Friends,

Last week we made took several big steps forward with Dharma protocol and Dharma.js. We’re really excited about the enthusiasm we’ve seen for in its testnet release, and we are working through the great feedback from our community. Thanks to everyone that submitted feedback!

Reminder: We want your feedback on . Try out the application and fill out for a chance to win a 100 USD Amazon Gift Card**

Development Update:Formalized Mainnet deployment procedures for the Dharma smart contractsMerged the Collateralizer contract and associated dharma.js tooling — Collateralized loans will be available soon on Dharma Plex and dharma.jsMade important updates to dharma.js libraries — added clearer order generation API endpoints and functions for returning and seizing collateralCreated API in dharma.js for interacting with ERC721 debt tokens

Interested in learning more about Dharma? Check us out:

Thanks for your support,

Team Dharma

**Terms and Conditions apply: No purchase necessary. Winner will be chosen at random from valid submissions. Winner will be contacted via the email provided in the form.

Brendan Forster is Head of Growth Ops at Dharma Labs — a YCombinator and Polychain Capital backed R&D shop focused on building infrastructure for an efficient, borderless, and transparent credit market.

Brendan was formerly an expansion manager for UberEATS and a corporate strategy analyst at Microsoft, and graduated from the University of Pennsylvania’s Huntsman Program with a B.S. in Economics and a B.A. in International Studies.

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

TL;DR — While bitcoin is the most well-known crypto-currency, but it is limited in its functionality. Some of the real power behind innovations in blockchain technology comes from smart contracts that can be used to negotiate deals, the creation DApps (Decentralized Apps), and the tokenization of everything to understand value. Ethereum is the leading platform of this movement, but it is important to understand the underlying principle before building new platforms.

A Quick Disclaimer

Blockchain technology is an incredibly young concept. It’s recent spike in monetary gain and media buzz has caused a lot of people to want to dive in headfirst and hope for the best. Experts have been calling it the “new dotcom boom”, and enthusiasts see it as a way to upheave current systems in every industry. These articles are meant to be a primer on the field of blockchain technology, giving an overview of the landscape and an attempt to clear up confusion around topics. Yet these articles can only explore what is currently being done in the field, and as regulations are put into place and the uses of blockchain become more clear, definitions and understandings may change. That said, blockchain technology is an exciting subject and will definitely offer new opportunities for growth, and the possibilities are endless as to how it can help.

So What is bitcoin Again?

bitcoin is a cryptocurrency built on blockchain technology. In theory, bitcoin will be able to be used in the same way we spend a U.S. dollar, but it is still trying to gain holding as a viable currency and is mostly speculation at the moment. The key to bitcoin is that it is built on a blockchain network, which is a decentralized, constantly updating, and public ledger of transactions — making it highly secure.

What is a Smart Contract?

Also built on blockchain technology, a smart contract is a way to “exchange money, property, shares, or anything of value in a transparent, conflict-free way while avoiding the services of a middleman” (blockgeeks.com). Whereas bitcoin can only exchange currency, smart contracts can exchange basically anything via an automatic transaction. A common analogy to a smart contract is a vending machine — you drop in a dollar, and your Snickers immediately drops out with no need to have someone process the transaction for you. However, experts are looking at smart contracts as a potential way to rent apartments, buy cars, and manage entire supply chains.

What is The Ethereum Project?

Created first in 2013 by Russian-American Vitalik Buterin, Ethereum is a new kind of blockchain that uses smart contracts to create a “world computer”. It was released to the public in 2015 and has become the second-highest valued cryptocurrency behind bitcoin. However, Ethereum has an exponentially greater functionality. This is because of two reasons:

1 — Ethereum is verified at a much faster rate

Whereas each block in the bitcoin blockchain is verified every ten minutes, each Ethereum block is verified every twelve seconds. This allows for more transactions, of all sorts, to take place. The speed difference comes from Ethereum’s “proof of stake” model of bitcoin’s “proof-of-work”. A “proof-of-stake” verification relies on transaction fees paid by the the verifier to complete the payment. In this way, transactions on Ethereum can cycle through blocks faster and build more, even if some argue that it is less secure.

2 — Ethereum acts like a programming platform that people can build apps for

Due to the simplicity of transactions on the Ethereum platform, creators have begun building applications and networks that rely on Ether payments to verify users, show activity, and complete transactions. These decentralized applications (or DApps) are where the real innovation for businesses come into play. When you go on the news and hear about how companies are opening an Initial Coin Offering (ICO) to the public, they have either built a DApp on top of Ethereum (which they will say) or they built a DApp that is on their own blockchain.

A Bit More on DApps

What is worth understanding about DApps is that they have their own transactions and protocols within their “network”. A good way to picture how a DApp on top of Ethereum works is to think about Chuck E. Cheese’s. You go into a Chuck E. Cheese’s and give dollars for tokens, which can be used throughout the building to play games and win prizes. In the same way, DApps take Ether (the currency you get through Ethereum) to convert to whatever token the DApp uses for transactions. At the end of your use of the DApp, you can transfer your tokens back into Ether to “refocus” your wallet.

Each DApp on the Ethereum network goes through an ICO, which is more like a Kickstarter fund than it is an IPO done by an established company. These ICOs are ways for creators to get buy in to their DApp to help build the DApp or expand on it. The coins you receive here are your investment into that DApp, so when it makes money, so do you. However, these ICOs are still being explored by governmental institutions and regulation committees, as there are plenty of ICOs that are scams and will be rendered ineffective (and some that outright tell you they are ).

Wait, there are coins?

In the last article, we explained that essential aspect to bitcoin being a secure and viable currency is the ability to verify each block in the blockchain. Every time a block is “mined” and verified, the miner gets a bitcoin, or more accurately, a token. In the case of bitcoins, these tokens represent a cryptocurrency, which is one of four basic kinds of tokens:

Currency Tokens

This is where we would place bitcoins. Currency tokens do little more than act as a digital fiat currency. These coins are also reliant on the supply and demand of the currency, much like the U.S. dollar.

Utility (or App) Tokens

Utility tokens, counter to currency tokens, allow people to actually use an app or service. This is where the Chuck E. Cheese’s analogy comes into play. For most DApps, the use of a utility token is simply a way to make sure that transactions are legitimate and that you can actually pay to play.

Asset Tokens

Unlike utility tokens, which operate like a token in an arcade, an asset token is basically a proof of ownership token. Sometimes asset tokens can have a physical commodity backing (i.e. ) and sometimes they can be a digital hold on digital asset (i.e. ).

Equity and/or Security Tokens

The last kind of token worth discussing in this primer are equity or security tokens. Both tokens operate as a representation of ownership, but unlike an asset token, it is an ownership of a blockchain. When a blockchain company opens an ICO they might offer securities or equity tokens. Holders of these tokens could be voters for how a DApp is operated, or they could simply be investments that give them some monetary benefit.

This Seems Complicated…

It is! Each DApp in theory will have its own wallet, and you will have to transfer all that currency back into Ether, bitcoin, etc. Otherwise it is like you are carrying around a wallet for U.S. dollars, a wallet for Pesos, a wallet for Chuck E. Cheese coins, and a wallet of Monopoly money. Each have a value, but some have a lot more than others, and you can’t universally spend any of it. Of course, since having a token does not always mean holding currency, a better analogy might be having an investment portfolio that exists solely in the blockchain world. And at the moment, a lot of these DApps, even Ethereum itself, are so young that understand the security and possibilities of what can actually occur are incredibly vague.

So, Why Should I Care?

Despite the complexity, security, and buy-in limits of diving into blockchain, the potential for innovative uses, transparency on the internet, and real-time tracking of goods and contracts are incredibly exciting. Ethereum is the foremost example of how to make blockchain technology benefit creators and users, as everyone gets paid for simply going about their daily lives and being on there. More importantly, blockchains, DApps, and the security of networks are constantly improving as more people learn how to create DApps and secure their networks.

In the next few articles, we will explore some of the areas of marketing that blockchain technology is trying to improve, such as changing how viewers and content creators can escape the middleman and how users can actually receive kickbacks for the ads they see online.

Further Reading

Adam Ludwin:

The Motley Fool:

VentureBeat:

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

TL;DR — Blockchain is one of the biggest buzzwords out there, yet it is deeper than a new currency or hyped up “app” that everyone will use for a few weeks and forget about. Instead, it is a new technology platform that could radically change how we use the internet, or just make things a little better, who’s to say?

Why are we talking about this?

Part cool story, part new (-ish) technology that is worth knowing about, part de-mythification. We want to understand what blockchain is at this moment so we can start to better understand where it will take us in the future.

What is Blockchain technology?

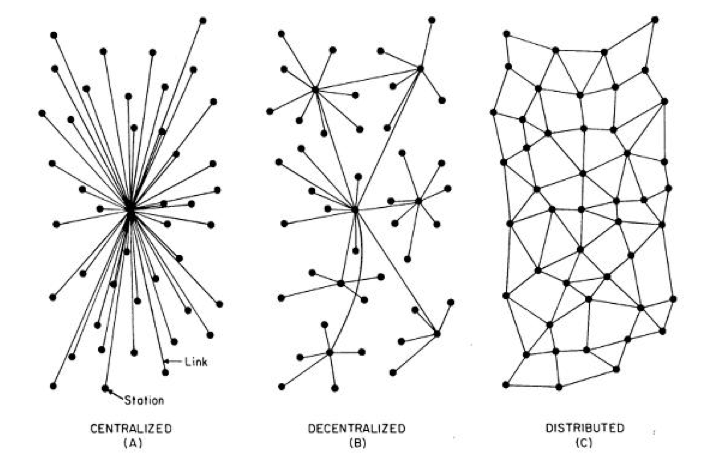

Simply put, blockchain is a decentralized, distributed, and constantly-updated digital ledger that tracks all transactions across a peer-to-peer network. Makes total sense, right? Let’s try breaking that statement down term-by-term to better understand:

In even simpler terms, blockchain technology acts like a universal shared Excel spreadsheet that everyone is constantly updating with every transaction made. So why is it called blockchain? This is because over varying increments of time, all transactions are stored in a “block” of data. Each block is verified by the users on the network, then added to the chain of blocks that make up all transactions recorded. Thus, we have a blockchain.

This is because the history of blockchain and bitcoin are tied to each other, even if the technologies are different. In 2008, a person or group of people known as (not their real name) wrote a on the bitcoin concept that could be built on a blockchain. bitcoin is a digital currency built on a blockchain, where a bitcoin (currency) is given to a “miner” whenever they secure a new block on the blockchain. A “miner”, as the name implies, is either a programmer or person with the proper programming software who goes through the transactions that will be lumped in a block to make sure the transactions are valid and recorded. This block becomes a miner’s “Proof-of-Work”. Because of this self-auditing nature, the blockchain stays secure and transparent.

All of this means that bitcoin is a secure form of digital currency, known as cryptocurrency. Since each transaction made or coin spent is unique, each transaction is verified before it’s made and coins cannot be spent twice. This is also why bitcoin is being compared to digital gold. There is a limited amount on the market and it literally has to be mined for there to be more, but there is a finite amount. bitcoin as a protocol and as a currency are only the first iterations of what has created over 700 cryptocurrencies and started even more potential apps and businesses. However, bitcoin is limited in its ability, and is only used as a currency, whereas blockchain as a technology has an almost unlimited potential for various applications.

What Does This Mean for Marketers?

Well, in reality it does not mean much yet. We are only at the beginning of our understanding of blockchain and what it can do. We are even further behind on regulation, laws, and understanding the potential effects of this technology. However, even with our limited knowledge there are some really exciting opportunities that blockchain can open up. From better digital advertising and data tracking to making our customers a larger part of the conversation by passing the middlemen of ad space regulators, decentralized applications (or dApps) offer immense potential for marketers to be in a better relationship with both the companies they work with and the consumers they are trying to reach. The transparency and intrinsic trust built into the philosophy and structure of blockchain can have a very positive effect.

Now that we have a base understanding of what blockchain technology is, we can start diving into what these potential possibilities are. We will be publishing a series of posts on what is currently on the market and what researchers are working on. But for our next article, we will dive into our understanding of the platform a lot of these dApps are built on — .

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.