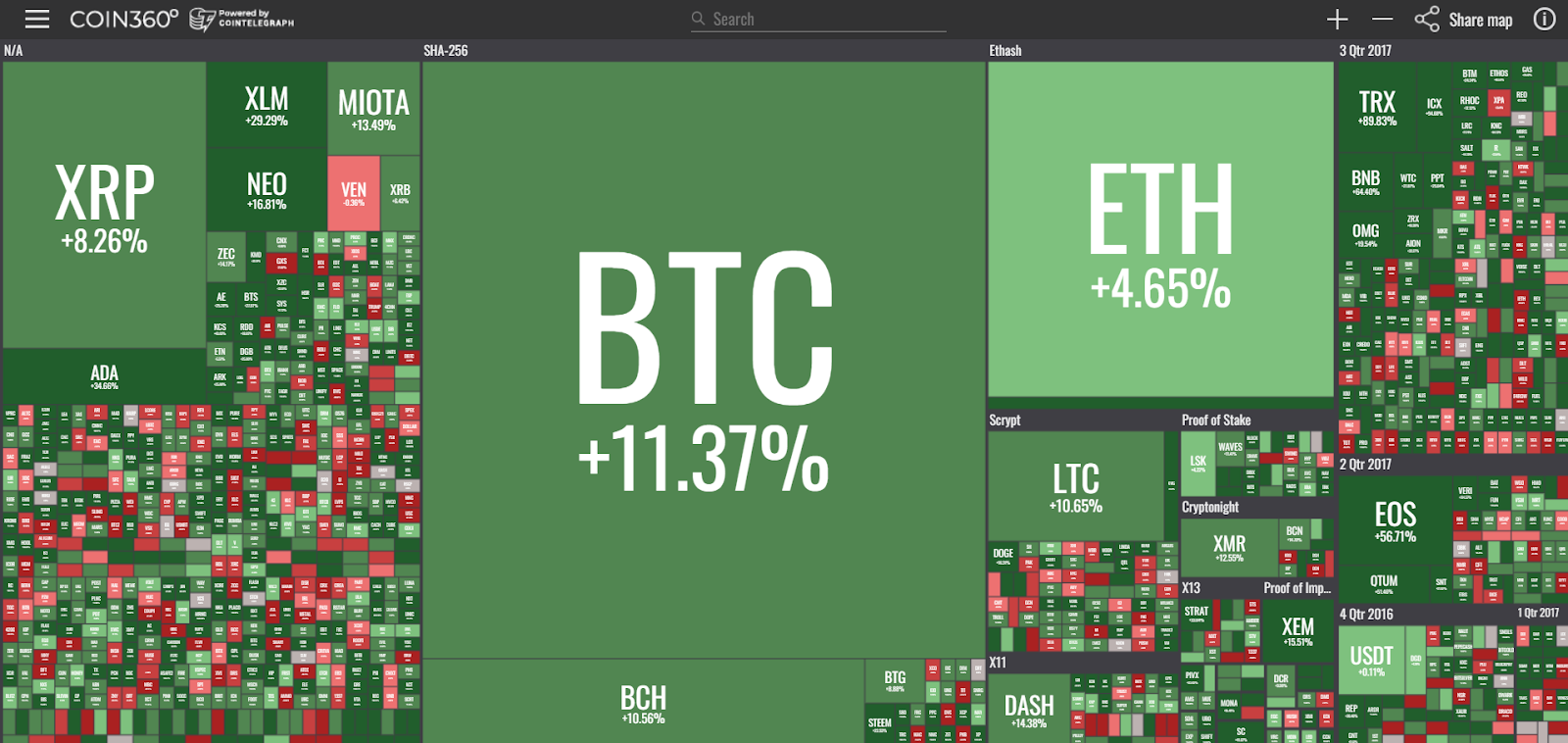

March 25: markets have seen a slight decline over 24 hours to press time, but are still in the green over the seven-day period.

All top-10 cryptocurrencies listed on are in the red over the past 24 hours, with the sitting at around $330 bln at press time.

(BTC) has lost as much as 5 percent of its value, trading at around $8,520, according to .

(ETH) is at about $519, having lost 3.7 percent over the past 24 hours.

(ADA) and (XLM) are also down 2.19% and 3.13%, trading at $0.18 and $0.23 respectively.

After bitcoin has managed to approach $9,000 and Ethereum went closer to $600 on , the crypto markets are fluctuating again. Yesterday, Cointelegraph reported that Nigeria’s Deposit Insurance Corporation to stay away from cryptocurrencies, citing the lack of backing by any “physical commodity,” likely contributing to the renewed downward dynamic.

Additionally, it was reported that Reddit removed the option to pay with bitcoin for its premium membership program, Reddit Gold, due to the “upcoming Coinbase change.”

However, over the past 7 days the majority of crypto markets are still in the green, with some growing by as much as 60 percent.

bitcoin and Ethereum are up about 11% and 8% respectively over the past week, with most of the top-10 altcoins displaying similar, or larger growth.

is probably the biggest winner this week with a 58% percent increase from March 18 when it was trading around $4. The altcoin is now at $6.58, according to . This growth is likely to have been caused by the recent made by Block.one and Finlab AG, about the launch of a $100 mln fund to accelerate development of EOS.IO software projects in Europe.

Published at Sun, 25 Mar 2018 14:57:20 +0000

bitcoin[wpr5_ebay kw=”bitcoin” num=”1″ ebcat=”” cid=”5338043562″ lang=”en-US” country=”0″ sort=”bestmatch”]