August 22: The crypto markets are seeing a second flush of green, with virtually all of the major cryptocurrencies seeing solid growth on the day, as data shows.

Positive price momentum is a welcome respite from protracted , although multiple crypto commentators are attributing the upswing to yesterday’s by leveraged crypto trading platform BitMEX that it would be halting trading for scheduled maintenance.

The window has allegedly been by bulls to force a spike, especially within the of a forthcoming August 23 decision on another bitcoin exchange-traded-fund () application, that many will be negative.

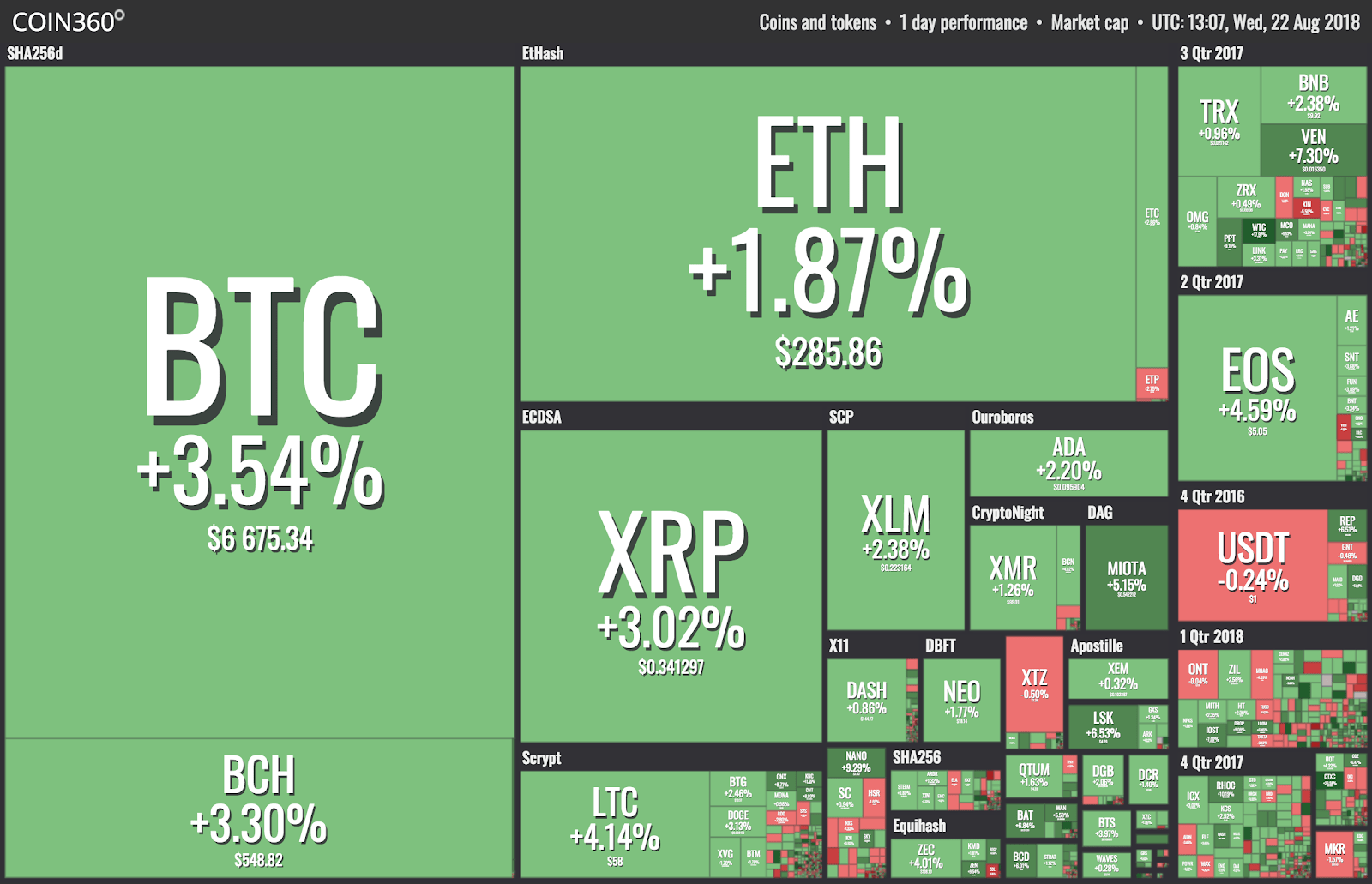

Market visualization from

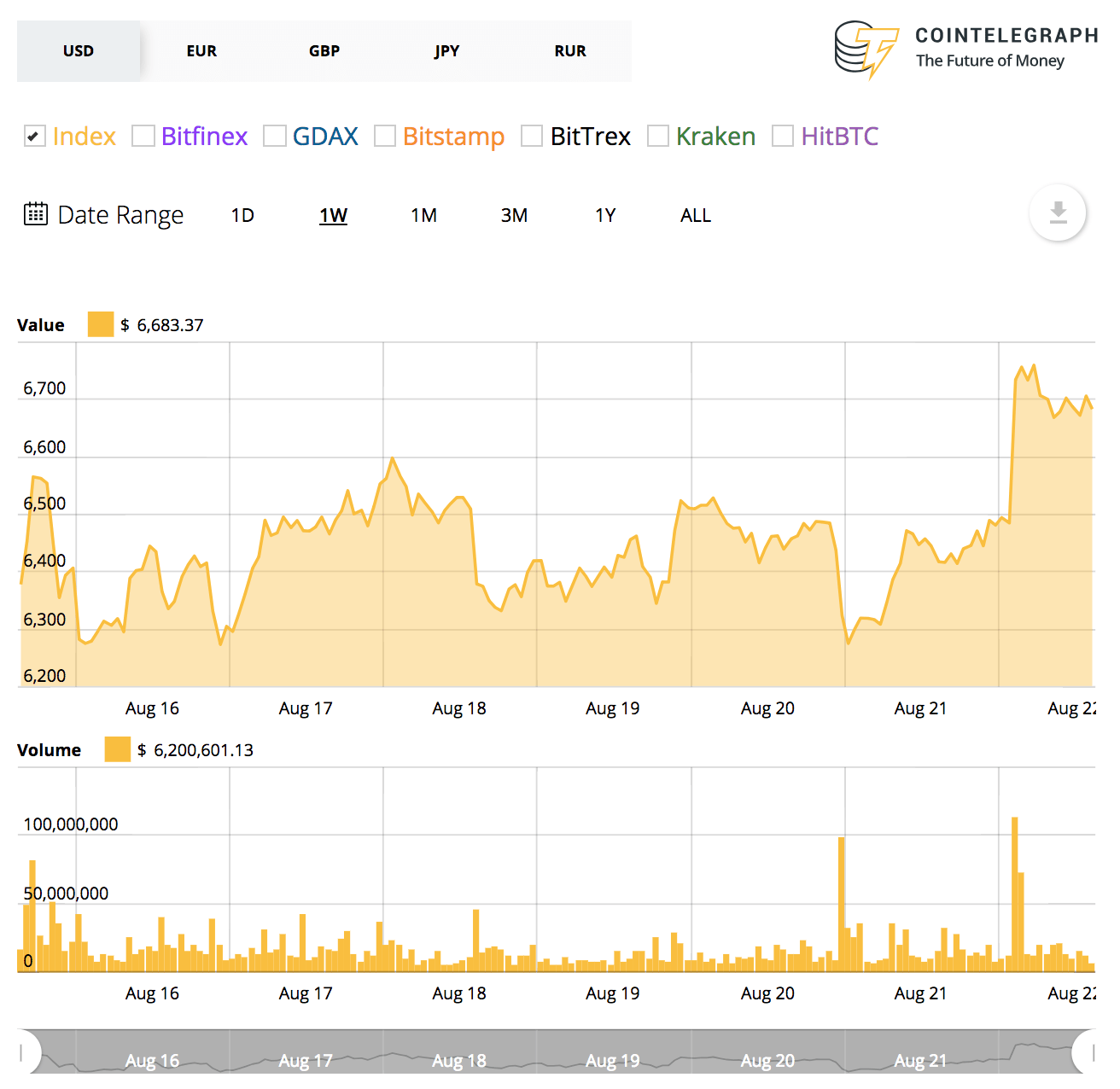

bitcoin () is trading at around $6,644 at press time, up almost 4 percent on the day, according to Cointelegraph’s bitcoin price index.

The top coin had been range bound around $6,400-6,500 for most of the week before sharply spiking by 5 percent within the space of just 45 minutes earlier today to peak around $6,790. While it has since corrected slightly, bitcoin has been closely circling the $6,700 mark for most of the day.

On the week, bitcoin is now up 3.2 percent, and has closed its monthly losses down to around 11 percent.

bitcoin’s 7-day price chart. Source: Cointelegraph

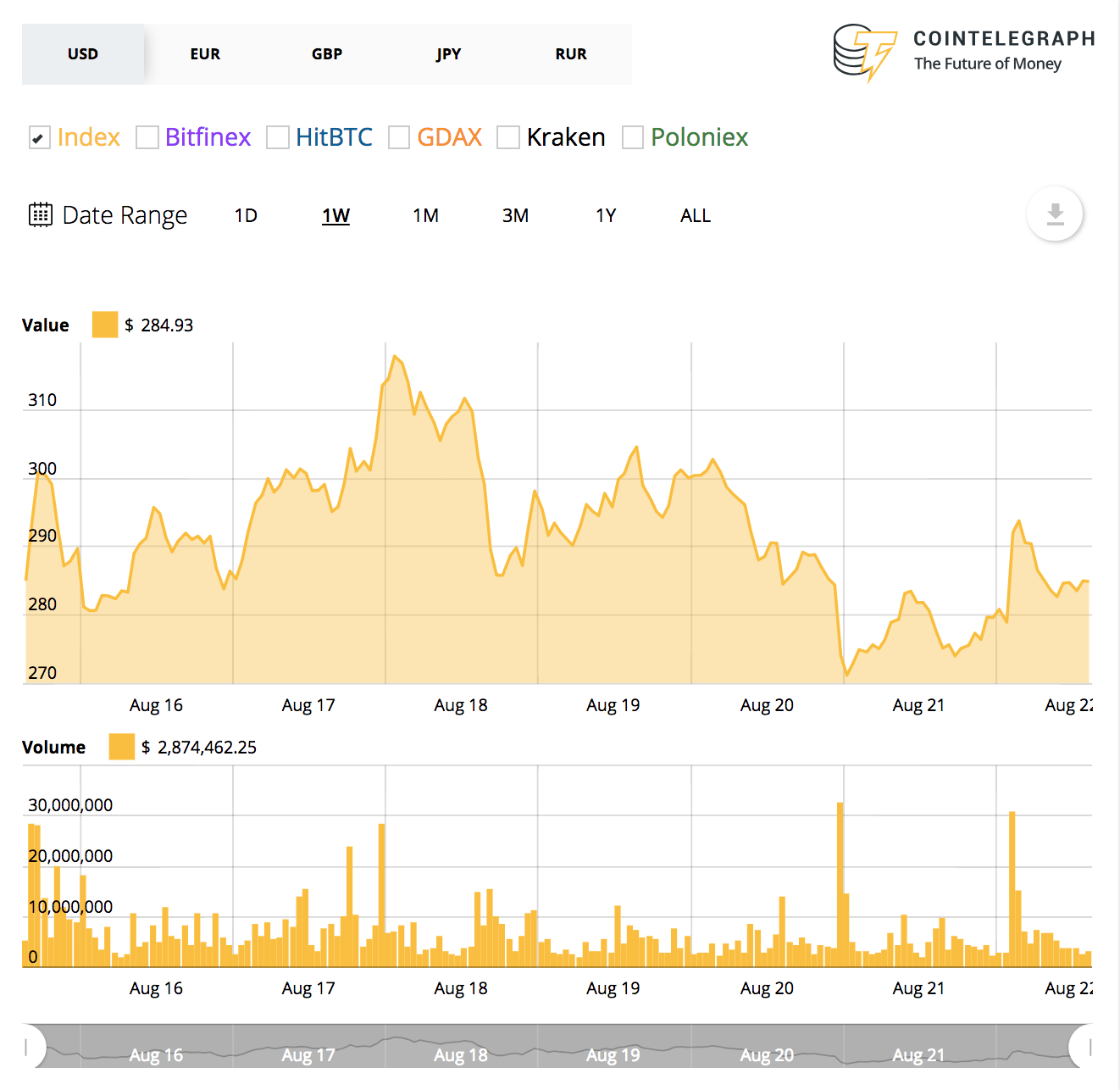

Ethereum () is trading around $285 at press time, up around 3.5 percent on the day.

Following bitcoin’s sharp ascent, the leading altcoin briefly peaked as high as $295, but failed to break through the $300 resistance. On its weekly chart, Ethereum is 3.7 percent in the negative; on the month, losses remain at a stark 39 percent.

Ethereum’s 7-day price chart. Source: Cointelegraph

Virtually all of the other top twenty coins on ’s listings are in the green, seeing gains within a range of 2-8 percent.

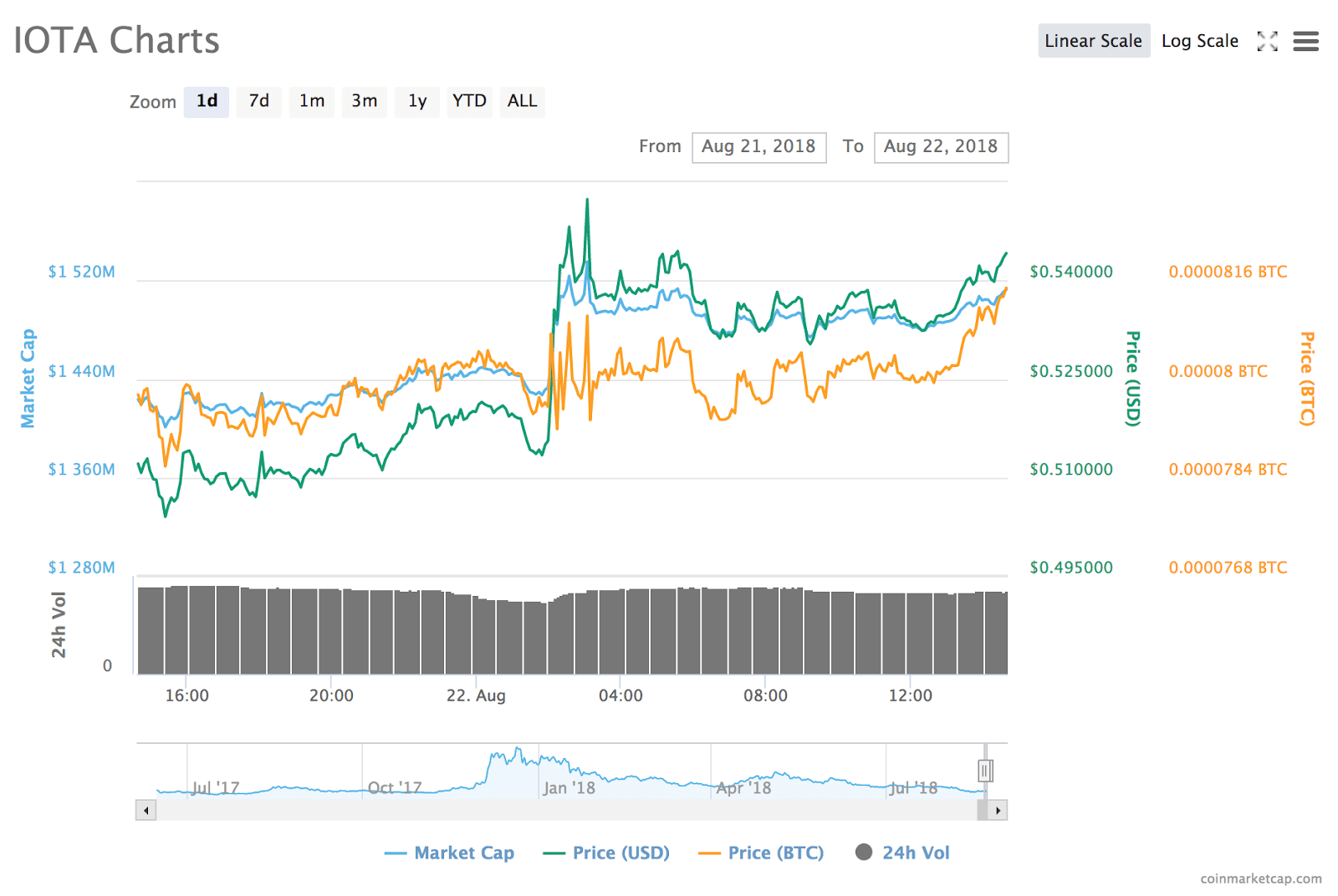

, IOTA () and Litecoin () are all seeing solid growth, trading at $5.06, $0.54 and $57.89 – up 5.2, 5.8 and 4.3 percent on the day respectively. As IOTA’s 24-hour chart indicates, the pattern of today’s gains among these altcoins correlates closely with the timing of bitcoin’s sudden upswing.

IOTA’s 24-hour price chart. Source:

Stellar () and Cardano () are seeing just slightly more modest growth, up 1.6 and 1.9 percent to trade around $0.22 and $0.095 respectively.

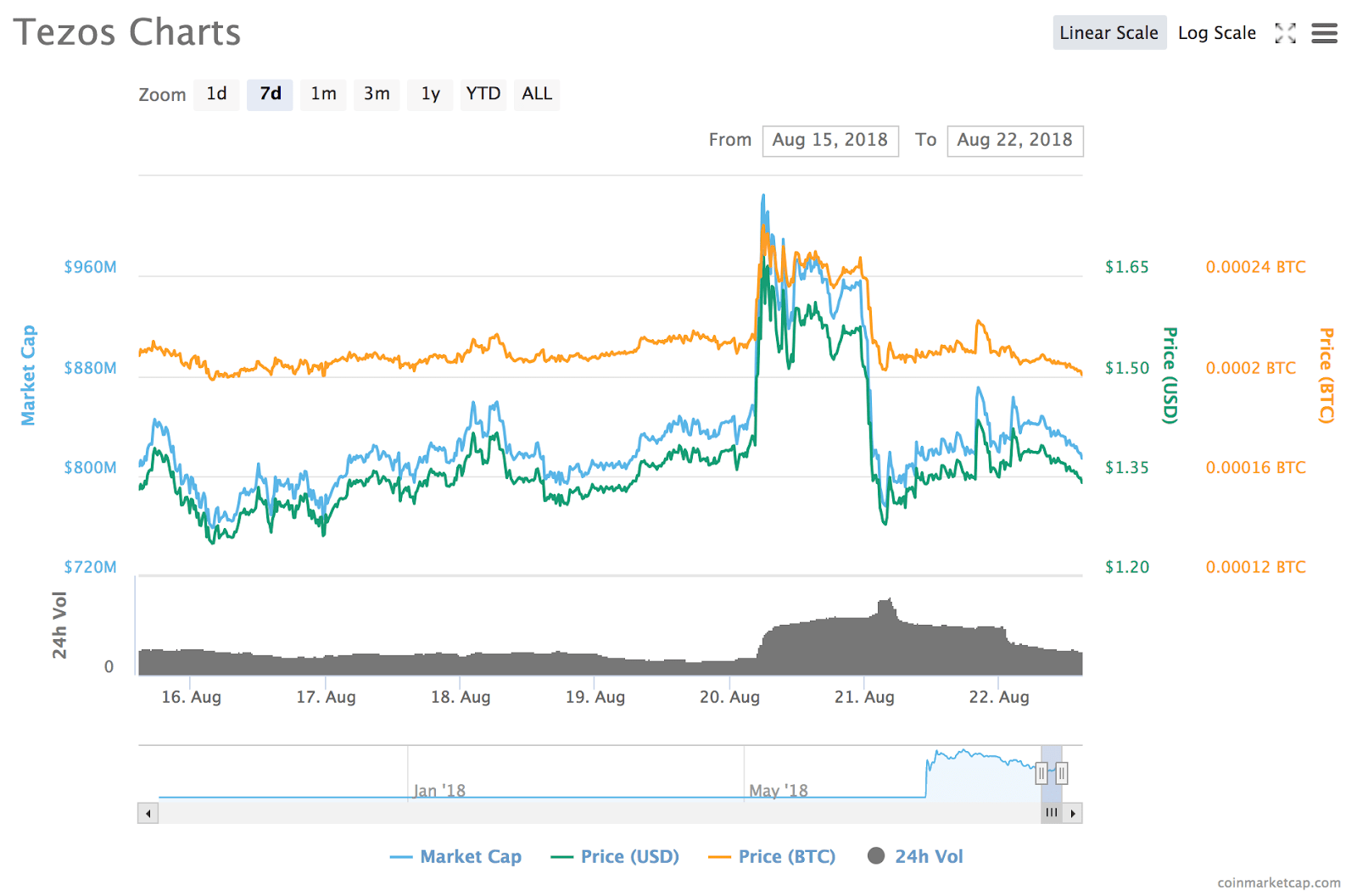

Tezos (), ranked 19th, is the only alt to post a slight loss on the day, down almost 2 percent to trade at $1.33 at press time. While Tezos saw a similar upwards spike in close keeping with the wider market, its valuation has since corrected back towards its week-long price range, which has been unusually consistent amid a distinctly volatile post- market picture.

Tezos’ 7-day price chart. Source:

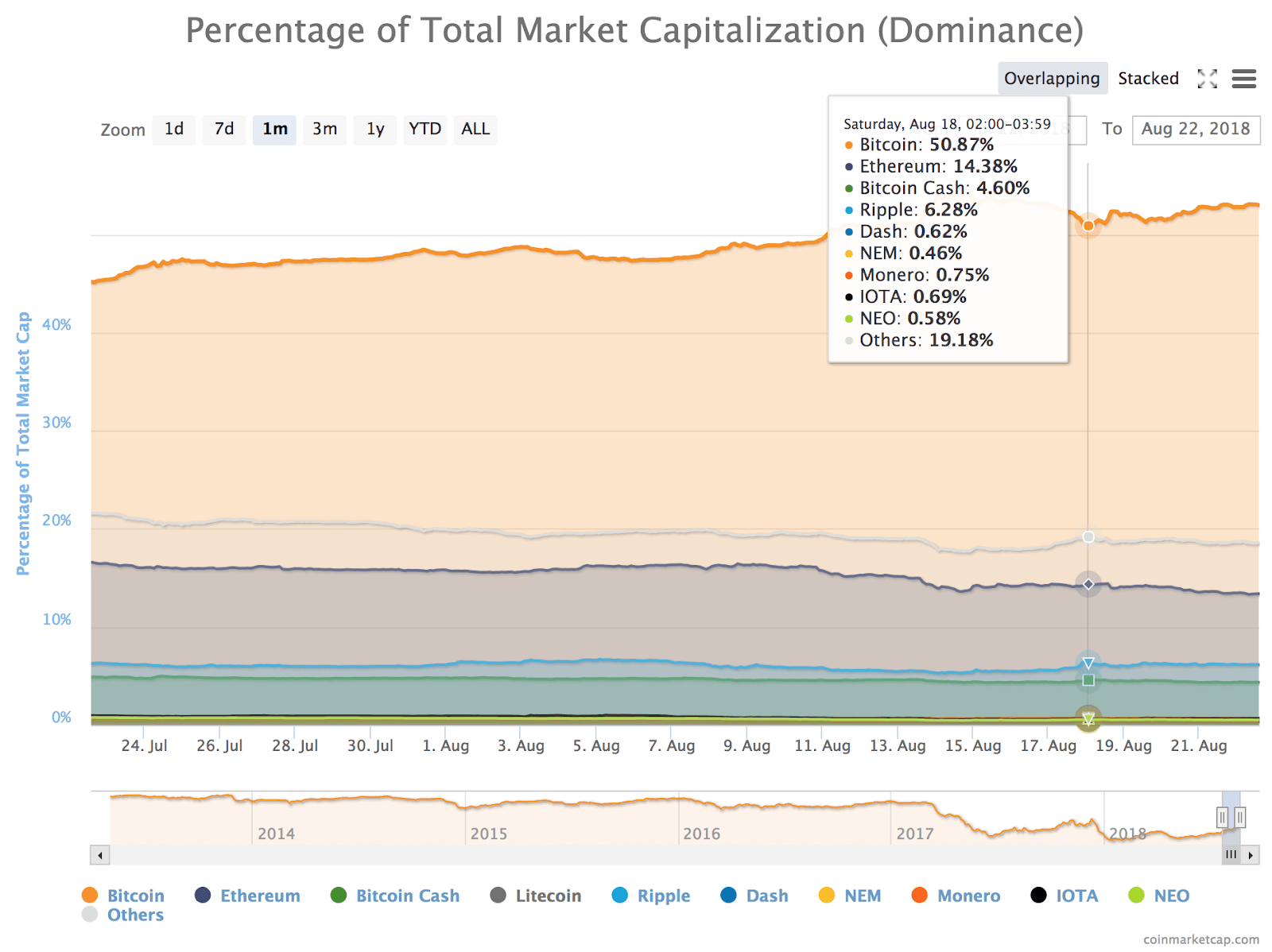

bitcoin () – or bitcoin’s share of total crypto market capitalization – is pushing back upwards to , having slightly dropped down to 50.8 percent this weekend. BTC dominance has been as of mid-May, soaring as high as 54.6 percent August 14 as smaller assets .

1-month chart of cryptocurrencies by dominance. Source

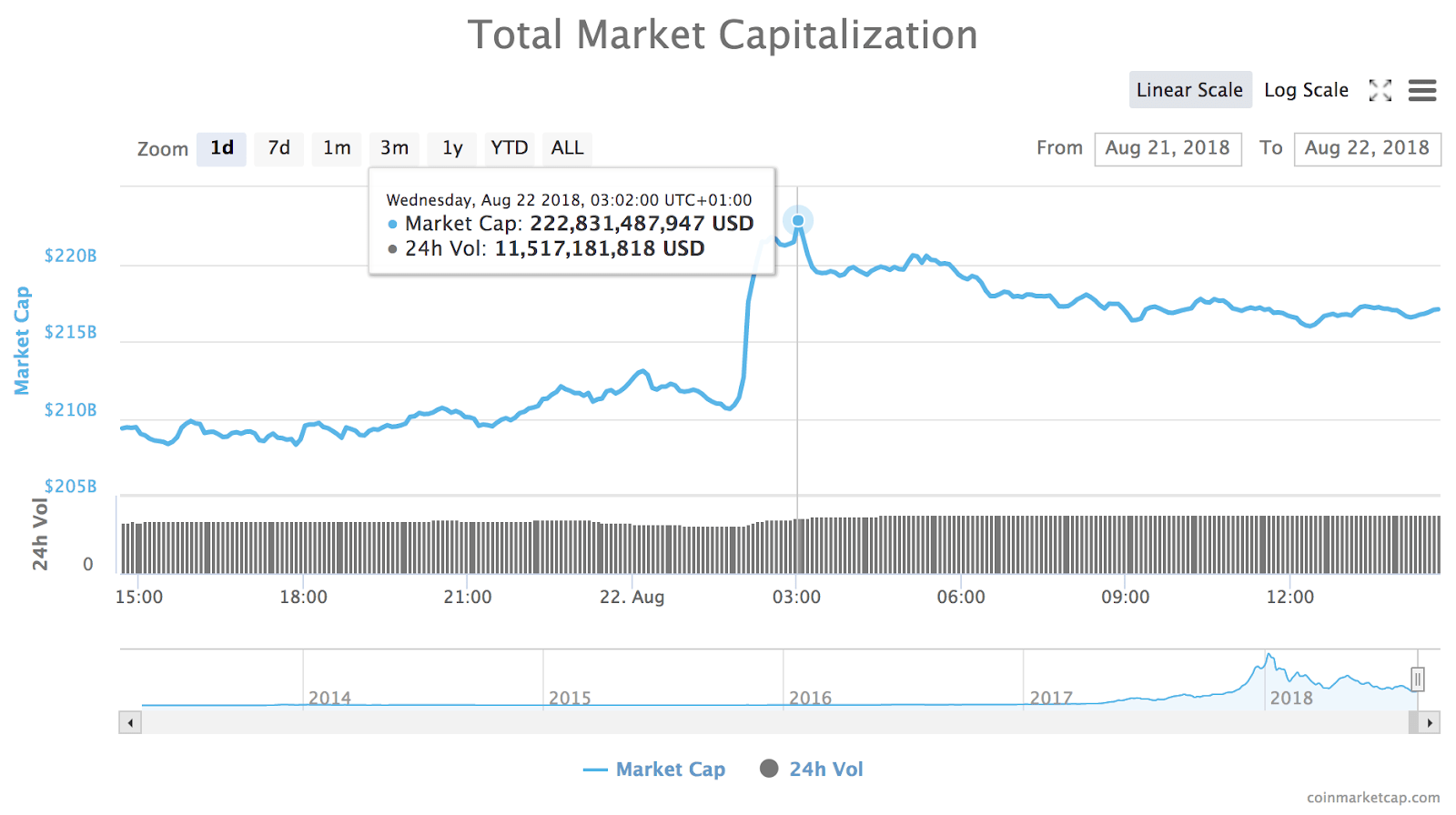

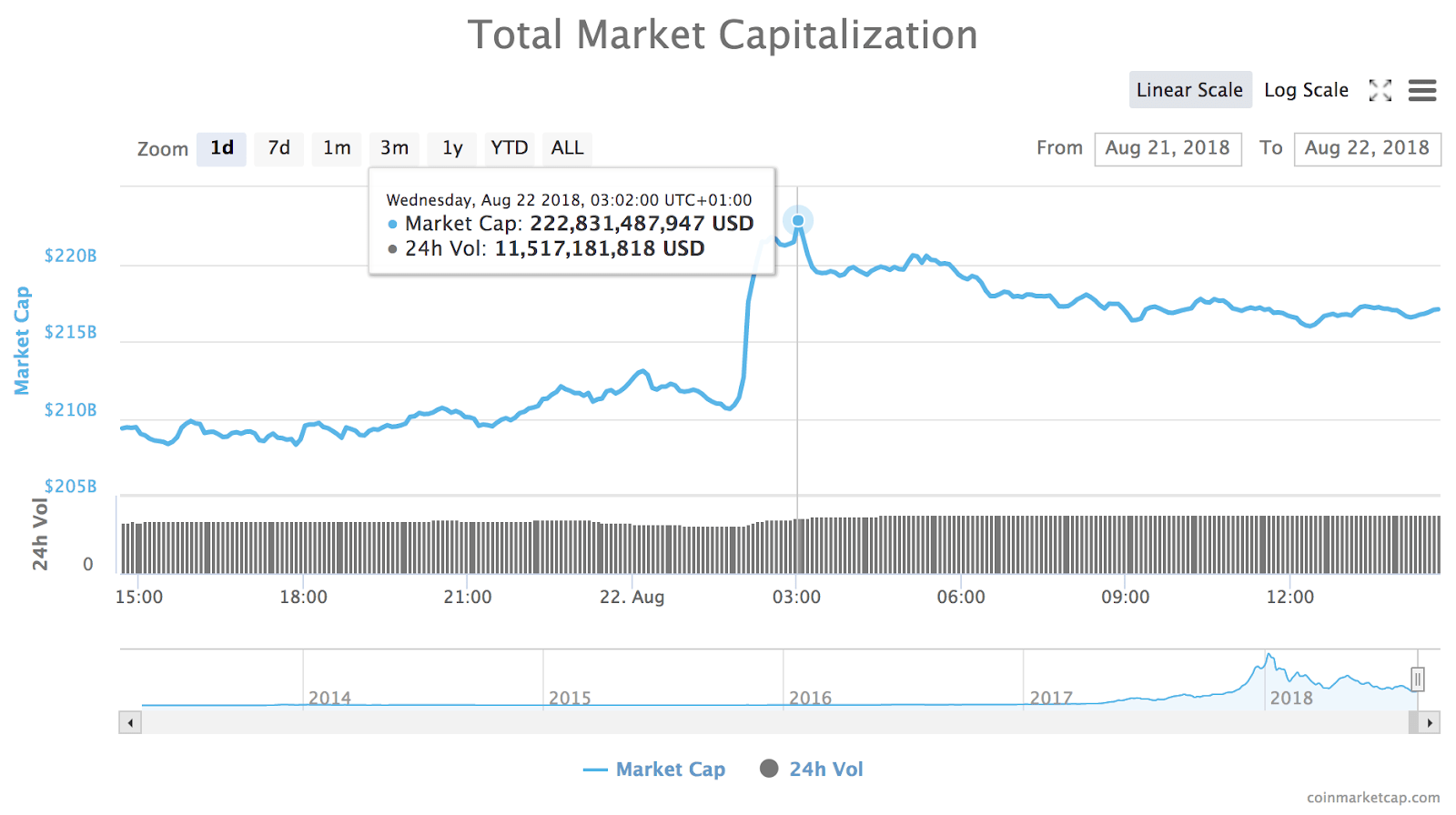

Total market capitalization of all cryptocurrencies is around at press time, seeing a 24-hour peak at around $222.8 billion.

24-hour chart of the total market capitalization of all cryptocurrencies from

The alleged ripple effect of BitMEX trading on the wider market is sparking widespread discussions on crypto social media as being likely to adversely impact forthcoming decisions from US regulators on the approval of new crypto investment instruments. Technical analyst and crypto commentator Alex Kruger has that:

“The $BTC lightning +7% breakout during Bitmex’s downtime shows why odds of SEC approving the CBOE bitcoin ETF proposal should be close to zero. Even if no manipulation (that’s debatable) this stresses the importance of Bitmex, a fully unregulated market with 40% market share.”

Kruger is referring to the bitcoin ETF application that was recently filed by VanEck & SolidX for trading on the Chicago Board Options Exchange (), the decision over which the SEC has for further review until this fall.

Notably, in its second-time of another BTC ETF application from the Winklevoss Twins this July, the SEC had stated the reason as being the largely unregulated nature of bitcoin markets. Regarding the Winklevoss’ claim that crypto markets are “uniquely resistant to manipulation,” the agency said that “the record before the Commission does not support such a conclusion.” This reinforced the stance the regulator had first in its 2017 rejection:

”When the spot market is unregulated–there must be significant, regulated derivatives markets related to the underlying asset with which the Exchange can enter into a surveillance-sharing agreement.”

As TetrasCapital founder Alex Sunnarborg has , the SEC will reportedly to postpone its decision on the other bitcoin ETF application from ProShares tomorrow: it will have to either approve or deny it outright.

Published at Wed, 22 Aug 2018 14:50:00 +0000

Altcoin

![How to become a better bitcoin trader [interview] How to become a better bitcoin trader [interview]](https://ohiobitcoin.com/storage/2019/04/19sNL3.jpg)