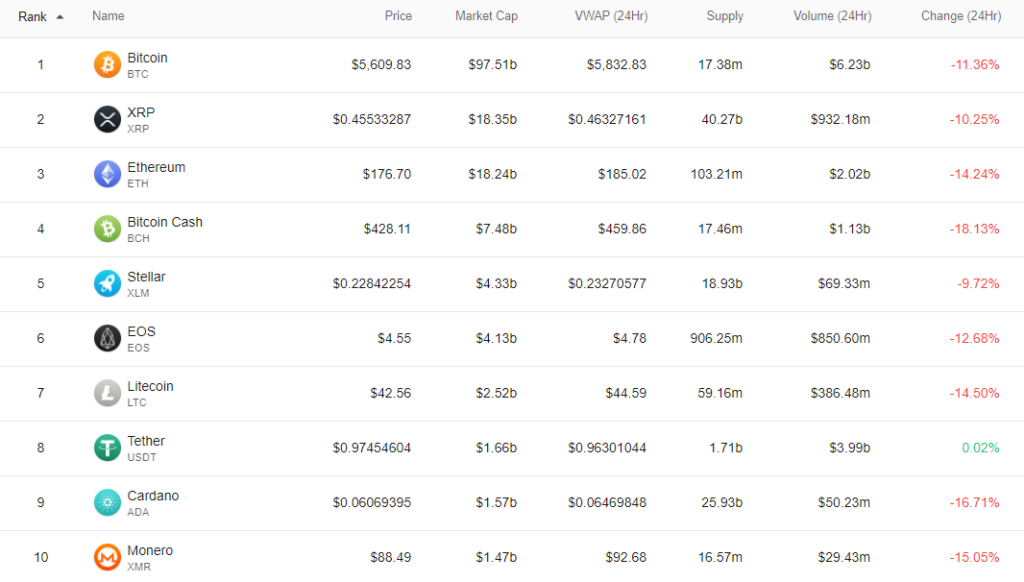

Over the last 24 hours, the crypto market suffered a devastating wipeout of more than $26 billion, making it one of the most intense daily sell-offs in all of 2018.

bitcoin (BTC), which demonstrated a record high level of stability from August to November, recorded a drop of more than 11 percent within a 12-hour period. The unforeseen decline in the price of BTC led other major cryptocurrencies and small market cap digital assets to initiate steep downward movements.

bitcoin Cash (BCH) recorded the worst drop on the day, falling by more than 19 percent at one point. Within a seven-day span, BCH dropped by over 50 percent against the US dollar and by nearly 40 percent against BTC.

bitcoin Volume Doubles

The intensity of the sell-off on November 15, which is still ongoing for several major cryptocurrencies, reached a point in which BTC saw its volume double from $4 billion to $8.1 billion.

From August to November, the volume of BTC rarely surpassed the $4 billion, other than the first two weeks of this month. bitcoin’s volume mostly stayed in the range of $3.1 billion to $3.5 billion, as the cryptocurrency exchange market demonstrated low trading activity in a period of low volatility.

Prior to the drop of bitcoin from $6,200 to the low $5,600 region, DonAlt, a respected cryptocurrency trader and technical analyst, that BTC showed low momentum and weakness.

“BTC looks pretty weak, this might be the first time I’m not buying $6,200 in quite a while. I’m just not trusting it to hold forever after getting battered for so long. If it does break, alternative cryptocurrencies will suffer hardest.”

Over the past 24 hours, the price trend of bitcoin has played out similarly to the trend laid out by DonAlt, and small market cap cryptocurrencies have suffered against both bitcoin and the US dollar.

Throughout the first two quarters of 2018, tokens and small market cap digital assets recorded 40 to 80 percent losses against BTC, which declined by around 70 percent on its own. The 15 to 20 percent losses of tokens on November 15 bring their total yearly losses to around 95 to 98 percent.

Some traders, including Cred, expects BTC to revisit the $6,000 resistance level as it operated as a support level for over four months.

“Around $6,000 was a very active level — I expect price to revisit that area. If it does, make sure you have a plan as opposed to blindly panicking. This is what I am looking at from a D1 swing trade perspective. Use LTFs to further define your areas.”

An immediate corrective rally to $6,000 will relieve most of the sell pressure on the crypto market and revive the momentum of many major cryptocurrencies. But, at $5,600, a short-term recovery to $6,000 seems unlikely at this point.

2019

If the negative sentiment from 2018 continues to 2019, it is most likely for the crypto market to bottom out by the end of the first quarter or the second quarter of next year, especially if the launch of the Bakkt bitcoin futures market has a less of an impact on the market and fails to meet the expectations of investors.

Featured image from Shutterstock.

Follow us on or subscribe to our newsletter .

Published at Thu, 15 Nov 2018 06:33:50 +0000