A Russian arbitration court of appeals has recognized cryptocurrency as a property with value in its ruling on Monday. This overturned a previous ruling by another court even though Russia currently has no legal framework for cryptocurrencies.

Also read:

Crypto Recognized as Property

The case involves Russian citizen Ilya Tsarkov who filed bankruptcy in October last year. The court has ordered his cryptocurrencies to be transferred to the trustee, Alexei Leonov, who is expected to be handed the private key to the crypto wallet belonging to Tsarkov soon. According to Vedomosti, Tsarkov owns almost 0.2 bitcoin which is worth approximately US$1,885 at current market rates.

“The cryptocurrency was first recognized as property in Russia,” Ris Novosti reported. Leonov commented that with this ruling:

The court indirectly recognized the cryptocurrency as property and recognized its value.

Court Recognizes Crypto

Prior to Monday’s ruling, the case was heard in February by the Moscow Arbitration Court, which ordered Tsarkov to his cryptocurrency holdings after he revealed to the bankruptcy trustee that he had a wallet at Blockchain.info.

However, with Monday’s ruling, the Ninth Arbitration Court of Appeals overturned the judgment of the Moscow Arbitration Court after Leonov appealed. Russian Legal Information Agency Rapsi conveyed the court’s explanation:

Currently Russian legislation does not provide the definition of cryptocurrency and there are no requirements for its circulation. There is no way to tell if it is property, information or a ‘surrogate’…it is impossible to regulate the relations involving cryptocurrency.

Leonov cited “the position of the European Court of Human Rights on the issue of property and a bankruptcy case in Japan, where a court permitted to sell the debtor’s cryptocurrency,” the agency noted. “The lower court should have taken into account modern economic realities and new information technologies…bad-faith parties could exploit the fact that cryptocurrencies were excluded from bankruptcy estates by converting their assets and thus rendering them inaccessible,” he reportedly conveyed.

What do you think of the court’s ruling? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

Billionaire and Microsoft founder is very skeptic about the cryptocurrency and says that he would like to bet against bitcoin if he had such an opportunity.

In his joint interview with legendary investor and CEO of Berkshire Hathaway Warren Buffett and the company’s vice chairman Charlie Munger for , he expressed his view on the nature of bitcoin and its future.

He the journalists: “As an asset class, you’re not producing anything and so you shouldn’t expect it to go up. It’s kind of a pure ‘greater fool theory’ type of investment”. “I agree I would short it if there was an easy way to do it,” added Gates.

Gates as well as many other critics of the cryptocurrency are very negative about the extreme volatility of the cryptocurrency market. In 2017 the price of one bitcoin skyrocketed from $2,000 to $19,000 by the end of the year. And this year, after a significant decline the price still hasn’t managed to reach the mark of $10,000. At the press time, according to , bitcoin is traded at $9,393.

Gates believes that bitcoin and ICOs are “some of the crazier, speculative things” said Gates. When the billionaire was asked whether he currently owns any digital assets, he answered that once he got a bitcoin as a birthday present. But now he doesn’t have it, as he sold it back some years ago.

The Microsoft founder considers digital currencies to be too risky for long-term commitments for private investors as well as for institutional ones. Though virtual currencies are just nothing more than crazy investments, according to Gates, like other cryptocurrency skeptics he still believes that blockchain itself as a separate technology can be rather useful.

Blockchain gives a possibility to exclude a participation of an external intermediary, such as a bank, for example, or any financial institution, from any transaction. It can be achieved thanks to quick creation of a permanent reliable and secure record of a transaction in which only two parties participate. Though blockchain was initially used only as an underlying technology for bitcoin, currently companies are actively examining ways for implementation of blockchain in many other areas like trading, banking and supply chain management.

Gates’ opinion is very close to the view of Warren Buffett who named bitcoin a “zero-sum game”. Being an absolute anti-fan of investing into cryptocurrencies, he said that bitcoin is “probably rat poison squared”.

Nevertheless, some cryptocurrency experts strongly that “traditional investors forget bitcoin is actually a technology infrastructure”. Though it is clear that bitcoin differs from traditional investments and it acts differently, according to crypto supporters, it shouldn’t be considered as a disadvantage of bitcoin as it is done by many gurus of traditional investors.

The post appeared first on .

In the latest episode 7 of Season 5 in HBO’s ‘Silicon Valley’ series, cryptocurrencies have taken the center stage and turns out to be the theme of the episode. The episode is titled as “Initial Coin Offering” and takes a balanced approach while covering the very controversial and complex space of ICOs.

The episode shows ‘Pied Piper’ as a fictional decentralized internet startup that is exploring an alternative way of fundraising by the means of an ICO after its original plans for the Series B funding gets shattered. This episode has soon become the talk-of-the-town especially within the cryptocurrency community who is discussing the same on several social media platforms like Reddit.

In one of the scenes, Monica (Amanda Crew) warns Richard while venturing into the bitcoin bandwagon and says “Before you walk away from stability and gamble your entire company on crypto, there’s another friend of yours I think you should talk to.” One of the other scenes also shows the harsh reality of the cryptocurrency markets and the fact that how nearly half of the ICOs launched last year in 2017 have met with a miserable end.

Instead of going all praises for the hype surrounding the crypto space, the episode shows the extremely volatile behavior and the ruthless path that the ICOs can take as the industry is filled with innumerable and unpredictable problems like fraudulent schemes, online hacks, regulatory inquiries and much more.

The episode’s main character is Bertram Gilfoyle who is the chief systems architect of the Pied Piper ICO and has been into mining digital currencies from the very early days of bitcoin in 2009. Gilfoyle talks of taking the ICO route as a win-win situation as the management is not willing to dilute their control with the venture-capitalists but instead ready to take the risk in the volatile crypto markets.

The episode also shows Gifoyle giving an interview to Bloomberg Tech where host Emily Chang is seen in a cameo. Gifoyle talks about the Pied Pieper Coin which was his idea.

WATCH: Pied Piper's Bertram Gilfoyle talks (rants) to about the company's recent ICO and his opinion of banks, paper money and VCs (he's not a fan).

And… well… just watch.

— Tech At Bloomberg (@TechAtBloomberg)

When Chang asks Gifoyle about his decision and the idea of ICO, he says “What attracted me was the passage an ICO offers across the river sticks of venture capital. What attracted me was an informed disdain for traditional fiat currency, its paper stained with the greasy fingerprints of your banks and your mints.”

Gifoyle further adds “What attracted me was cryptocurrencies’ fundamental anonymity that shields private transactions from the peering green eyes of the all-knowing governmental overlords.”

One of the Reddit users appreciated that the Silicon Valley doesn’t back away from showing the clear picture and the risks associated with the ICOs.

There’s one scene where the Pied Piper management team is discussing ICO with a “friend” who claims to be an advisor to dozen of startups in the cryptosphere for organizing a token sale. When one member from the Pied Piper team asks whether the token sales have worked, the advisor says “It’s not always about money. Sometimes it’s about wisdom.”

It's not always about money. Sometimes, it's about wisdom. New episode of tonight at 10PM.

— Silicon Valley (@SiliconHBO)

The advisor has lost around $1 billion in deals and also lost $300 million in cryptocurrencies as the thumbdrive on which the funds were stored has been thrown in the trash. The episode shows that the fictional decentralized startup Pied Piper has put itself in a very critical condition.

Like for example there also a website dedicated to the startup which looks a lot like a solid blockchian startup which could very much be real with the claims of promising some unreasonable “100x profit”. The Pied Piper Coin has started trading at $0.07 and must trade at $68 in order to get the sort of valuations which they would have otherwise got through venture capital funding.

The post appeared first on .

Information as of May 7, 2018

This report was created by:

Professor , Doctor of Economics, Member of the Russian Academy of Natural Sciences, and Leading Analyst at ICOBox;

, PhD in Economics, Head of International Public Relations and Business Analytics Department Chief at ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox;

, Co-Founder of ICOBox

This report presents data on the ICO market changes during 2018. Special emphasis has been placed on an analysis of the changes that have taken place in April-May 2018, including over the past week (April 30-May 6, 2018).

1. General analysis of the ICO market (by week, month)

1.1. Brief overview of ICO market trends

Table 1.1. Brief ICO market overview, key events, news for the week of May 1-6, 2018

| № | Factors and events

(link to source) |

Date of news | Description | Type of impact |

| 1. | Telegram Cancels ICO After Multi-Billion-Dollar Private Sale [source: ] | May 2, 2018 | Sources have told The Wall Street Journal that the company believed the $1.7 billion collected during the private rounds was sufficient, and elected not to get mixed up with the regulators for a public coin offering. | Uncertain |

| 2. | South Korea Aims at ICO Legalization [source: ] | May 3, 2018 | A group of South Korean parliamentarians are working on a draft law to legalize new ICOs, provided that token issuers will adhere to the strict restrictions established by the government. | Favorable

ICO ⇑

|

| 3. | Northern California City Comes Close to Issuing its Own ICO [source: ] | May 5, 2018 | The city council voted unanimously to forward the pilot program envisaging the issue and sale of municipal bonds using blockchain for the consideration of the city manager. | Favorable

ICO ⇑

|

Table 1.2 shows the development trends on the ICO market since the beginning of 2018. Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered.

Table 1.2. Aggregated trends and performance indicators of past (completed) ICOs1,2

| Indicator | January

2018 |

February

2018 |

March

2018 |

April

2018 |

May 1-6, 2018 |

| Total amount of funds collected, USD million | 1 666 | 2 702 | 7 174 | 1 085 | 227.5 |

| Number of companies that completed an ICO1 | 95 | 95 | 83 | 107 | 14 |

| Maximum collected, USD million (ICO name) | 100 (Envion) | 850

(Pre-ICO-1 TON) |

5000

(Petro3) |

133 (Basis (previously Basecoin)) | 35 (SHIVOM); 35 (Solve.Care) |

| Average collected funds, USD million | 17.5 | 28.4 | 86.4 | 10.1 | 16.2 |

Note:

1 Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com. For some ICOs information may currently be incomplete (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

2 Including the TON Pre-ICO-1,2 and the Petro ICO.

3 According to the data from the official website of the Petro ICO, Petro sales equaled more than $5 billion, which is equivalent to more than $4 billion euros or $31 billion yuan. . However, the data on the amount collected by El Petro from some other sources differ. For example, according to criptomoedasfacil.com, the amount of funds collected cannot exceed billion taking into account discounts, the project indicates billion, and other sources mention the billion stated by the President of Venezuela Nicolas Maduro.

4 The data for 2018 have been updated (date updated: May 6, 2018).

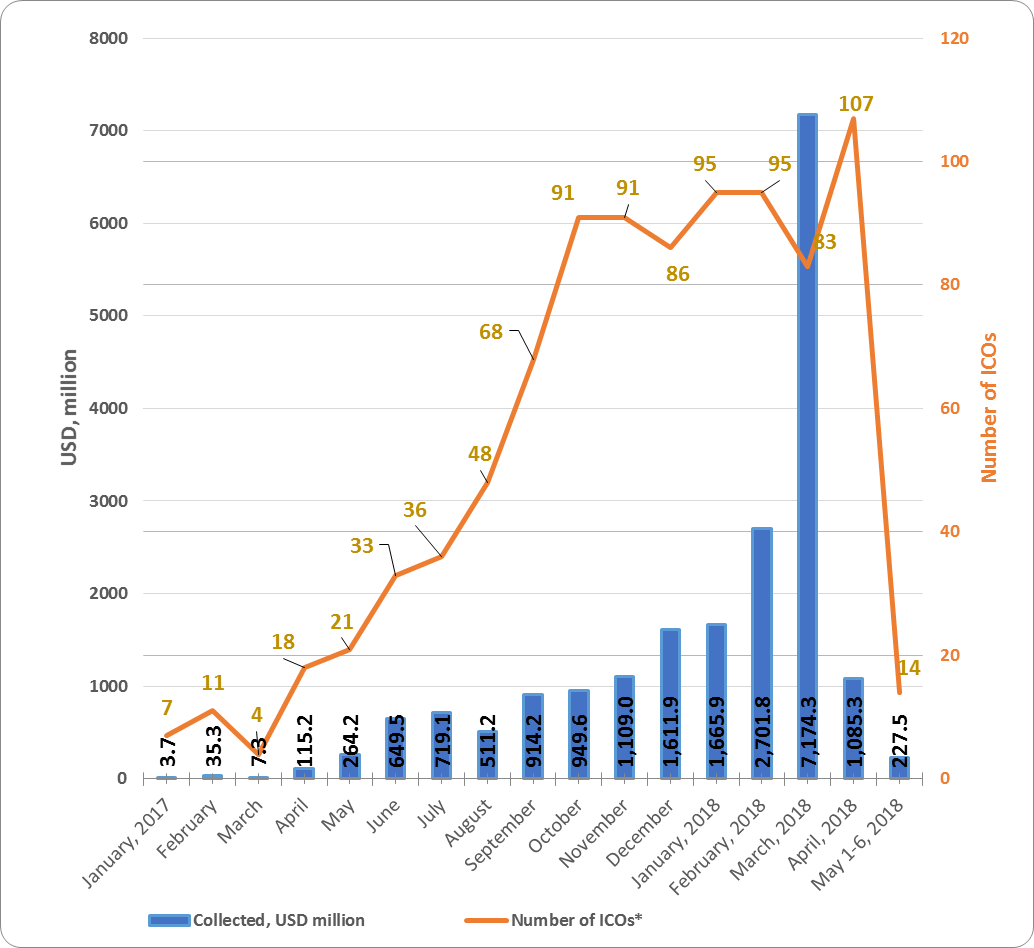

The data for the previous period (since January 1, 2018) have been adjusted to account for the appearance of more complete information on past ICOs. Since the start of May (May 1-6, 2018) the amount of funds collected via ICOs equaled $227.5 million. This amount consists of the results of 14 successfully completed ICOs, with the largest amount of funds collected equaling $35 million. Two projects collected this amount, SHIVOM and Solve.Care. The average collected funds per ICO project equaled 16.2 million (see Tables 1.2, 1.3).

Table 1.3. Amount of funds collected and number of ICOs

| Month | Collected,

$ million |

Number of ICOs* | Average collected,

$ million |

| January 2017 | 3.7 | 7 | 0.53 |

| February | 35.3 | 11 | 3.21 |

| March | 7.3 | 4 | 1.82 |

| April | 115.2 | 18 | 6.4 |

| May | 264.2 | 21 | 12.58 |

| June | 649.5 | 33 | 19.68 |

| July | 719.1 | 36 | 19.97 |

| August | 511.2 | 48 | 10.65 |

| September | 914.2 | 68 | 13.44 |

| October | 949.6 | 91 | 10.44 |

| November | 1 109 | 91 | 12.19 |

| December | 1 611.9 | 86 | 18.74 |

| Total, 2017 | 6 890.1 | 514 | 13.4 |

| January 2018 | 1 666 | 95 | 18 |

| February 2018 | 2 702 | 95 | 28.4 |

| March 2018 | 7 174 | 83 | 86.4 |

| April 2018 | 1 085 | 107 | 10.1 |

| May 1-6, 2018 | 227.5 | 14 | 16.2 |

| Total for 2018*** | 12 854.8 | 394 | 32.6 |

* Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com.

Information on funds collected is not available for all ICOs (information for last week is tentative and may be adjusted). ICOs that collected less than $100,000 were not considered.

** More than 1,000 ICOs were performed in 2017. However, the data for the 514 largest and most popular ICOs, the data of which can be processed, were considered when calculating the total amount of funds collected during 2017.

*** Including TON Pre-ICO-1,2 ($1.7 billion) and the Petro ICO ($5 billion). The data for 2018 have been updated (date updated: May 6, 2018).

Table 1.3 shows that the largest amount of funds was collected via ICOs in March 2018, mainly due to the appearance of major ICOs. The highest average collected funds per ICO was also seen in March 2018.

Figure 1.1. Trends in funds collected and number of ICOs since the start of 2017

1.2. Top ICOs of last week

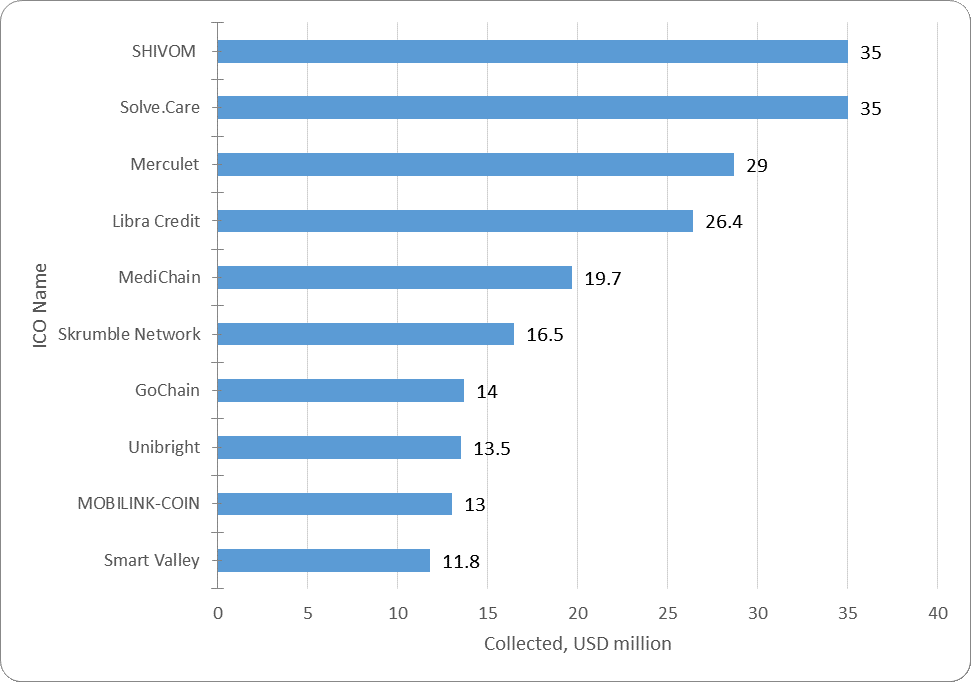

Table 1.4 shows the ten largest ICOs of the week.

Table 1.4. Top 10 ICOs in terms of the amount of funds collected (May 1-6, 2018)*

| № | Name of ICO*** | Category** | Collected, $ million | Date |

| 1 | SHIVOM | Drugs & Healthcare | 35 | May 3, 2018 |

| 2 | Solve.Care | Drugs & Healthcare | 35 | May 1, 2018 |

| 3 | Merculet | Infrastructure | 29 | May 4, 2018 |

| 4 | Libra Credit | Finance | 26.4 | May 5, 2018 |

| 5 | MediChain | Data Storage | 19.7 | May 1, 2018 |

| 6 | Skrumble Network | Social Network | 16.5 | May 5, 2018 |

| 7 | GoChain | Infrastructure | 14 | May 3, 2018 |

| 8 | Unibright | Infrastructure | 13.5 | May 2, 2018 |

| 9 | MOBILINK-COIN | Communications | 13 | May 5, 2018 |

| 10 | Smart Valley | Infrastructure | 11.8 | May 4, 2018 |

| Top 10 ICOs* | 213 | |||

| Total funds collected from May 1-6, 2018 (14 ICOs)* | 227.5 | |||

| Average funds collected | 16.2 |

* When compiling the lists of top ICOs, information from the websites tokendata.io, icodrops.com, icodata.io, coinschedule.com and other specialized sources is used.

** The category was established based on expert opinions.

*** Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered. Information may be incomplete for some ICOs (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

The data for the previous period (May 1-6, 2018) may be adjusted as information on the amounts of collected funds by completed ICOs is finalized.

The leaders of the week were the SHIVOM and Solve.Care projects, which can be assigned to the same category, Drugs & Healthcare.

Shivom is a project that allows donors of DNA data to receive a deciphering of their DNA, and to sell or share these data with the international scientific community and make their contribution to an unprecedented era in genomics. The Shivom ecosystem or blockchain storage will make it possible to identify biomarkers and assess the risk probability of illness.

Solve.Care is a global blockchain solution for coordination and administration of healthcare and healthcare payments.

Figure 1.2 presents the ten largest ICOs completed during the past week.

Figure 1.2. Top 10 ICOs in terms of the amount of funds collected (May 1-6, 2018)

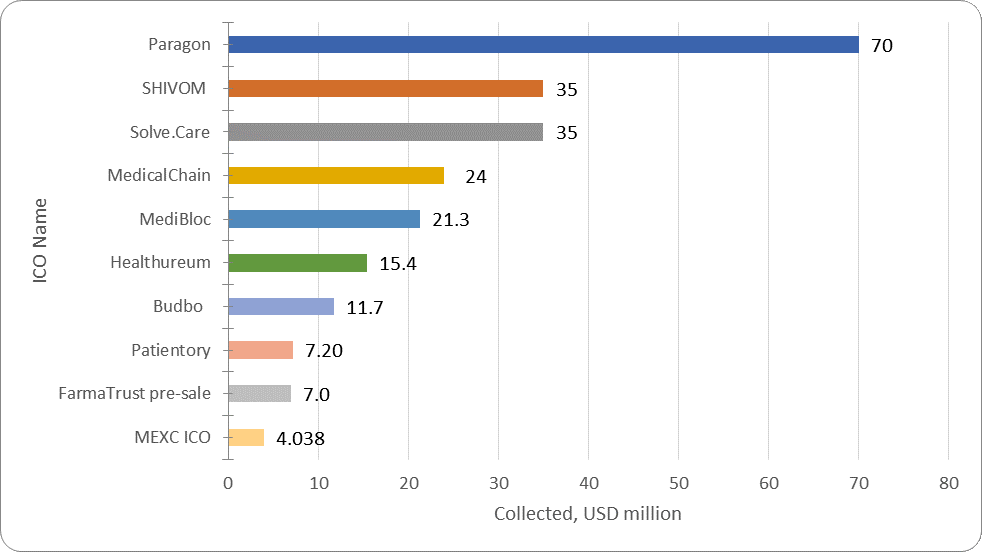

1.3. Top ICOs in their categories

The list of top ICOs by category is compiled with due account of the categories of the leading ICOs for the week.

Table 1.5. Top 10 ICOs in terms of the amount of funds collected, Drugs & Healthcare category

| № | Name of ICO | Category* | Collected, $ million | Date | Token performance |

| 1 | Paragon*** | Drugs & Healthcare | 70 | October 15, 2017 | 0.19x |

| 2 | SHIVOM | Drugs & Healthcare | 35 | May 3, 2018 | n/a |

| 3 | Solve.Care | Drugs & Healthcare | 35 | May 1, 2018 | n/a |

| 4 | MedicalChain | Drugs & Healthcare | 24 | February 1, 2018 | 1.58x |

| 5 | MediBloc | Drugs & Healthcare | 21.3 | December 15, 2017 | 3.28x |

| 6 | Healthureum | Drugs & Healthcare | 15.4 | April 1, 2018 | n/a |

| 7 | Budbo | Drugs & Healthcare | 11.7 | March 5, 2018 | n/a |

| 8 | Patientory | Drugs & Healthcare | 7.20 | June 3, 2017 | 1.74x |

| 9 | FarmaTrust pre-sale | Drugs & Healthcare | 7.0 | April 15, 2018 | n/a |

| 10 | MEXC ICO | Drugs & Healthcare | 4.038 | April 29, 2018 | n/a |

* When compiling the lists of top ICOs, information from the websites tokendata.io, com, icodata.io, coinschedule.com and other specialized sources is used. The ICO project categories correspond to the information from the website coinschedule.com. If there is no information on the website concerning the project category at the time of compilation of this analytical report, the category is determined by experts.

** The top projects in this category completed in May 2018 are highlighted in red.

*** There is no data on the amount of funds collected by the leader in the category on the official website of , and the numbers of different sources diverge significantly (from $ to $ million).

At present, all projects from the top 10 in this category have a token performance indicator of 0.19x to 3.28x. The MediBloc project can be considered one of the most successful exchange listings, as this project has a current token price to token sale price ratio of 3.28x. When considering this indicator, it is important to remember that the MediBloc ICO was completed on December 15, 2017, i.e. the 3.28x growth took place over approximately four months. The market capitalization of MediBloc currently exceeds $90 million, while the market capitalization of the leader in the category in terms of the amount of funds collected, Paragon, equals $12.6 million.

Figure 1.3. Top 10 ICOs in terms of the amount of funds collected, Drugs & Healthcare category

During the analyzed period (May 1-6, 2018) at least 14 ICO projects were successfully completed, each of which collected more than $100,000, with the total amount of funds collected exceeding $227.5 million. Last week’s leaders were the SHIVOM and Solve.Care projects, which both collected $35 million. The total amount of funds collected by a number of ICOs failed to reach even $100,000 (the information for some projects is still being finalized).

Annex – Glossary

| Key terms | Definition |

| Initial coin offering, ICO | A form of collective support of innovative technological projects, a type of presale and attracting of new backers through initial coin offerings (token sales) to future holders in the form of blockchain-based cryptocurrencies and digital assets. |

| Token sale price

Current token price |

Token sale price during the ICO.

Current token price. |

| Token reward | Token performance (current token price ÷ token sale price during the ICO), i.e. the reward per $1 spent on buying tokens. |

| Token return | (see token reward) Performance of funds spent on buying tokens or the ratio of the current token price to the token sale price, i.e. performance of $1 spent on buying tokens during the token sale, if listed on an exchange for USD. |

| ETH reward – current dollar value of $1 spent on buying tokens during the token sale | Alternative performance indicator of funds spent on buying tokens during the ICO or the ratio of the current ETH price to its price at the start of the token sale, i.e. if instead of buying tokens $1 was spent on buying ETH at its rate at the start of the token sale and then it was sold at the current ETH price. |

| BTC reward– current dollar value of $1 spent on buying tokens during the token sale | Similar to the above: Alternative performance indicator of funds spent on buying tokens during the token sale, i.e. if instead of buying tokens $1 was spent on buying BTC at its price at the start of the token sale and then it was sold at the current BTC price. |

| Token/ETH reward | This ratio describes a market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying ETH. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on ETH. |

| Token/BTC reward | This ratio describes the market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying BTC. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on BTC. |

The post appeared first on .