By : The surged on Monday and Tuesday as a social media campaign pressuring crypto exchanges to delist its top rival gained momentum.

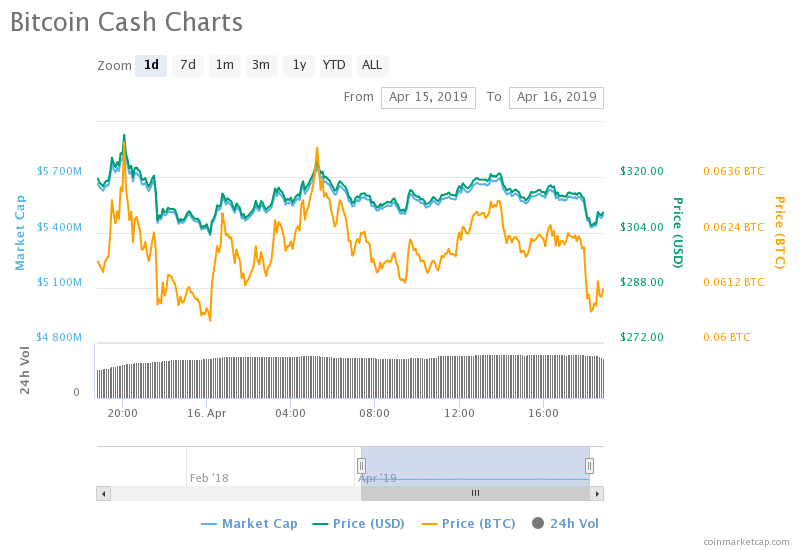

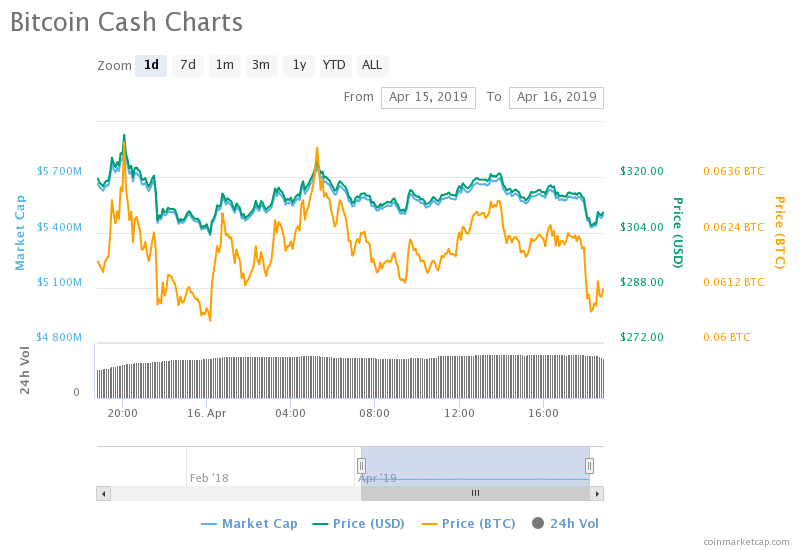

CASH (BCH) SLIPPING FROM ITS INTRADAY HIGH | SOURCE: COINMARKETCAP.COM

The fourth-largest set an intraday high at $324.80 following the Asian market open.

Unsurprisingly, BCH demonstrated an inverse trajectory to SV (BSV). As some of the leading exchanges announced that they would , the plunged by 23-percent. At the same time, the cash price appreciated more than 10-percent against the dollar.

One straightforward theory suggested that crypto traders were dumping BSV for BCH, and social media sentiment seemed to bear that out. On exchanges, both experienced large volumes against tether (USDT), which could indicate that funds were flowing from one to the other.

According to the OKEx Delisting and Hiding Guideline (), BSV currently does not meet our delisting criteria. As such, OKEx has no intention to delist BSV for the time being.

— OKEx (@OKEx)

Hong Kong-based OKEx, which , was the top spot platform for both BSV and BCH. The crypto exchange hosted almost 8.9-percent of the total BSV volume. It also hosted 10-percent of the overall BCH volume. That proves that both the assets shared an interim inverse relationship in terms of price action.

This Crypto Twitter-Driven Rally Doesn’t Have Legs

The minor correlation should not mislead speculators into believing that cash will continue to bleed its rival dry. The average profit-driven trader with an option to trade BSV would likely buy the dips and wait for the #DelistBSV campaign to blow over and the market to stabilize.

At the same time, cash’s uptrend lacks strong fundamental and technical support, given that it merely cashed in on the anti-BSV hysteria.

Chief backer Roger Ver did his best to fan the flames of the intramural spat, challenging Craig Wright to sue him, . That’s a political tactic: pose BCH as the only rival to BSV and then excite traders so they develop an emotional connection with the .

cash could experience some headwinds now that SBI Virtual Currencies, a Tokyo-based regulated exchange, broke from the #DelistBSV fervor to expel BCH from its platform.

All in all, the recent cash rally is not the final word in the ongoing BCH/BSV civil war. Intraday traders are smart enough to play the pump – as well as the potential dump. In the end, this was just another day in the crypto market.

Published at Tue, 16 Apr 2019 18:16:22 +0000