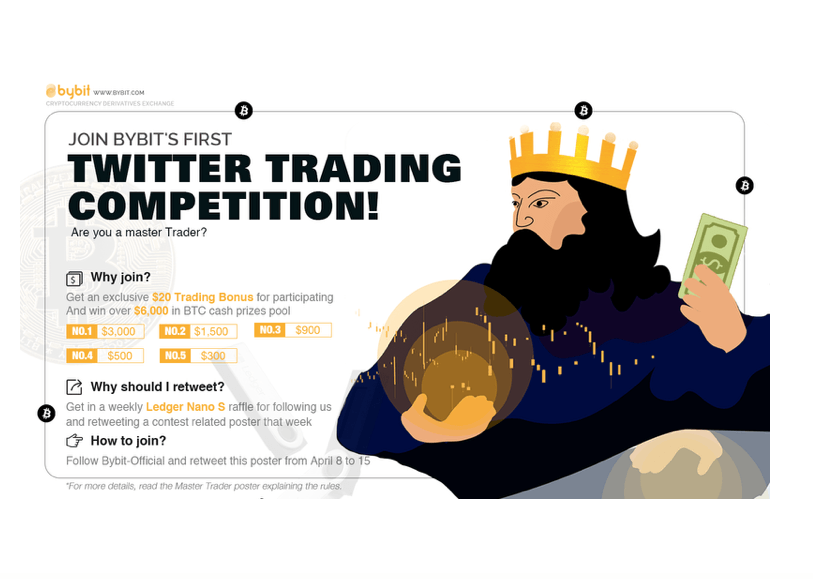

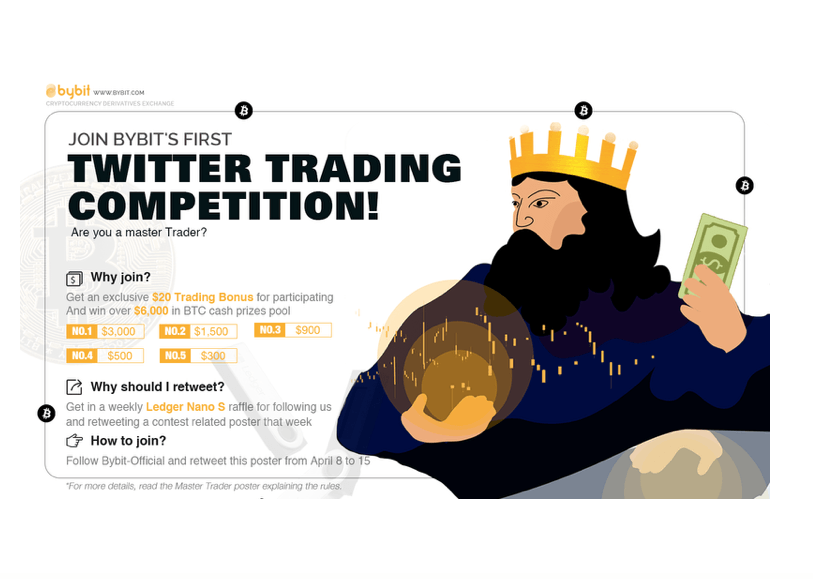

bitcoin Press Release: Derivatives Exchange Bybit has officially started its first Trading Competition on Twitter. The competition will run from April 8th to May 6th, 2019.

April 11, 2019, Singapore – has launched a new for users to match their skills against one another in the hunt for over $6,000 in total prize money. The trading competition will see participants demonstrate their trading mastery in an attempt to place among the top 5 traders at the end of the period to qualify for a prize pool worth over 6,000 USD, and the 1st place prize is 3000 USD.

The best traders will be calculated using ‘Realized Profit and Loss’, which means that all traders can fairly participate, regardless of factors like trading volume. Interested Individuals can join by , , having at least 0.02BTC in deposits in a Bybit account, and . Bybit will DM all participants on Twitter to confirm registration and send out a $20 Competition Bonus.

The registration will take place from April 8th to 15th and the competition will run from April 15th to May 6th. Additionally, any weekly from April 8th to May 6th will enter participants into a Weekly Raffle to win a Ledger Nano S. For a see here.

Welcome Bonus

so they may try out the platform at no risk to themselves. The Welcome Bonus will reward new users registering on the platform with a $10 Bonus and an additional $50 Trading Bonus with an initial deposit of at least 0.2 BTC for a grand total of $60 of Trading Bonus. Only the initial BTC deposit will count towards the Trading Bonus.

The Trading Bonus is a margin amount transferred directly to client’s bitcoin wallets and is meant to be used for trading on the platform. It cannot be withdrawn but can be used for trading fees, order margin, funding fees and to cover potential losses. Profits made from the Trading Bonus can be freely withdrawn, but doing so would forfeit any Bonus remaining

About Bybit

established in March 2018 and registered in the BVI. It is headquartered in Singapore and has offices in Hong Kong and Taiwan. We have users from all over the world including North America, Europe, Russia, Japan, South Korea, and Southeast Asia. We are focused on serving everyone from individual retail clients to professional derivatives traders. Our technology team includes experts from numerous leading companies such as Morgan Stanley, Tencent, Ping’an Bank and Nuoya Fortune.

Our liquidity ranks second because we put our clients first.

To these ends, we provide a professional 24/7 multi-language online customer support and direct access to our CEO via Twitter.

Our matching engine never overloads with over 100,000 TPS dedicated to every single trading pair, and our servers are never down with our grey release feature and hot patches released on the go. Lastly, all funds are kept safe with our Hierarchical Deterministic Cold Wallet System storing all assets. All of these and much more are what makes Bybit committed to creating a fair, transparent and efficient trading environment for all.

Currently, the products on the platform include BTC/USD and ETH/USD perpetual contracts and Bybit will soon launch EOS/USD, XPR/USD and LTC/USD perpetual contracts.

Find out more about Bybit on the Official Website –

Chat on Telegram –

Check out Bybit on Twitter –

Follow Bybit on LinkedIn –

Follow Bybit on Facebook –

Stay up to date on Medium –

Media Contact Details

Contact Name: Joseph Imbruglia

Contact Email:

Bybit is the source of this content. Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. This press release is for informational purposes only. The information does not constitute investment advice or an offer to invest.

This is a paid-for submitted press release. CCN does not endorse, nor is responsible for any material included below and isn’t responsible for any damages or losses connected with any products or services mentioned in the press release. CCN urges readers to conduct their own research with due diligence into the company, product or service mentioned in the press release.

Published at Sat, 13 Apr 2019 10:41:18 +0000