CoinFalcon is one of the first exchanges to list DasCoin, along with and . The listing, which appeared live on April 27 2018, includes trading pairs DasCoin (DASC) with BTC, ETH and Euro Trading and is part of the overall plan by DasCoin, branded The Currency of Trust, to bring crypto-currency to the mainstream. Across the three new exchanges, traders will be able to buy and sell DasCoin with USD, Euro, BTC and ETH.

DasCoin, founded in 2016 by visionary Michael Mathias, draws on the strengths of both traditional currencies and emerging digital currencies while addressing their weaknesses. Its super-fast blockchain has capacity to process up to 100,000 transactions per second and it is built upon Graphene technology and BitShares, a peer-to-peer, decentralized, distributed ledger which has been in use since the early days of cryptocurrency and is used by three of the top 10 Blockchains in the world.

The new exchange listing represents a milestone in the company’s history and is the first in a series of announcements to be made by the company. Forthcoming announcements are set to include further exchange listings, (which could include HitBTC).

Up p to 10 new ICO partners, some of whom made presentations at the recent event in London, are set to utilize DasCoin blockchain. Meanwhile, NetLeaders, DasCoin’s decentralized marketing community, is gaining rapidly in popularity and has authenticated the DasCoin proposition in more than 100 countries worldwide, including Poland, UK, Nigeria, Germany and Philippines.

There has been growing interest in the DasCoin blockchain-powered ecosystem, with its vision to lay down a global bedrock of trust that unlocks prosperity for everyone. By eliminating the problems of traditional money and adapting trust to the digital age, the team at DasCoin feels this will create a better system for holding and exchanging value and could be the best long-term currency hold as well as one of the biggest gainers in 2018.

The products offered by DasCoin include blockchain-services for entrepreneurs, start-ups, banks, governments and enterprises. DasCoin uses a consortium blockchain to make it faster, more efficient and more secure;

Transactions confirmed in just six seconds

Network of users authenticated by banking standard KYC procedures

Through DasPay, DasCoin to be accepted in millions of merchants worldwide

Balanced by a responsive, transparent, system of governance

Smart-chip enabled hardware wallet makes DasCoin the most secure digital currency

On April , 2018, released its codebase onto Github to ensure that every piece of information in its’ blockchain can be shared or queried, making DasCoin’s blockchain fully transparent.

Additionally, DasCoin are not “mined” like those of bitcoin and other “proof-of-work” coins. Instead DasCoin utilizes a “minting process” which results in a significant reduction in energy consumption, as well as a more equitable distribution of value.

Michael Mathias, CEO of DasCoin, said: “Public trading is a significant milestone in the DasCoin story, and listing on these initial exchanges is a testament to the interest in our unique blockchain solutions model. It fulfils the promise of a huge amount of work by DasCoin and continues to build upon the launch of our proprietary blockchain in March last year.

Mathias continued: “We are pleased to be partnering with three exchanges, some established and other new innovative market entrants as we continue on this journey. We look forward to announcing many more as we continue to expand our blockchain alliance.”

It’s a time-tested stock market strategy – snapping up stocks in the hope of earning quick gains once the stocks start trading, so now could be a good time to buy DasCoin. Crypto-currencies have attracted a lot of interest of late with more than $400 billion of tradable crypto-assets and ICOs raising more than $13bn for blockchain-related start-ups. The first 90 days of launch often sees the biggest gains.

The post appeared first on .

, J.P. Morgan’s former head of blockchain, announced a new blockchain start-up called Clovyr.

Welcome to the Clovyr ecosystem! Decentralized networks, growing together. ☘️

— Clovyr (@GrowClovyr)

“Amber is extremely talented and helped build the outstanding team we have today. We respect her desire to start her own venture and we wish her nothing but the best,” a J.P. Morgan spokesperson said.

is one of the oldest financial institutions in the United States. It is the largest bank in the United States, and the world’s sixth largest bank, with total assets of US$2.6 trillion. Being a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management, JPMorgan serves millions of consumers, small businesses and many of the world’s most prominent corporate, institutional and government clients.

Two years ago, J.P. Morgan developed its blockchain technology Quorum for clearing and settling derivatives and cross-border payments. Amber Baldet led the bank and helped it set its strategy. Now she has been replaced by Christine Moy, another senior product manager at the bank.

Amber Baldet leaving her job in April. But then her next steps were unknown. And now she and her partner Patrick Mylund Nielsen, a former JPMorgan’s employee as well, are ready to reveal the details of Clovyr, a new startup that seeks to provide a new layer of enterprise-driven services between blockchains and user-facing applications.

is a decentralized application store that will host a selection of well-vetted applications alongside some in-house developer tooling designed to simplify application development for enterprises. Clovyr is building tools that make it easier to be smart about how data is collected, stored, and disclosed.

“It’s a way to help people think differently about decentralized application design,” Baldet said.

Clovyr will initially be compatible with Parity and Geth, two popular Ethereum software clients. According to the founders, other blockchain integrations can be added if there is a demand. The team plans to launch a full tech stack for privacy-protecting decentralized application design, that would achieve compliance with upcoming data protection law, the GDPR.

“When public cloud started to be a thing, a lot of businesses said, Oh, cloud, it’s a great idea architecturally, but we’re going to go ahead and build our own private cloud internally, because it’s safer and we know what we need,” Baldet said. “Now they’re spending millions of dollars to undo a lot of that work in an attempt to migrate to the public clouds that have evolved to the point where they are secure and robust and connected.”

Starting the project, Amber Baldet became an instigator for a between bitcoin developer Jimmy Song and Joseph Lubin. Jimmy Song said took on Lubin’s proposed bet that “blockchain tech”—the use of a decentralized ledger without a cryptocurrency—won’t have any significant users in five years.

The post appeared first on .

The cryptocurrency market is maturing rapidly as more sophisticated institutional participants enter the space. In fact, in the past few months over 100 hedge funds were created that exclusively invest in and trade cryptocurrency. Some of the world’s largest financial institutions have also recently announced their plans to begin trading cryptocurrency.

At Coinbase, we welcome these developments as they help accelerate the world’s adoption of cryptocurrency by bringing new capital, greater awareness, and additional infrastructure to the space. This movement requires institutional grade products and services, something Coinbase has been developing with leading institutions and which we are proud to formally launch today.

Coinbase Custody to Launch in Partnership with SEC-regulated Broker-Dealer

We have leveraged our experience safely storing more than $20 billion of cryptocurrency to create , the most secure crypto storage solution available. In partnership with an SEC-regulated broker-dealer, Coinbase Custody is proud to offer a service that couples Coinbase’s cryptocurrency security excellence with third-party auditing and financial reporting validation that operates at the high standard of an SEC-regulated, custodial broker-dealer.

Our Coinbase Custody launch partners are all leading institutions in the crypto industry, including:

If you’re an institution interested in a custody solution, to receive more information about Coinbase Custody.

Introducing Coinbase Markets

Coinbase already offers the deepest pool of liquidity to the largest number of participants in the cryptocurrency space. We intend to continue developing this electronic marketplace, known as Coinbase Markets, by opening a new engineering office in Chicago and cementing Coinbase as the leading cryptocurrency exchange.

Coinbase Markets provides a centralized pool of liquidity for all Coinbase products. Over the course of the year Coinbase Markets will introduce new features like low latency performance, on-premise datacenter colocation services, institutional connectivity and access, and settlement and clearing services. These additions will allow for a more efficient price discovery process to occur, creating tighter markets, deeper liquidity, and increased certainty of execution.

We are thrilled to open an office in Chicago and have access to a large talent pool of engineers with deep exchange infrastructure experience. This office will serve as the home for our Coinbase Markets team and enable us to continue offering the most performant and reliable cryptocurrency exchange. Chicago is an ideal location for our newest Coinbase office and we hope our investment will continue to position the city as a growing hub for technological innovation.

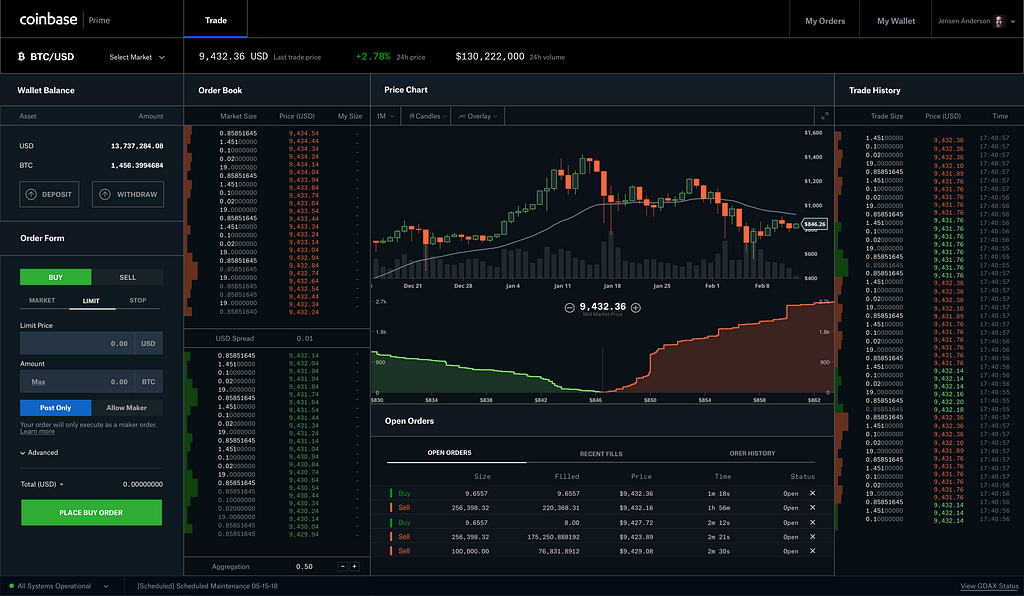

Launching Coinbase Prime

We are also excited to announce the launch of , a new platform designed specifically to provide a suite of tools and services that institutional investors rely on when trading cryptocurrency.

This product will fill a missing piece of critical infrastructure needed for institutions. Over the course of the year we intend to offer lending and margin financing products to qualified clients, high touch and low touch execution services like over-the-counter (OTC) trading and algorithmic orders, and new market data and research products. We will also introduce platform improvements like multi-user permissions and whitelisted withdrawal addresses.

We believe Coinbase Prime will accelerate adoption of cryptocurrency worldwide and we are excited to help institutions everywhere participate in this emerging asset class. To learn more or sign up as an institution, check out .

The Coinbase Institutional Coverage Group

We understand that institutions need more than great products, they need great service too. Our Institutional Coverage group is focused exclusively on serving the needs of institutional clients by providing sales, sales trading, research, market operations, and client services support. This group, headquartered in our New York City office, brings years of diverse and relevant institutional experience from firms such as the New York Stock Exchange, Morgan Stanley, and the SEC and CFTC.

By guiding clients through the onboarding process and advising on execution strategies, this team will deliver a best-in-class client experience. We are proud to offer personalized white-glove service and help institutional investors navigate the increasingly complex world of cryptocurrency investing.

As institutions continue to enter the cryptocurrency market, we are committed to building the products and services that uniquely meet their needs. We believe our suite of products and dedicated Institutional Coverage group will accelerate the rate of institutional adoption and create a more mature and diverse market. If you’re interested joining the Coinbase Institutional team, check out our .

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

XRP Prices Hang in the Balance

Ripple bears like to claim that XRP “serves no purpose” in its technology, but recent success with the “xRapid” software says otherwise. That—plus the continual “Is XRP a security?” debate—drove Ripple prices round and round in circles last week.

I see these two forces working in opposite directions.

Investors should be happy that xRapid is providing genuine benefits to businesses that dared to take a chance on XRP. But does it matter if the U.S. Securities & Exchange Commission (SEC) designates XRP a security?

xRapid Success

For the uninitiated, Ripple has multiple offerings. One is “xCurrent,” a.

The post appeared first on .