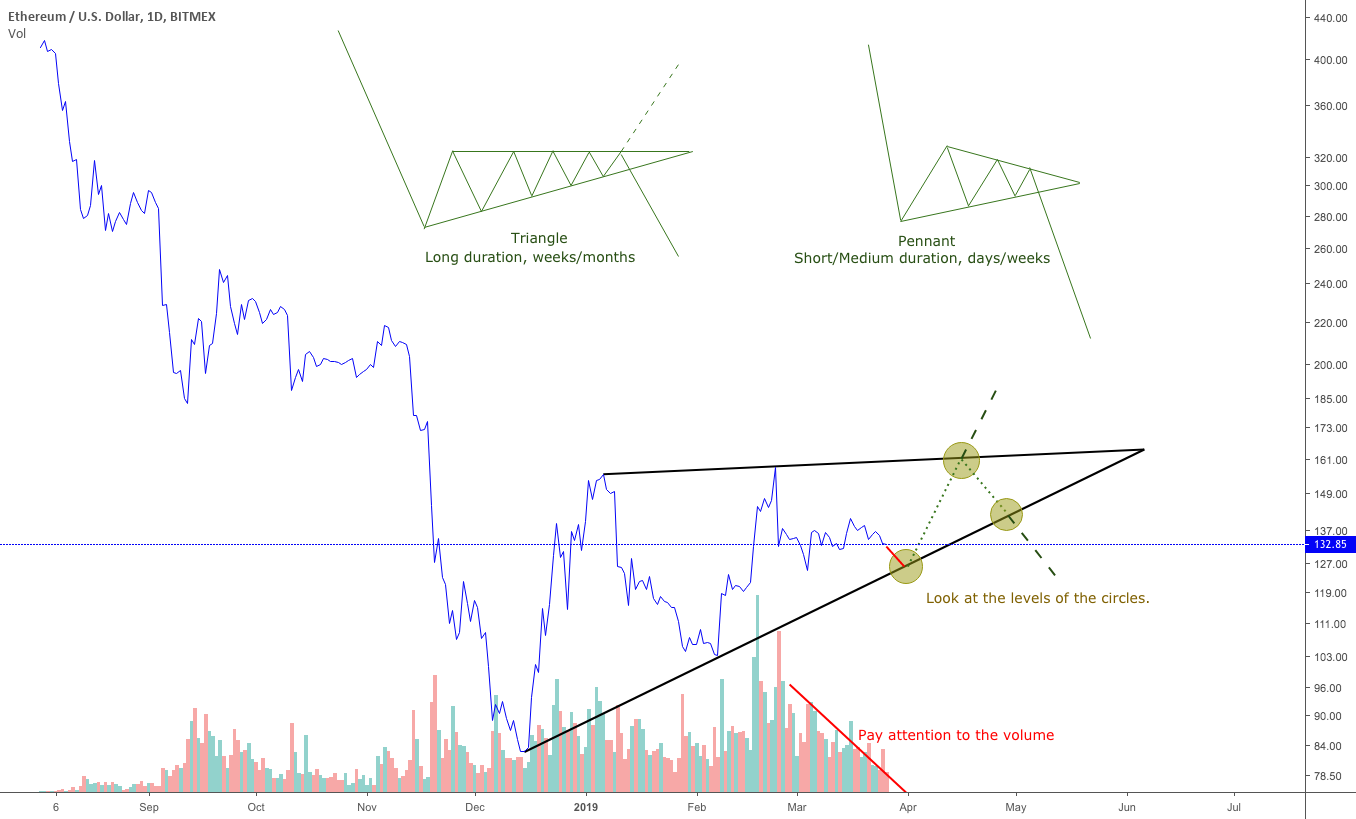

There is a debate wether the market is printing a symmetrical triangle, an or a . First of all you have to pay attention to the overall trend, all those patterns are continuations of the trend with a high grade of fiability. However there is cases where it could fail due to mostly or a prompt high . As a trend trader I´ll never fight the current, I just pay attention on important levels to determine wether the pattern is working or not.

So what´s the main difference within a and a triangle? Mainly the body, the timeframe and expectations. don´t use to be extended more than 1-3 weeks while triangles are medium-long term duration patterns. Both the symmetrical triangle and the have conical bodies made during a consolidation period. You will see the price consistently reaching higher lows and lower highs, creating two converging that form the shape. However, the includes a flagpole at the beginning of the pattern, which normally is not present in the formation of the triangle. The flagpole is a characteristic of the and is created when price suddenly spikes or dives drastically in the direction of the current trend, forming an almost vertical line. This sharp move is followed by heavy and marks the beginning of an aggressive move within the current trend. Price then take a while, forming the body of the , before breaking out in the direction of the trend with new strength.

Expectations? Usually a will be made of an ABCDE and the price tend to breakout the opposite side of the E wave, however in triangles we could an ABCDE formation as well, but it could be extended to more waves between the the base and the top of the triangle and in that case the breakout will depend pretty much on the market sentiment, , indicators and .

The structure of the picture a resistance generally flat at the top with the lower side sloping upwards as the price reaches higher lows. It can indicate the resistance is weakening and near a breakout to the upside. This clearly points out that the bulls are gaining command and is the possible buying opportunity. However you have to be careful with that, since ascending triangles are typically formed in a uptrend, not in a downtrend. So, in my opinion that´s the bull trap that the market have prepared for us. Depending the exchange you use you could see an or a shy . The have unequivocally a meaning while the could be interpreted as a sign, but remember, we are coming from a huge downtrend.

In the current situation in both and Ether, the triangle was first formed on December 15th meaning it has more than 3 months, so the chances are very very high to be inside of triangle, since normally triangles form as the range contracts over a period greater than three weeks.

As I described in previous ideas, the ABCDE move is almost imminent. We need to watch out the levels I marked with circles, because this is crypto, traditional markets are way more predictable. In my public Telegram group I´m sending daily signals and updates with recommendations on how to profit from this market, feel free to join us.

Thanks for watching, I always appreciate your support by making click on the like button and following me.

Published at Tue, 26 Mar 2019 15:00:32 +0000

![Bitcoin [btc]: kidnappers demand five bitcoin to return missing nine-year-old in africa Bitcoin [btc]: kidnappers demand five bitcoin to return missing nine-year-old in africa](https://ohiobitcoin.com/storage/2019/01/Iol.jpg)