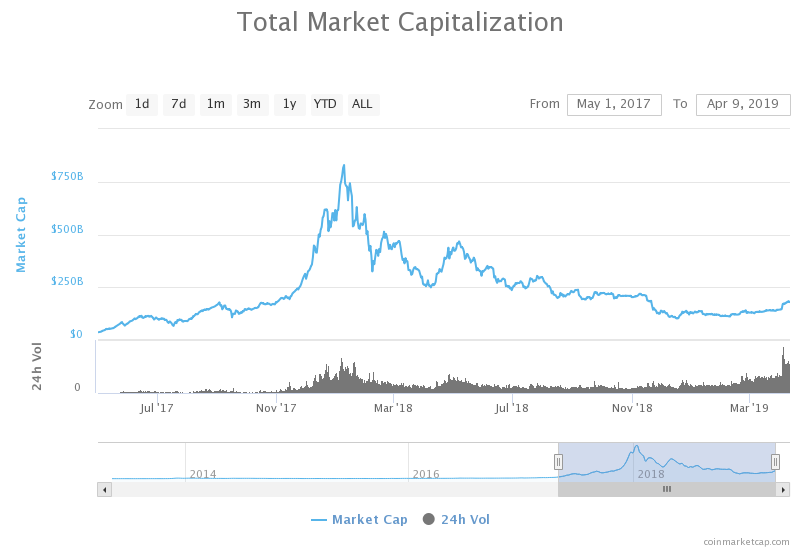

Volume has been ramping up across the cryptocurrency markets, with April seeing a new all-time high posted for daily global cryptocurrency volume. The month has also seen Chicago Mercantile Exchange (CME) report record trade volume for its BTC futures contracts, in addition to Cumberland’s trade desk reporting an influx of 1,000 BTC buy orders, signaling strength across numerous facets of the virtual currency ecosystem.

Also Read:

New All-Time High Posted for Global Cryptocurrency Trade

According to Coinmarketcap, new records for daily global cryptocurrency trade were posted on April 4 and 5 consecutively, with $77.07 billion and $79.99 billion worth of crypto changing hands on each day. The new records beat out the former all-time high of nearly $70 billion that was posted on Jan 5, 2018, by more than 10%.

The rally appears to have been driven by a significant spike in USDT trade, with USDT volume beating BTC on both April 3 and April 4. Currently, April 4 comprises the strongest day on record for both USDT and BTC, with $25.3 billion worth of tether and $21.7 billion worth of bitcoin core changing hands.

As of this writing, BTC and USDT volume is nearly identical, with almost $15.81 billion worth of BTC and $15.74 billion worth of USDT having been traded over the past 24 hours.

CME Reports Record Volume

April 4th also saw report record volume for its BTC futures contracts with more than 22,500 contracts or the equivalent of 112,700 BTC traded, beating out the previous record of 18,300 contracts that was set as of February 19.

On April 1, reported that a large influx of 1,000 BTC buy orders had been executed within the span of a single hour on its trading desk, further evidencing a dramatic spike in demand across the cryptocurrency markets.

Speaking to , the chief executive officer of Binance, CZ, reported that the platform has seen a record number of orders executed in recent days, stating: “The number of transactions … is at an all-time high, we are actually seeing more orders than January 2018.”

News.bitcoin.com also reached out to an over-the-counter (OTC) BTC broker, who noted that “demand is picking up” in the OTC markets.

Do you think that the increase in trade volume is an indication of a shift in the cryptocurrency meta-trend? Share your thoughts in the comments section below!

Images courtesy of Shutterstock, Coinmarketcap

At bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post appeared first on .

is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

source:

TheBitcoinNews.com is here for you 24/7 to keep you informed on everything crypto. Like what we do? Tip us some Satoshi with the exciting new Lightning Network Tippin.me tool!

Published at Tue, 09 Apr 2019 12:40:49 +0000