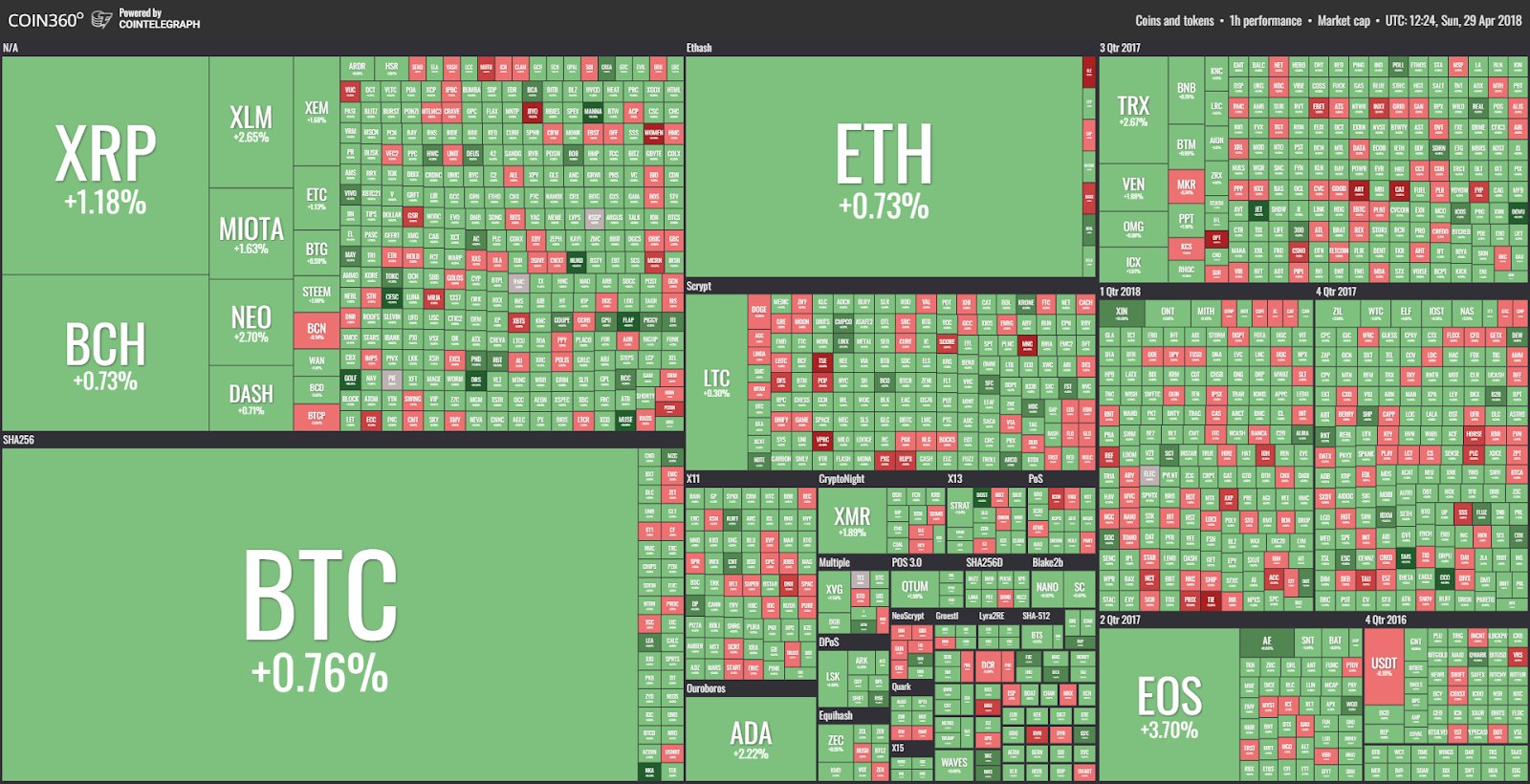

The top ten coins by market cap are mostly in the green today, as markets make a tentative recovery following their earlier this week, data shows.

(BTC) hit $9,500 at one point in early trading hours this morning. The coin is currently holding ground, hovering around the mark, with a value gain of less than 1 percent over 24 hours to press time.

(ETH) is down slightly, after being over 5 percent in the green yesterday, April 28, now trading around , down about 0.5 percent as of press time.

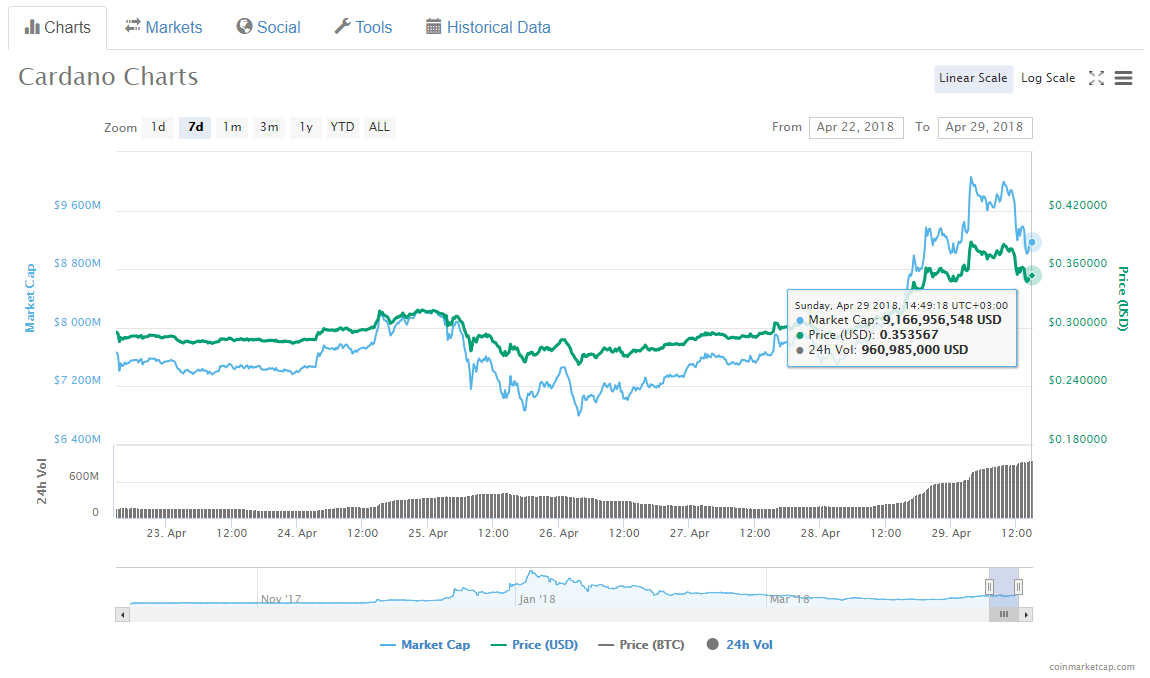

Of the top ten coins on , Cardano is making the strongest gains, percent, with its total market cap brushing $10 bln earlier today .

EOS has also seen a healthy rise of over seven percent in the same 24 hour period, trading around to press time, indicating that the markets are continuing to respond positively to the pre-release of its Blockchain scalability platform EOSIO Dawn 3.0 .

Total market cap is currently around to press time, according to data from CoinMarketCap, with BTC dominance at .

Ran Neu-Ner, host of CNBC’s CryptoTrader, compared this morning’s healthy outlook with early January’s bullish markets:

Market just hit 50% of the ATH in Jan. On that day BTC was at $17500 and had a lower dominance than today!

— Ran NeuNer (@cryptomanran)

Mid to long-term crypto market sentiment remains bullish, particularly . The CEO of crypto hedge fund Pantera Capital, forecast thatthe crypto market within ten years, in a Bloomberg interview earlier this week. Tech giant IBM twice with Blockchain-focused , signalling that major tech industry players are edging closer towards realizing real world Blockchain applications.

Yet others from the traditional financial sector continue to balk at short time volatility, with American investor, Warren Buffett, again in an interview yesterday, April 28. The 87-year old investor joined ranks with other bitcoin sceptics, such as the ousted Paypal CEO, Bill Harris, who this week said that “,” and that , in an apparent reference to the poison-laced drink which killed over 900 cult members in the Jonestown Massacre of 1978.

Published at Sun, 29 Apr 2018 11:16:57 +0000

Altcoin[wpr5_ebay kw=”bitcoin” num=”1″ ebcat=”” cid=”5338043562″ lang=”en-US” country=”0″ sort=”bestmatch”]