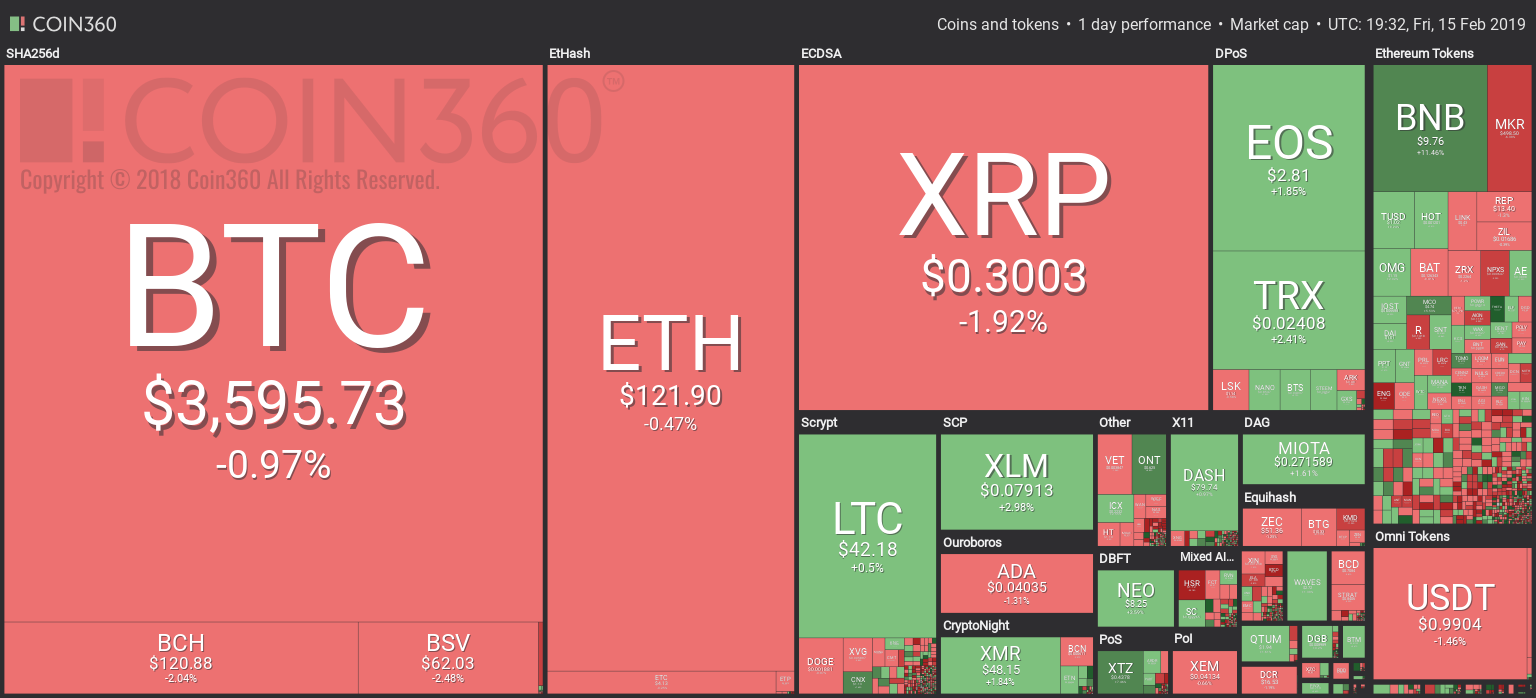

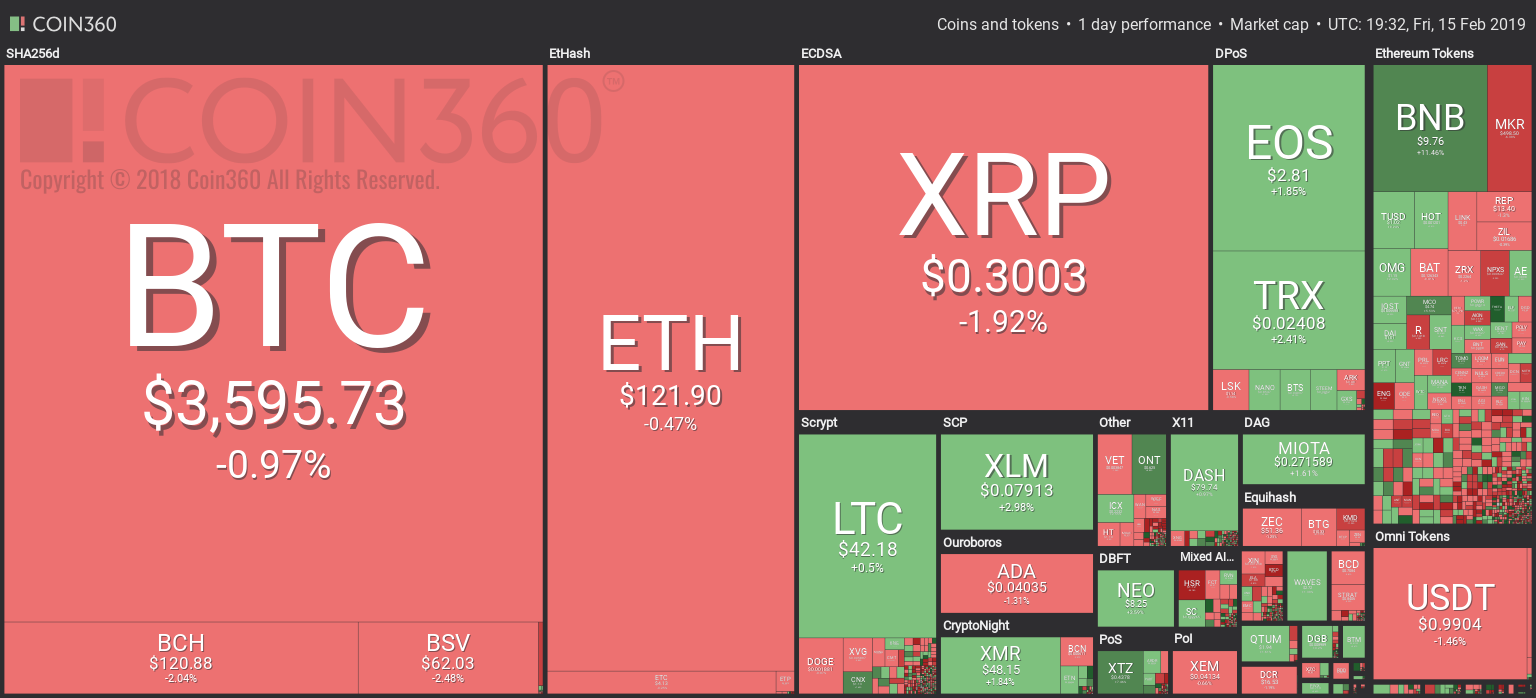

Feb. 15 — markets sideways after a multi-month high of daily volume of more than $36 billion yesterday, according to data.

Market visualization from

() is slightly down over the past 24 hours, and is at $3,626 at press time. At press time, the biggest is up around 0.41 percent over the past 7 days, while down some 0.1 on the day. On Feb. 11, transaction fees a new low point.

7-day price chart. Source:

(), the top by market cap, is at $122.37 at press time. After surging up to $124 per coin on Feb. 10, is holding its weekly momentum, up more than 5 percent over the past 7 days, and up around 0.11 percent on the day.

7-day price chart. Source:

(), the third top by market cap, is seeing slight losses today, down 1.38 percent over the past 24 hours. at $0.3, the coin is also down around 2.60 percent on the week.

7-day price chart. Source:

Total has been hovering around $120 billion, while daily trade volume exceeded $36 billion on Feb. 14 for the first time since July 2018.

Out of top 20 cryptos by market cap, Maker () is down the most, with its price tumbling almost 7 percent on the day. Coin () is up more than 5 percent.

Earlier today, the Securities and Exchange Commission () reviewing a rule change proposal for NYSE Arca’s exchange-traded fund (). The regulator is now expected to provide an initial decision to approve or reject the proposal within 45 days starting from today.

Yesterday, authorities a bill that facilitates the use of tech in financial services, granting -powered transactions the same legal status and protection as those done by traditional means.

In the meantime, stocks have surged today amidst increasing over a U.S.– trade deal, also reportedly a two-month high this week. The Dow Jones Industrial Average is up or around 1.4 percent at press time as J.P. Morgan Chase and Goldman Sachs outperformed. The S&P 500 gained 0.84 percent, led by the energy and industrials sectors.

Major prices are also seeing a flush of green this Friday, with the Canadian Crude Index rising rising almost 4 percent at press time, while Brent Crude is up by 2.62 percent and West Texas Intermediate (WTI) has grown by 2.19 percent, according to . Analysts that oil prices are getting closer to breakout levels, and the final day of this week will give a better idea of whether crude futures can keep rallying.

Published at Fri, 15 Feb 2019 20:00:17 +0000