The San Francisco-based cryptocurrency exchange is reportedly in talks with the US Securities and Exchange Commission (SEC) about becoming a regulated brokerage firm and trading platform. According to The Wall Street Journal, Coinbase reached out to regulators about the getting licensed even as the SEC moves closer to crafting some regulatory framework by which exchanges and other market players would operate.

bitcoin exchanges have been feeling increased pressure from the Wall Street regulator of late, as evidenced by the SEC launching an investigation into ICOs and putting exchanges on notice that they were on the radar, too. While SEC Chairman Jay Clayton that not all ICOs are fraudulent, the regulatory agency has also made it clear that security tokens must be traded on licensed exchanges.

According to the WSJ story, Coinbase may look to become licensed by the SEC as an exchange but at the same time register as a broker-dealer, the latter of which face less stringent rules. But it would also mean the securities regulator would have carte blanche access to buy and sell transaction records.

Licensing Opens the Door to More Altcoins

At the moment, Coinbase only supports bitcoin, bitcoin Cash, Ethereum and Litecoin.

Becoming licensed could potentially open the door to the exchange supporting more altcoins, including those that US regulators deem securities, the WSJ story suggests. It could also explain why Coinbase has been reluctant to , such as Ripple’s XRP, till now. As CCN previously reported, Ripple was willing to pay for a listing on top cryptocurrency exchange Coinbase.

Coinbase’s President Asiff Hirji told CNBC a few days ago:

“We are on the right side of where the regualtions are,” said Hirji on CNBC, adding: “You cannot then list things for which there are regul uncertainty because that dosen’t fit with our mission. The assets that we do list have all had some amount of regulatory certainty. As soon as there is more regulatory clarity than there currently is you would expect us to start listing more assets.”

If Coinbase becomes licensed by the US SEC, it could set a precedent for other trading platforms to do the same. An attorney is quoted in the WSJ story as saying:

“It’s an early phase where the industry leaders understand they have to live within a highly regulated environment. They have to deal with the SEC.” – Richard Levin in the WSJ

US-based Gemini is by the New York State Department of Financial Services. Meanwhile, in Japan, Monex Group, a regulated business, recently to acquire the beleaguered Coincheck in a $33.5 million transaction.

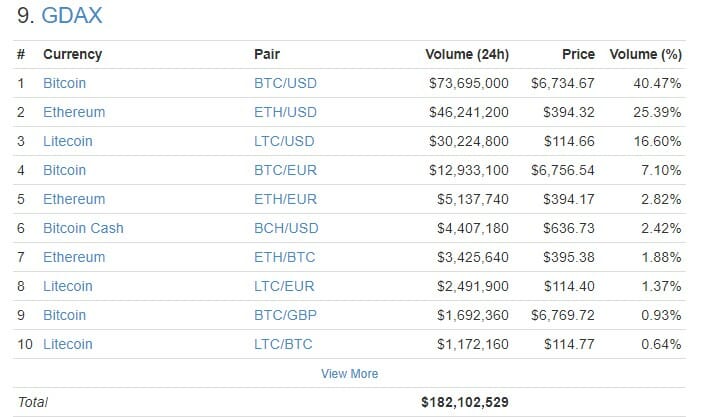

GDAX, which is run by Coinbase, is currently the No. 9 cryptocurrency trading platform based on volume over the past 24-hour period.

“Misimpression to Investors”

The SEC last month distinguished between cryptocurrency exchanges and trading platforms, saying a company that says it’s an exchange “ to investors that they are regulated or meet the regulatory standards of a national securities exchange.”

Featured image from Shutterstock.

Follow us on .

Advertisement

Published at Tue, 10 Apr 2018 13:01:22 +0000

bitcoin Exchange