After announcing the launch of in December 2017, the Chicago Mercantile Exchange () announced the launch of two Ethereum-focused indices on May 14, 2018, germinating speculation about the possible launch of an ether futures product in the near future.

CME’s ETH Introduction

According to an official press , the world’s largest futures operator said that it would provide “a daily benchmark price in U.S. dollars,” in addition to collating data (calculated by UK-based ) from crypto-exchanges and to determine real-time prices. This data would be based on transactions and order book activity of the world’s second-largest digital currency by market cap.

The two launched indices are the CME CF-Dollar Reference Rate, which would close daily prices at 3 PM (UTC), and the CME CF Ether-Dollar Real-Time Index. UK-based exchange Crypto Facilities calculates the price of both indices.

While the real-time value of is already online on CME’s website, the necessary market data shall be processed starting June 4, 2018.

(Source: )

Speaking about the development, Tim McCourt, CME Group managing director and global head of equity products and alternative investments, said in a statement:

“The Ether Reference Rate and Real Time Index are designed to meet the evolving needs of this marketplace. Providing price transparency and a credible price reference source is a key development for users of .”

In a similar vein, Timo Schlaefer, CEO of Crypto Facilities, noted:

“Ether, the second largest cryptocurrency, experienced incredible adoption and growth in 2017, evolving into the leading blockchain for smart contracts. We are excited to be contributing to the strong community that has developed around the Ethereum network by providing a reliable reference rate and real-time Ether-Dollar price.”

Echoing the thoughts of Schlaefer and McCourt was Brian Quintenz, a commissioner of the Commodity Futures Trading Commision, speaking at Consensus 2018, believing that quite a few traditional exchanges have expressed interest in ethereum derivatives, but the “decision needs to be made carefully.”

“No Plans for ETH Futures”

Despite the widespread speculation of soon-to-be-launched ether futures, CME maintained its stance and said that no plans currently exist for the product, even though the ether index is very firmly structured like the previously launched bitcoin index. McCourt adds that “the focus right now is on the index itself.”

In December 2017, CME the world by launching , possibly catalyzing the pioneer cryptocurrency’s largest price-spike, which saw it $20,000 on some exchanges. Undeniably, the futures launch saw a flurry of market activity by institutional investors, with banks such as going ahead to open their trading desk in May 2018.

According to the release, CME’s bitcoin Oversight Committee shall be monitoring the newly launched indices, along with Crypto Facilities and “other industry participants.” The committee shall enforce appropriate methodologies and practices while maintaining a high standard to ensure and “protect the integrity of the reference rates.” Notably, Crypto Facilities also provides CME with data for its bitcoin futures product.

At the time of writing, ether is trading at $730, to data on CME’s real-time CF reference index.

The post appeared first on .

The , which aims to improve privacy on the network, has been submitted as a BIP (bitcoin Improvement Protocol) on May 9, nearly a year after the last major announcement.

The Dandelion project was first shown off by a group of developers in January 2017 as a way to enhance privacy in bitcoin’s transaction propagation. By June 2017, they managed to set up a working implementation of the project on the testnet and invited peer review.

The concept was designed by advisor and developer Andrew Miller. The project contributors also include Giulia Fanti, an assistant professor at Carnegie Mellon University, and other University of Illinois researchers.

How does Dandelion Improve Transaction Privacy?

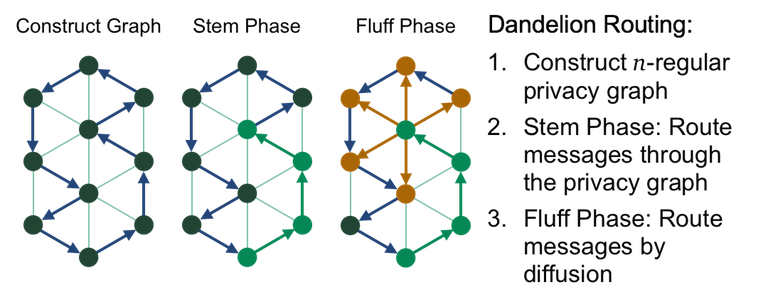

Dandelion is best described by the proposal’s on Github, which goes on to explain that the system works in two distinct phases, called the “stem” and “fluff” stages respectively. In essence, it is a routing protocol that overcomes deanonymization techniques that have been demonstrated in the past to uncover the identity of bitcoin users.

“During the stem phase, each node relays the transaction to a single peer. After a random number of hops along the stem, the transaction enters the fluff phase, which behaves just like ordinary flooding/diffusion. Even when an attacker can identify the location of the fluff phase, it is much more difficult to identify the source of the stem.”

Source:

In simpler words, the ‘stem’ refers to the data unique to a transaction, whereas ‘fluff’ is the process through which the sender’s IP address is hidden. By preventing nodes from ‘listening’ and finding out where a transaction originated, user privacy is improved by virtue of reducing the effectiveness adversaries can de-anonymize the network.

Dispelling Concerns

When first revealed, some speculated that while the Dandelion Project will bring a much-needed boost to the privacy and security capabilities of , its effect may be somewhat short-lived and akin to a band-aid on a larger problem. Well-known bitcoin Core developer Greg Maxwell alluded to this issue himself in his to the mailing list in 2017, stating that malicious actors could still cross-check transaction patterns to identify the origin of the transaction.

A year after concerns revolving around a deanonymization attack initially cropped up though, it appears as if the project’s authors finally have a solution. In another email sent to the bitcoin developer (bitcoin-dev) mailing list, the team a feature to combat the issue, dubbed the “per-inbound-edge.” With the measure, transactions would be hopped through different nodes to prevent tracing attempts.

bitcoin Network Upgrades

Any update to the bitcoin protocol, including the one proposed by the Dandelion Project, needs to be approved by a majority of all nodes on the network. The last major update to the bitcoin network was the launch of (SegWit) in late August 2017, codenamed BIP-141.

The term BIP is shorthand for a . Any new change to the network must be drafted thoroughly in the document for anyone to audit and review. The Dandelion BIP was first submitted to the bitcoin developer mailing list in June 2017 for feedback when it attracted the attention of Greg Maxwell.

Once the Dandelion project is ready to be launched, a BIP number will be assigned. Post that, it will be up to nodes on the network, the metaphorical guardians of any , to accept the change.

The post appeared first on .

![Bitcoin [btc]: on-chain volume will signal confirmation of bull run as long-term investment holds Bitcoin [btc]: on-chain volume will signal confirmation of bull run as long-term investment holds](https://ohiobitcoin.com/storage/2019/05/BTC-10.png)