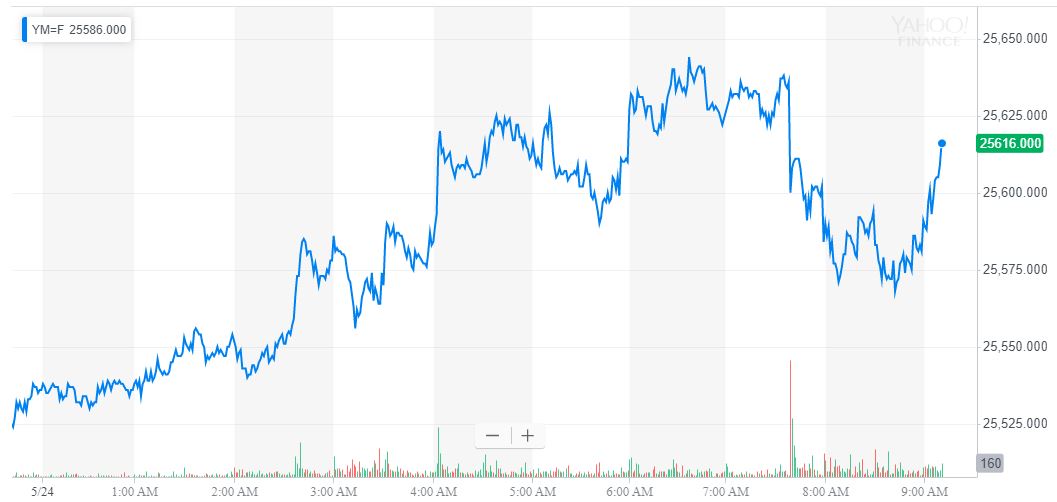

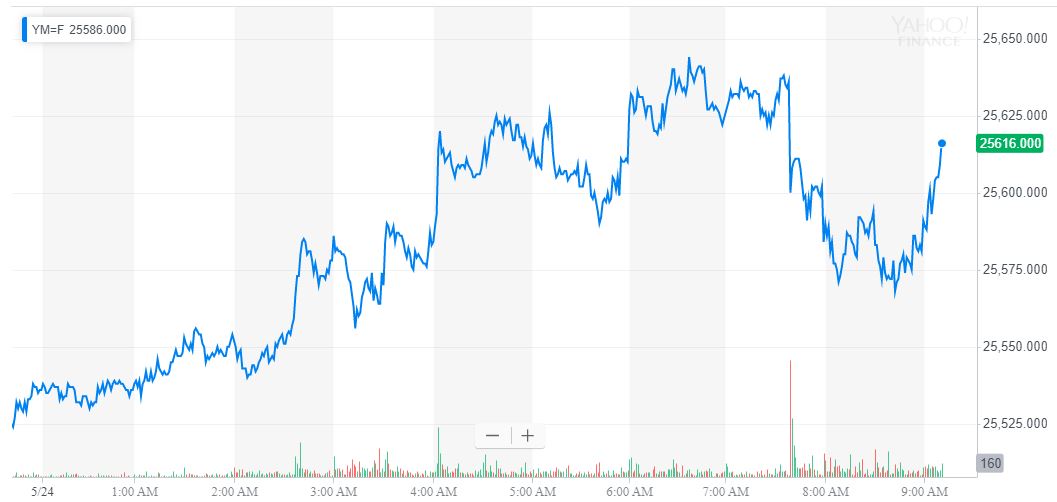

All of Wall Street’s major indices bounded into recovery mode on Friday morning. As of 9:23 am ET, futures had surged 151 points or 0.59%, implying an opening bell gain of 128.53 points. S&P 500 futures jumped 0.6%, and Nasdaq futures climbed 0.56% to round out a positive pre-market session.

President launched the Dow toward a triple-digit recovery on Friday. | Source: Yahoo Finance

Stocks bounced off their May 23 lows after Donald told White House reporters that he believes he can negotiate a , even as threatens to suspend talks indefinitely until the US apologizes for its “.”

Not fazed by Beijing’s threats, teased that the could be resolved under the parameters of the trade deal, potentially removing the “very dangerous” telecom giant from a US government blacklist.

“You look at what they’ve done from a security standpoint, from a military standpoint, it’s very dangerous,” said in remarks at the White House. “If we made a deal, I could imagine Huawei being possibly included in some form or some part of it.”

It’s not clear on what is basing his confidence, nor is this the first time the White House has swooped into calm Wall Street amid escalating trade tensions.

Bloomberg: Full-Blown Trade War a ‘Baseline’ Threat to Stock Market

Analysts say a full-blown trade war is a “baseline” threat to the stock market. Could ’s optimism be setting up the Dow for another brutal sell-off? | Source: AP Photo / Mark Lennihan

According to , analysts now believe that a full-blown trade war is quickly becoming the “baseline” economic forecast, with the odds of a trade deal steadily moving lower.

“The US- relationship has moved further off track over the past two weeks after a period of what appeared, on the surface, to be steady progress towards reaching an admittedly narrow agreement,” Nomura economists wrote in a note. “We do not think the two sides will be able to get back to where they seemed to be in late April.”

Nomura predicts that the trade spat will extend at least through the 2020 election, which – if loses – would afford Beijing the opportunity to negotiate with a president they haven’t already lambasted as a “bully.”

Chinese government researcher Zhang Yansheng delivered an even more , stating that Washington and Beijing could remain engaged in trade hostilities until 2035. Seemingly affirming this bearish outlook, Xi Jinping warned to prepare for a “new Long March” that will mire the ascendant economy in “difficult situations” for a long time.

Are Trump’s Boasts All Bluster and No Bite?

Wall Street will soon discover whether President can deliver on his promise for a swift end to the trade war. | Source: Fred DUFOUR / AFP

It’s striking that after a week of vicious stock market declines, ’s bullish commentary couldn’t manage to inspire a more feverish recovery. Could investors be growing disillusioned with the president’s strategy?

We’ll soon find out whether ’s latest boast is all bluster and no bite, but for now, his stunning optimism is helping Wall Street recoup a portion of the previous session’s brutal losses.

On Thursday, all three major stock market indices slid more than 1%. The Dow crashed 286.14 points or 1.11% to end the session at 25,490.47, and its peers fared even worse. The plunged 1.19% to 2,822.24, and the had slipped 1.58% to 7,628.28 by the time the closing bell brought a merciful end to the sell-off.

Click for a real-time Dow Jones Industrial Average price chart.

Published at Fri, 24 May 2019 13:41:23 +0000