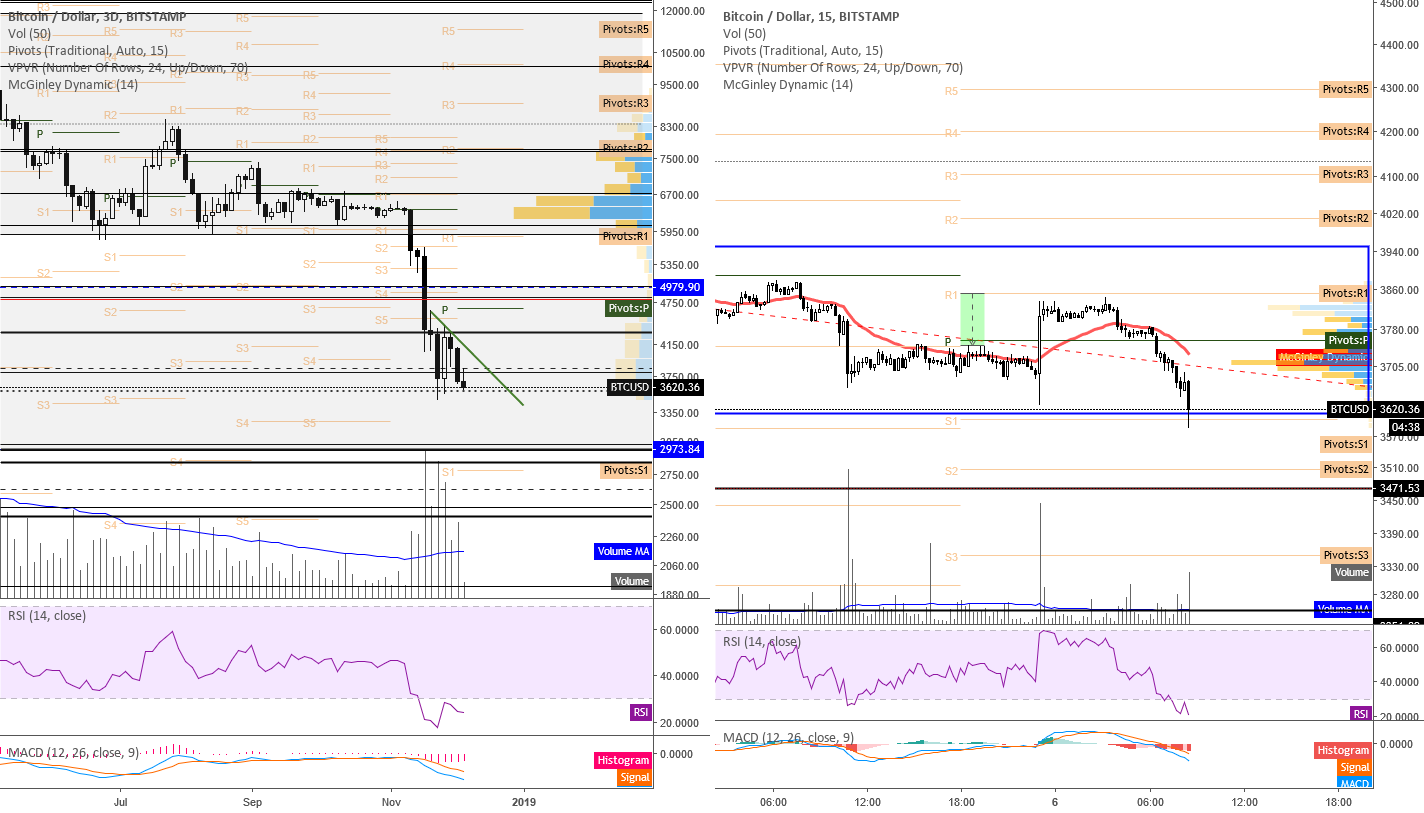

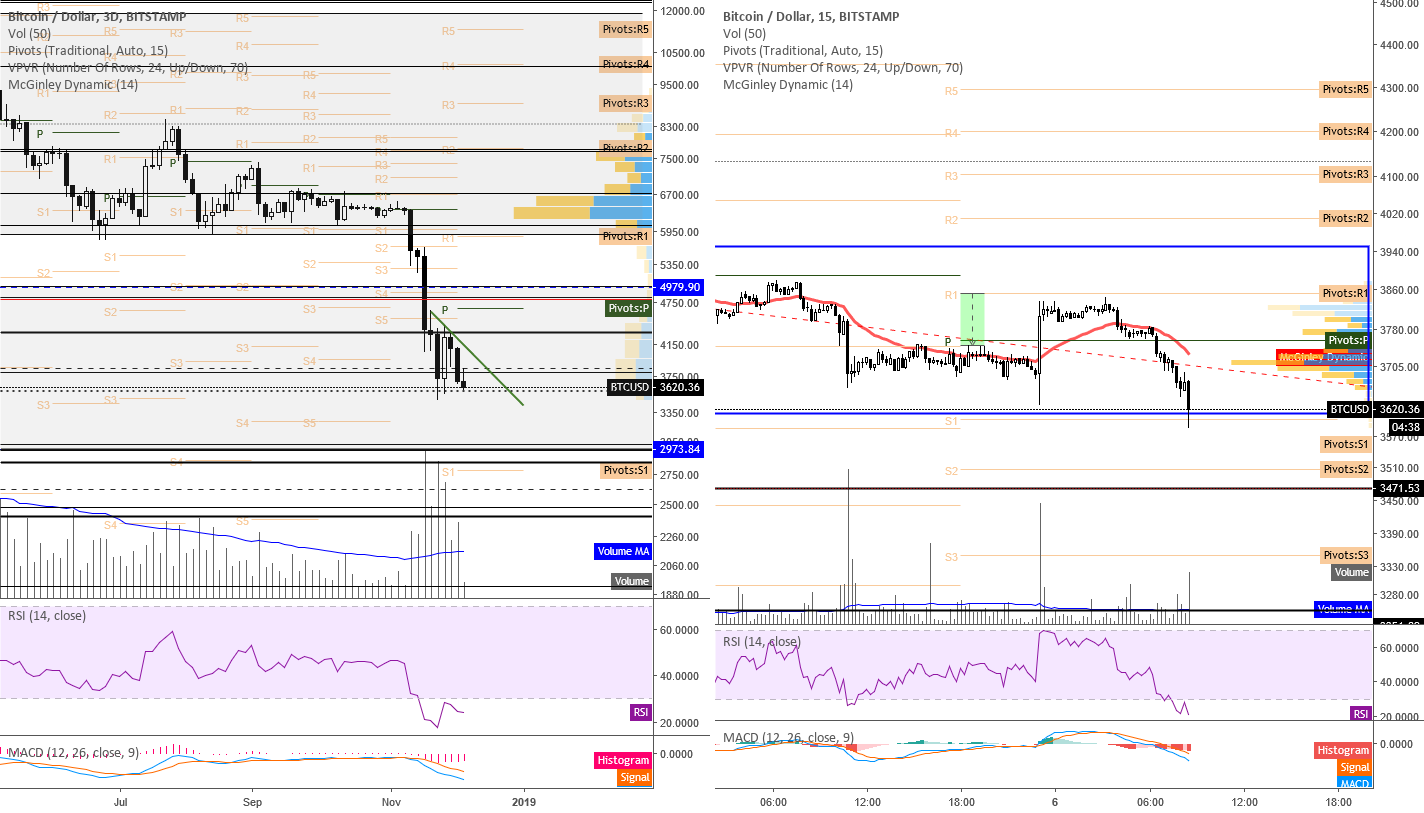

Good morning, traders. price remains under pressure this morning and its continued attempts to pull itself away from the resistance line that’s been keeping it in check since the drop from the $6000s have failed. Price has fallen through the black support line on yesterday’s 4H chart which sets up a downside target of $1040 below the point of breach. This would put it between $2677 and the S3 at $2725. Overnight a was seen on the 15 minute chart which saw price shooting back up toward that black line only to be rejected on its attempt to push through. continues to pick up in the $3600-$3800 area suggesting demand continues to remain present there but the longer price sits in this area the more likely that demand is to dry up.

The current 15 minute pattern appears to be mimicking the previous from a couple of days earlier as denoted by the blue boxes. has hit oversold and we can see price falling through the dashed red resistance line that has plagued it from the $6000s. Can it pull away this time with picking up at these price levels? We will have to wait and see. Liquidated longs continue to pull price downward with every attempt to rise as emotional retail traders FOMO in with heavy leverage. A close below the local swing low at $3629.41 should indicate further downward momentum. However, with already being oversold, my thought is that if price drops below that swing low it will likely close above it creating a Swing Failure Pattern and this should give price a bit of a boost. But remember this is only the 15 minute TF, so it doesn’t hold a lot of power in overall price movement.

The 3D chart shows diminishing since 11/18. Playing the longer TF, until price closes above the descending green line, the general expectation should be continued downward movement. The S4 and S5 from the previous periods sit at $3250, so that would be a good place to look for initial support on this TF if price were to fall further. We can see that remains oversold since 11/15, but is attempting to create higher highs and work itself out of that territory. The challenge remains the same as was mentioned for the shorter TFs the past couple of days — potential hidden divergence. The most recent histogram high was on 11/6 which had a price high of $6544, and that histogram is pretty short. With price as low as it is, we would need to see strong movement up to avoid that divergence. Depending on where price is when it makes a push up, it is more likely than not that we will see that divergence play out before price can get anywhere near $5200-$6000.

Every day, we have a choice to act positively or negatively, so if you get a chance, do something decent for someone today which could be as simple as sharing a nice word with them. You just might change their day, or even their life.

Remember, you can always click on the “share” button in the lower right hand of the screen, under the chart, and then click on “Make it mine” from the popup menu in order to get a live version of the chart that you can explore on your own.

Published at Thu, 06 Dec 2018 14:40:23 +0000