Throughout the past several days, has remained relatively stable at $3,900. The stability of has led crypto to record massive spikes in the range of 10 to 100 percent.

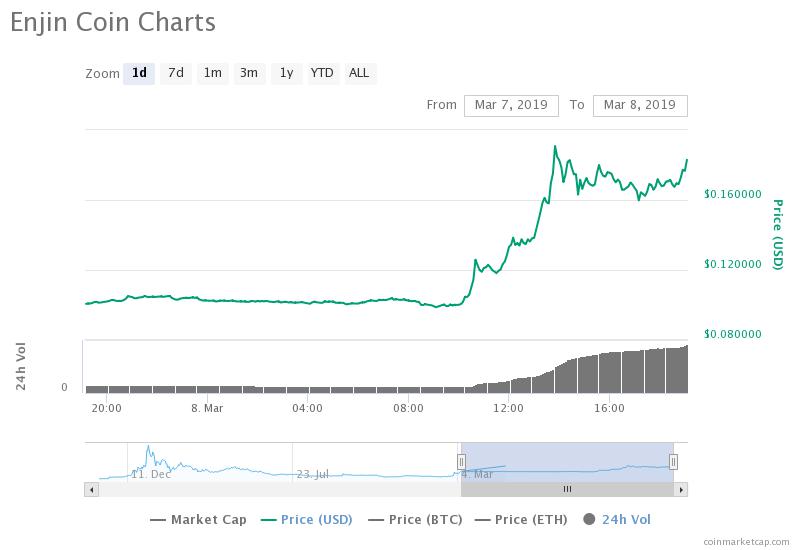

Enjin Coin, for instance, the native of a gaming-focused network called Enjin, surged by 100 percent at its daily peak following its .

Enjin Coin Daily Chart (Source: Coinmarketcap.com)

ICON, the most valuable project in South Korea, recorded a 15 percent gain within a 24-hour span.

Alternative tend to perform strongly when demonstrates stability but are the recent price movements of the crypto market sustainable?

bitcoin Isn’t Moving

Since February 7, for over a month, has remained in a tight range from $3,600 to $3,900.

Despite its break out above the $4,000 resistance level, has not been able to move higher in the $4,000 region and recover to the $5,000 to $6,000 range, which several traders have emphasized is crucial for the long-term recovery of the asset.

“Still a beautiful chart. If can’t bounce to at least $5k – $6k soon, it’s a really bad sign for the cyberbulls. And if it breaks down thru the yellow line at any point, even the HODLers need to GTFO,” former International Monetary Fund (IMF) economist Mark Dow said.

While has barely moved in the past month, economist Alex Krüger stated that has recorded two higher lows in a short time frame for the first time since January.

Momentum is key for to rebound in the upcoming weeks and consecutive higher lows, which essentially refers to net gains, could be crucial for the asset to break out of an extended period of low volatility.

This is the first time has two higher lows since … January 2018 🔥

— Alex Krüger (@krugermacro)

A sideways market often benefits and low market cap . But, alternative tend to follow the price movement of in an intensified manner.

If struggles to recover beyond the $4,000 level in the near-term, it may lead investors to lose confidence in the short-term performance of the market.

At this juncture, a downside price movement of , which remains unlikely due to the momentum of the crypto market, could still result in large losses for both major crypto assets and small market cap .

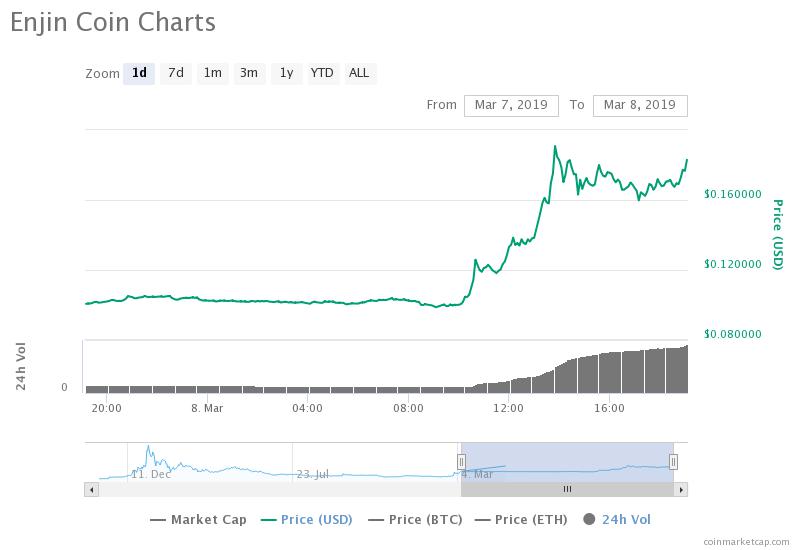

Monthly Chart (Source: Coinmarketcap.com)

But, traders who previously considered the recent price movement of the market to be a bull trap have become more optimistic in recent weeks.

“ETH is one of the many reasons I gave up on being net short: zooming out, it looks like a potential bear-trap below an obvious liquidity pool. Also, bull-flag, POC configuration choppy, big orders stacked both sides of the books, etc. In brief, I don’t see my edge anymore,” one trader .

Fundamentals Intact

On March 8, eToro, one of the largest brokerage and platforms in the global market, added crypto options across 32 states in the U.S., aggressively expanding its venture deep in the bear market.

The billionaire founder and CEO of Twitter and Square Jack Dorsey revealed that he purchased a hardware called Trezor with on the Square Cash app, reaffirming his support for once again.

Just bought a hardware with through

— jack (@jack)

The change in sentiment in the market combined with strong fundamental factors, rapid price movements of alternative , and positive media coverage could continue to fuel the momentum of the crypto market in the near-term.

Anthony Pompliano, the co-founder and partner of Morgan Creek Digital, also predicted more public pension funds in the U.S. to begin investing in the market, which could increase in the inflow of capital in a larger time frame.

Click for a real-time price chart.

Published at Fri, 08 Mar 2019 12:07:15 +0000