In today’s edition of Chatter Report, crypto influencers debate the importance of buy walls to support crypto prices, reason for and against miner anonymity and ponder the outcome of governments attacking bitcoin.

Also read:

Hodlers of Last Resort and Buy Walls

Early bitcoin adopter and investor in Kraken, Trace Mayer, argues that crypto market capitalizations are important, but not as important as the hodlers of last resort and “buy support.” Mayer reasons that the combination of investors who don’t panic sell their coins and buy orders that are reflected in order books are what keep crypto prices from sliding further down.

However, Eric Wall argues that this is incorrect, because buy and sell orders are just an illusion. The cryptocurrency lead at Cinnober reasons that buy walls can be pulled quickly when market sentiment turns bearish, so data on order books can’t really be trusted. Wall’s distrust of order books is also shared by others in the thread, as they point out that over-the-counter market orders are unseen and obscure buy and sell data even further.

Should Miners be Anonymous?

After Nchain proposed the , crypto Twitter erupted in a fiery debate over whether miners should be anonymous or have their identities publicly known.

Developer Chris Pacia argues that all miners should be anonymous because anonymity makes it more difficult for governments to shut down bitcoin. On the other hand, prominent bitcoiner Alex Pickard believes that miners should be known by the public, as that would “increase trust in the system,” which is better for the bitcoin ecosystem.

The argument then shifted focus to the purpose of Proof of Work (POW), with crypto-Twitter regular Karate McAwesome arguing that POW is set up for miner anonymity.

Pickard quickly disagreed, explaining that the point of POW is to prevent double spending and to maintain the fixed supply of bitcoin. He then elaborated, claiming that transparent miner identities could prevent the government from shutting bitcoin down.

bitcoin vs. the State

Picking up on the idea of governments trying to destroy bitcoin, cryptocurrency proponent Chris G and bitcoin Uncensored’s Chris DeRose began their own separate discussion. The former argued that bitcoin would benefit from the government trying to destroy it.

G reasons that after the Chinese government tried to shut down bitcoin from 2013 to 2015, the subsequent years were fantastic for bitcoin prices. G goes on to draw parallels between bitcoin and Christianity, explaining that governments initially killed all Christians until Constantine figured out how he could benefit from the religion.

Throughout the thread, DeRose appears convinced of G’s arguments. By the end, both parties conclude that divisions in the bitcoin community are more dangerous than governments trying to destroy bitcoin.

What do you think of the significance of buy walls and hodlers to support crypto prices? Should miners be anonymous or known entities? Would governments attacking bitcoin actually be good for it? Let us know in the comments below.

Images courtesy of Shutterstock.

Need to know the price of bitcoin? Check this.

The post appeared first on .

In Thursday’s edition of The Daily, we feature stories that show cryptocurrency exchanges continuing to develop advanced services designed to attract institutional investors. These include OTC trading, derivatives and futures.

Also Read:

Coinbase Launches Dedicated OTC Desk

“We launched our OTC business as a complement to our exchange business because we found a lot of institutions were using OTC as an on-ramp for crypto trading,” said Christine Sandler, head of sales at Coinbase, in an interview with . “We felt this was a huge benefit to our clients to actually leverage both our exchange and our OTC business.”

Unlike other OTC desks, Coinbase claims it is not a counter-party in the deals it helps clients complete. The company plans to eventually offer delayed settlement and perhaps integrate this with its custodial service.

Huobi Opens Crypto Derivatives Market

“Cryptocurrency is a rapidly expanding and maturing market,” said Joshua Goodbody, General Counsel of Huobi’s Global Institutional team. “As part of that maturation, we see more and more sophisticated investors and traders from more established financial markets looking to gain exposure, including institutional players. At the same time, we think many experienced, successful cryptocurrency traders are looking for a broader range of investment tools than has traditionally been available. Huobi DM is tailor-made to address these sorts of needs.”

The platform is not currently available to users from the U.S., Singapore, Israel, Iraq, Hong Kong, Cuba, Iran, North Korea, Sudan, Malaysia, Syria, Eastern Samoa, Puerto Rico, Guam, Bangladesh, Ecuador and Kyrgyzstan.

Nasdaq Teams Up With Vaneck on Futures

Just as cryptocurrency exchanges are looking to attract institutional traders, traditional operators are setting their sights on crossing over to the other side.

Nasdaq, for example, now plans to launch regulated bitcoin futures-type contracts in the first quarter of 2019. This is due to a partnership with MV Index Solutions, a Vaneck company with about $14 billion invested in its products, which last week .

The cooperation was recently revealed by Gabor Gurbacs, director of digital asset strategies at Vaneck/MVIS.

What do you think about today’s news tidbits? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our , the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at , another original and free service from bitcoin.com.

The post appeared first on .

Jason Moser that is making a lot of effort to gain more share in the payments space through Amazon Pay. According to Adobe Analytics, Black Friday pulled in a record $6.22 billion in online sales, which was up almost 24% from a year ago. It was the first day in history to see more than $2 billion in sales stemming from smartphones.

“Not only are we living in an e-commerce world, we’re certainly living in a mobile world, as well,” said Moser.

The truth is that Amazon is making a push to get its Amazon Pay digital wallet into restaurants, gas stations and other merchants that it doesn’t directly compete against.

It still isn’t exactly clear how Amazon Pay might be used at checkout; some wallets — such as Pay — employ RFID-enabled tap and pay technology while others utilize a QR code that is scanned by a point-of-sale device.

Frankel explained how he was recently buying a present for his wife and on the website, there were two payment buttons: one was PayPal button and another was Amazon Pay.

“I was curious, because I had never seen that on a merchant’s website. Amazon really hasn’t pushed it until recently. So, I clicked Amazon Pay, and it took me right to my Amazon checkout, where I have my Amazon credit card already set up. It was just like checking out for a normal Amazon purchase. It took me about two clicks. I actually think PayPal might have something to worry about here.”

Moser then noted the fact that U.S. consumers still aren’t all that digital-wallet-focused. He said:

“You look at something like Apple Pay, for example, as clever as that is, consumers still aren’t embracing that wholeheartedly. Whether it’s Apple Pay or Google Pay or Amazon Pay, the digital wallet, there’s a big opportunity there. That explains why Amazon is pursuing this.”

Frankel explained that he doesn’t think this will steal any market share from people who are already on Apple Pay or PayPal. But there are a lot of people who are not using digital wallets yet who are already comfortable with Amazon’s checkout process.

“I don’t necessarily think they’re going to steal market share or steal existing customers from any of the other ones, but I do think it gives them an advantage recruiting new adopters to digital wallets.

To be perfectly clear, PayPal, Amazon Pay, and Apple Pay all have tremendous growth runways. PayPal’s growth rate could go from 20% to 19%. I’m not saying they’re going to really suffer. To be clear, I still love PayPal on a long-term basis.”

A recent mentioned that Apple Pay is in the second position, behind PayPal, in the number of active users using the digital wallet. Last year, Amazon also introduced the ability to place orders with TGI Friday’s using the Amazon app. But this push aimed to bring Amazon Pay to a of merchants.

While other companies like Apple and Samsung have had a bit of a head start when it comes to getting their digital wallets into brick-and-mortar establishments, there’s still plenty of room for competitors in the US, where last year, only around 1 percent of in-store transactions were completed with some sort of mobile payment.

Apple Pay Takes Over Belgium and Kazakhstan

Apple Pay has gone live in two more countries, with customers of some banks in Belgium and Kazakhstan now able to make purchases in stores using their iPhones via Apple’s mobile payments platform.

Belgium and Kazakhstan become the 30th and 31st region where Apple Pay is officially available. Apple Pay is also set to launch in Germany this year and is “coming soon” to Saudi Arabia, according to Apple.com.

Today, they announced their – Amazon Quantum Ledger Database and Managed Blockchain. With it, they will maintain a complete and verifiable history of data changes, and allow users adjust and manage a scalable blockchain network.

Key Highlights:

price is in a downtrend;

the bears are still in control of the XLM market;

XLM price pulling back is inevitable.

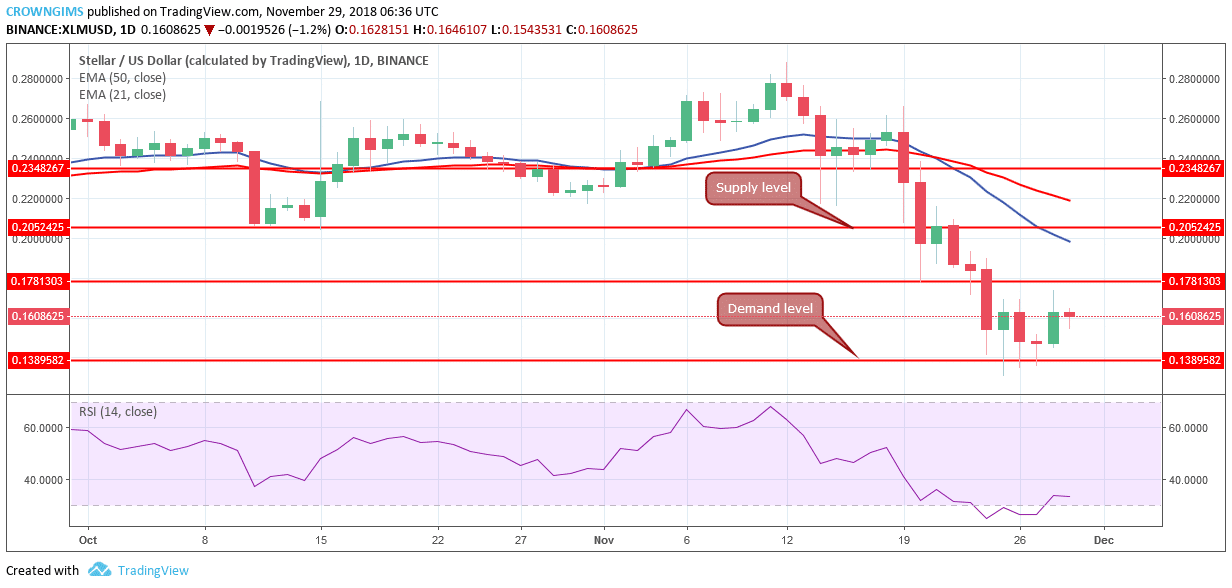

XLM/USD price Long-term Trend: Bearish

Supply levels: $0.17, $0.20, $0.23

Demand levels: $0.13, $0.10, $0.06

The opening market candle formed today is bullish which may be a pullback of the XLM price in order to continue its bearish trend at the demand level of $0.13. The 50-day EMA is above21-day EMA with the XLM price below the two EMAs and the price is at a distance from the EMAs indicating that bearish pressure is high in the XLM market and the XLM price may fall further. The relative strength index is above 30 levels pointing downward connotes sell signaling.

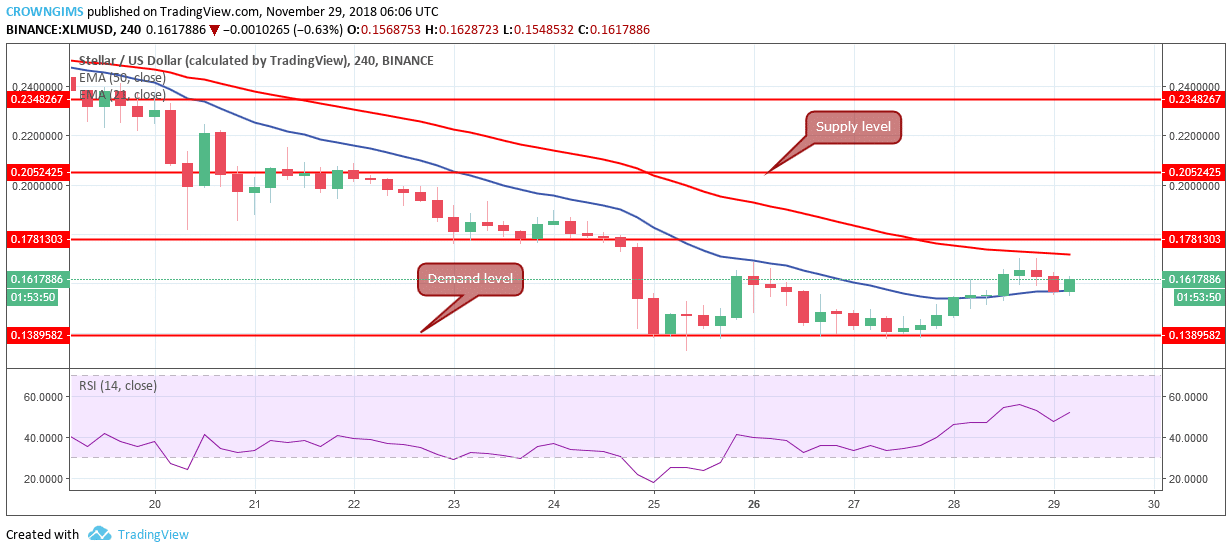

XLM/USD Price Medium-term Trend: Bearish

Stellar is still in its bearish trend on the 4-Hour chart. On November 25, the coin bottomed at the demand level of $0.14, it was pushed up but resisted by the 21-day EMA dynamic resistance and the price was returned to the previous low.

Yesterday, the coin broke upside the 21-day EMA and moved towards 50-day EMA which was resisted and the price remains between the two EMAs and the relative strength index is above 50-level pointing to the north which indicates buy signal and that the bulls are gaining momentum gradually.

In case the bulls gain enough momentum to break up the supply level of $0.17, Stellar will rally to the north and have its target at the $0.20 price level. Should the supply level of $0.17 holds XLM will have its low at $0.10 price level.