The market saw a massive spike over the past week, with several coins enjoying double-digit gains. [], the largest on the planet, was the catalyst for the price rise as the rest of the market followed its suit after the $5000 threshold breach. Looking at , there were many which shot up in value, and [LTC] was a key player here.

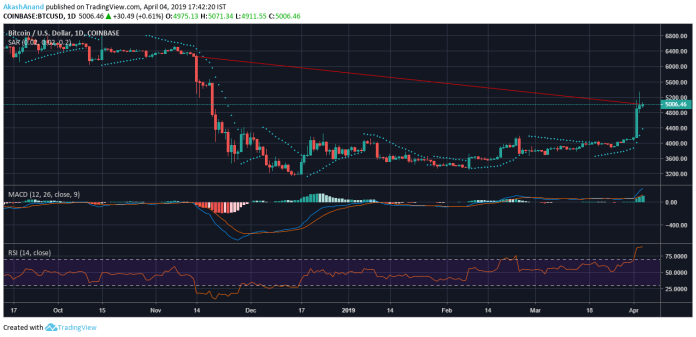

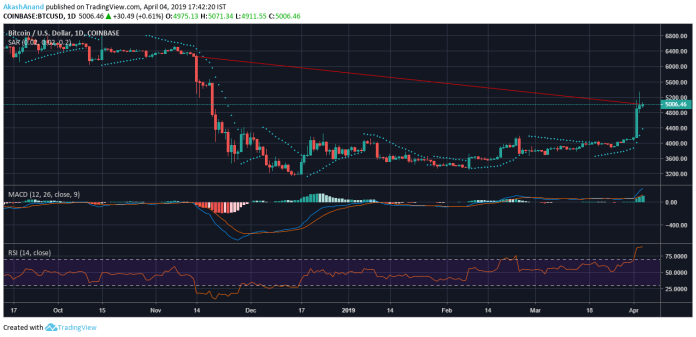

1 day

’s one-day chart signified a downtrend, despite the recent bullish spike. The downtrend resulted in the price falling from $6253.45 to $5042.32. The long term support was holding at $3139.11.

The Parabolic SAR was under the price candles, a sign of the bullish atmosphere that was in, at press time.

The MACD indicator displayed the signal line spiking upwards after moving as a conjoined pair with the MACD line previously. The MACD histogram was predominantly bullish.

The Relative Strength Index had breached the overbought zone, suggesting that the buying pressure was significantly higher than the selling pressure.

LTC 1 day

The one-day chart for displayed a massive uptrend that resulted in a price hike from $26.43 to $84.89. The long term support was holding at $22.4.

The Bollinger bands were diverging due to the recent price outbreak. The size of the Bollinger cloud was also significant on the charts.

The Awesome Oscillator indicated bullish momentum for the market.

The Chaikin Money Flow indicator was above the zero line because the capital coming into the market was more than the capital leaving the market.

Conclusion

All the above-mentioned indicators suggest that the market will continue to undergo a bullish phase. This was evidenced by the positive increase in the market momentum, as well as the number of investors entering the field.

The post appeared first on .

Published at Fri, 05 Apr 2019 08:06:48 +0000