The market has always been volatile and liquidation of leveraged positions happens often. A common concern of most leverage using traders is: If there is a contract loss during a liquidation, who on the exchange will cover it? ADL system was made to cover that loss after a Liquidation with a contract loss cannot be covered by the Insurance Fund.

Let’s look at a contract loss example to better understand what it is

A whale trader is holding a large position with 100x leverage and speculating for an uptrend in the market. One day, due to a market retracement, their position is liquidated. The contract loss would be any extra loss that his initial margin could not cover.

To cover that loss, some exchanges use a socialized loss system that spreads the loss proportionately to all profitable traders.

With this system, a single risky trader can create a large contract loss for all profiting traders, including low-risk traders. This system is unfair as it forces low-risk traders, despite their lower profits and risk-taking, to cover the loss of high-risk traders. Mass liquidations further increase the problem as it might affect most traders on the exchange.

ADL Definition

This system automatically deleverages opposing traders’ positions by profit and leverage priority. This means that the chances of getting auto-deleveraged increase if a trader has a more profitable position with high effective leverage.

This makes the ADL system more fair than a socialized loss system for low-risk traders as they have a lower chance to be selected.

How can a Trader see their ADL ranking?

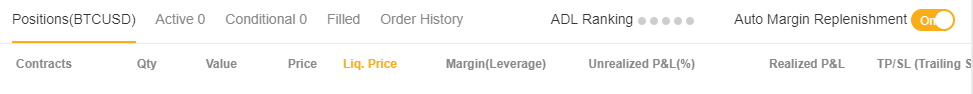

In the “Positions” tab, traders are able to check their ranking in the ADL system; this is represented by a number of bright dots. Each dot represents your priority in 20% increments; when all 5 lights are lit this indicates that your position is in the top percentile of the ADL queue. Traders can lower their ranking by reducing their leverage or closing some of their positions.

How does the ADL system work?

The ADL system selects and prioritizes traders with the highest ranking to deleverage. This is derived from a ranking of highest profits and effective leverage used.

The system then matches the selected profiting positions with liquidation orders at ‘Bankruptcy Price’. There will be a Maker’s rebate paid to the trader covering the loss, and a Taker’s fee charged to the trader’s whose loss was covered.

Lastly, Traders who experience an ADL will receive an email or phone notification and have all of their active orders closed. After this, they are free to re-enter the market.

Let’s look at an example to better explain this

A trader buys 3,000 contracts of BTCUSD at USD 8,000. Let’s assume they have a liquidation price at USD 7,700 and a bankruptcy price at USD 7,500.

When the mark price hits liquidation price, their 3,000 contracts are forcibly liquidated. However, the current last traded price was is USD 7,300, which is much lower than their bankruptcy price. As there is an insufficient balance in the insurance fund to cover the contract loss, the ADL system will take over the liquidation process.

There are 6 short positions on the exchange.

Looking at the table, we can see that Trader A has the highest ADL ranking. They will be selected to cover the 3,000 contracts’ loss at a USD 7,500 bankruptcy price. Trader A’s 2,000 remaining contracts will stay open, and they will be auto-deleveraged as they will then use the same margin while holding less contract value. After this, the ADL ranking of trader A may not be at the top anymore.

Similarly, if there were 10,000 contracts’ worth of loss, then Trader A, B, and C will all be selected. They will receive an email or phone alert and have all their BTCUSD active orders closed. After which, they are free to re-enter the market.

I hope this brief explanation of our ADL system can help you better understand how works and aid you in profitable !

Published at Sun, 05 May 2019 09:20:14 +0000