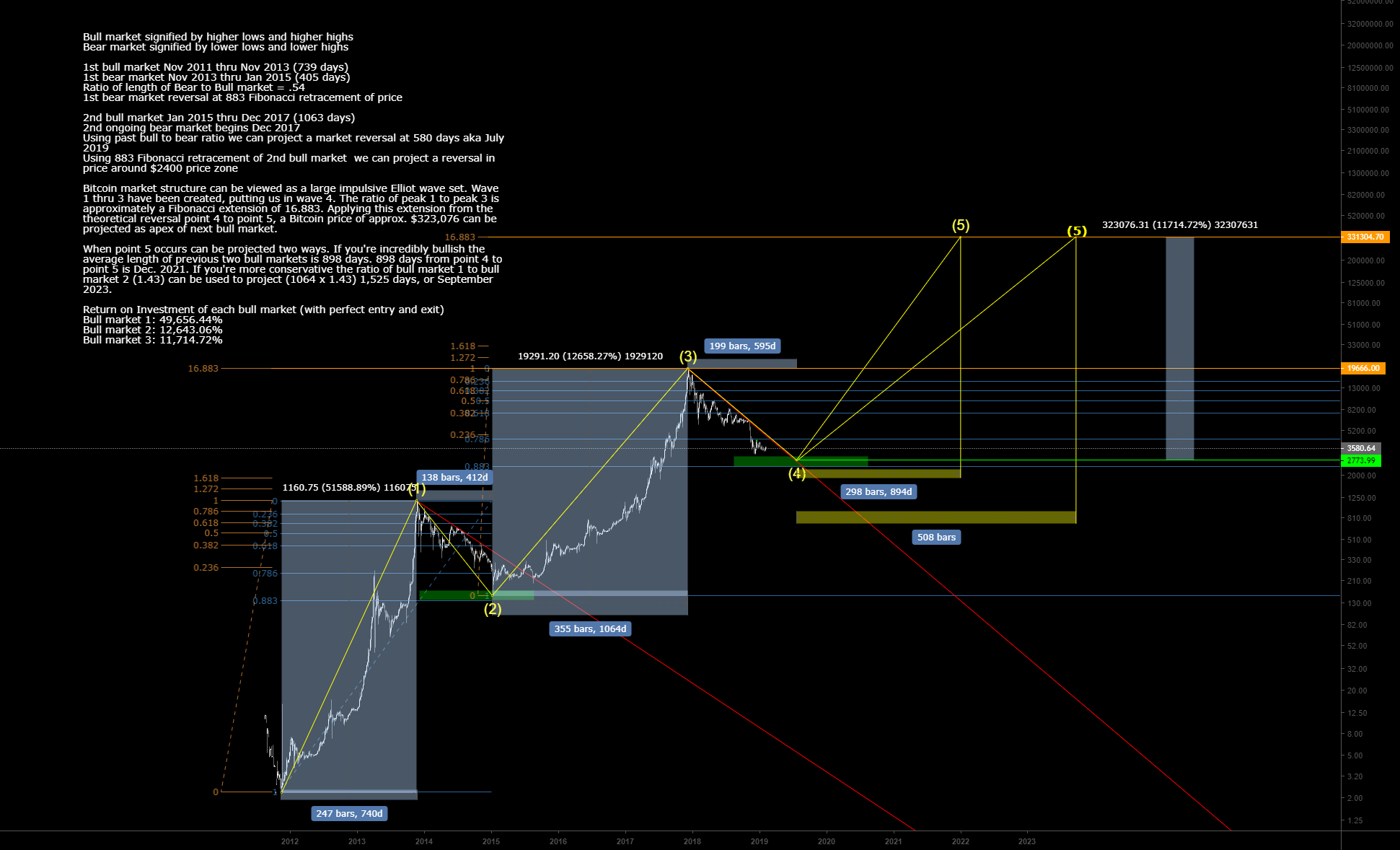

Bull market signified by higher lows and higher highs

Bear market signified by lower lows and lower highs

1st bull market Nov 2011 thru Nov 2013 (739 days)

1st bear market Nov 2013 thru Jan 2015 (405 days)

Ratio of length of Bear to Bull market = .54

1st bear market reversal at 883 of price

2nd bull market Jan 2015 thru Dec 2017 (1063 days)

2nd ongoing bear market begins Dec 2017

Using past bull to bear ratio we can project a market reversal at 580 days July 2019

Using 883 of 2nd bull market we can project a reversal in price around $2400 price zone

market structure can be viewed as a large impulsive set. Wave 1 thru 3 have been created, putting us in wave 4. The ratio of peak 1 to peak 3 is approximately a of 16.883. Applying this extension from the theoretical reversal point 4 to point 5, a price of approx. $323,076 can be projected as apex of next bull market.

When point 5 occurs can be projected two ways. If you’re incredibly the average length of previous two bull markets is 898 days. 898 days from point 4 to point 5 is Dec. 2021. If you’re more conservative the ratio of bull market 1 to bull market 2 (1.43) can be used to project (1064 x 1.43) 1,525 days, or September 2023.

Return on Investment of each bull market (with perfect entry and exit)

Bull market 1: 49,656.44%

Bull market 2: 12,643.06%

Bull market 3: 11,714.72%

Published at Tue, 12 Feb 2019 16:41:00 +0000

![Women in crypto [female in bitcoin & blockchain tech]+[investment class] Women in crypto [female in bitcoin & blockchain tech]+[investment class]](https://ohiobitcoin.com/wp-content/uploads/2018/03/YvHq75.jpg)