Today in crypto saw positive bitcoin price action amidst recent negative SEC sentiment, two ransomware participants caught, plans announced for a partnership between Nasdaq and VanEck, and positive statements from Tom Lee. Take a look at the details.

SEC Boss Pours Cold Water On bitcoin ETF Hopes

bitcoin ETF talk has filled the air this year, with many rejections by the SEC. SEC chairman Jay Clayton expressed several hesitations about bitcoin and crypto exchanges yesterday at the New York Consensus Conference.

Clayton Stated – “[w]hat investors expect is that trading in the commodity that underlies that ETF makes sense and is free from the risk of manipulation,” … “It’s an issue that needs to be addressed before I would be comfortable”, reported Crypto Insider.

US Regulators Tie Two bitcoin Addresses To Iranian Ransomware Plot

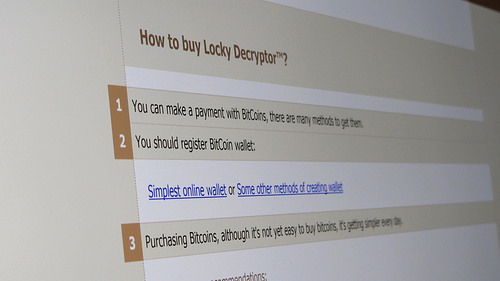

The Office of Foreign Assets Control (OFAC) for the US Department of Treasury put two people on its Specially Designated Nationals list today.

Ali Khorashadizadeh and Mohammad Ghorbaniyan are the two Iranians being put on the list, along with their bitcoin addresses and other pertinent information. The two individuals were involved in ransomware activities.

OFAC’s list has not contained crypto asset addresses until now.

Nasdaq, VanEck Partner To Launch ‘Crypto 2.0’ Futures Contracts

Exchange Giant Nasdaq announced partnership with VanEck recently. VanEck is an investment management operation recently in the crypto headlights for their bitcoin ETF applications.

VanEck strategy head Gabor Gurbacs recently mentioned a “regulated crypto 2.0 futures-type contract”. Other additional projects are also in the works for 2019.

Gurbacs explains they aim for fresh custody and surveillance standards with their futures. “In a follow-up interview, Gurbacs told CoinDesk that these futures products could be thought of as an ‘upgrade’ to current regulatory standards that surround bitcoin futures products”, reported CoinDesk today.

bitcoin Sees Strongest 24-Hour Performance Since July, Total Market Cap Jumps $11Bln

bitcoin has been beaten down pretty substantially over the past couple of weeks. However, the past 24 hours have provided a bit of price relief for the bulls.

Just today bitcoin has jumped at least 9.3%, rising above $4000.

reports bitcoin being en route to the strongest positive day since July.

Fundstrat’s Tom Lee: Bear Markets Are A ‘Golden Time’ To Be In Crypto

Fundstrat Global Advisor Tom Lee looks at the crypto bear market with optimism, according to his comments today at BlockShow Asia.

Lee links a few events to recent bearish price action – the bitcoin Cash fork, recent SEC regulation on ICOs, and poor worldwide market performance.

Lee stated – “[We] have a price correction taking place, which has caused the price to fall even below its 200-day [a popular technical indicator used by investors to analyze price trends], but if you’ve got time, it will arise. It will not happen within three months, or one year, but in two to three years, and this is the golden time to be in crypto. As soon as bitcoin crosses its 200-day, we know there will be a flood of money coming”, as reported by CoinTelegraph.

The post appeared first on .

Following an announcement from Bitfinex yesterday regarding their newfound “neutrality” to tether (USDT) and intent to use other stablecoins in addition to USDT, crypto firm Tether has revived its former business model of enabling 1:1 redemption of USDT for USD on its own platform. “Now, thanks to stronger banking as a result of our new

The post appeared first on

Nearly three months have passed since Goldman Sachs, a $73 billion investment bank based in the US, said that it is not ready to facilitate the delivery of “physical bitcoin” to its clients. The banking giant is still not able to hold cryptocurrencies on behalf of its clients, despite growing demand from clients. At a

The post appeared first on