Neither the Dow nor the bitcoin price made a strong move ahead of Wednesday’s opening bell, though US President Donald Trump’s bombastic stock market commentary provided more than enough entertainment for investors on Wall Street and Main Street alike.

Dow Quiet as Stock Market Enters Mid-week Session

Shortly before the market open, Dow Jones Industrial Average Futures had declined by 24 points or 0.09 percent, implying a fair value loss of 25.32 points. S&P 500 futures declined 0.04 percent, while Nasdaq futures rose 0.11 percent in pre-bell trading.

Futures tracking the Dow Jones Industrial Average (blue), S&P 500 (red), and Nasdaq (orange) traded sideways ahead of the opening bell.

On Tuesday, all three US stock market indices crept to minor gains, so minor that you’d have to squint to see them.

The Dow added 8.07 points or 0.03 percent, just one trading session after higher. The Dow might have even traded lower had it not been for Walmart’s earnings report.

The Nasdaq rose 14.36 points or 0.19 percent, closing at 7,486.77.

Donald Trump Takes Sole Credit for Saving the Stock Market from Collapse

The S&P 500, meanwhile, closed at 2,779.76 following a 4.16 point or 0.15 percent climb. The consumer index faces strong resistance at 2,800, and bearish analysts have warned that failure to break through that mark could portend a moderate-to-severe stock market sell-off.

Some stock market analysts believe the S&P 500 will retrace significantly if it fails to break through 2,800 in the near-term. | Source: Twitter via MarketWatch

That , drafted by financial analyst , came in response to US President Donald Trump’s characteristically bombshell claim that his election was the only thing that saved the stock market from complete collapse in 2016

Writing on Twitter, Trump said that stock market would have crashed by “at least 10,000 points by now” if the Democrats had won the 2016 election.

Had the opposition party (no, not the Media) won the election, the Stock Market would be down at least 10,000 points by now. We are heading up, up, up!

— Donald J. Trump (@realDonaldTrump)

While Trump was almost certainly speaking hyperbolically, let’s dig into the specifics of his claim. The Dow closed at 18,332.74 on Nov. 8, 2016 – the day of the election – and climbed by more than 41 percent in the two years that followed to close at 25,891.32 on Tuesday. According to Trump, the Dow should have at the very least crashed to 8,332.74, which would represent a decline of 55 percent from its election-day mark and a 67 percent implosion from its present level.

Donald Trump’s claim that he alone saved the stock market from collapse is a bit much, even for him.

It’s true that Trump and his advisers possess the power to exert extraordinary influence over the stock market’s day-to-day movements, as demonstrated by the government shutdown saga and the ongoing US-China trade war.

However, taking sole credit for a 17,558.58 point Dow swing seems a tad hubristic, even for Trump.

And given Hillary Clinton’s , it’s unlikely that her administration would have adopted the sort of anti-capital policies progressives favor, anyway.

On the other hand, a potential isn’t likely to inspire confidence in the hearts of Wall Street bulls – but that discussion can wait until election year.

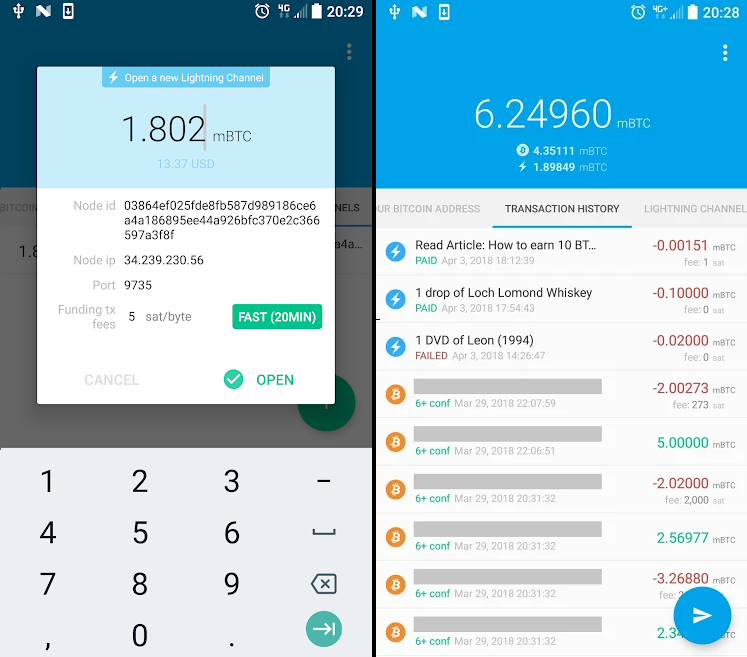

bitcoin Price Continues to Test $4,000

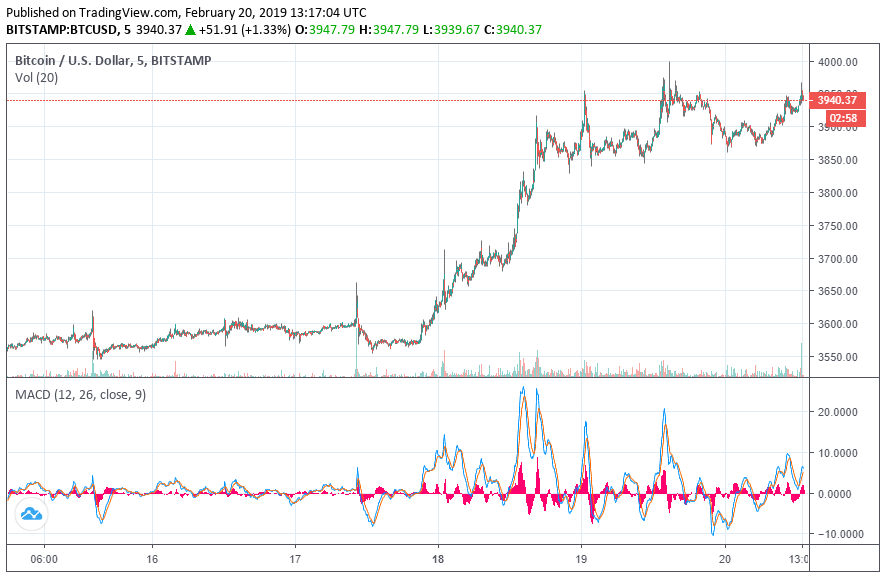

The cryptocurrency market is similarly quiet ahead of the US trading session, but few chart watchers expect it to remain that way for long now that the bitcoin price has begun to test the $4,000 mark.

The bitcoin price is testing $4,000, and it may have ethereum to thank for its most recent rally.

Analysts have grappled to find an explanation for the rally that pushed bitcoin to a 40-day high, and mainstream media outlets have resorted to grasping at straws. Bloomberg, for instance, credited JP Morgan’s so-called “cryptocurrency” project with boosting the market, even though it’s , others have predicted it will be a “bitcoin killer,” and the bank JPM Coin several days before the market began grinding higher.

Ethereum’s Hard Fork Fiasco May Have Launched Market Higher

For his part, eToro Senior Market Analyst Mati Greenspan pointed to the delay of as a potential trigger.

Along with delaying the activation of a number of software upgrades, pushing back the fork allowed Ethereum’s “difficulty bomb” to activate. Implemented to ensure that Ethereum would be forced to activate a hard fork by a certain date, the difficulty bomb steadily increases mining difficulty, which in turn slows the creation of new currency units.

Ethereum’s issuance rate has now arrived at a record low, and Greenspan says that this, coupled with stable demand, caused the – and by extension, the overall crypto market – to rally.

This is the chart that kind of started this whole rally.

New Ether coming online is less than 13,000 for the first time in history. Usually, it's between 20k to 30k a day but has been declining lately due to the delay of .

Less supply + steady demand = 📈

— Mati Greenspan (@MatiGreenspan)

Expanding on this point in daily market commentary, Greenspan wrote:

“This supply shortage while demand remained consistent caused Ethereum’s price to rise dramatically and the rest of the cryptos followed. By today, we’re going on sheer momentum. After months of depressed prices, it’s about time we had a real rally in this market.”

Crypto Market Cap Adds $15 Billion in a Week

Whatever the root cause, the crypto market does seem to be holding onto its early-week gains, at least for now.

A surge in trading volume has helped power the crypto market’s recovery. | Source:

As of the time of writing, the stood near $3,945 on Bitstamp, up from a 24-hour low of $3,873 and just $55 below psychological resistance at $4,000. The overall now trades at $136 billion, an increase of more than $15 billion over the past seven days. Trading volume, meanwhile, has jumped above $30 billion.

Featured Image from REUTERS / Jim Young. Price Charts from .

Published at Wed, 20 Feb 2019 14:19:56 +0000