Crypto markets have taken a sharp downturn, today, July 27, with all of the top ten coins by market cap hit by hefty losses and (BTC) dipping back below the psychological price point, as data from shows.

The grim market picture is likely due to yesterday’s that the Winklevoss Twins’ application for a bitcoin exchange-traded fund () has now been rejected for a second time by the U.S. Securities and Exchange Commission ().

Market visualization from

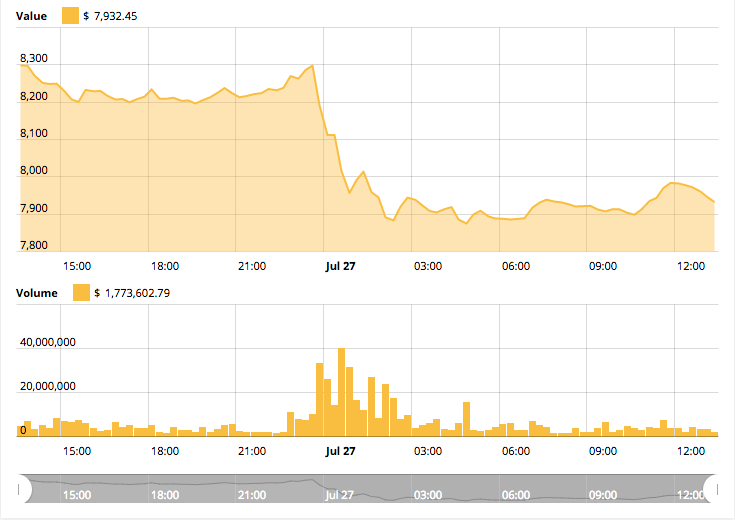

(BTC) is trading around $7,915 to press time, down about 4 percent on the day. After leading last week’s impressive market and hitting as high as $8,431 July 25, the coin tumbled over $400 within the space of 3 hours earlier today.

bitcoin has since slightly recovered from its intraday low at around $7,874 –– and its weekly and monthly price performance remains in the green, up around 6 and 30 percent respectively.

bitcoin’s 24-hour price chart. Source: Cointelegraph

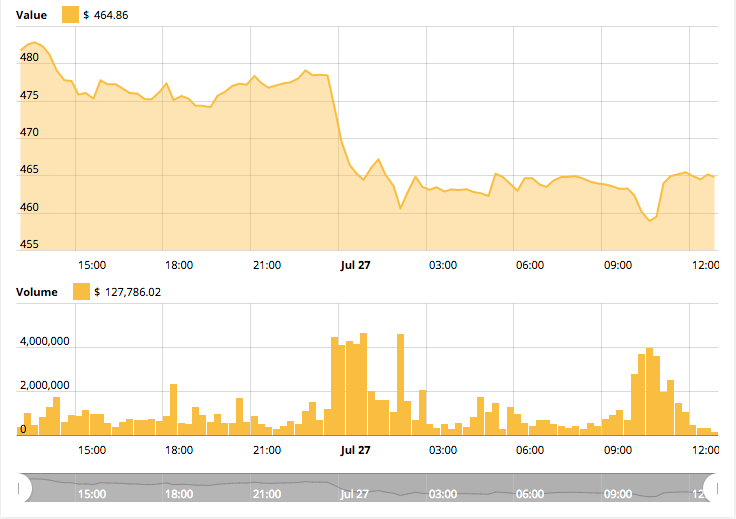

(ETH) is trading around $462 at press time, down about 3 percent on the day. The altcoin took a similarly sharp plunge to bitcoin, losing roughly $20 in value within 3 hours, and later dipping yet further to see a 24-hour low of around $459. Ethereum’s weekly price performance is now just shy of half a percent in the negative, but it’s monthly gains remain at a firm 6 percent.

Ethereum’s 24-hour price chart. Source: Cointelegraph

On ’s listings, all of the top 10 coins by market cap are down between 3 and 7 percent on the day.

(XLM) has seen the steepest loss of the top ten, 6.5 percent in the negative and trading around to press time. (ADA) is down almost 7 percent, trading around per coin, with (MIOTA) down around 5.4 percent at and (BCH) down almost 5 percent to trade at to press time.

Of the top 20 coins on CoinMarketCap, — ranked 18th by market cap — has somehow been immunized from the declining fortunes of most crypto assets on the day. After a major surge yesterday to hit as high as $2.66, the token is still up around 13.5 percent today and is trading at around to press time.

VeChain 7-day chart. Source:

Crypto exchange ’s native token (BNB) — ranked 17th on CoinMarketCap — is also up a solid 6 percent on the day, trading around to press time –– its highest price point yet during its bullish run this week.

Binance Coin 7-day chart. Source:

Over $12 billion has been wiped from the total market capitalization of all cryptocurrencies on the day. After yesterday’s peak at $303.7 billion, total market cap is now around $290 billion.

Total market capitalization of all cryptocurrencies from

Of the top 100 cryptocurrencies by market cap, just seven coins are in the green on the day to press time, according to CoinMarketCap.

Crypto entrepreneur has on Twitter yesterday that the SEC’s rejection of the Winklevoss bitcoin ETF it is in some sense “old news.” He stated that a pending decision over the bitcoin ETF that has recently been by VanEck & SolidX for trading on the Chicago Board Options Exchange () will be more pivotal for the industry –– and would likely generate more price-impactful “ETF excitement.”

Shrem moreover argued that regulators will be more likely to grant a stalwart mainstream institution such as CBOE the right to trade an ETF, and that this was a more decisive factor in the Winklevoss rejection than the SEC’s alleged qualms over inadequate “resistance to price manipulation” yesterday. In response to Shrem’s argument, other commentators have his perspective, saying that:

“The VanEck SolidX bitcoin Trust ($XBTC) will trade on the CBOE. Its pricing relies on the MVIS bitcoin OTC Index, not a [single crypto] exchange like Gemini. It seems like the SEC would have to deem OTC markets as having better investor protections and liquidity. More investigation is required.”

Other simply that the SEC’s broadcasting of its concerns over vulnerabilities to market manipulation in an regulated derivatives (futures) market will be “hard to overcome” –– it appears that these fears have been borne out by markets, at least in the immediate-short term.

Meanwhile, on July 24 the SEC on a bitcoin ETF application from investment firm Direxion, the same day as digital asset manager Bitwise filed its own application with the regulator for an ETF that would track an index of ten cryptocurrencies.

Yesterday, the CEO of the Chicago Mercantile Exchange () the institution would not be introducing on cryptocurrencies other than bitcoin anytime soon, reiterating his that it would be “a little irresponsible” to launch futures contracts given that they are still “highly volatile and new.”

Published at Fri, 27 Jul 2018 12:29:00 +0000

bitcoin[wpr5_ebay kw=”bitcoin” num=”1″ ebcat=”” cid=”5338043562″ lang=”en-US” country=”0″ sort=”bestmatch”]