Since February 17, within 4 days, the valuation of the crypto market has increased from $120 billion to $135 billion, by $15 billion.

Crypto assets that have outperformed both and the U.S. dollar throughout February in the likes of and recorded 4 to 6 percent gains in the past 24 hours, showing strong momentum.

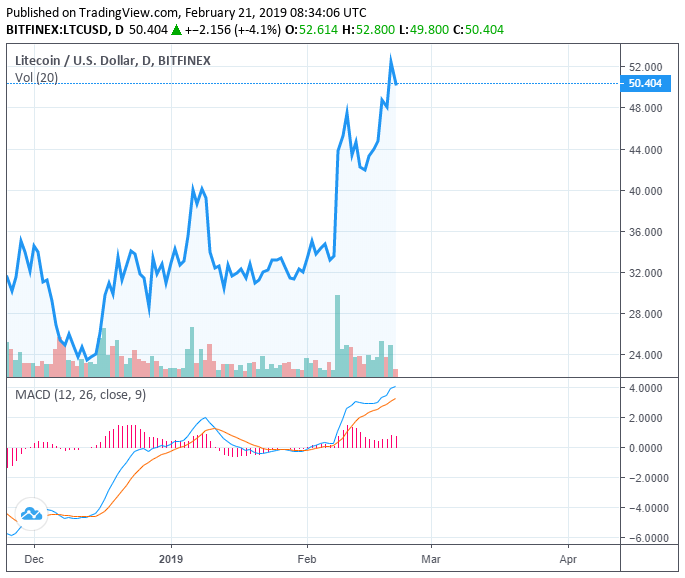

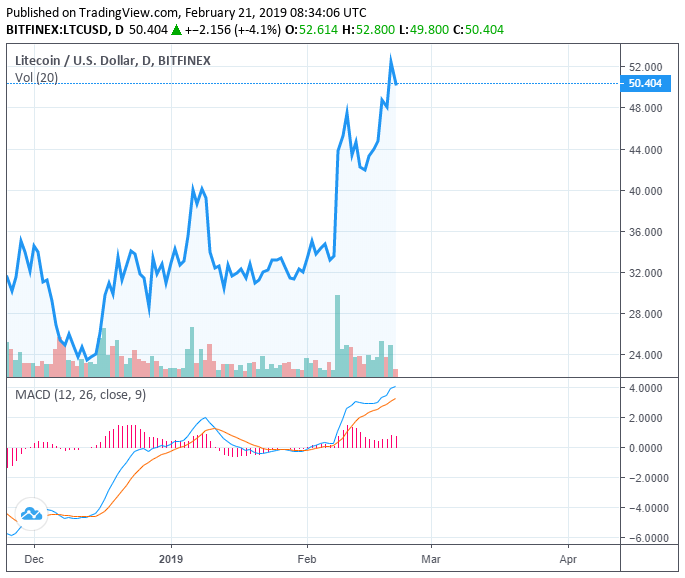

Surges by More Than 50% in 3 Weeks, Source: TradingView

, in particular, demonstrated a spectacular rally from $33 to $50, gaining 51.5 percent in less than three weeks.

However, a technical analyst with an online alias “The Crypto Dog” remains unconvinced that will initiate a large upside movement above $4,000 in the near-term.

Despite Crypto Market Momentum, bitcoin Investors are Patient

Fundamentals of most major crypto assets have strengthened throughout 2019 in spite of the 85 percent decline in the valuation of the crypto market.

Some of the world’s largest financial institutions and technology conglomerates such as Fidelity, Nasdaq, ICE, and Samsung have started to build an infrastructure supporting the asset class.

On February 20, in San Francisco, Samsung officially the integration of crypto private key storage support on its flagship Galaxy S10. The move could expose to the mainstream in a magnitude previously unseen.

Breaking: Samsung Galaxy S10 Features Built-in Crypto Support

— CCN.com (@CryptoCoinsNews)

However, technical indicators generally point toward a minor retrace in the price of in the short-term following a rapid movement from mid-$3,000 to $4,000.

The analyst said that expecting the value of to rise substantially in the $3,900 to $4,000 range could be risky.

He explained:

Potential bull pennant. I’m not trying to fade it, but not in a leveraged position either. If we break down 3,800 is the first major support and it may hold, but for now I’m just holding spot waiting for a long closer to $3,720.

This is starting to look and feel like ETH circa Jan 5. It could pump, sure, but I personally don’t want to long $39XX.

As demonstrates stability in a tight range near $4,000, small market cap crypto assets and have started to regain momentum.

like ICON, Ontology, and Aelf recorded 5 to 15 percent gains against the USD on the day.

Overall, the many traders and technical analyst foresee the brutal bear market of coming to an end in the mid-term.

weekly

One massive year long plus falling wedge and the breakout to end the bear market …

— Satoshi, MBA (@SatoshiFlipper)

But, traders are cautious in expecting any strong upside rally in the upcoming months, projecting the market to begin recovering from the 14-month correction by the end of the second quarter of 2019.

Sentiment is Improving

During corrections, especially amidst extended bear markets, low market cap and liquidity assets tend to struggle as investors reallocate their funds to alternatives such as , stablecoins, and exchanges.

The abrupt rise in the value of in the past several weeks show that the sentiment in the crypto market is gradually improving.

The volume of the market has substantially risen to above $29 billion and the daily volume of , which hovered at around $4 billion, has doubled to over $8 billion.

The activity in the global exchange market has noticeably increased since the beginning of February, as the interest in the asset class rose in recent weeks.

The interest in the sector is expected to increase over time with high-profile product launches such as Samsung’s crypto private key storage.

One digital asset researcher stated that the impact of Samsung Galaxy S10’s new feature could be larger than any other fundamental factor including Bakkt’s futures market launch.

“Twitter has 326 million active monthly users and Samsung shipped 70 million units In Q4 2018 alone. Tippin.me and the new Galaxy smartphones will do more for than @Bakkt and all the ’s in the pipeline combined,” the researcher said.

Published at Thu, 21 Feb 2019 09:12:23 +0000

![Tron’s bittorrent [btt] sees major slump; falls by 5. 64% Tron’s bittorrent [btt] sees major slump; falls by 5. 64%](https://ohiobitcoin.com/storage/2019/03/BTTh.png)