DMG Blockchain Solutions has announced that it has started generating up to 60 megawatts (MW) of electricity at an 85MW substation it owns in western Canada. It will use the substation to power its flagship cryptocurrency mining facility, which is one of the largest such sites in the country by power output.

Also Read:

DMG Partially Powers New Mining Facility

The facility is believed to be the second-biggest mining operation in Canada. The site is powered by clean hydroelectric power and will not have an impact on the electricity distributed to the local community.

“DMG now proudly owns one of the largest, most cost-efficient, bitcoin mining facilities in North America,” said Dan Reitzik, chief executive officer of DMG. “It was an audacious undertaking, but DMG’s executive team has been in the mining space for years, and we have the know-how and connections with the utilities and government agencies to pull it off.”

The site will provide low-cost energy to DMG, as well as third-party customers via its mining-as-a-service operation. The construction of the crypto mine took approximately one year. As part of the announcement, DMG also said that Simon Padgett has stepped down from his role as the director of the company.

Hut8 and Bitfury Still Operate Largest Mine in Canada

“I’m in the business of making electricity and selling it to industrial users,” Ted Clugston, the mayor of Medicine Hat, recently stated. He also described the cryptocurrency mining industry as comprising “mining for ones and zeros” by converting “gas into electricity, which is being turned into Bitcoins.”

Do you think crypto mining poses a challenge to the environment, or is it a form of electricity arbitrage across the global market? Share your thoughts in the comments section below!

Images courtesy of Shutterstock

At bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post appeared first on .

San Francisco-based blockchain startup has been fighting a long battle over the claims of as securities. Much recently, the company removed a pending lawsuit pertaining to XRP’s regulatory nature, to a federal court. The Ripple executives argued that the class action lawsuit was initiated by several investors beyond geographical boundaries. As a result, the case should now move to the federal court.

Attorney Peter Morrison supporting Ripple Labs has retaliated on the charges of XRP as securities. Morrison cited that lawsuit also involves an Israeli resident, hence it should be moved under the ambit of international cases. Having faced multiple lawsuits, Ripple Labs is trying to make persistent efforts to streamline the case and fight all the similar allegations in a singular manner.

In August itself, the California Superior court the lawsuit as a “complex litigation”. This helped Ripple Labs to prevent the duplication of efforts as well eliminating the possibility of different results in different cases but of similar nature.

Leveraging the Class Action Fairness Act

Leveraging the Class Action Fairness Act, Morrison presented three points for the removal of the lawsuit from state courts.

“A putative class action may be removed to the appropriate federal district court if (1) the action purports to be a ‘class’ action brought on behalf of 100 or more members; (2) any member of a class of plaintiffs is a citizen of a state different from any defendant; and (3) the amount in controversy exceeds $5 million.”

Jake Chervinsky, a government enforcement defense and securities litigation attorney at Kobre & Kim, praised Ripple Labs for its decision to move the lawsuit to the federal court calling it a brilliant tactical move. As by Law.com, Chervinsky said:

“Ripple’s legal team showing some tactical brilliance here. It’s hard to explain the procedural maneuver in one tweet & I’m not going to thread this, but suffice to say it’s a seriously crafty attempt to go federal. Might not work, but slick regardless.”

According to Chervinsky, even if the class action lawsuit stayed in the state court of California, it could still cover a nationwide lawsuit. However, according to the lawyer, the company needed a reason to move to the federal court. The lawyer further states that Ripple Labs legal team finds the odds of winning this lawsuit to be higher in the federal court. Hence it took this significant effort in removing this case.

It would be a big victory for Ripple if the federal court would rule the lawsuit in favor of the company. It would bring a huge clarity on the regulatory nature of the cryptocurrency. More importantly, it would clear all doubts regarding XRP is not a security.

MUFG Bank is Japan’s largest bank. Its parent, MUFG, is headquartered in Tokyo, has over 360 years of history, and is one of the main companies of the Mitsubishi Group. Banco Bradesco was on the other hand founded in 1943, and it is headquartered in the city of Osasco, in the metropolitan area of São Paulo.

Japan’s premier bank and Banco Bradesco are therefore joining forces for the service, that’ll facilitate cross-border payments between Japan and Brazil.

As MUFG Bank said in a public :

“The new payment system – developed by Ripple, a San Francisco-based software vendor – will assist the banks as they work toward commercializing a high-speed, transparent and traceable cross-border payments solution between Japan and Brazil.

In 2017, MUFG Bank said it would join Ripple’s interbank group of leading transaction bankers responsible for building, maintaining, and enhancing rules which ensure operational consistency and legal clarity to support the Ripple global payments network.”

Key ingredient in the whole deal is . It is true thought that not everyone in the cryptocurrency world is a big fan of Ripple. With their strong focus on improving the financial system, the company has taken a very different path. Despite a lot of opposition from cryptocurrency enthusiasts, the project is a major player in the banking sector.

In fact, 11 of the world’s top banks are already a member of RippleNet. Just to name some fishes in the pond, MUFJ, Bank of America, and Santander are all RippleNet members. That still doesn’t mean they will all make use of Ripple’s technology in the real world, though.

While there is plenty of initial interest, it will take a while until proper projects are developed. As expected, Asian banks are well ahead of the competition in this regard. Many of the banks are also trying to use the ripple protocol in order to transfer money for their clients. As the number of these clients goes on increasing, the value of ripple would also go on increasing. In the future, with the rise in the value of ripple, founders are of ripple are expected be much more valuable as well.

This new deal is just an extension of an existing agreement between the two banks, incidentally, that have a history of working together.

The MOU is an extension of an existing September 2017 collaboration agreement between MUFG Bank and Bradesco, and represents the banks’ most recent business engagement. In fact, the relationship between MUFG Bank and Bradesco dates back to 1973 when an MUFG Bank predecessor bank invested in the Brazilian financial institution. MUFG Bank has had a presence in Brazil since 1919, when Yokohama Specie Bank, Ltd., another MUFG Bank predecessor bank, opened a branch in Rio de Janeiro – the first Japanese financial institution to establish a foothold in Brazil.

Ripple Sets Sights to China Market

American Express has announced that they will be finally entering Chinese market through the joint venture with LianLian Group. This is the first venture to not process payments through the state-controlled UnionPay network.

Both American Express and LianLian Group have been in a partnership with Ripple, and are confirmed to be members of RippleNet. AmEx joined RippleNet with a vision to aid Small and Medium Enterprises with moving money late last year. LianLianPay on the other hand, joined the network in February this year and has over 150 million registered customers.

The venture is also a licensed company which now has about 150 million registered users in China today. LianLian makes use of Ripple blockchain to settle China’s e-commerce payments. Not only that, LianLian Group now settles Chinese cross-border payments through the use of Ripple’s xCurrent.

The Central bank called this approval a significant step toward opening up China’s bank card market to foreign investors, and they also confirmed that it would continue to ease in an orderly way market access for clearing and settlement institutions.

Key Highlights:

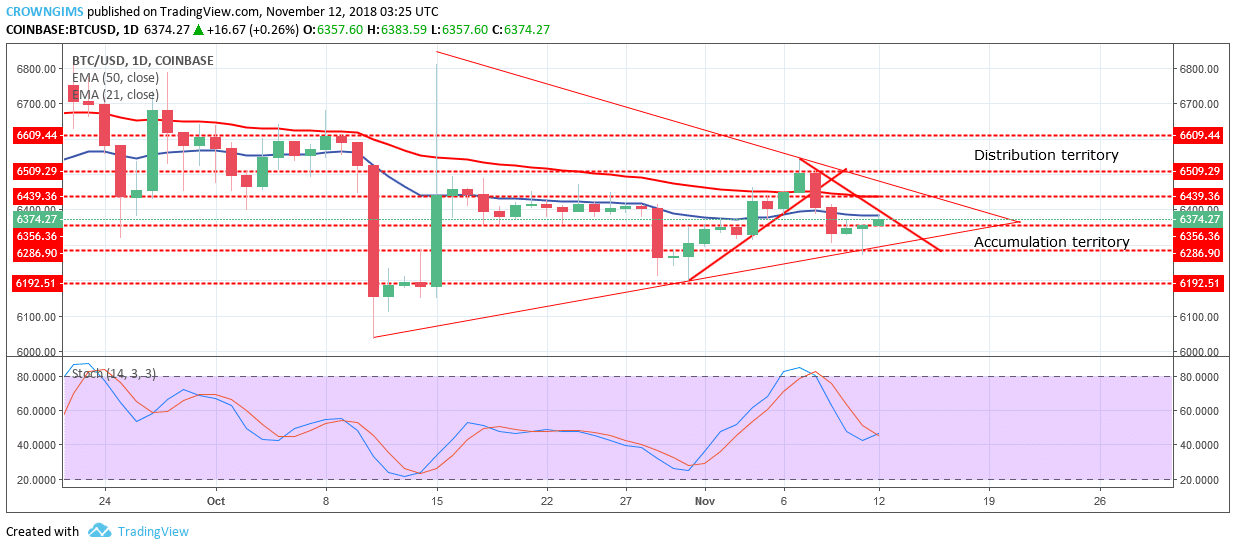

Formation of Symmetrical triangle confirmed;

price broke out is imminent;

there is a probability of the bulls taking over the BTC market.

BTC/USD Long-term Trend: Bearish

Distribution Territories: $6,439, $6,509, $6,609

Accumulation Territories: $6,356, $6,286, $6,192

Last week, bitcoin was bearish on the long-term outlook. The bulls were able to pushed BTC price to the high of $6,509 distribution territory last week, before the Bulls lost the pressure and were unable to continue its uptrend due to the bears’ pressure that is clearly seen on the daily chart with the formation of bearish engulfing candle followed by strong bearish candle that brought the BTC price to the low of $6,286 accumulation territory before the bulls rejected further reduction in BTC price.

The scenario has led to the formation of a symmetrical triangle pattern on the daily chart. This sideways movement within the symmetrical triangle may continue until there is a break out of the bitcoin price from the triangle.

The bulls will be required to gain enough momentum in order to break out from the upper trend line of the symmetrical triangle before noticeable volatility in the BTC market. Likewise, the bears need more pressure to break the bottom trend line of the triangle before the downtrend movement can occur.

BTC price remains under the 21- day EMA and 50-day EMA which indicate that downward trend is ongoing, even indicated with the drawn trend line. The Stochastic Oscillator period 14 is above 40 levels with the signal lines crossing each other upside which indicates the bulls may take over the BTC market soon. Traders should be patient and watch out for the break out before placing a trade.

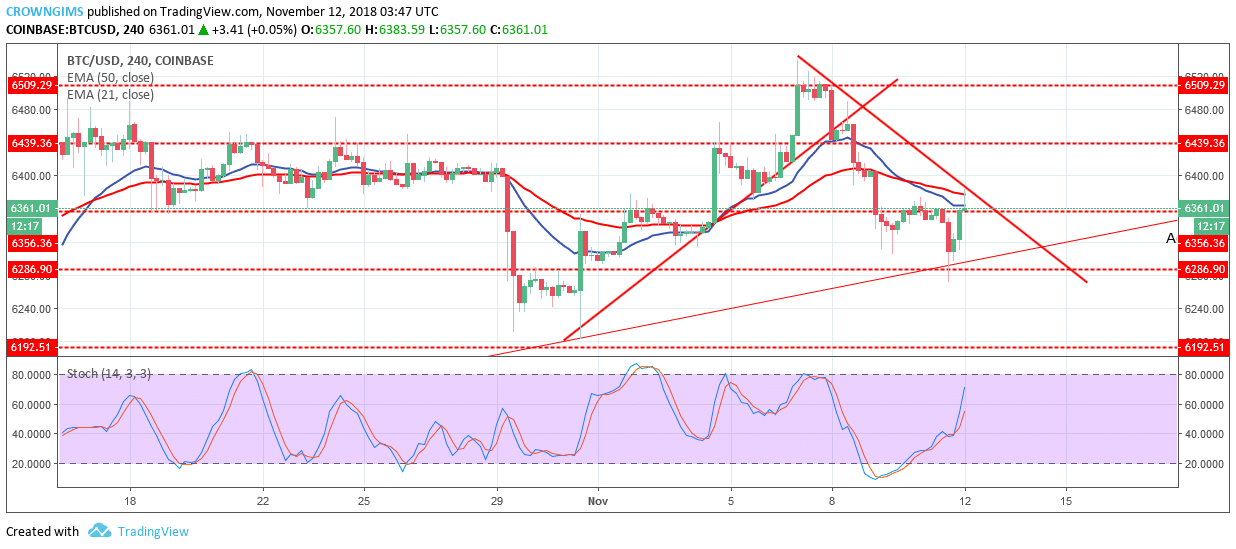

BTCUSD Medium-term Trend: Bearish

Currently, the BTC price is between the 21-day EMA and 50-day EMA which connotes the increase in the bulls’ momentum. Also, the Stochastic Oscillator period 14 is at 50 levels with the signal lines point to the north which indicates a buy signal.