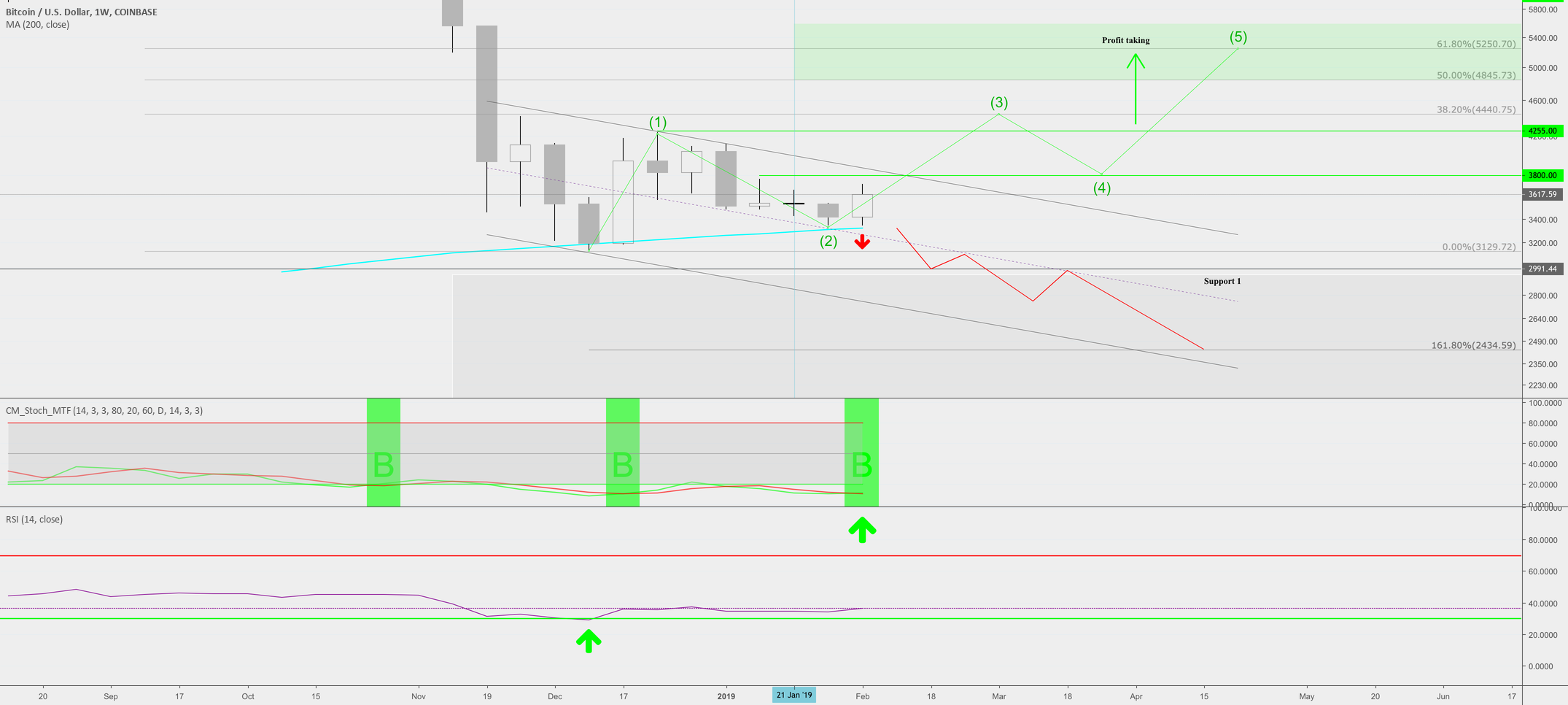

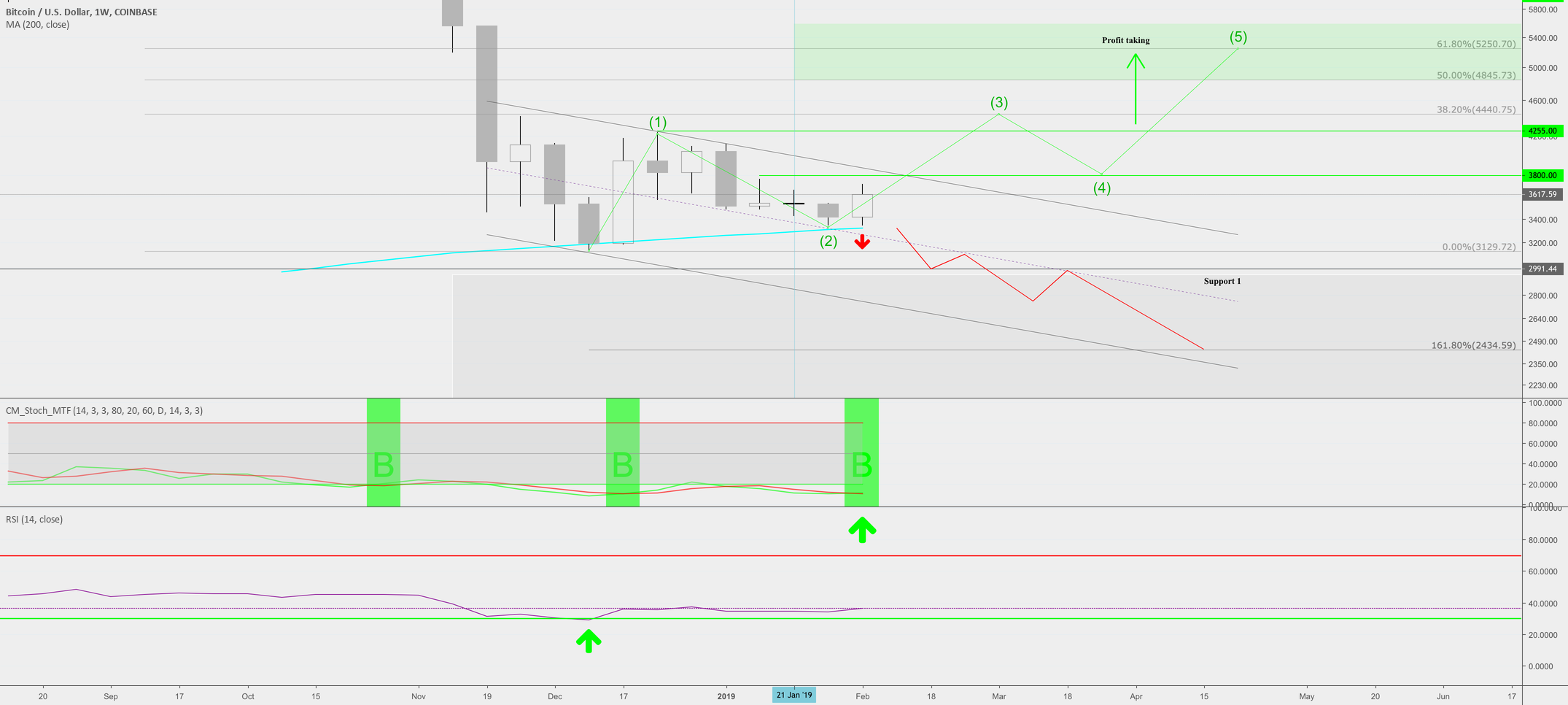

Chart should be uber clear to understand. I really feel the market is nearing a point where bulls need to step up and continue the positive trend next week or we risk making this another dead cat bounce. If prices get squeezed again in sideways trading coupled with low it will not be good for us bulls. The infamous 200 Week MA is not far away and bears would love to break through this level like they did with $6,000 back in December.

If you are:

Bullish bias: Need to break through $3,800, $4,255 and then 38.2% Fib extension to get to the profit taking area in the coming weeks.

OR

Bearish bias: Simple – break through the 200 Week MA (blue ) and you WIN! We’ll grind our way down to $2,400-$2,600 price area.

Stochastic: Printed a buy signal on current weekly candle. %K rolled over the signal line and confirms higher low on 2nd wave is gaining positive momentum overall. We need to continue printing these higher lows on Wave 4.

RSI: Dec 10th was historically most oversold weekly candle in history. Has slowly (very slowly) been trending up. But remains in bear territory.

Summary: Bulls have everything they need to turn this market around printing a lower high on the Wave 2 impulse wave. However, Bulls really need to step it up over the next couple of weeks and continue printing higher candles and breaking through the key resistance levels I have stated. If you bought with me around that $3,500 there is nothing for us to do but be patient. Ideally we want to see next week’s candle continue the positive momentum. I’m still bias until breaks through the $4,255 level.

Continue having a great weekend and my next follow up reports will be on Monday.

Cheers,

Bobby

Published at Sat, 09 Feb 2019 23:26:17 +0000