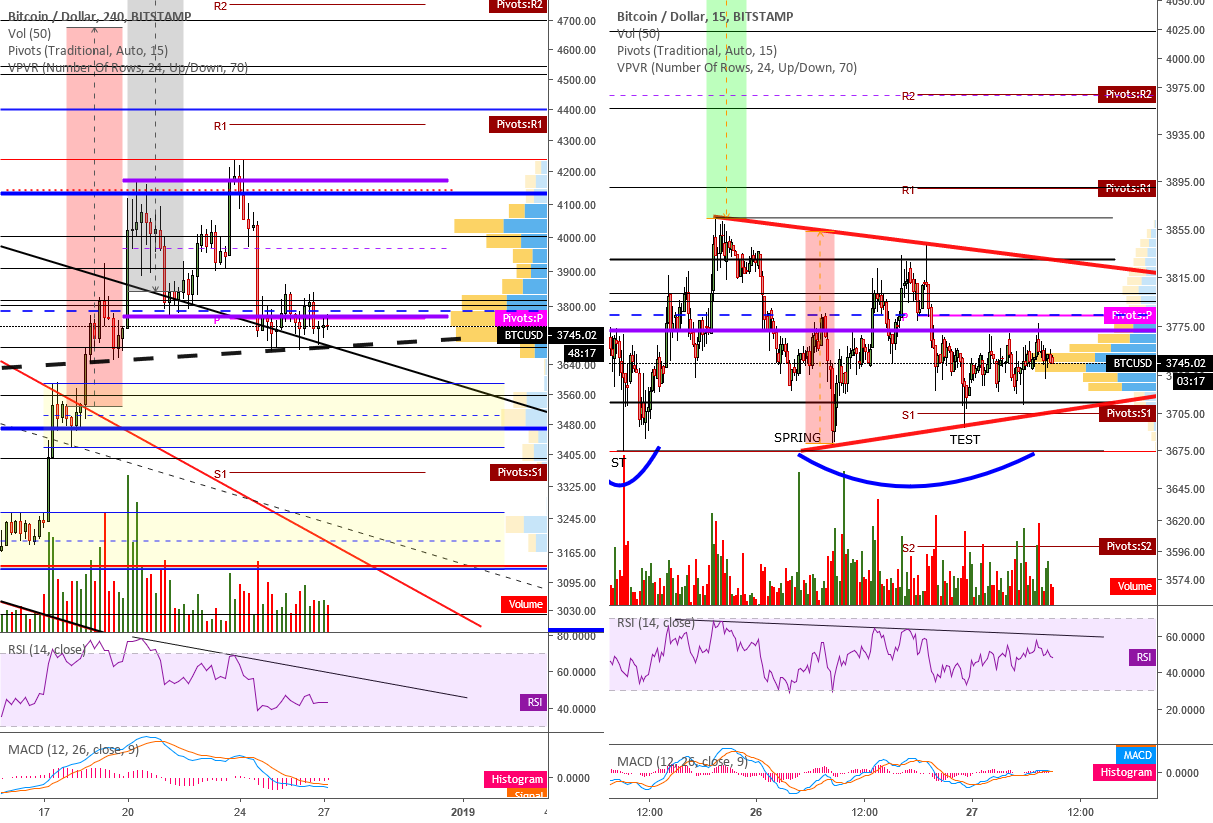

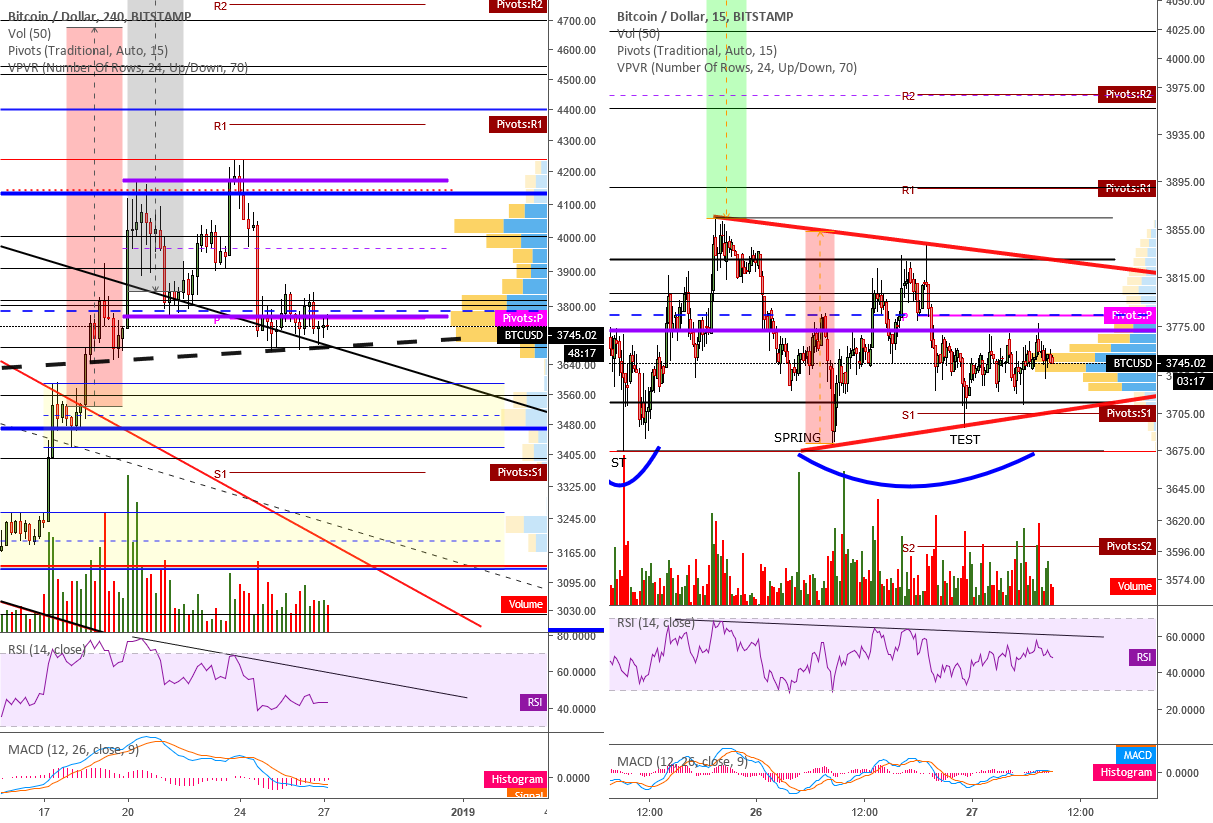

Good morning, traders. Not a whole lot to talk about this morning but I’ll do my best to give you multiple views of current price action. bitcoin’s price continues to trade sideways within a small which I have labeled on the 15 minute chart. We can also see that a possible Adam and Eve is building. This won’t be confirmed unless price closes above the swing high between them at $3863.34. We can watch the for a sign of strength which should manifest itself as passing through the descending resistance line. If price closes above that swing high, then we should be looking for a target of around $4050 based on the height of the proposed . However, a close below the swing low of $3674.73 would suggest further downward momentum. Price is currently printing a symmetrical triangle. As usual, these patterns have no directional bias. The height of the triangle is about $170, so traders can use this as an initial target upon a close above the triangle’s resistance or below its support by adding it to the former’s point of breach or subtracting it from the latter’s point of breach. So, as we were yesterday, we continue to watch the swing high and low for entry signals. Beware of possible or SFPs, which is why we always wait for a close and we don’t immediately buy or sell the breach.

The 4H chart shows us the large blue accumulation and the much smaller purple distribution or re-accumulation . Looking closely, we can see that price is currently ranging around the pink at the bottom of the purple . It also shows us the red descending and related target as well as the black and related target. As we can see, price is utilizing the top of that channel as support at this time. These targets suggest further upward movement, rather than down, but risk management demands that we see movement progress in that direction before we go long from here (i.e. a close above the swing high on the 15 minute chart). The two lower yellow zones give us an idea of likely reversal or, at the very least, consolidation areas if price heads down. A drop through that dashed ascending black support line would signal a likely move toward these areas. Traders need to be aware of possible hidden divergence printing on the MACD’s histogram if price can’t get a surge up similar to the recent drop from the top of the purple . The histogram is quite short so the longer it takes price to move up once it goes, the more likely that is to play out. As always, another way to look at that move down and current sideways action, is that it is a checkmate pattern playing out which means we would expect a move back up to the drop’s point of origin (top of the purple ) in the same sudden fashion thereby eliminating the risk of hidden divergence.

Normally, I would at least expect a move up toward the top of the purple again, but we may not get that. Traders should not be too anxious to enter at this time, rather they should wait for price to give them a signal of likely direction. The most promising bit of data I am seeing at the moment is that on the reactions on the 15 minute chart continue to drop. The first step is for price to close above the on this short TF, then above the red triangle, and finally above the swing high. If we can continue to see dropping on the reactions as price does that, we should be good to go toward the aforementioned targets. On the 4H TF, we want to see push through its descending resistance line to signal stronger likely upward momentum which would suggest a move up to the top of the purple . As mentioned during yesterday morning’s live stream, price has hit the of the move up so far.

Every day, we have a choice to act positively or negatively, so if you get a chance, do something decent for someone today which could be as simple as sharing a nice word with them. You just might change their day, or even their life.

Remember, you can always click on the “share” button in the lower right hand of the screen, under the chart, and then click on “Make it mine” from the popup menu in order to get a live version of the chart that you can explore on your own.

Published at Thu, 27 Dec 2018 15:11:44 +0000