On the eve of Christmas and New Year, with great deal optimism or positivity, and its crypto-peer group prices have continued its streaks that have taken place since mid-December. price has rallied to $4,336 levels or up +6.47%, while has also climbed above $151 levels (i.e. up about 13.14%) and so is , spiked-off $36 levels (or +7.99%).

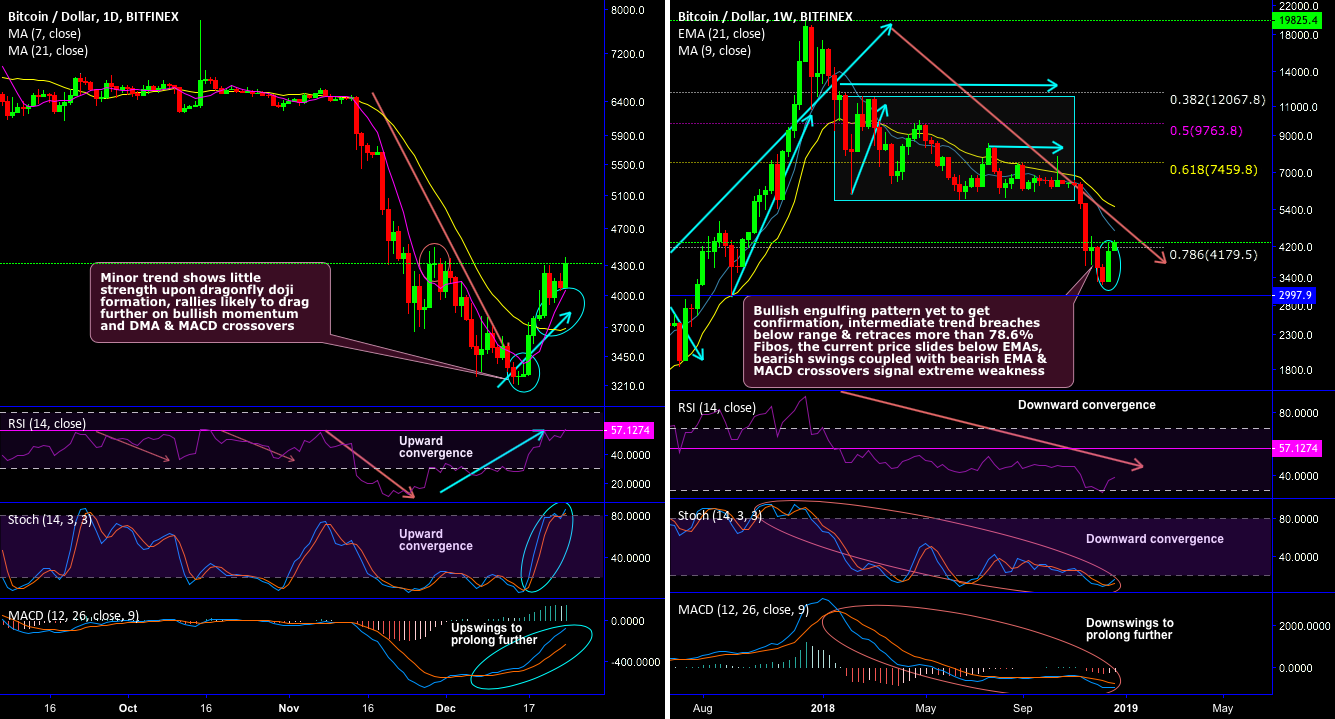

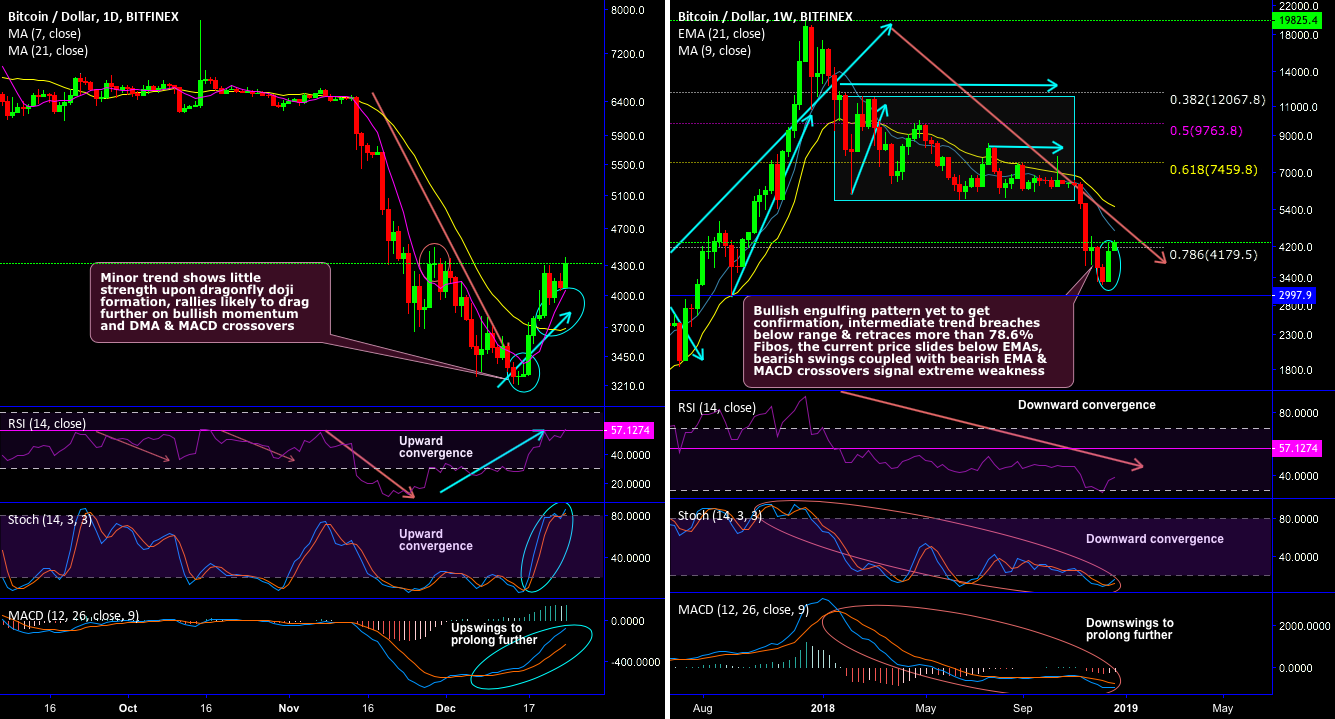

Well, before we move onto fundamentals, let’s just quickly look through some key indications of technical.

Technically, today, has taken support at $4,069 levels (i.e. 7DMAs) and extended last week’s rallies.

The minor trend of this pair shows little strength upon dragonfly formation at $4,329 levels, the prevailing rallies are most likely to drag further upon intensified momentum and DMA & crossovers.

On a broader perspective, last week, the pattern has occurred at $4,071.70 levels which is yet to get confirmation from technical indicators (on weekly plotting), while the intermediate trend breaches below range & retraces more than 78.6% Fibonacci levels, the current price on this timeframe slides below EMAs, swings coupled with & crossovers signal extreme weakness.

Let’s now glance at the recent developments of fundamentals. The new cryptocurrency start-up established by the (ICE), is all set to launch futures contracts which would be first physically delivery facilities.

Well, the announcement has been confirmed in the recent past by ICE, that would offer new tracks especially for institutional clients and retail traders to make an access for cryptocurrency trading. ICE, which also operates the New Stock Exchange (NYSE) released the latest specifics about this development.

The appears to be on a quest to make investing easier. The company is said to be in discussions with the US CFTC regarding the launch of physically settled futures .

Rumors about a cash-settled futures contract are circulating since early autumn. In the last days of November, the ICE announced a prospective date for the launch which is set to the 24thof January. The plan is still subject to regulatory approval.

Bakkt, ICE’s “regulated ecosystem” for institutional investors intending to obtain exposure in cryptocurrency-space, that will offer against at least three predominant fiat currencies: the U.S. dollar, British and , according to a document released October 22nd.

The derivatives instrument would be physically-settled and cleared by ICE, as per the document.

It further elucidates: “Each contract calls for delivery of one held in the Bakkt Digital Asset Warehouse, and will trade in U.S. dollar terms. One daily contract will be listed for trading each Exchange Business Day.”

Well, overall on a concluding note, contemplating both technical and fundamental factors, we could foresee upside traction of prices in the months to come in 2019.

Currency Strength Index: FxWirePro’s hourly spot index is flashing at 49 levels (which is ), hourly USD spot index was at 37 (mildly ) while articulating at (07:37 ).

Published at Mon, 24 Dec 2018 07:42:30 +0000