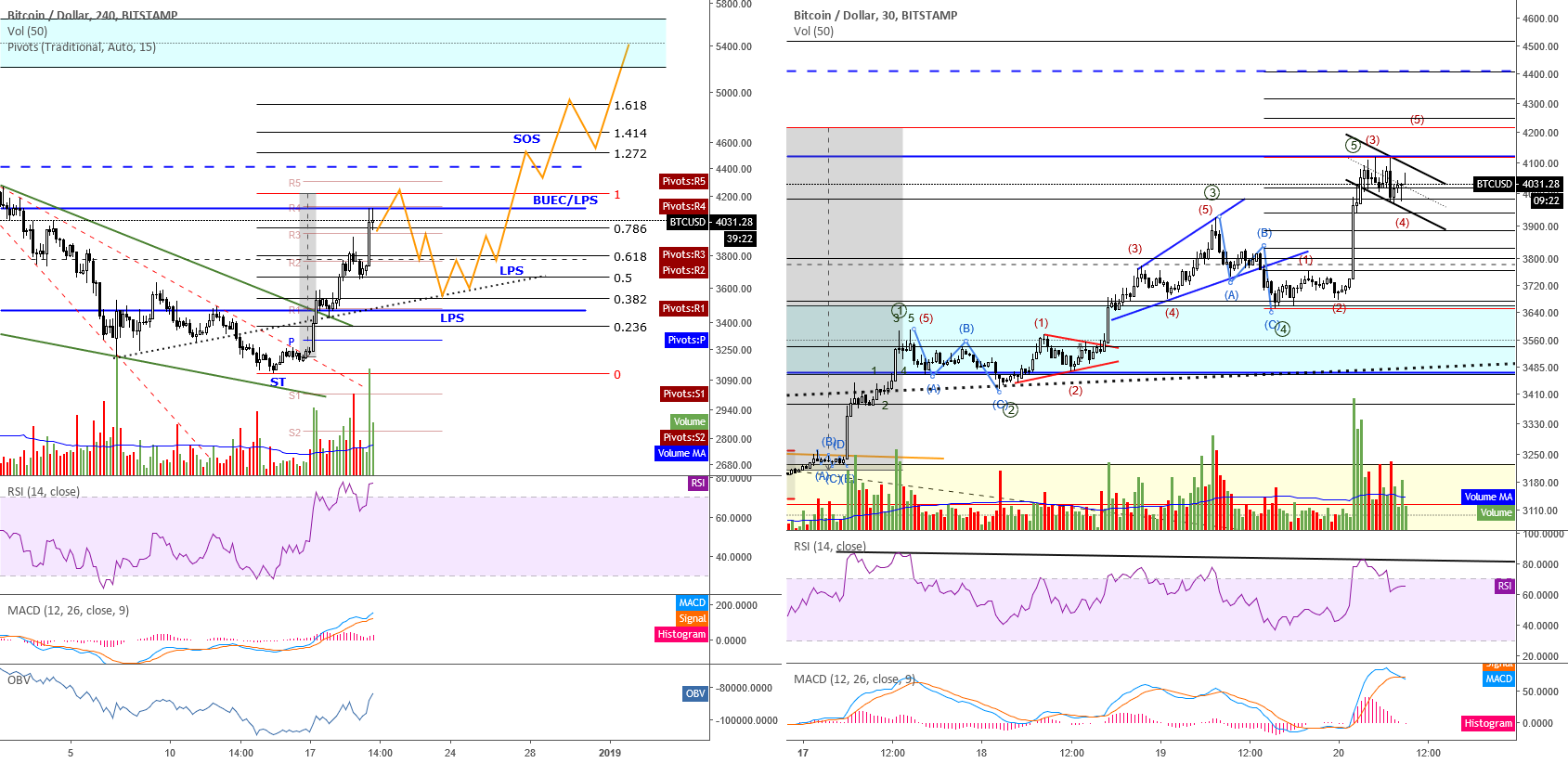

Good morning, traders. I was wrong yesterday and it appears that had one more leg up. This is why I continue to stress the importance of risk management, not only in your entry but also in your exit. If you watch my morning live streams then you know I consistently discuss the importance of having your exits figured out before you enter a trade. This includes, as I have stated numerous times, that point at which the trade goes against you. Fortunately, my manual trailing stop loss was hit and I was able to still notch a 16% portfolio profit on yesterday’s move down while I slept as a result. Sure, I missed the extra bit of upward momentum but I ended up with a significant profit for one day’s trade and I can now look to short once more this morning.

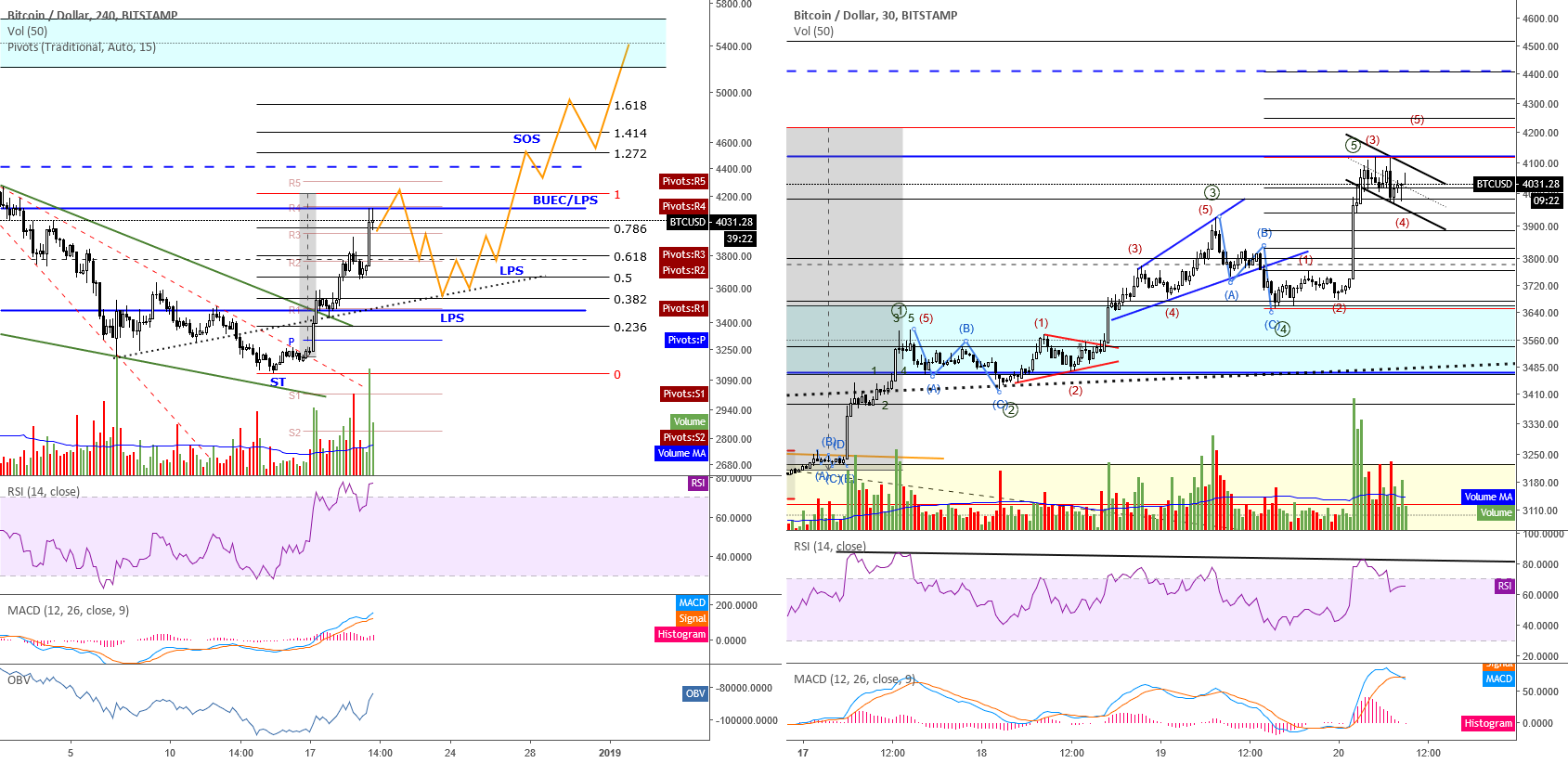

Last night’s move up touched the top of the which also happens to be the 4H R4 as well as the target off the smaller I discussed in the Tuesday update and noted as the red dotted line, though I believe I referred to it as dashed (). The 30 minute chart gives you an updated EW count which aligns with the slightly higher grey price tool target based on the larger wedge’s width. The histogram is already printing hidden as well signalling a possible last subwave up. However, we could see a truncated 5th subwave. The end of this first large wave, around $4220, would put price where we would expect it to be in terms of accumulation (between the AR and failed upthrust’s high). For reference, please refer to the Wyckoff accumulation schematics. Furthermore, a 61.8% retrace from the projected $4220 high would be at the of the light blue . Price would also be getting support from the ascending black dotted line. All of this strengthens the likelihood of yesterday’s mentioned orange path, though the would be about $100-$150 higher at that point. Based on this larger that we have been working with for a few weeks now, if we get a bounce from that blue demand, I believe the possibility of a Spring would be greatly diminished which means we could very well have seen our lowest point of this correction. Refer, specifically, to Wyckoff accumulation schematic #2 as a general guide. It also means that we should expect to end up back in the 2018 within the next few weeks at the most.

None of this guarantees that we won’t go down further, whether it’s just for a Spring or to even lower targets, but it does provide more support for the narrative that I am discussing. As such, traders must continue to concentrate most of their effort on their risk management. I have outlined the proposed path on the 4H chart.

As mentioned previously, yesterday’s Fed comment that it will raise interest rates .25% gave a strong initial bounce. However, the Fed sounded much less dovish than anticipated which caused the stock market to drop. This drop took price below the 2018 and I expect that we will see continues downward movement, at least in the near term though we should at least expect some sort of relief bounce before too long. I will continue to watch price action and to get an idea if price will make another attempt at the top of the or if it will find resistance at the bottom. Since that initial pop, we have seen continue its downward path as I mentioned we were likely to see. As a matter of fact, hit my 96.20 target exactly as traders/investors seem convinced that the Fed will not raise interest rates in 2019 thereby taking the wind out of DXY’s sails. As a result, the pair had a strong run overnight, topping out at 1.14857. I was in a short yesterday that hit my trailing stop before this move up late last night, which exited my position in a very small profit (nothing to write home about, but confirmed upward momentum), and I am currently watching price action as I look for an entry today.

Every day, we have a choice to act positively or negatively, so if you get a chance, do something decent for someone today which could be as simple as sharing a nice word with them. You just might change their day, or even their life.

Remember, you can always click on the “share” button in the lower right hand of the screen, under the chart, and then click on “Make it mine” from the popup menu in order to get a live version of the chart that you can explore on your own.

Published at Thu, 20 Dec 2018 15:20:39 +0000